Wrapping up Q1 earnings, we look at the numbers and key takeaways for the vertical software stocks, including Agilysys (NASDAQ: AGYS) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 14 vertical software stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 2.8% while next quarter’s revenue guidance was in line.

Luckily, vertical software stocks have performed well with share prices up 13% on average since the latest earnings results.

Agilysys (NASDAQ: AGYS)

Originally a subsidiary of Pioneer-Standard Electronics that distributed electronic components, Agilysys (NASDAQ: AGYS) offers a software-as-service platform that helps hotels, resorts, restaurants, and other hospitality businesses manage their operations and workflows.

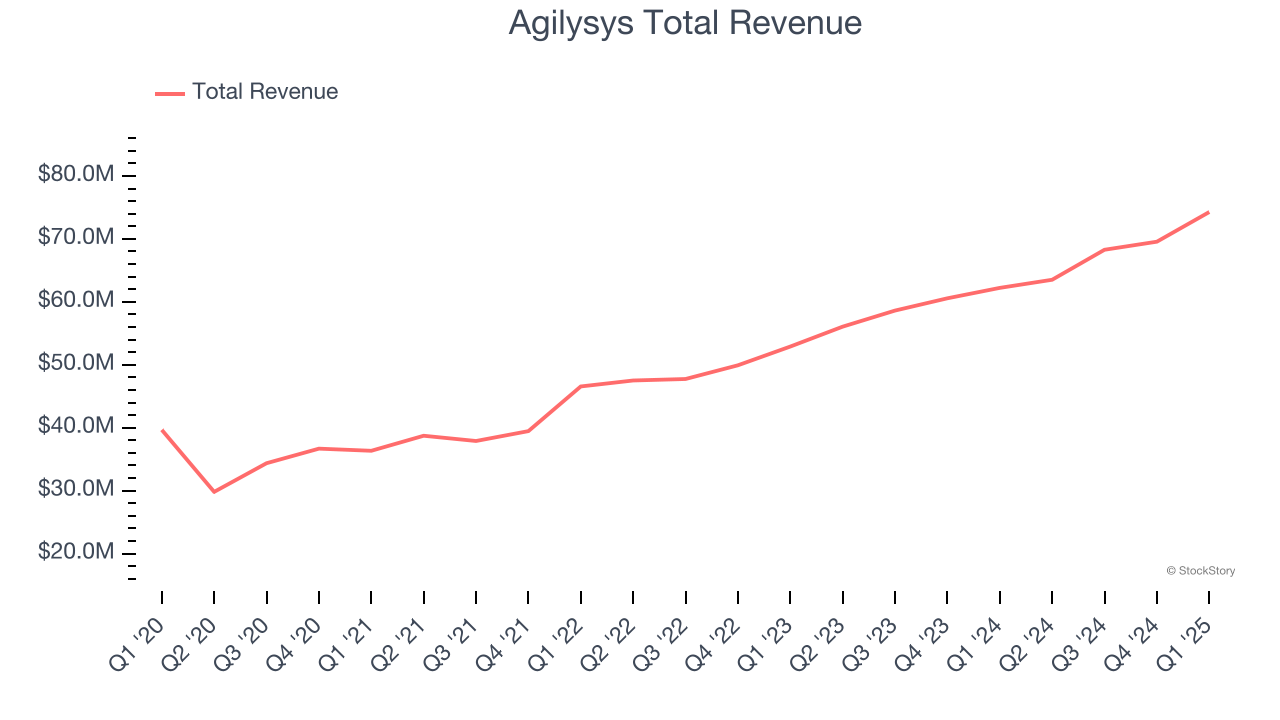

Agilysys reported revenues of $74.27 million, up 19.4% year on year. This print exceeded analysts’ expectations by 3.7%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ EBITDA estimates but full-year revenue guidance missing analysts’ expectations significantly.

Ramesh Srinivasan, President and CEO of Agilysys, commented, “We are pleased with our fourth quarter results, which featured year-over-year subscription revenue growth of 42.7% including Book4Time and services revenue growth of 21.7%, producing the 13th consecutive record quarter for overall revenue. Annual fiscal year 2025 total revenue, subscription revenue and services revenue were also all records, led by subscription growth of 39.5% and services growth of 27.7% for the full year.

Agilysys delivered the weakest full-year guidance update of the whole group. Interestingly, the stock is up 38.3% since reporting and currently trades at $114.73.

Is now the time to buy Agilysys? Access our full analysis of the earnings results here, it’s free.

Best Q1: Veeva Systems (NYSE: VEEV)

Built on top of Salesforce as one of the first vertical-focused cloud platforms, Veeva (NYSE: VEEV) provides data and customer relationship management (CRM) software for organizations in the life sciences industry.

Veeva Systems reported revenues of $759 million, up 16.7% year on year, outperforming analysts’ expectations by 4.2%. The business had an exceptional quarter with an impressive beat of analysts’ billings estimates and EPS guidance for next quarter exceeding analysts’ expectations.

Veeva Systems delivered the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 20% since reporting. It currently trades at $282.

Is now the time to buy Veeva Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Doximity (NYSE: DOCS)

Founded in 2010 and named for a combination of “docs” and “proximity”, Doximity (NYSE: DOCS) is the leading social network for U.S. medical professionals.

Doximity reported revenues of $138.3 million, up 17.1% year on year, exceeding analysts’ expectations by 3.5%. Still, it was a weaker quarter as it posted full-year guidance of slowing revenue growth and EBITDA guidance for next quarter missing analysts’ expectations significantly.

The stock is flat since the results and currently trades at $58.41.

Read our full analysis of Doximity’s results here.

Q2 Holdings (NYSE: QTWO)

Founded in 2004 by Hank Seale, Q2 (NYSE: QTWO) offers software-as-a-service that enables small banks to provide online banking and consumer lending services to their clients.

Q2 Holdings reported revenues of $189.7 million, up 14.6% year on year. This number surpassed analysts’ expectations by 1.7%. It was a very strong quarter as it also put up a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is up 15.2% since reporting and currently trades at $92.55.

Read our full, actionable report on Q2 Holdings here, it’s free.

Unity (NYSE: U)

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE: U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

Unity reported revenues of $435 million, down 5.5% year on year. This print beat analysts’ expectations by 4.4%. More broadly, it was a mixed quarter as it also produced a solid beat of analysts’ billings estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

Unity had the slowest revenue growth among its peers. The stock is up 12.8% since reporting and currently trades at $24.05.

Read our full, actionable report on Unity here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.