Ellington Financial currently trades at $13.03 per share and has shown little upside over the past six months, posting a middling return of 3.7%.

Is there a buying opportunity in Ellington Financial, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think Ellington Financial Will Underperform?

We're cautious about Ellington Financial. Here are three reasons why EFC doesn't excite us and a stock we'd rather own.

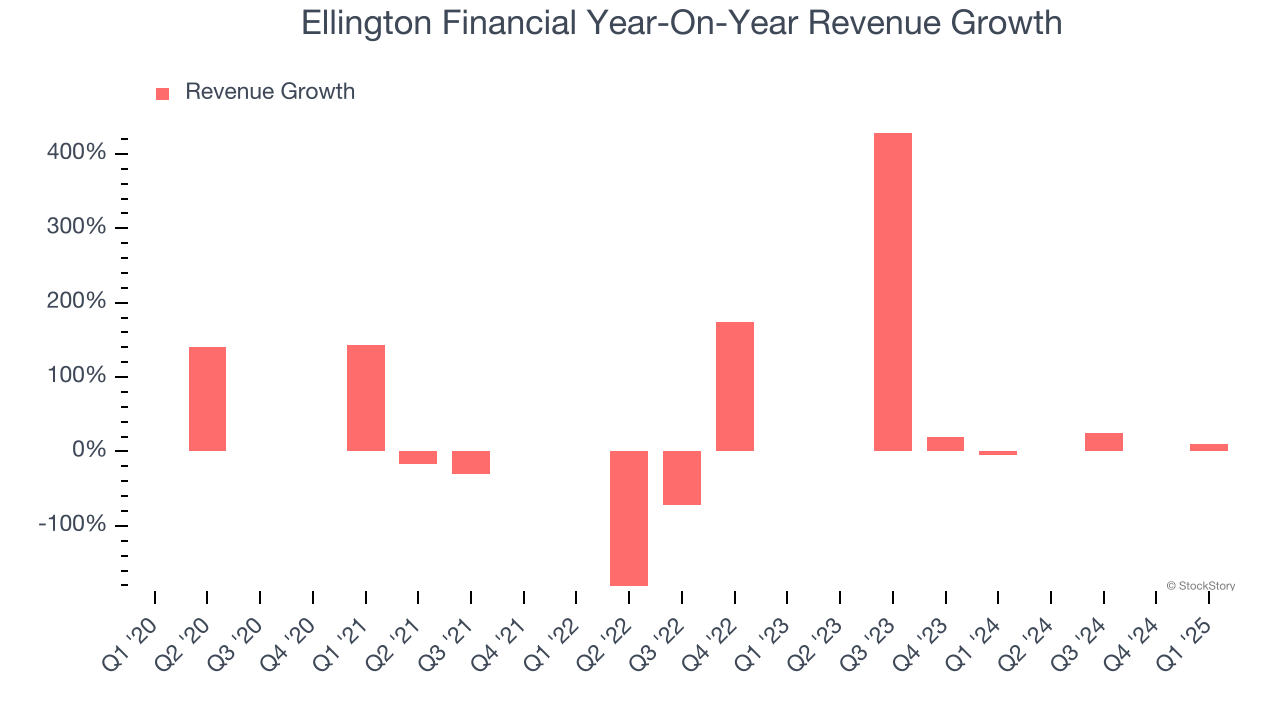

1. Lackluster Revenue Growth

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, market returns, and industry trends. Ellington Financial’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 1.5% over the last two years was well below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

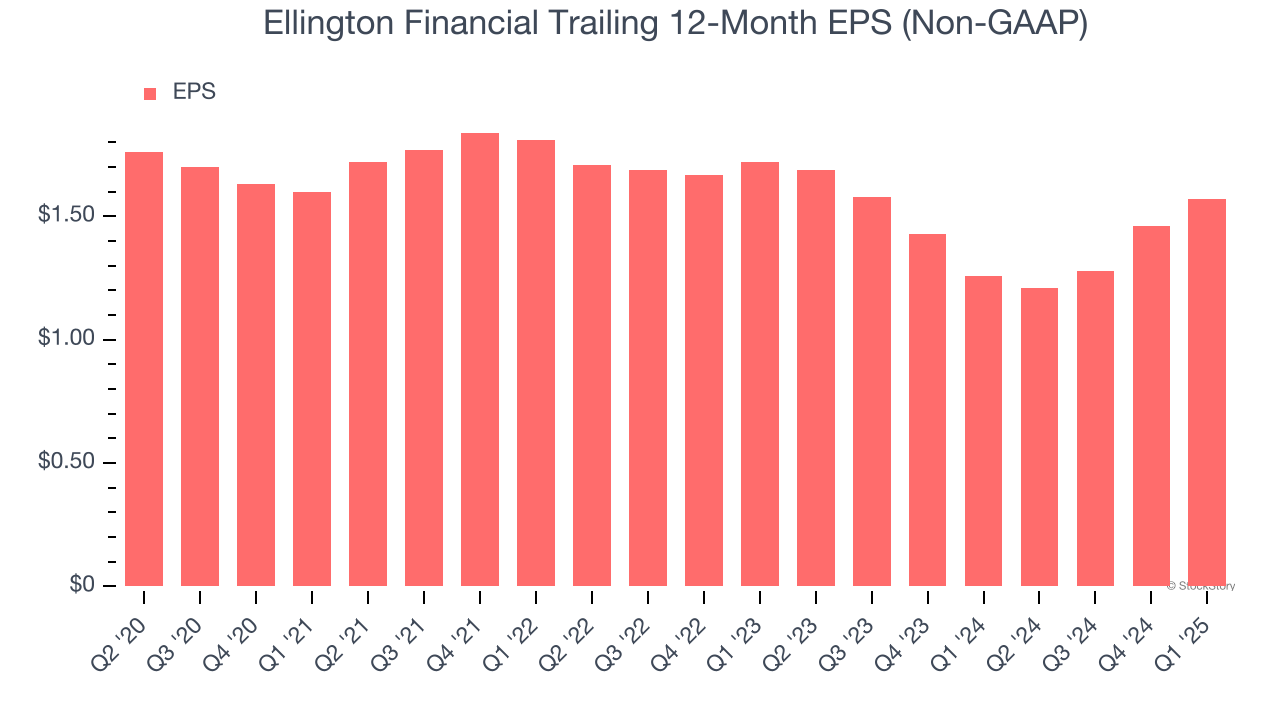

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Ellington Financial, its EPS declined by 2% annually over the last five years while its revenue grew by 28.2%. This tells us the company became less profitable on a per-share basis as it expanded.

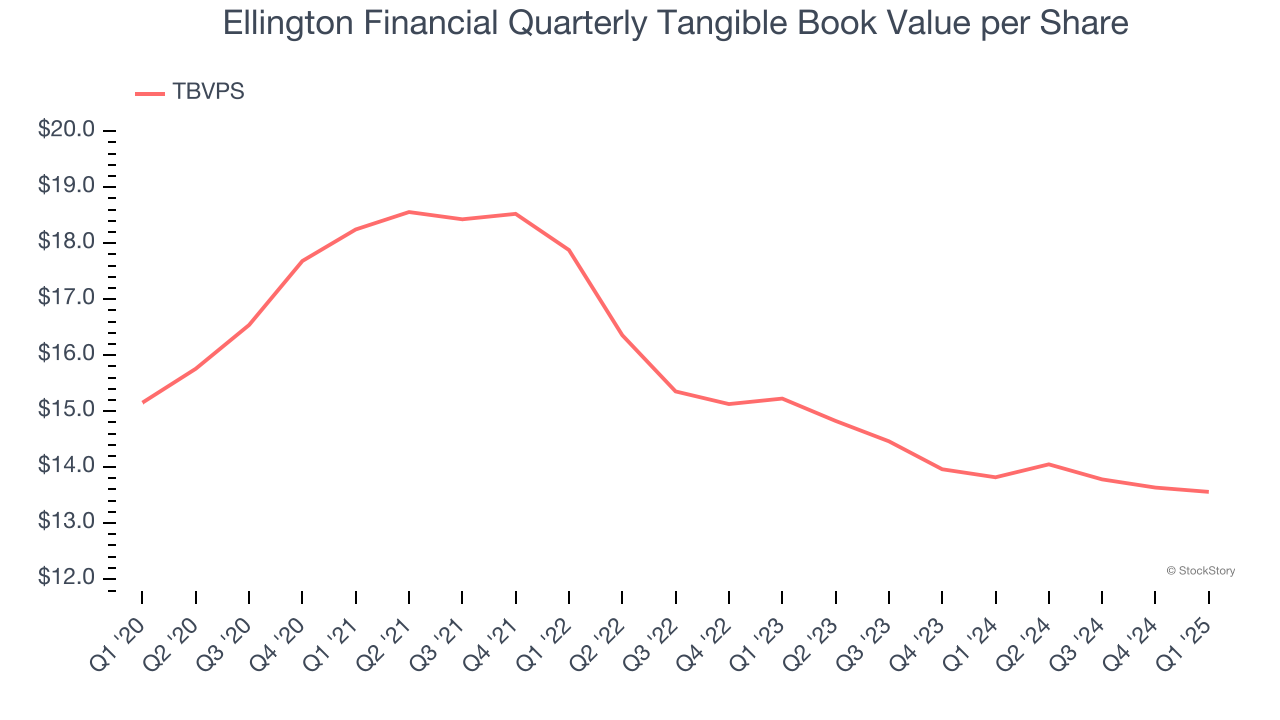

3. Declining TBVPS Reflects Erosion of Asset Value

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

To the detriment of investors, Ellington Financial’s TBVPS continued freefalling over the past two years as TBVPS declined at a -5.6% annual clip (from $15.22 to $13.56 per share).

Final Judgment

We see the value of companies driving economic growth, but in the case of Ellington Financial, we’re out. That said, the stock currently trades at 1× forward P/B (or $13.03 per share). At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment. Let us point you toward a top digital advertising platform riding the creator economy.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2024, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.