Consumer products giant Clorox (NYSE: CLX) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 4.5% year on year to $1.99 billion. Its non-GAAP profit of $2.87 per share was 29.7% above analysts’ consensus estimates.

Is now the time to buy Clorox? Find out by accessing our full research report, it’s free.

Clorox (CLX) Q2 CY2025 Highlights:

- Revenue: $1.99 billion vs analyst estimates of $1.93 billion (4.5% year-on-year growth, 3.3% beat)

- Adjusted EPS: $2.87 vs analyst estimates of $2.21 (29.7% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $6.13 at the midpoint, missing analyst estimates by 5.1%

- Operating Margin: 20.6%, up from 13.9% in the same quarter last year

- Organic Revenue rose 8% year on year (3% in the same quarter last year)

- Market Capitalization: $15.48 billion

"While we delivered strong margin expansion and adjusted EPS growth for the year, we did not meet our topline expectations in the back half. We continued to see rapidly shifting consumer behaviors and broader market volatility which we expect to continue," said Chair and CEO Linda Rendle.

Company Overview

Founded in 1913 with bleach as the sole product offering, Clorox (NYSE: CLX) today is a consumer products giant whose product portfolio spans everything from bleach to skincare to salad dressing to kitty litter.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $7.1 billion in revenue over the past 12 months, Clorox is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when your existing brands have penetrated most of the market. To accelerate sales, Clorox likely needs to optimize its pricing or lean into new products and international expansion.

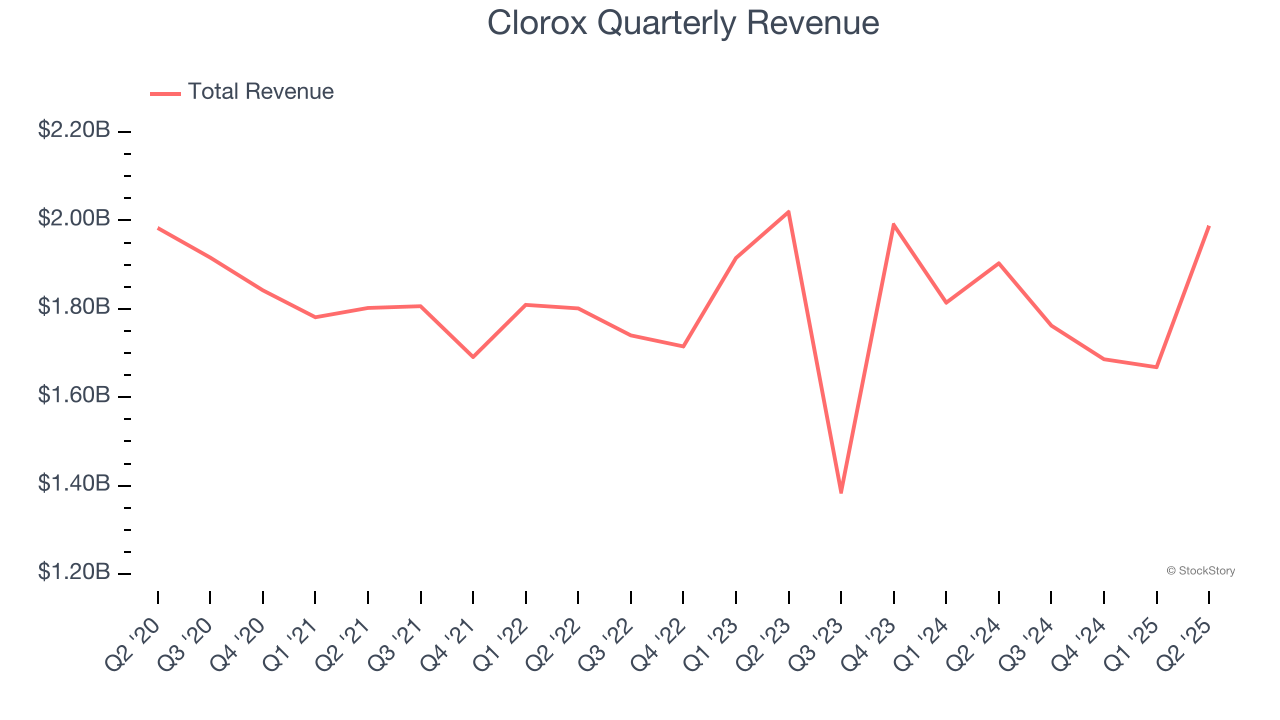

As you can see below, Clorox struggled to increase demand as its $7.1 billion of sales for the trailing 12 months was close to its revenue three years ago. This shows demand was soft, a poor baseline for our analysis.

This quarter, Clorox reported modest year-on-year revenue growth of 4.5% but beat Wall Street’s estimates by 3.3%.

Looking ahead, sell-side analysts expect revenue to decline by 5% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Organic Revenue Growth

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

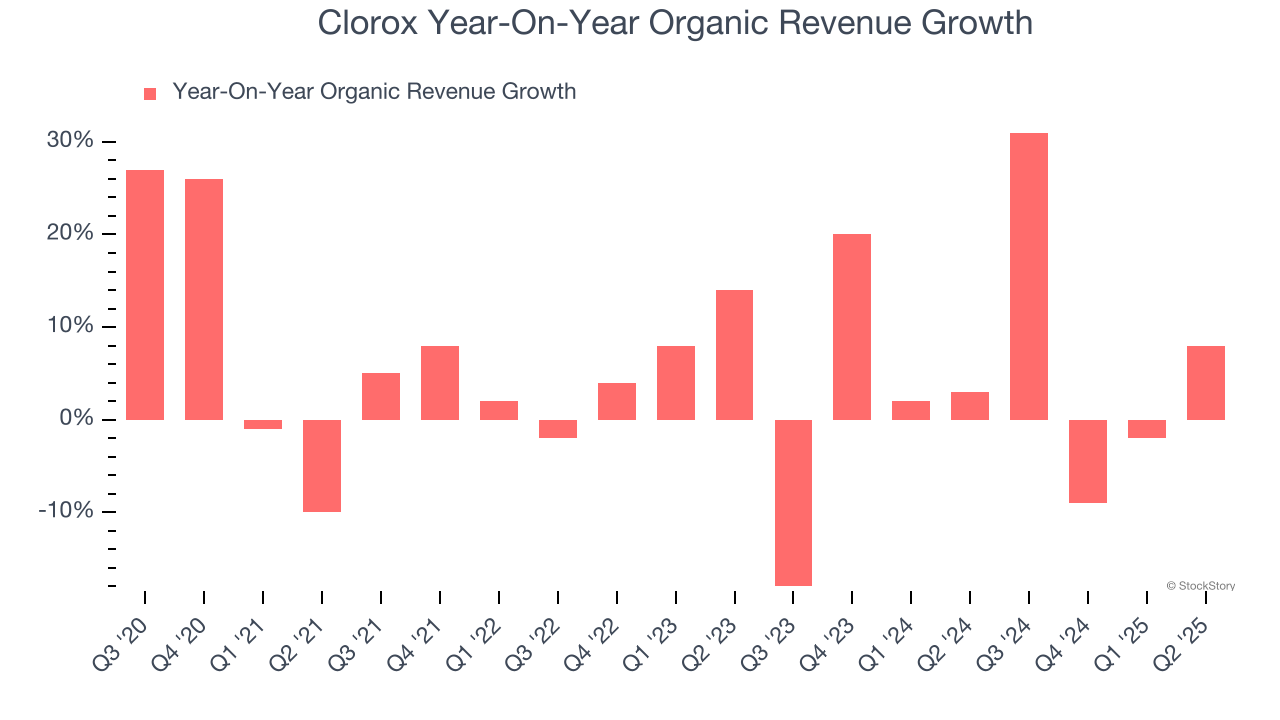

The demand for Clorox’s products has generally risen over the last two years but lagged behind the broader sector. On average, the company’s organic sales have grown by 4.4% year on year.

In the latest quarter, Clorox’s organic sales rose by 8% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from Clorox’s Q2 Results

We enjoyed seeing Clorox beat analysts’ organic revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 1.4% to $127.13 immediately after reporting.

Indeed, Clorox had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.