Since May 2020, the S&P 500 has delivered a total return of 106%. But one standout stock has nearly doubled the market - over the past five years, Darden has surged 205% to $203.31 per share. Its momentum hasn’t stopped as it’s also gained 20.5% in the last six months, beating the S&P by 21.5%.

Is now the time to buy Darden, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Darden Not Exciting?

Despite the momentum, we're swiping left on Darden for now. Here are three reasons why you should be careful with DRI and a stock we'd rather own.

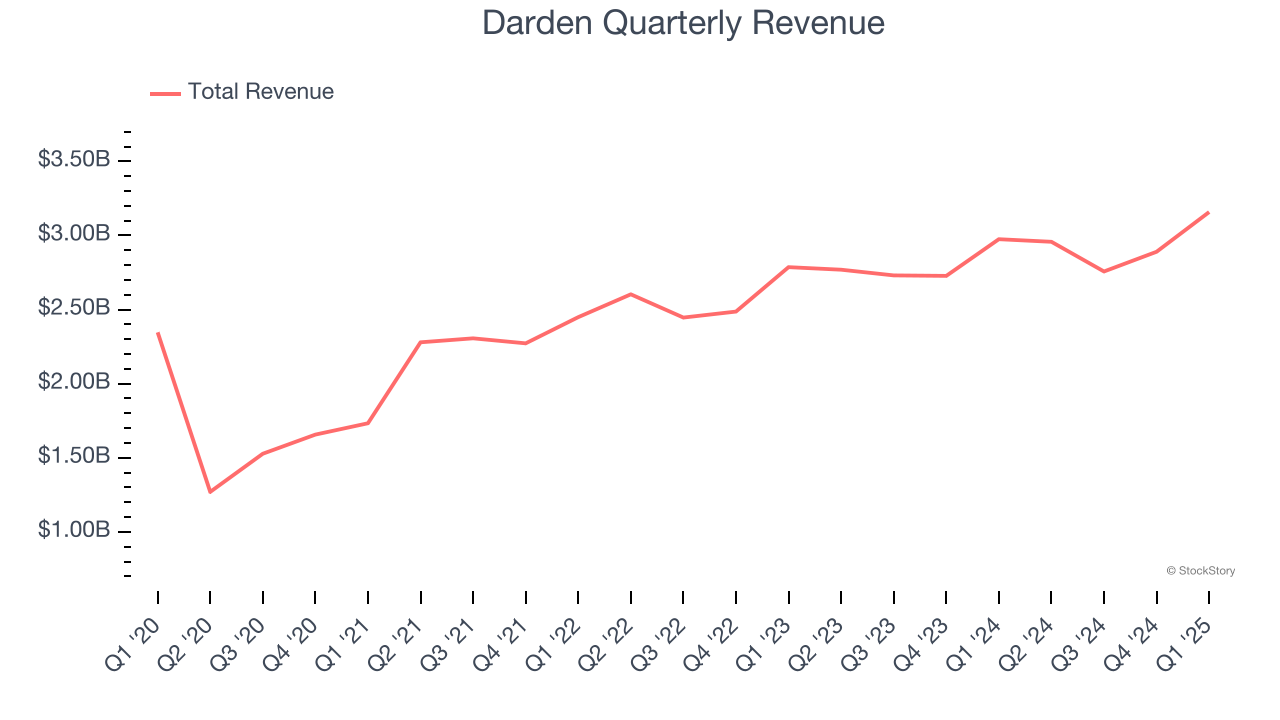

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Darden’s sales grew at a tepid 5.7% compounded annual growth rate over the last six years. This fell short of our benchmark for the restaurant sector.

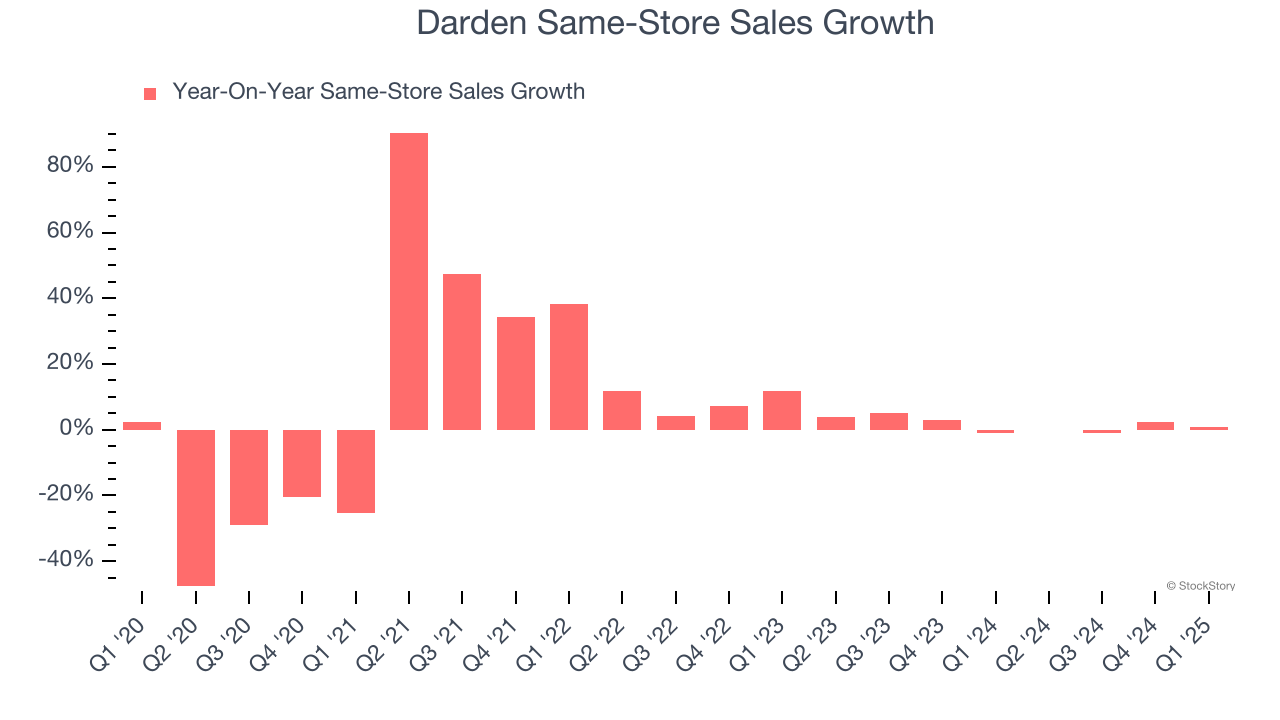

2. Same-Store Sales Falling Behind Peers

Same-store sales show the change in sales at restaurants open for at least a year. This is a key performance indicator because it measures organic growth.

Darden’s demand within its existing dining locations has been relatively stable over the last two years but was below most restaurant chains. On average, the company’s same-store sales have grown by 1.6% per year.

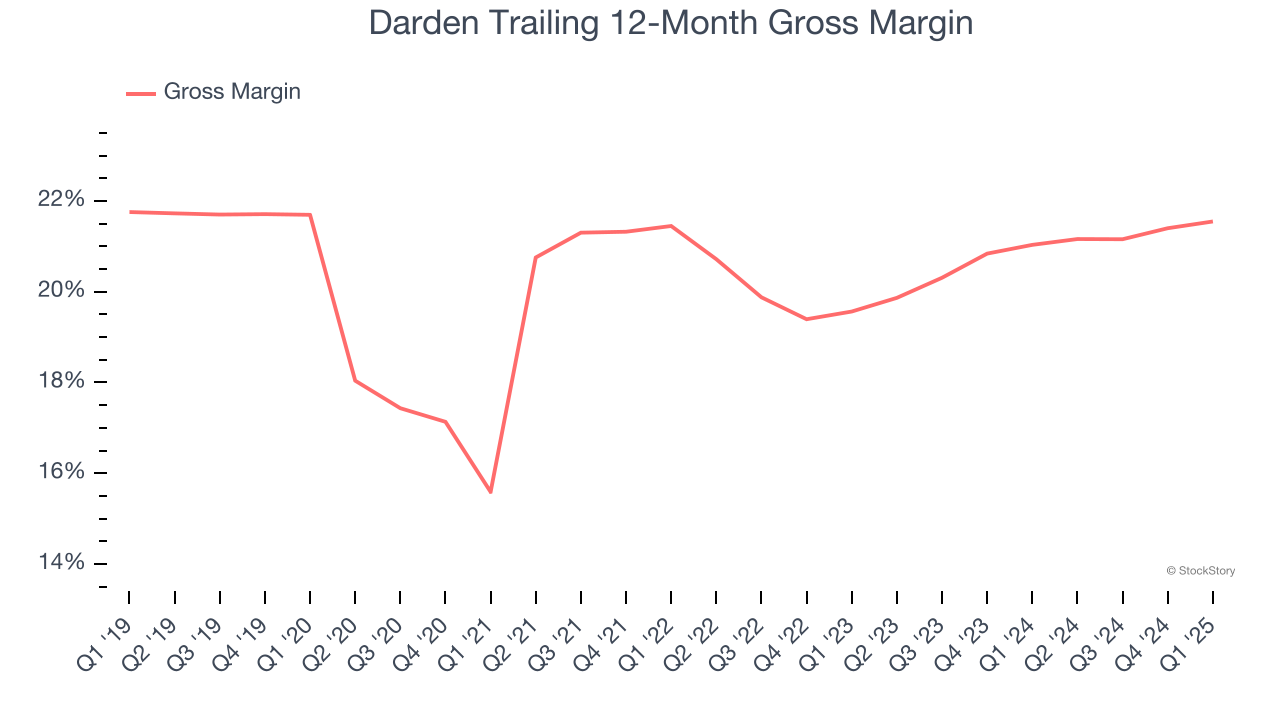

3. Low Gross Margin Reveals Weak Structural Profitability

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate pricing power and differentiation, whether it be the dining experience or quality and taste of food.

Darden has bad unit economics for a restaurant company, giving it less room to reinvest and grow its presence. As you can see below, it averaged a 21.3% gross margin over the last two years. Said differently, Darden had to pay a chunky $78.70 to its suppliers for every $100 in revenue.

Final Judgment

Darden isn’t a terrible business, but it doesn’t pass our quality test. With its shares outperforming the market lately, the stock trades at 20.1× forward P/E (or $203.31 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. Let us point you toward an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Darden

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.