City Holding currently trades at $123.25 per share and has shown little upside over the past six months, posting a middling return of 2.2%.

Is now the time to buy CHCO? Or does the price properly account for its business quality and fundamentals? Find out in our full research report, it’s free.

Why Does CHCO Stock Spark Debate?

With roots dating back to 1957 and a strategic presence along the I-64 and I-81 corridors, City Holding (NASDAQGS:CHCO) operates as a financial holding company providing banking, trust, and investment services through its subsidiary City National Bank across West Virginia, Kentucky, Virginia, and Ohio.

Two Things to Like:

1. Net Interest Income Drives Additional Growth Opportunities

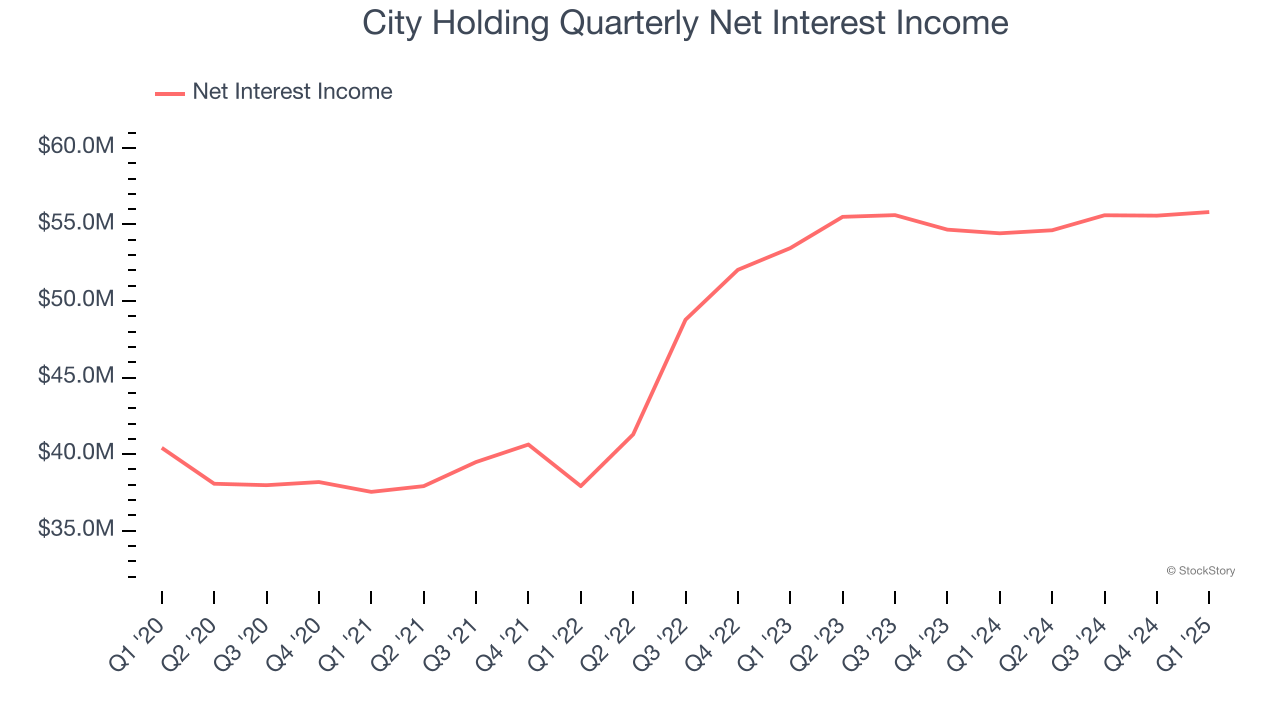

Our experience and research show the market cares primarily about a bank’s net interest income growth as non-interest income is considered a lower-quality and non-recurring revenue source.

City Holding’s net interest income has grown at a 9.9% annualized rate over the last four years, a step above the broader bank industry. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

2. Increasing Net Interest Margin Juices Financials

Revenue is a fine reference point for banks, but net interest income and margin are better indicators of business quality for banks because they’re balance sheet-driven businesses that leverage their assets to generate profits.

Over the past two years, City Holding’s net interest margin averaged 3.9%, climbing by 30.7 basis points (100 basis points = 1 percentage point) over that period.

This expansion was a tailwind for its net interest income, and while prevailing interest rates matter the most for industry net interest margins, banks that consistently increase this figure generally boast higher-earning loan books (all else equal such as the risk of those loans) or provide differentiated services that give them the ability to charge higher rates (pricing power).

One Reason to be Careful:

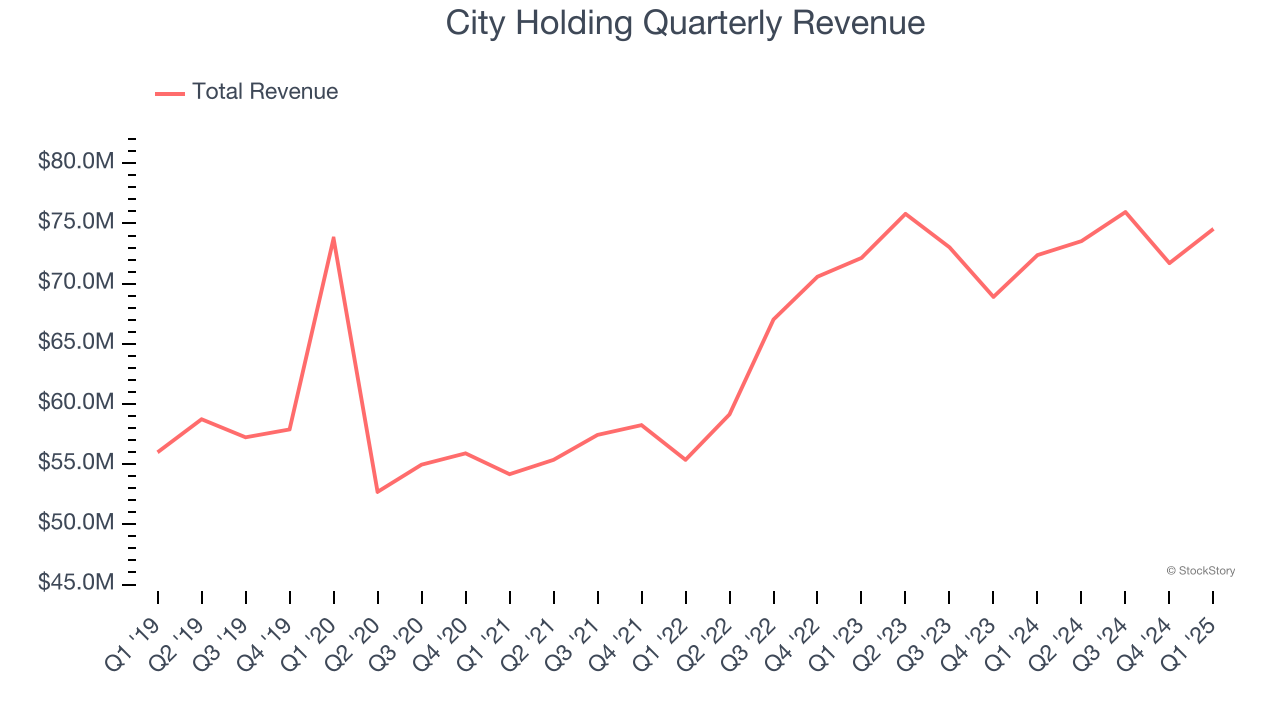

Long-Term Revenue Growth Disappoints

From lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions.

Unfortunately, City Holding’s 3.6% annualized revenue growth over the last five years was mediocre. This wasn’t a great result compared to the rest of the bank sector, but there are still things to like about City Holding.

Final Judgment

City Holding has huge potential even though it has some open questions, but at $123.25 per share (or 2.3× forward P/B), is now the time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.