Academic publishing company John Wiley & Sons (NYSE: WLY) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, but sales fell by 5.5% year on year to $442.6 million. Its GAAP profit of $1.25 per share was 16.8% above analysts’ consensus estimates.

Is now the time to buy Wiley? Find out by accessing our full research report, it’s free.

Wiley (WLY) Q1 CY2025 Highlights:

- Revenue: $442.6 million vs analyst estimates of $435 million (5.5% year-on-year decline, 1.7% beat)

- EPS (GAAP): $1.25 vs analyst estimates of $1.07 (16.8% beat)

- Adjusted EBITDA: $125.6 million vs analyst estimates of $125.3 million (28.4% margin, in line)

- Operating Margin: 17.3%, in line with the same quarter last year

- Free Cash Flow Margin: 28.7%, down from 35.1% in the same quarter last year

- Market Capitalization: $2.00 billion

“We delivered another strong year of execution as we met or exceeded our financial commitments, drove profitable growth in our core, expanded margins and free cash flow, and extended further into the corporate market through AI licensing and partnership, science analytics, and knowledge services,” said Matthew Kissner, President and CEO.

Company Overview

With roots dating back to 1807 when Charles Wiley opened a small printing shop in Manhattan, John Wiley & Sons (NYSE: WLY) is a global academic publisher that provides scientific journals, books, digital courseware, and knowledge solutions for researchers, students, and professionals.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $1.68 billion in revenue over the past 12 months, Wiley is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

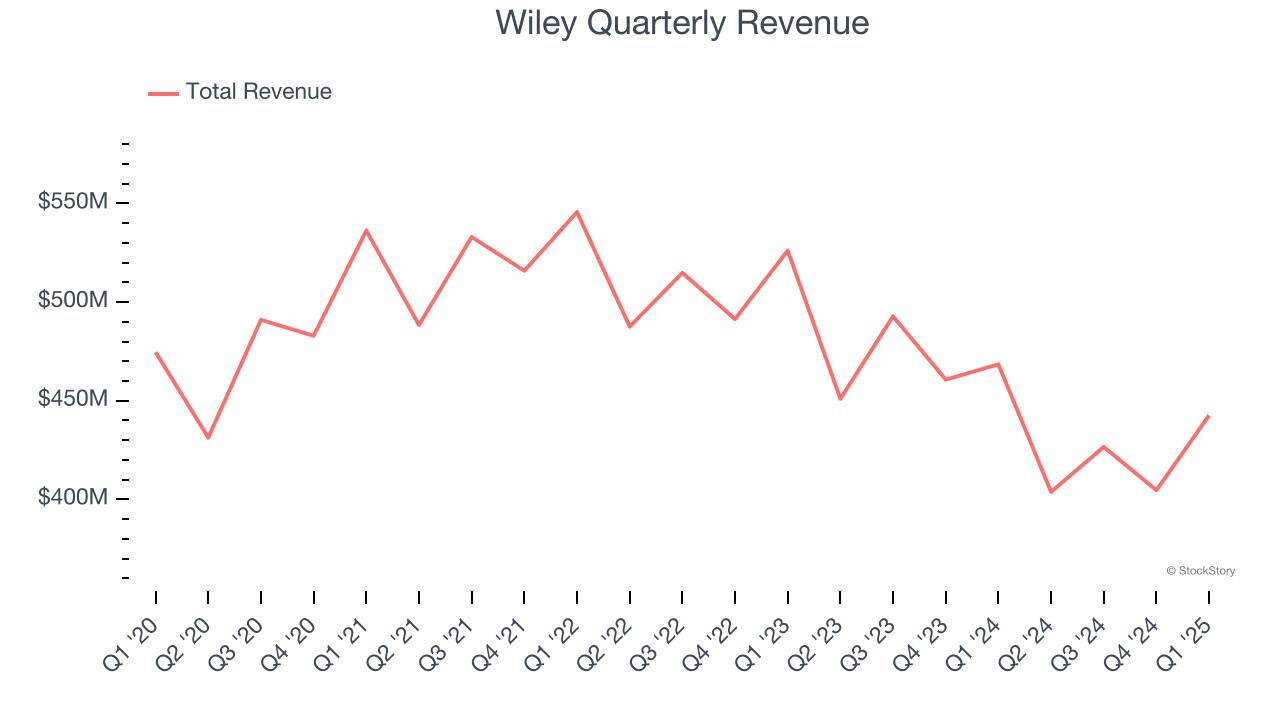

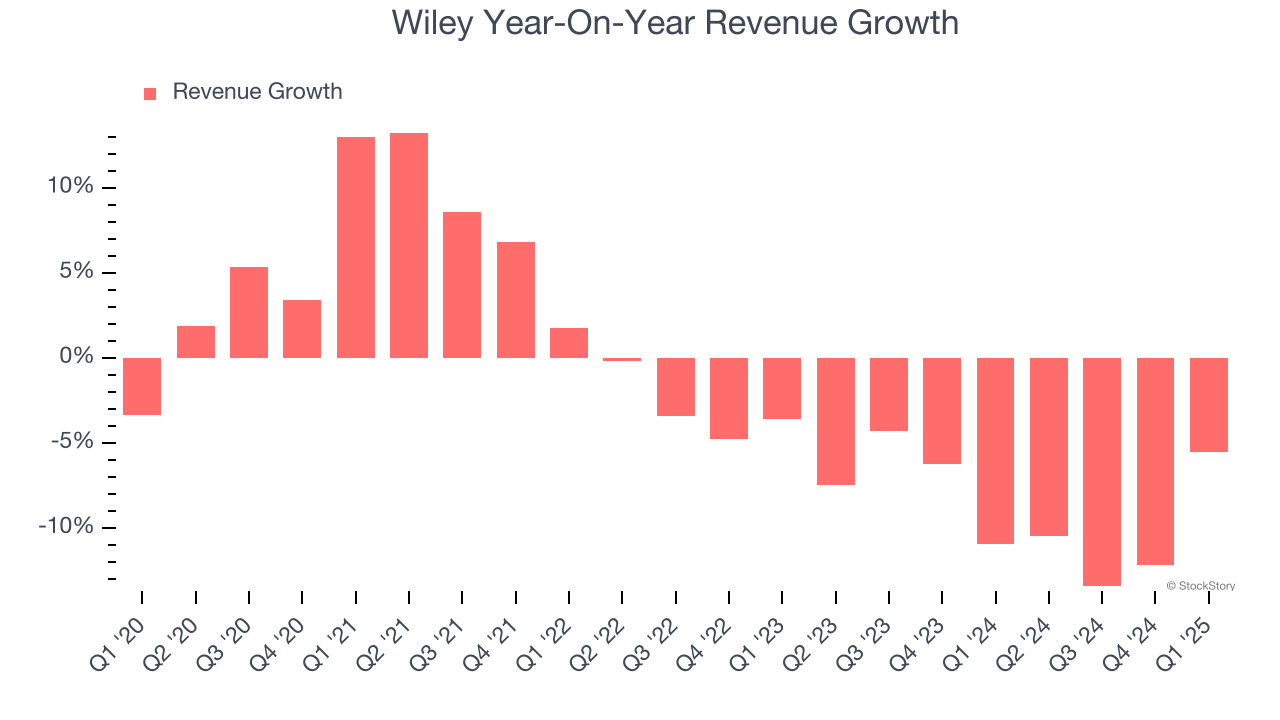

As you can see below, Wiley’s revenue declined by 1.7% per year over the last five years, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Wiley’s recent performance shows its demand remained suppressed as its revenue has declined by 8.9% annually over the last two years.

This quarter, Wiley’s revenue fell by 5.5% year on year to $442.6 million but beat Wall Street’s estimates by 1.7%.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

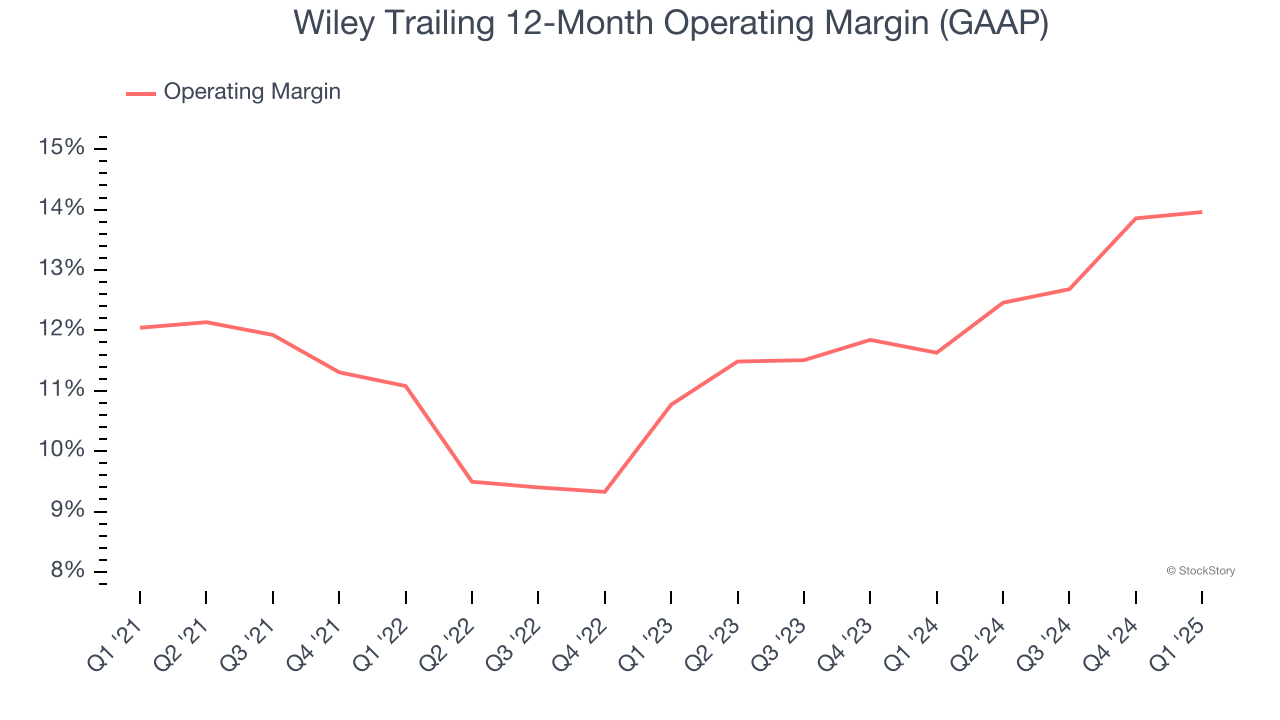

Wiley has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 11.8%, higher than the broader business services sector.

Looking at the trend in its profitability, Wiley’s operating margin rose by 1.9 percentage points over the last five years, showing its efficiency has improved.

This quarter, Wiley generated an operating margin profit margin of 17.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

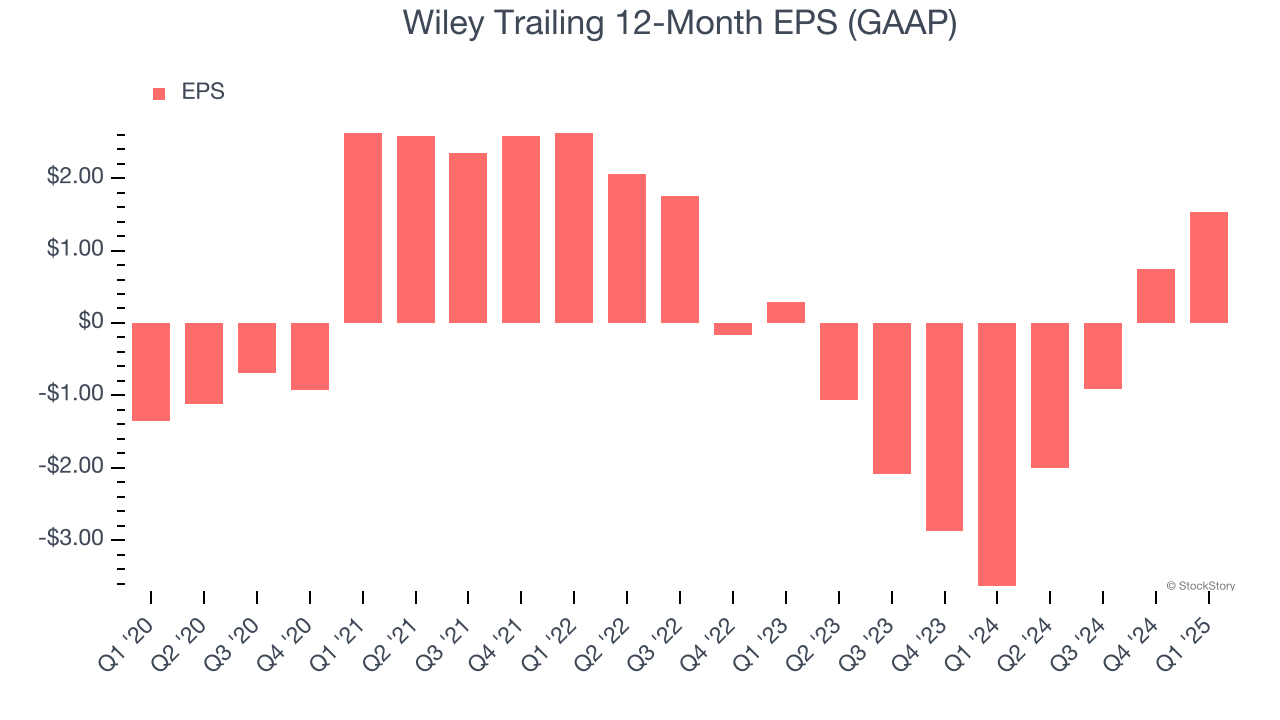

Wiley’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q1, Wiley reported EPS at $1.25, up from $0.46 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Wiley’s Q1 Results

We were impressed by how significantly Wiley blew past analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $40.72 immediately after reporting.

Is Wiley an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.