Workforce housing company Target Hospitality (NASDAQ: TH) reported Q1 CY2025 results topping the market’s revenue expectations, but sales fell by 34.5% year on year to $69.9 million. The company’s full-year revenue guidance of $275 million at the midpoint came in 0.7% above analysts’ estimates. Its GAAP loss of $0.07 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Target Hospitality? Find out by accessing our full research report, it’s free.

Target Hospitality (TH) Q1 CY2025 Highlights:

- Revenue: $69.9 million vs analyst estimates of $65.35 million (34.5% year-on-year decline, 7% beat)

- EPS (GAAP): -$0.07 vs analyst estimates of -$0.02 (significant miss)

- Adjusted EBITDA: $21.57 million vs analyst estimates of $19.97 million (30.9% margin, 8% beat)

- The company reconfirmed its revenue guidance for the full year of $275 million at the midpoint

- EBITDA guidance for the full year is $52 million at the midpoint, below analyst estimates of $52.87 million

- Operating Margin: -1.5%, down from 28.5% in the same quarter last year

- Free Cash Flow was -$12.65 million, down from $41.77 million in the same quarter last year

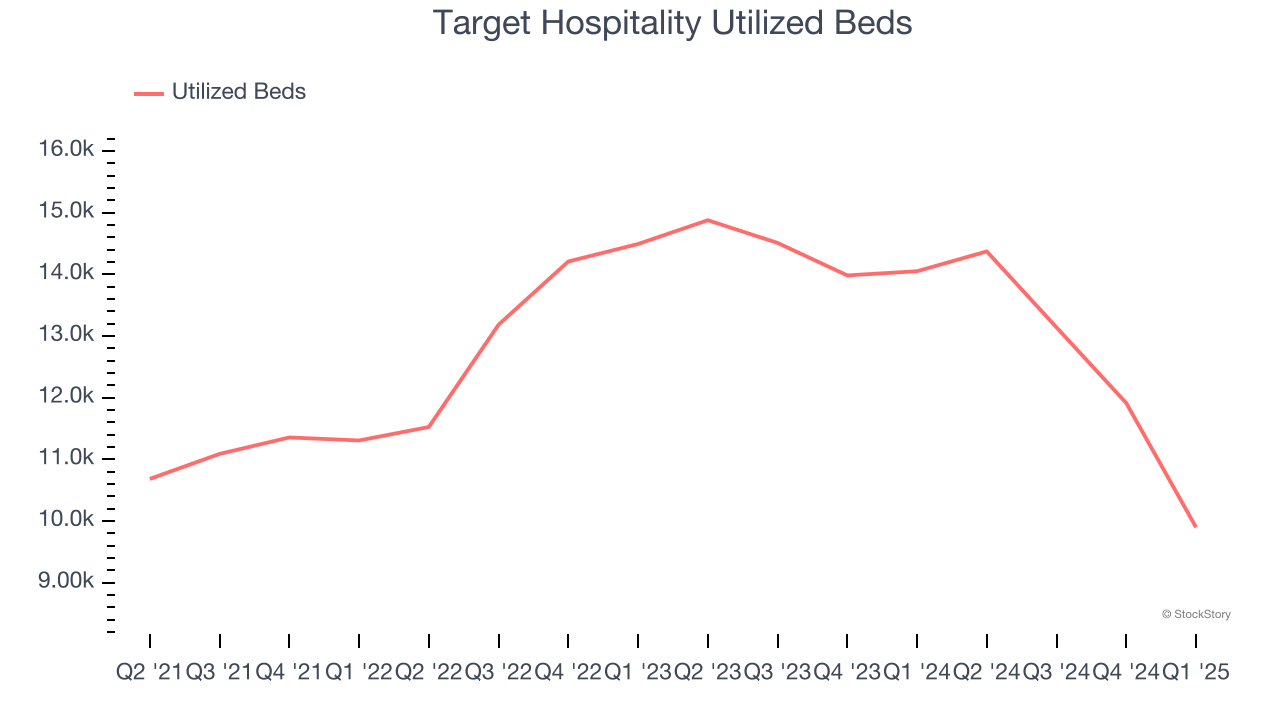

- Utilized Beds: 9,898, down 4,151 year on year

- Market Capitalization: $701.6 million

"We delivered a strong first quarter marked by sound business fundamentals and continued momentum executing on recent contract wins. We are pleased with the pace of activity on our Workforce Hub Contract and reactivation of our Dilley, Texas assets, reinforcing our confidence and ability to appropriately respond to customer demand," stated Brad Archer, President and Chief Executive Officer.

Company Overview

Building mini-communities at places such as oil drilling sites, Target Hospitality (NASDAQ: TH) is a provider of specialty workforce lodging accommodations and services.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Target Hospitality’s sales grew at a weak 2.4% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Target Hospitality’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 21.7% annually.

Target Hospitality also discloses its number of utilized beds, which reached 9,898 in the latest quarter. Over the last two years, Target Hospitality’s utilized beds averaged 2.8% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Target Hospitality’s revenue fell by 34.5% year on year to $69.9 million but beat Wall Street’s estimates by 7%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

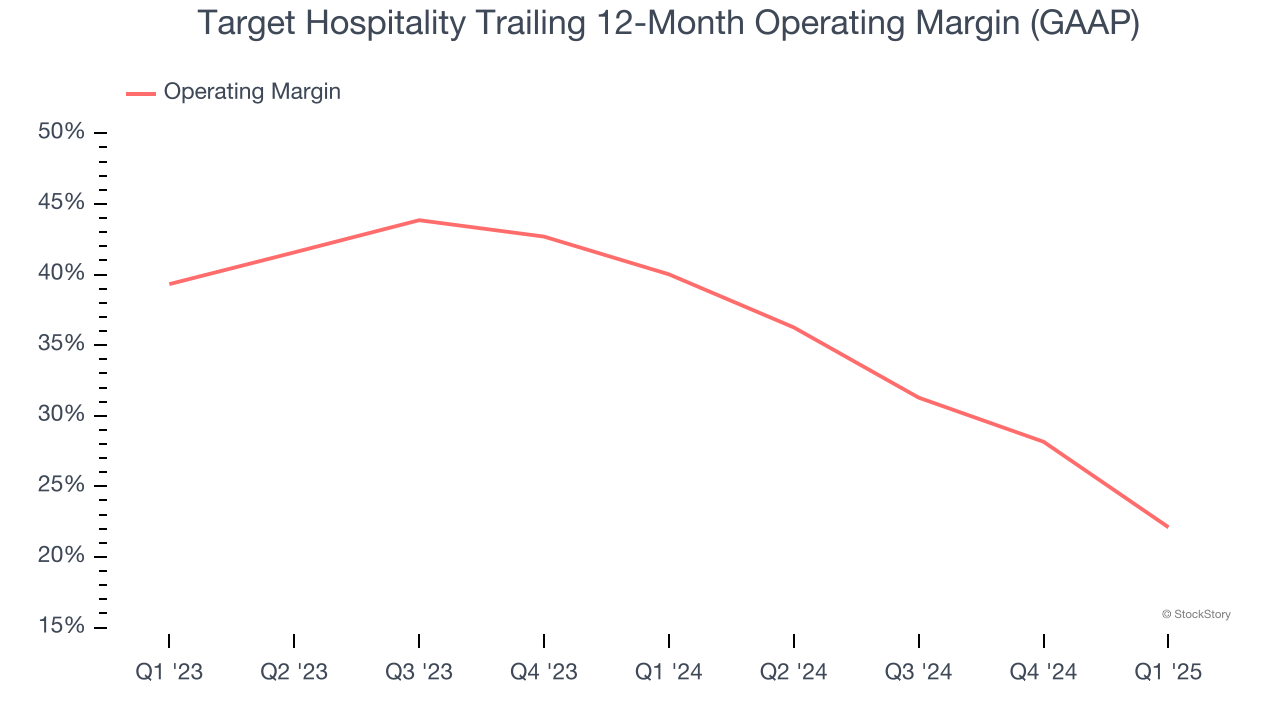

Operating Margin

Target Hospitality’s operating margin has shrunk over the last 12 months, but it still averaged 32.8% over the last two years, elite for a consumer discretionary business. This shows it’s an well-run company with an efficient cost structure, and we wouldn’t weigh the short-term trend too heavily.

This quarter, Target Hospitality generated an operating profit margin of negative 1.5%, down 30.1 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Target Hospitality’s EPS grew at a decent 10.8% compounded annual growth rate over the last five years, higher than its 2.4% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t expand and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q1, Target Hospitality reported EPS at negative $0.07, down from $0.20 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data. This signals Target Hospitality could be a hidden gem because it doesn’t have much coverage among professional brokers.

Key Takeaways from Target Hospitality’s Q1 Results

We enjoyed seeing Target Hospitality beat analysts’ revenue expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its EPS missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock traded up 2.6% to $7.28 immediately following the results.

Is Target Hospitality an attractive investment opportunity at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.