Radiation safety company Mirion (NYSE: MIR) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 7.6% year on year to $222.9 million. Its non-GAAP profit of $0.11 per share was in line with analysts’ consensus estimates.

Is now the time to buy Mirion? Find out by accessing our full research report, it’s free.

Mirion (MIR) Q2 CY2025 Highlights:

- Revenue: $222.9 million vs analyst estimates of $216.2 million (7.6% year-on-year growth, 3.1% beat)

- Adjusted EPS: $0.11 vs analyst estimates of $0.10 (in line)

- Adjusted EBITDA: $51.2 million vs analyst estimates of $51.52 million (23% margin, 0.6% miss)

- Management raised its full-year Adjusted EPS guidance to $0.50 at the midpoint, a 5.3% increase

- EBITDA guidance for the full year is $228 million at the midpoint, above analyst estimates of $224.2 million

- Operating Margin: 4.4%, up from 1.9% in the same quarter last year

- Free Cash Flow Margin: 1.6%, similar to the same quarter last year

- Market Capitalization: $4.62 billion

Company Overview

With its technology protecting workers in over 130 countries and equipment used in 80% of cancer centers worldwide, Mirion Technologies (NYSE: MIR) provides radiation detection, measurement, and monitoring solutions for medical, nuclear energy, defense, and scientific research applications.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $886 million in revenue over the past 12 months, Mirion is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

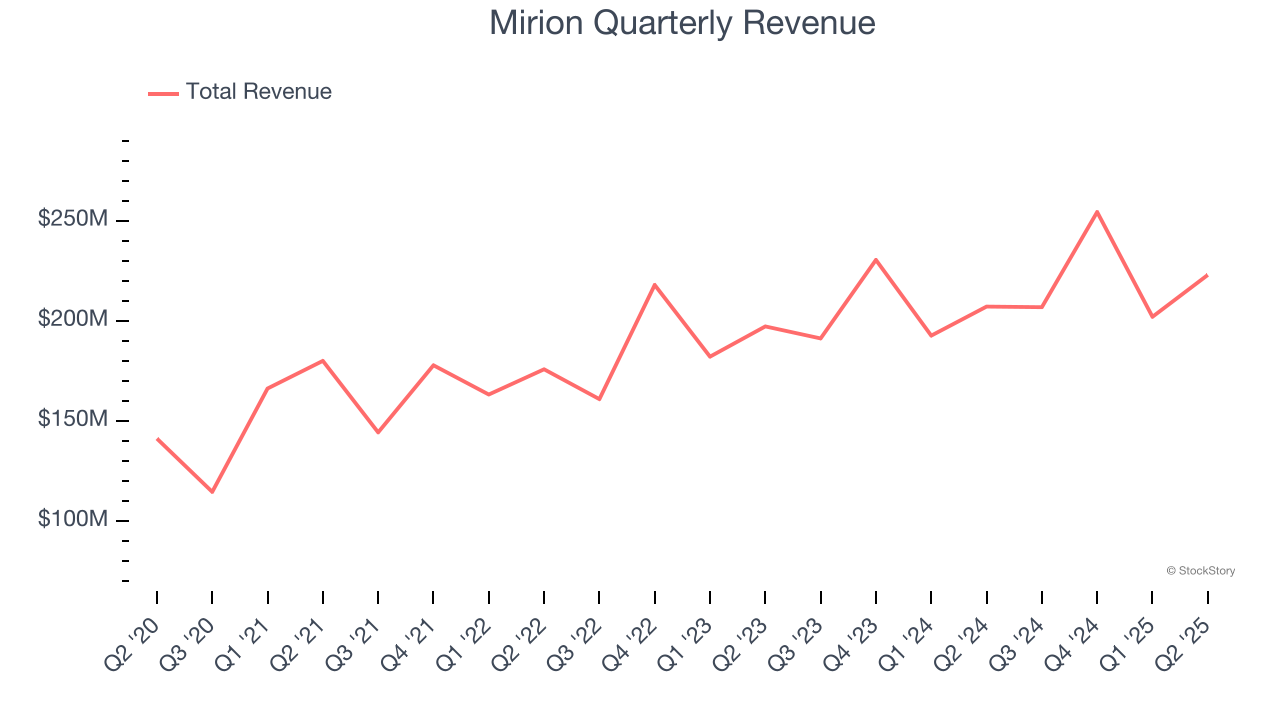

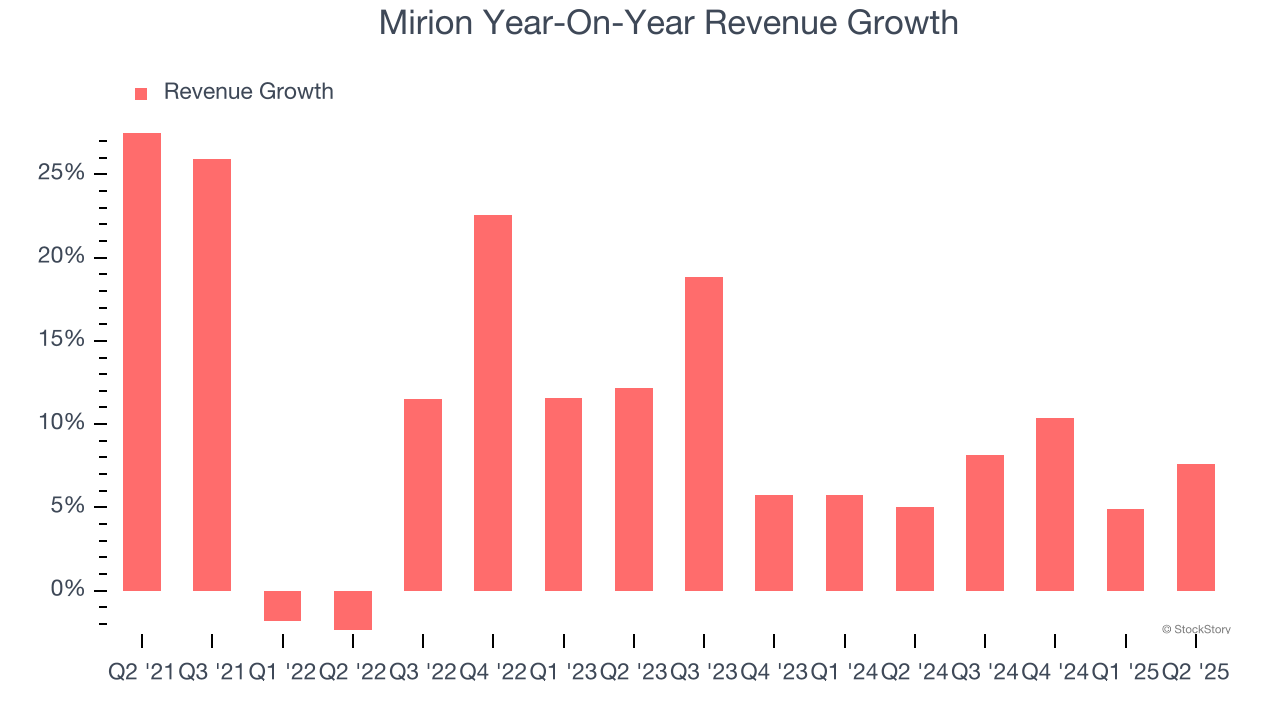

As you can see below, Mirion’s sales grew at a solid 8.2% compounded annual growth rate over the last four years. This is an encouraging starting point for our analysis because it shows Mirion’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. Mirion’s annualized revenue growth of 8.1% over the last two years aligns with its four-year trend, suggesting its demand was predictably strong.

This quarter, Mirion reported year-on-year revenue growth of 7.6%, and its $222.9 million of revenue exceeded Wall Street’s estimates by 3.1%.

Looking ahead, sell-side analysts expect revenue to grow 6.6% over the next 12 months, similar to its two-year rate. Still, this projection is above the sector average and implies the market is forecasting some success for its newer products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

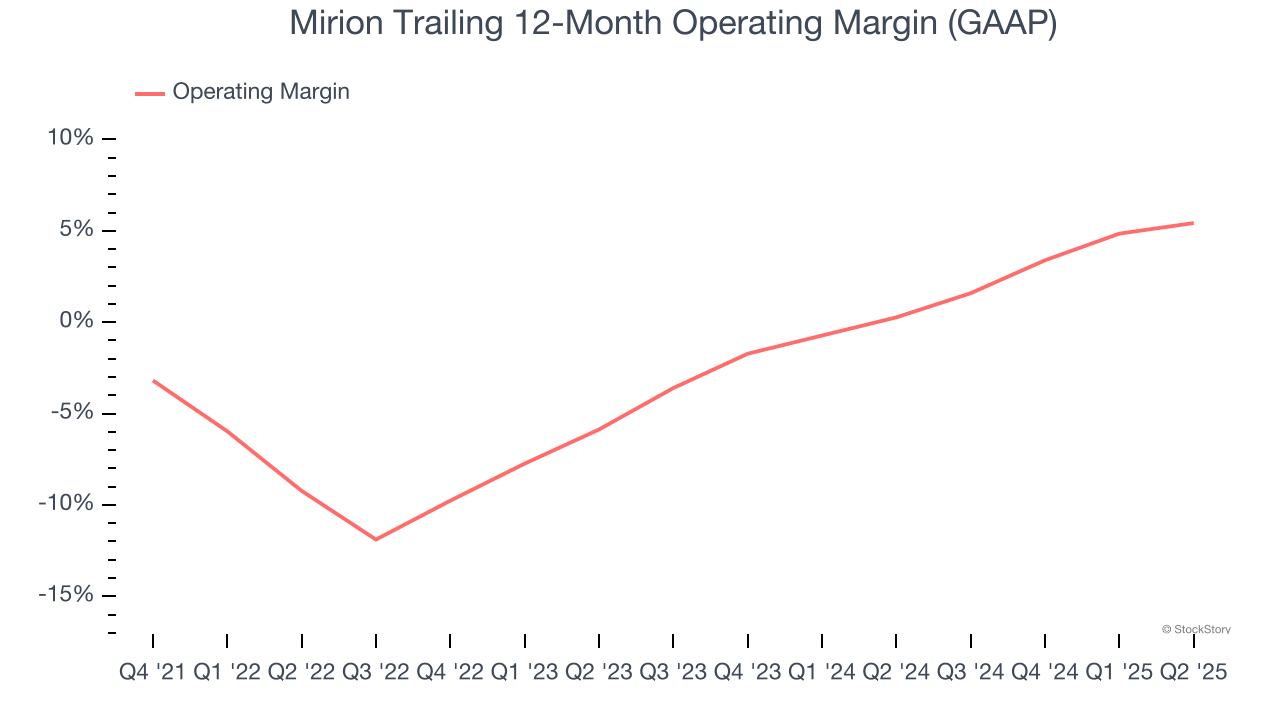

Although Mirion was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 1.5% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Mirion’s operating margin rose by 2.5 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to show consistent profitability.

In Q2, Mirion generated an operating margin profit margin of 4.4%, up 2.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

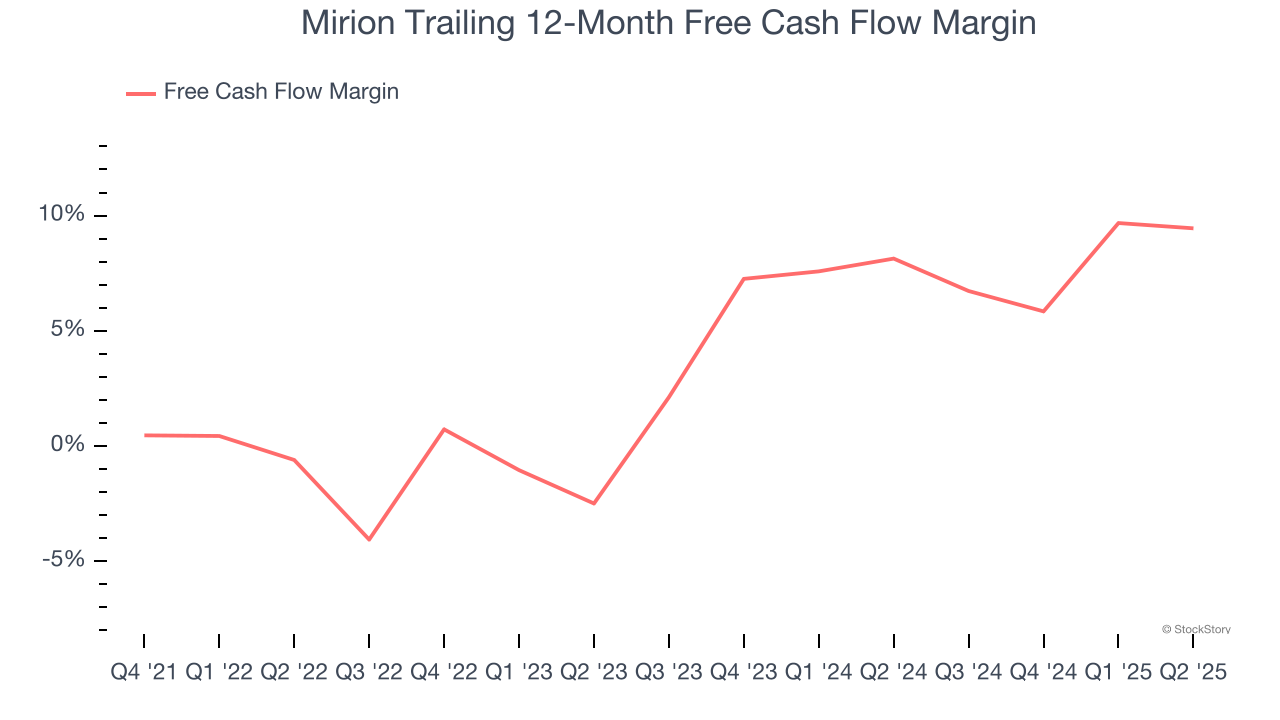

Mirion has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.8%, subpar for a business services business.

Taking a step back, an encouraging sign is that Mirion’s margin expanded by 3.7 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Mirion’s free cash flow clocked in at $3.6 million in Q2, equivalent to a 1.6% margin. This cash profitability was in line with the comparable period last year but below its five-year average. We wouldn’t read too much into it because investment needs can be seasonal, leading to short-term swings. Long-term trends carry greater meaning.

Key Takeaways from Mirion’s Q2 Results

We enjoyed seeing Mirion beat analysts’ revenue expectations this quarter. We were also glad it raised its full-year EPS and EBITDA guidance. Zooming out, we think this was a good print with some key areas of upside. Investors were likely hoping for more, and shares traded down 7.8% to $20.58 immediately following the results.

Is Mirion an attractive investment opportunity right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.