Over the last six months, PennyMac Mortgage Investment Trust’s shares have sunk to $12.25, producing a disappointing 6% loss - a stark contrast to the S&P 500’s 1.7% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy PennyMac Mortgage Investment Trust, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is PennyMac Mortgage Investment Trust Not Exciting?

Even with the cheaper entry price, we don't have much confidence in PennyMac Mortgage Investment Trust. Here are three reasons why you should be careful with PMT and a stock we'd rather own.

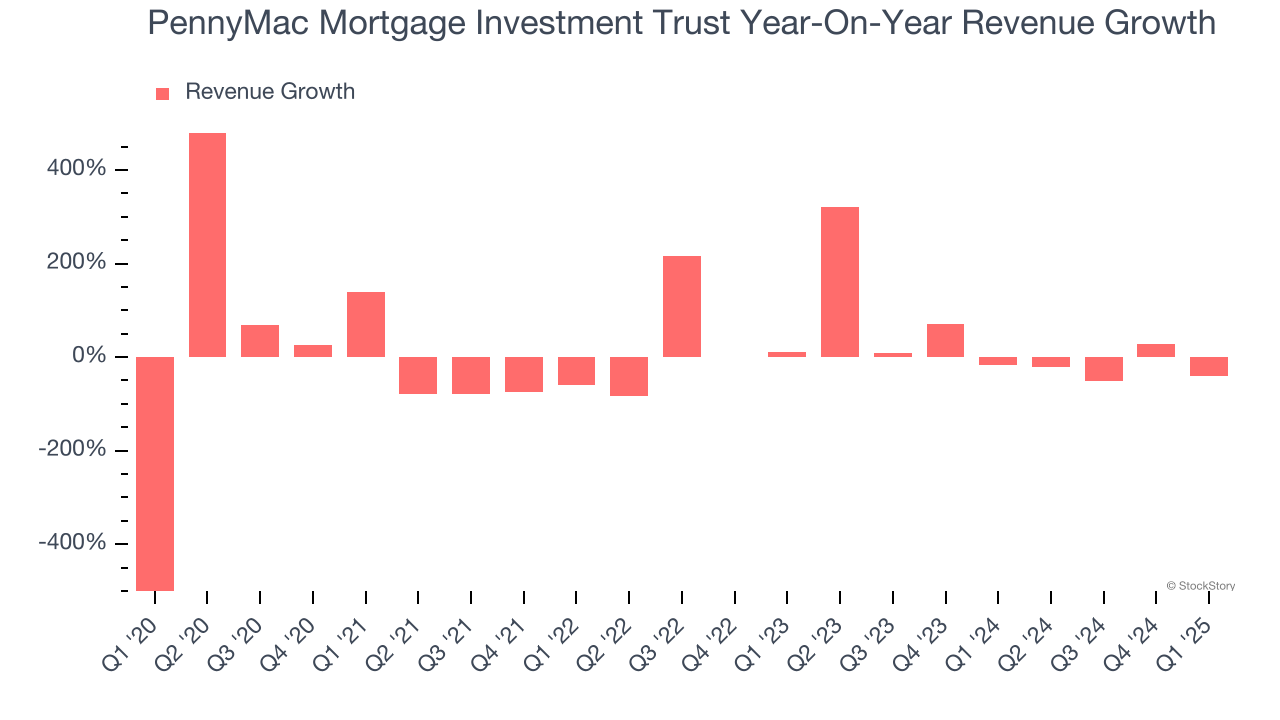

1. Revenue Tumbling Downwards

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, inflation readings, and industry trends. PennyMac Mortgage Investment Trust’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.3% over the last two years.

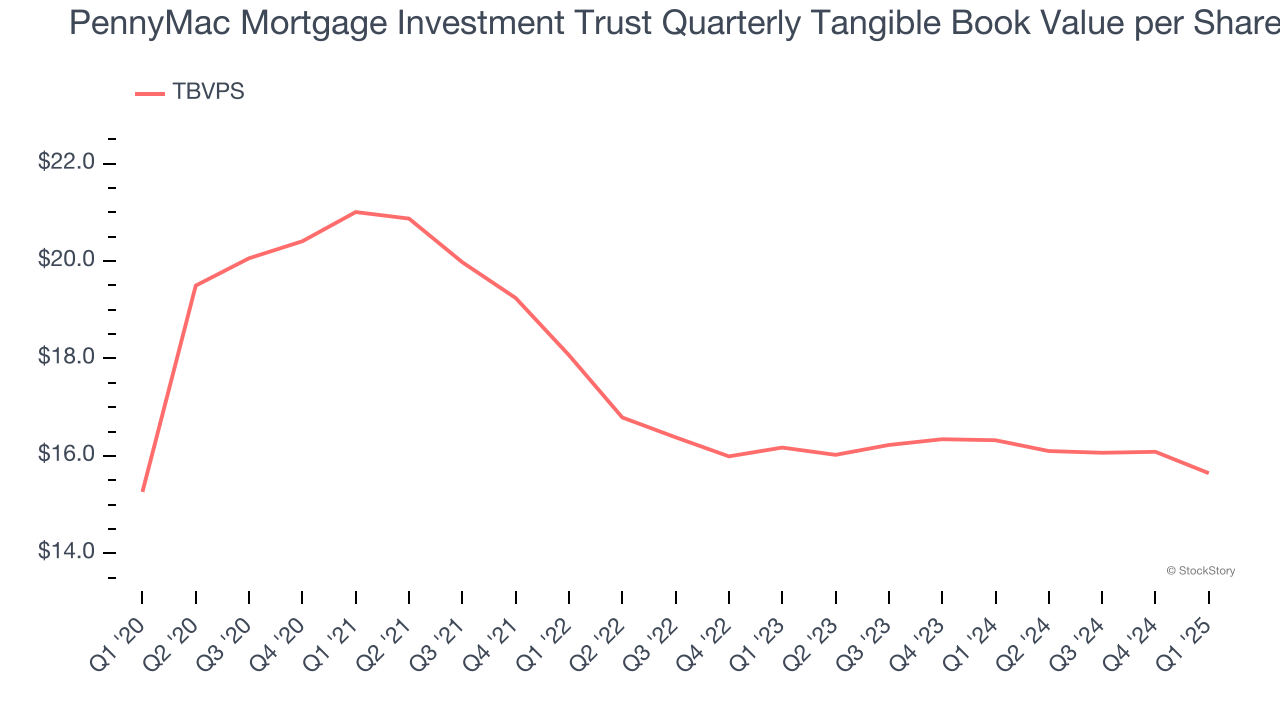

2. Declining TBVPS Reflects Erosion of Asset Value

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

PennyMac Mortgage Investment Trust’s TBVPS was flat over the last five years, and the past two years paint an even worse picture as TBVPS declined at a -1.6% annual clip (from $16.17 to $15.64 per share).

3. TBVPS Projections Show Stormy Skies Ahead

Because banks generate earnings primarily through borrowing and lending, they’re valued based on their balance sheet strength and ability to compound book value (another name for shareholders’ equity). Specifically, we look at tangible book value per share, or TBVPS, which represents the real, liquid net worth of a bank.

Over the next 12 months, Consensus estimates call for PennyMac Mortgage Investment Trust’s TBVPS to shrink by 2.2% to $15.30, a sour projection.

Final Judgment

PennyMac Mortgage Investment Trust isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 0.8× forward P/B (or $12.25 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward one of our all-time favorite software stocks.

Stocks We Like More Than PennyMac Mortgage Investment Trust

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.