Renasant currently trades at $37.21 per share and has shown little upside over the past six months, posting a small loss of 4.3%. The stock also fell short of the S&P 500’s 5.4% gain during that period.

Is now the time to buy Renasant, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Renasant Not Exciting?

We're swiping left on Renasant for now. Here are three reasons why you should be careful with RNST and a stock we'd rather own.

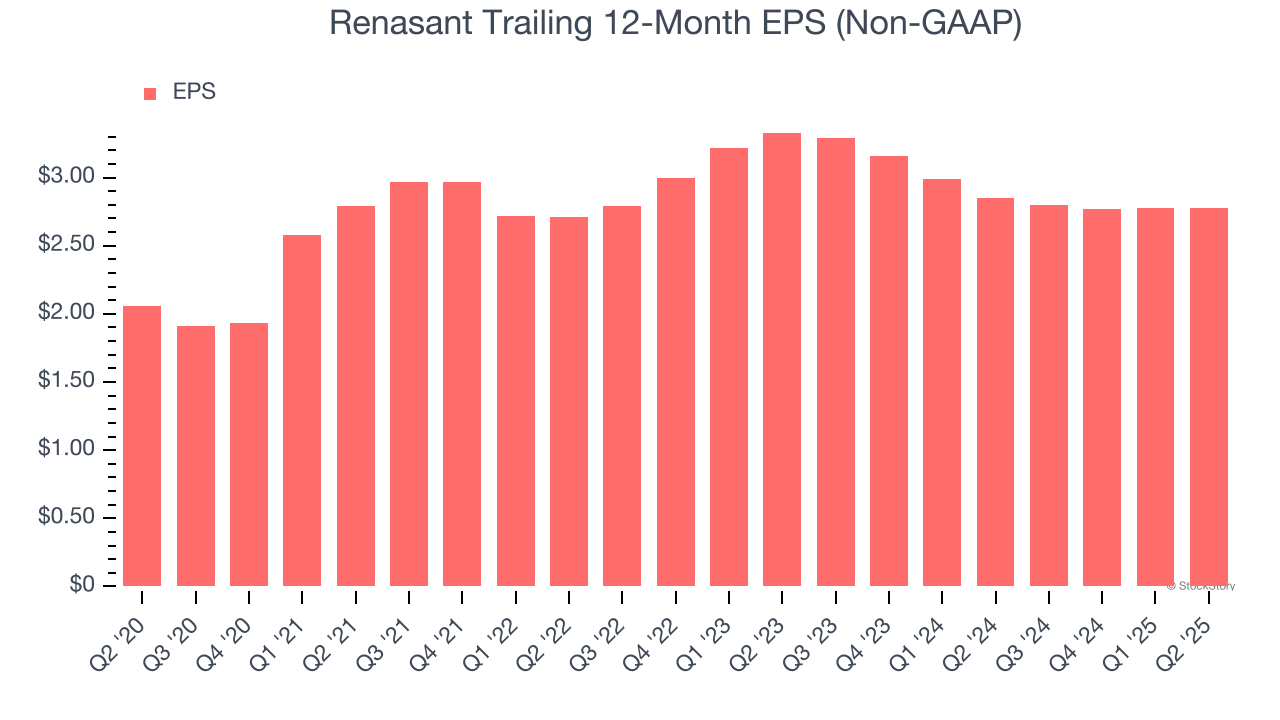

1. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Renasant, its EPS declined by 8.6% annually over the last two years while its revenue grew by 11.5%. This tells us the company became less profitable on a per-share basis as it expanded.

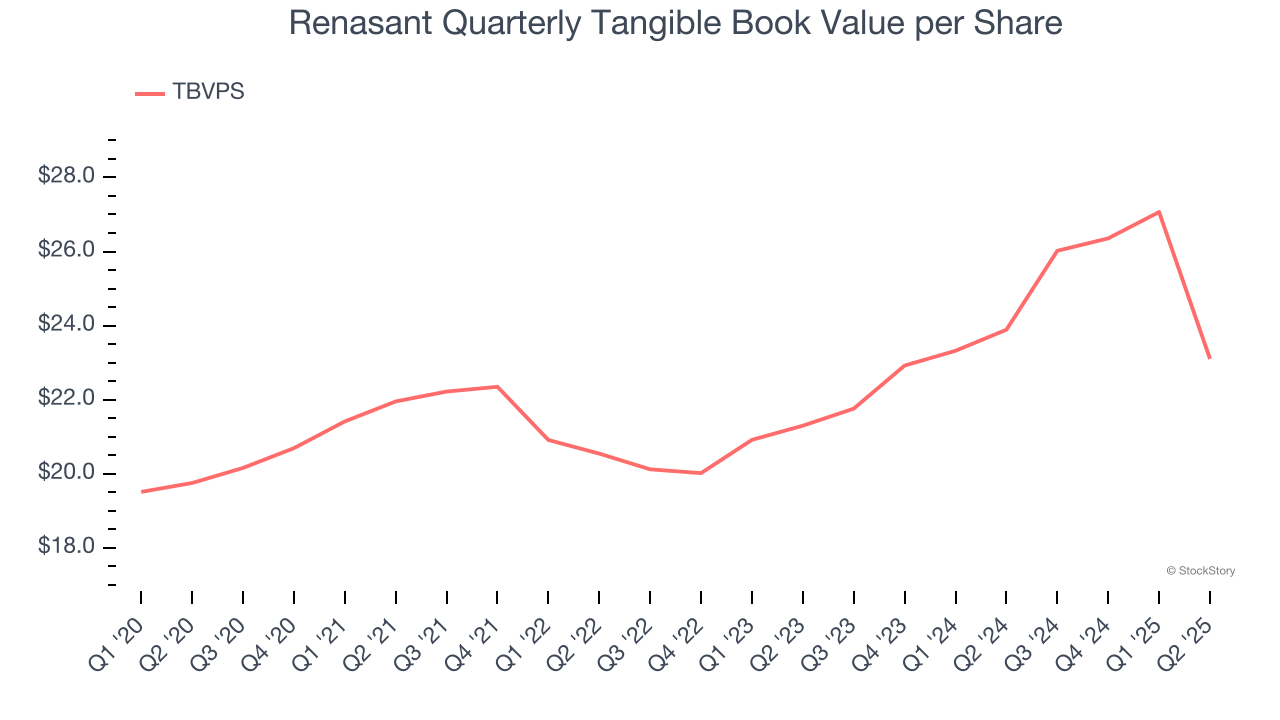

2. Substandard TBVPS Growth Indicates Limited Asset Expansion

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

To the detriment of investors, Renasant’s TBVPS grew at a sluggish 4.2% annual clip over the last two years.

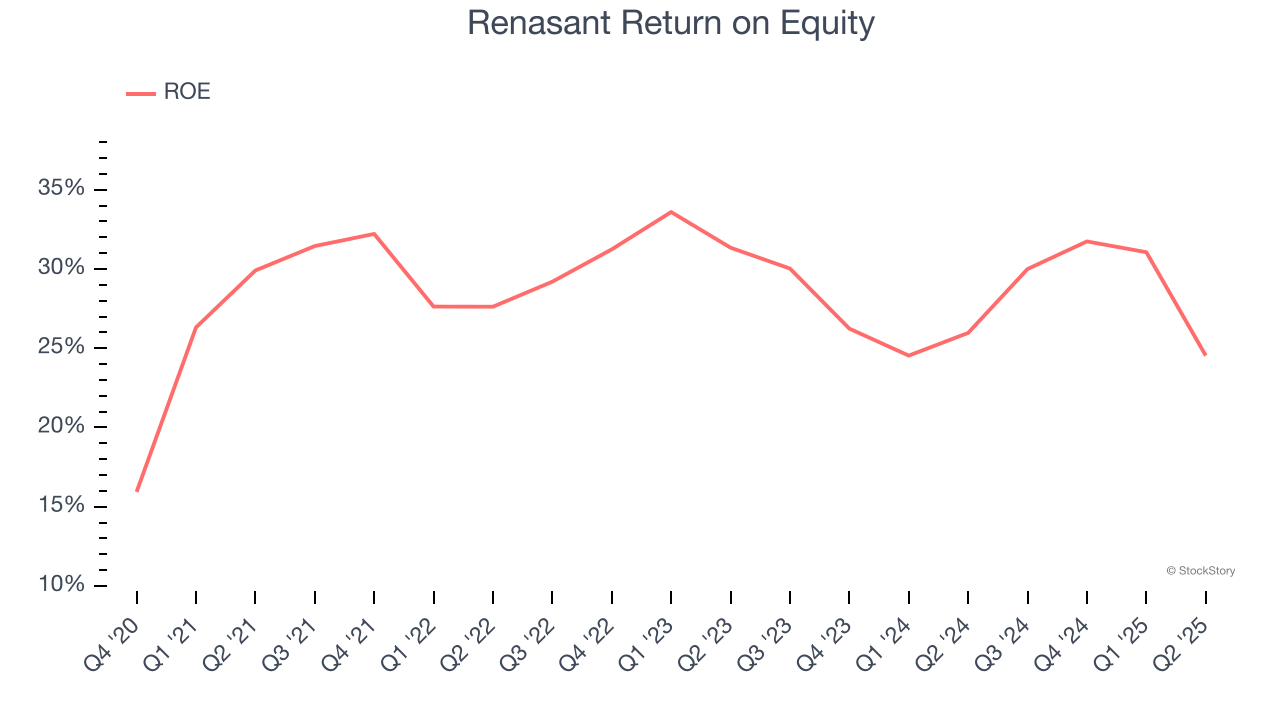

3. Previous Growth Initiatives Haven’t Impressed

Return on equity (ROE) reveals the profit generated per dollar of shareholder equity, which represents a key source of bank funding. Banks maintaining elevated ROE levels tend to accelerate wealth creation for shareholders via earnings retention, buybacks, and distributions.

Over the last five years, Renasant has averaged an ROE of 7%, uninspiring for a company operating in a sector where the average shakes out around 7.5%.

Final Judgment

Renasant isn’t a terrible business, but it isn’t one of our picks. With its shares underperforming the market lately, the stock trades at 0.9× forward P/B (or $37.21 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better stocks to buy right now. Let us point you toward one of our top software and edge computing picks.

Stocks We Like More Than Renasant

Trump’s April 2024 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.