What a time it’s been for KLA Corporation. In the past six months alone, the company’s stock price has increased by a massive 43.8%, reaching $1,222 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is it too late to buy KLAC? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On KLA Corporation?

Formed by the 1997 merger of the two leading semiconductor yield management companies, KLA Corporation (NASDAQ: KLAC) is the leading supplier of equipment used to measure and inspect semiconductor chips.

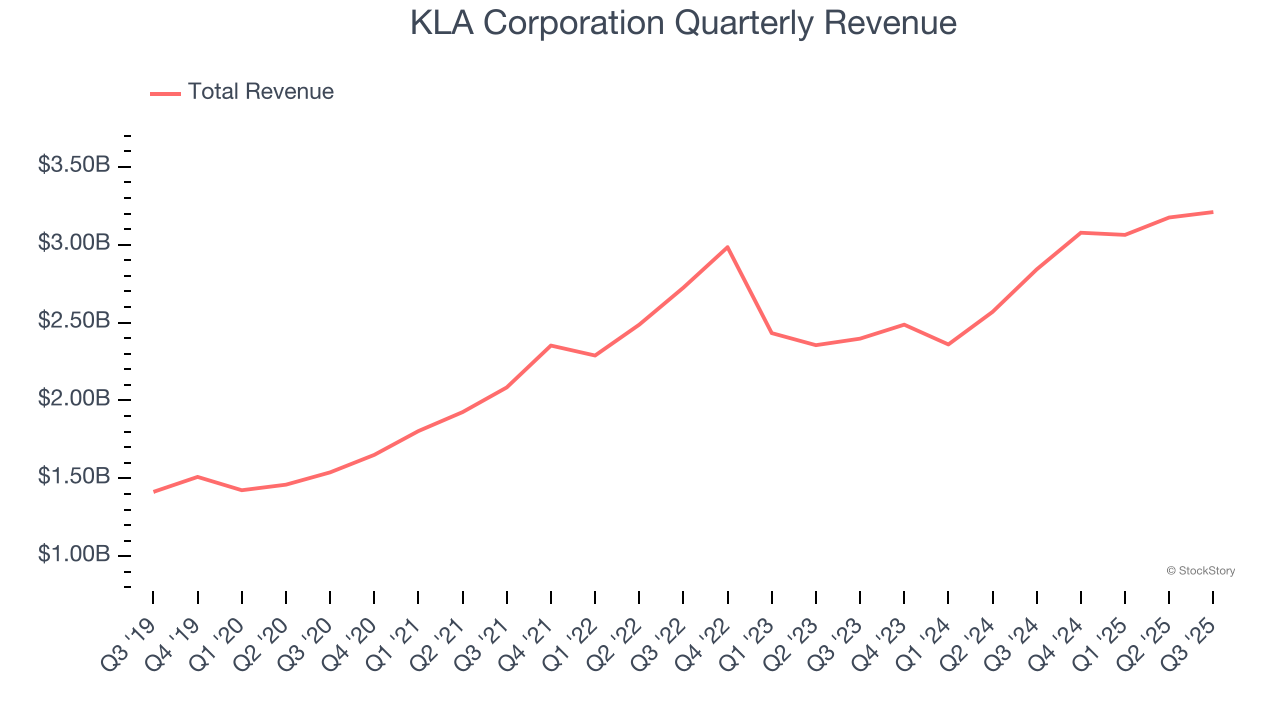

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, KLA Corporation’s sales grew at an excellent 16.1% compounded annual growth rate over the last five years. Its growth surpassed the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

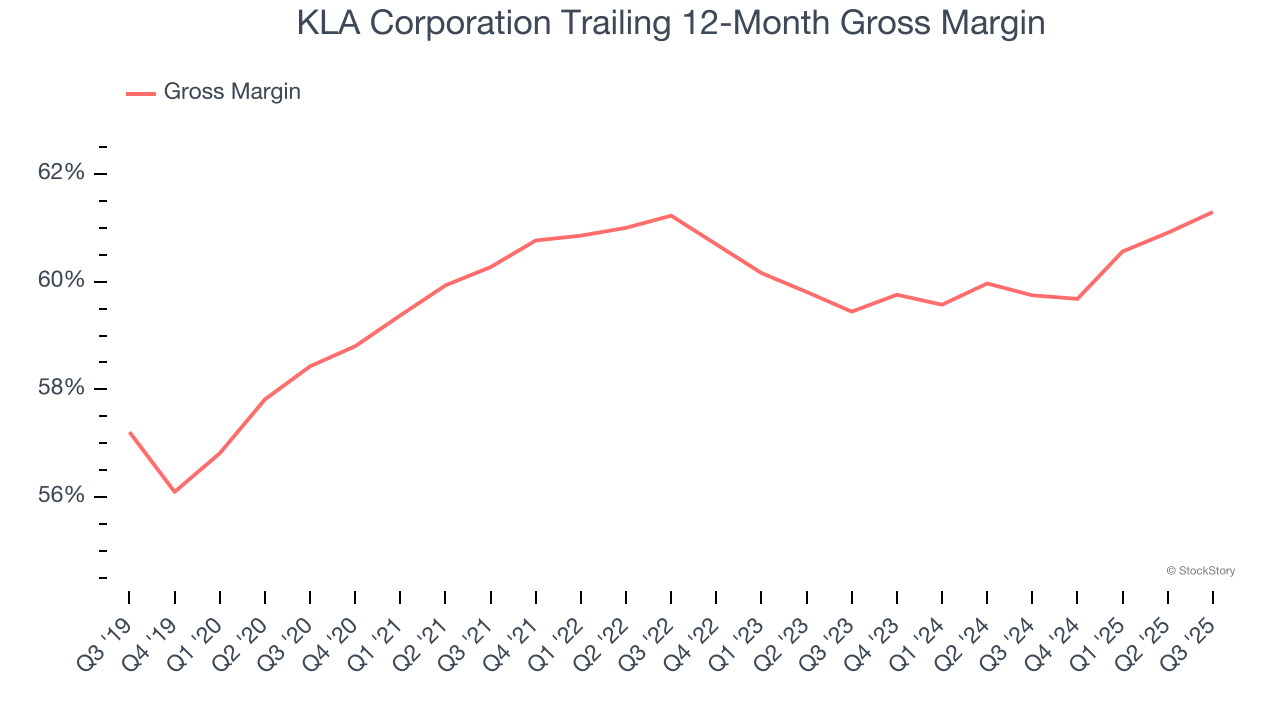

2. Elite Gross Margin Powers Best-In-Class Business Model

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

KLA Corporation’s gross margin is one of the best in the semiconductor sector, and its differentiated products give it strong pricing power. As you can see below, it averaged an elite 60.6% gross margin over the last two years. That means KLA Corporation only paid its suppliers $39.40 for every $100 in revenue.

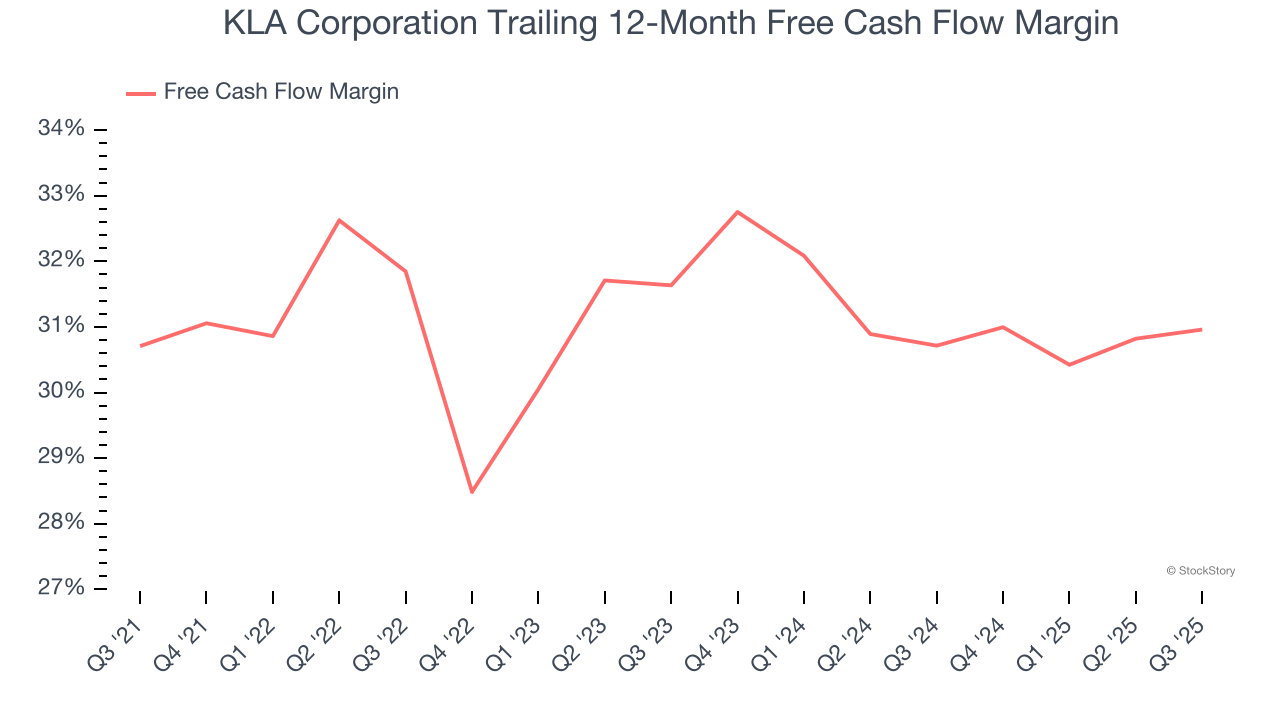

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

KLA Corporation has shown terrific cash profitability, and if sustainable, puts it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the semiconductor sector, averaging an eye-popping 30.8% over the last two years.

Final Judgment

These are just a few reasons why we think KLA Corporation is a great business, and with the recent surge, the stock trades at 31.6× forward P/E (or $1,222 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free for active Edge members .

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.