Walker & Dunlop’s stock price has taken a beating over the past six months, shedding 21.3% of its value and falling to $75.61 per share. This might have investors contemplating their next move.

Is there a buying opportunity in Walker & Dunlop, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Walker & Dunlop Not Exciting?

Despite the more favorable entry price, we don't have much confidence in Walker & Dunlop. Here are three reasons why we avoid WD and a stock we'd rather own.

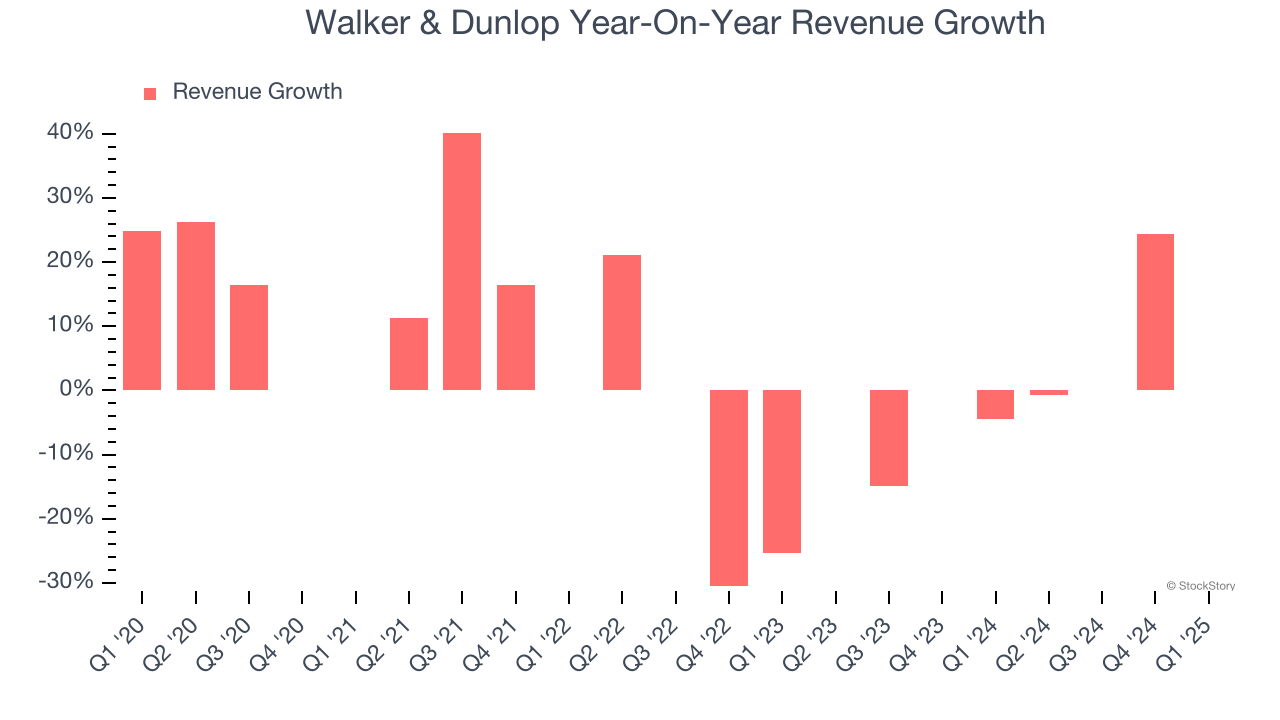

1. Revenue Tumbling Downwards

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, market returns, and industry trends. Walker & Dunlop’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.6% over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

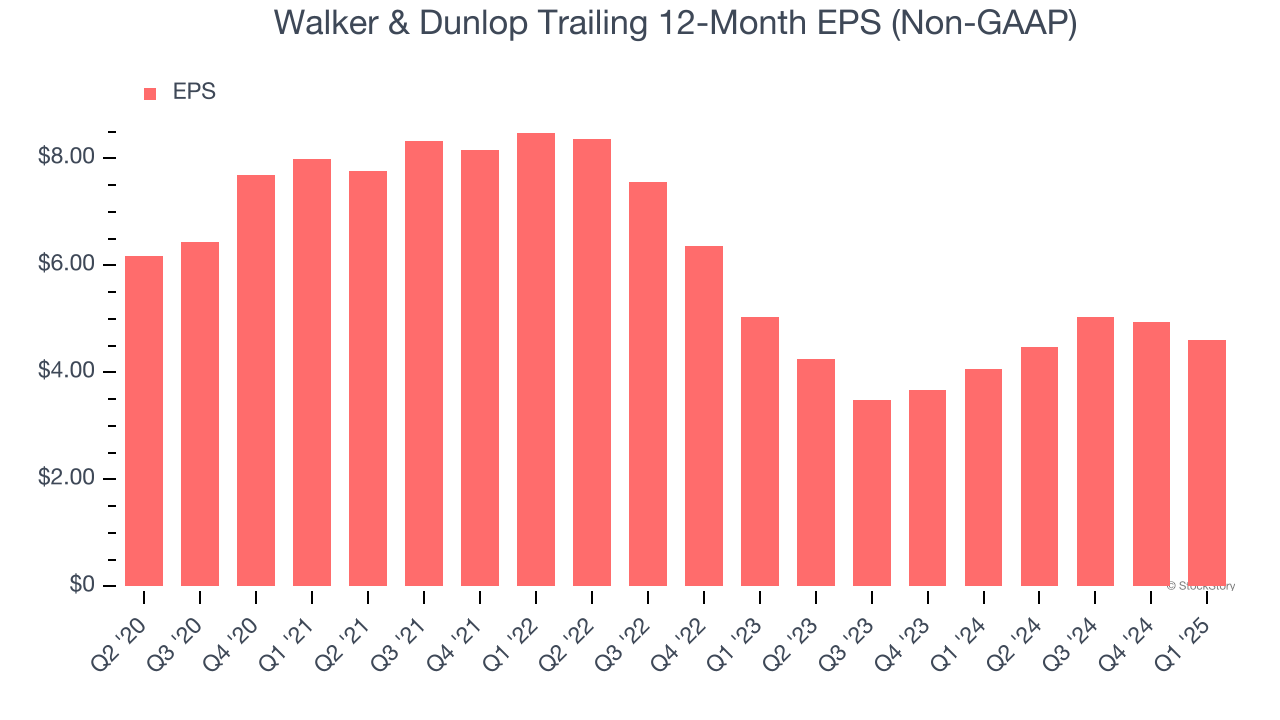

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Walker & Dunlop, its EPS declined by 4.3% annually over the last five years while its revenue grew by 5.7%. This tells us the company became less profitable on a per-share basis as it expanded.

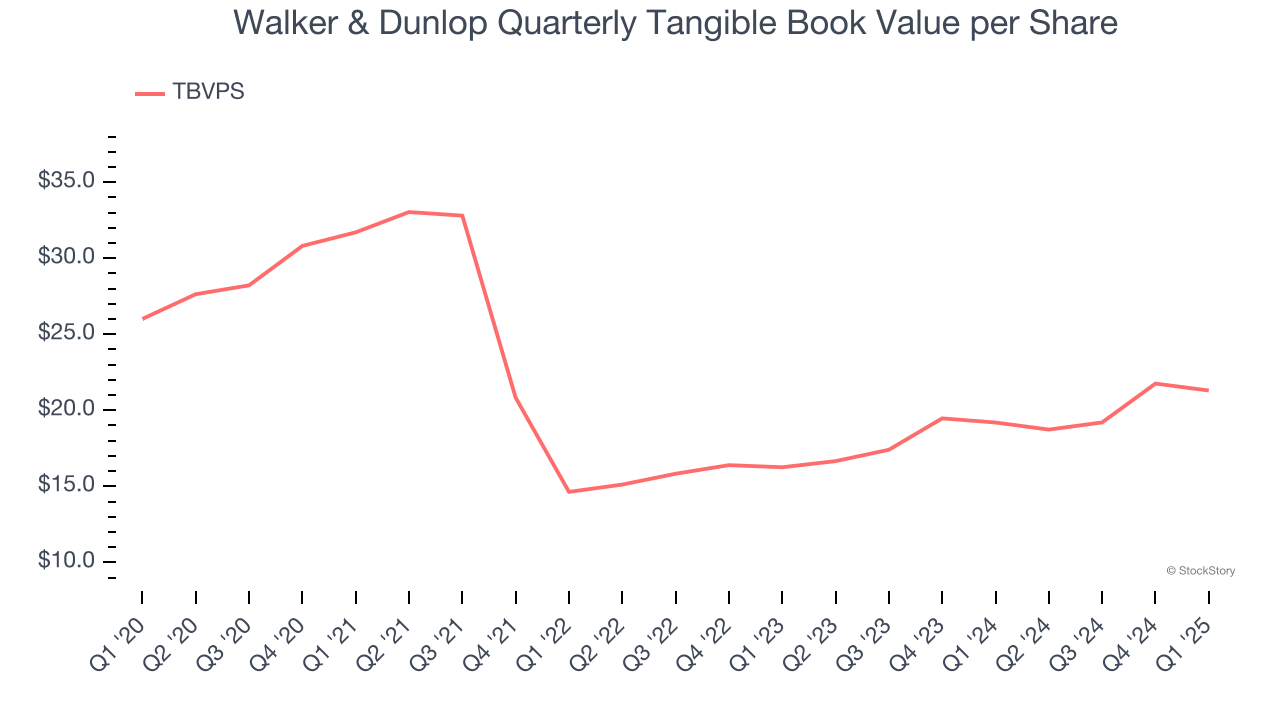

3. Growing TBVPS Reflects Strong Asset Base

Tangible book value per share (TBVPS) serves as a key indicator of a bank’s financial strength, representing the hard assets available to shareholders after removing intangible assets that could evaporate during financial distress.

Although Walker & Dunlop’s TBVPS declined at a 3.9% annual clip over the last five years. the good news is that its growth inflected positive over the past two years as TBVPS grew at an impressive 14.5% annual clip (from $16.26 to $21.30 per share).

Final Judgment

Walker & Dunlop isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 1.4× forward P/B (or $75.61 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find more timely opportunities elsewhere. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Like More Than Walker & Dunlop

Trump’s April 2024 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.