Gorman-Rupp (NYSE: GRC) manufactures and sells pumps globally. reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 5.6% year on year to $179 million. Its non-GAAP profit of $0.60 per share was 6.2% above analysts’ consensus estimates.

Is now the time to buy Gorman-Rupp? Find out by accessing our full research report, it’s free.

Gorman-Rupp (GRC) Q2 CY2025 Highlights:

- Revenue: $179 million vs analyst estimates of $174.6 million (5.6% year-on-year growth, 2.5% beat)

- Adjusted EPS: $0.60 vs analyst estimates of $0.57 (6.2% beat)

- Adjusted EBITDA: $35.3 million vs analyst estimates of $32.21 million (19.7% margin, 9.6% beat)

- Operating Margin: 15%, in line with the same quarter last year

- Free Cash Flow Margin: 13.9%, up from 11.5% in the same quarter last year

- Backlog: $224.4 million at quarter end

- Market Capitalization: $996 million

Scott A. King, President and CEO, commented, “We were pleased to report record sales, earnings per share and incoming orders during the quarter. Sales increased in the majority of our markets led by the municipal market benefiting from infrastructure spending, including strong demand for flood control and storm water management. In addition, a number of our markets are benefiting from increased demand related to data center construction. While we will continue to monitor tariffs and plan to mitigate their impact through selling price increases, we believe that our primarily U.S. based supply chain provides a competitive advantage. Our strong cash flow has allowed us to reduce our debt levels, including a $30 million reduction in the first half of 2025, contributing to our significant improvement in interest expense. With positive incoming order trends and current backlog levels, we are well positioned for the second half of the year.”

Company Overview

Powering fluid dynamics since 1934, Gorman-Rupp (NYSE: GRC) has evolved from its Ohio origins into a global manufacturer and seller of pumps and pump systems.

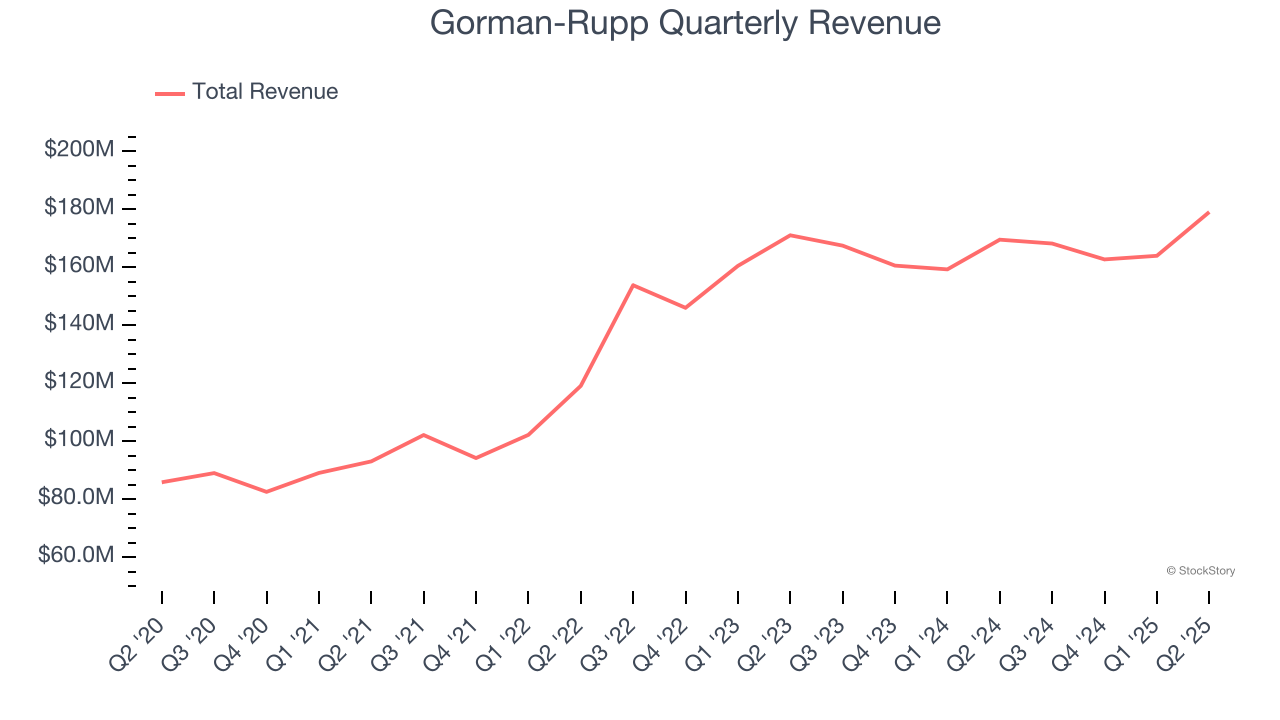

Revenue Growth

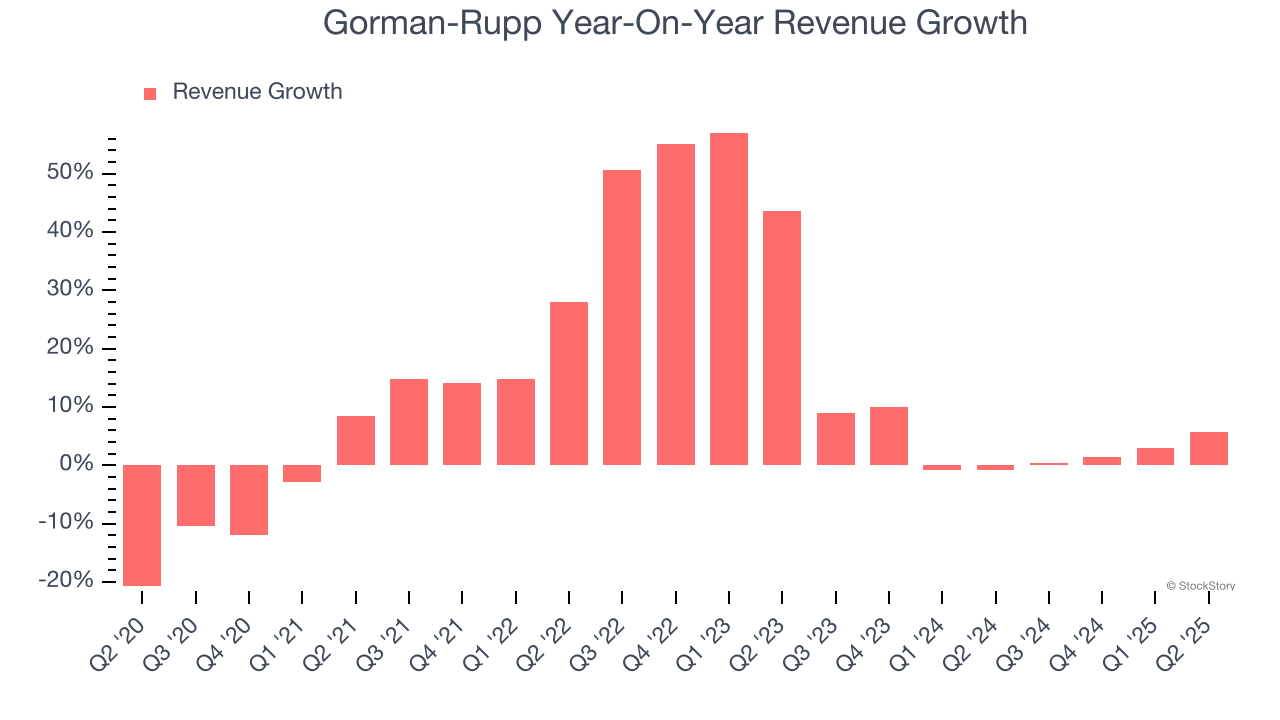

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Gorman-Rupp’s sales grew at an excellent 12.7% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Gorman-Rupp’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 3.3% over the last two years was well below its five-year trend.

This quarter, Gorman-Rupp reported year-on-year revenue growth of 5.6%, and its $179 million of revenue exceeded Wall Street’s estimates by 2.5%.

Looking ahead, sell-side analysts expect revenue to grow 3.7% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not lead to better top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Gorman-Rupp has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 11.9%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Gorman-Rupp’s operating margin rose by 4.2 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q2, Gorman-Rupp generated an operating margin profit margin of 15%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

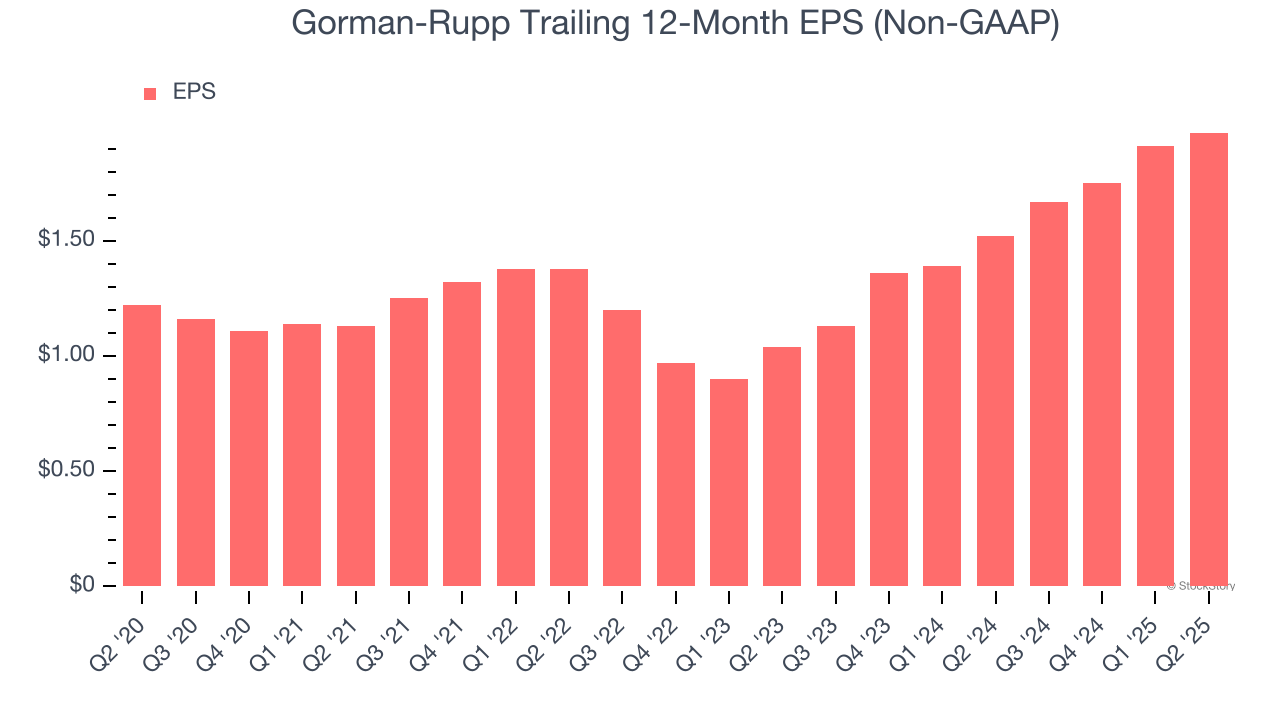

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Gorman-Rupp’s EPS grew at a solid 10.1% compounded annual growth rate over the last five years. Despite its operating margin improvement during that time, this performance was lower than its 12.7% annualized revenue growth, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Gorman-Rupp’s two-year annual EPS growth of 37.6% was fantastic and topped its 3.3% two-year revenue growth.

Diving into Gorman-Rupp’s quality of earnings can give us a better understanding of its performance. While we mentioned earlier that Gorman-Rupp’s operating margin was flat this quarter, a two-year view shows its margin has expanded by 1 percentage points. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q2, Gorman-Rupp reported EPS at $0.60, up from $0.54 in the same quarter last year. This print beat analysts’ estimates by 6.2%. Over the next 12 months, Wall Street expects Gorman-Rupp’s full-year EPS of $1.97 to grow 12.9%.

Key Takeaways from Gorman-Rupp’s Q2 Results

We were impressed by how significantly Gorman-Rupp blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 3.4% to $39.15 immediately after reporting.

Sure, Gorman-Rupp had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.