Casual restaurant chain Noodles & Company (NASDAQ: NDLS) missed Wall Street’s revenue expectations in Q2 CY2025, with sales flat year on year at $126.4 million. The company’s full-year revenue guidance of $491 million at the midpoint came in 3.6% below analysts’ estimates. Its non-GAAP loss of $0.12 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Noodles? Find out by accessing our full research report, it’s free.

Noodles (NDLS) Q2 CY2025 Highlights:

- Revenue: $126.4 million vs analyst estimates of $131.6 million (flat year on year, 3.9% miss)

- Adjusted EPS: -$0.12 vs analyst estimates of -$0.06 (significant miss)

- Adjusted EBITDA: $6.02 million vs analyst estimates of $7.61 million (4.8% margin, 20.9% miss)

- The company dropped its revenue guidance for the full year to $491 million at the midpoint from $507.5 million, a 3.3% decrease

- Operating Margin: -11.7%, down from 1% in the same quarter last year

- Locations: 453 at quarter end, down from 473 in the same quarter last year

- Same-Store Sales rose 1.5% year on year, in line with the same quarter last year

- Market Capitalization: $50.54 million

Company Overview

Offering pasta, mac and cheese, pad thai, and more, Noodles & Company (NASDAQ: NDLS) is a casual restaurant chain that serves all manner of noodles from around the world.

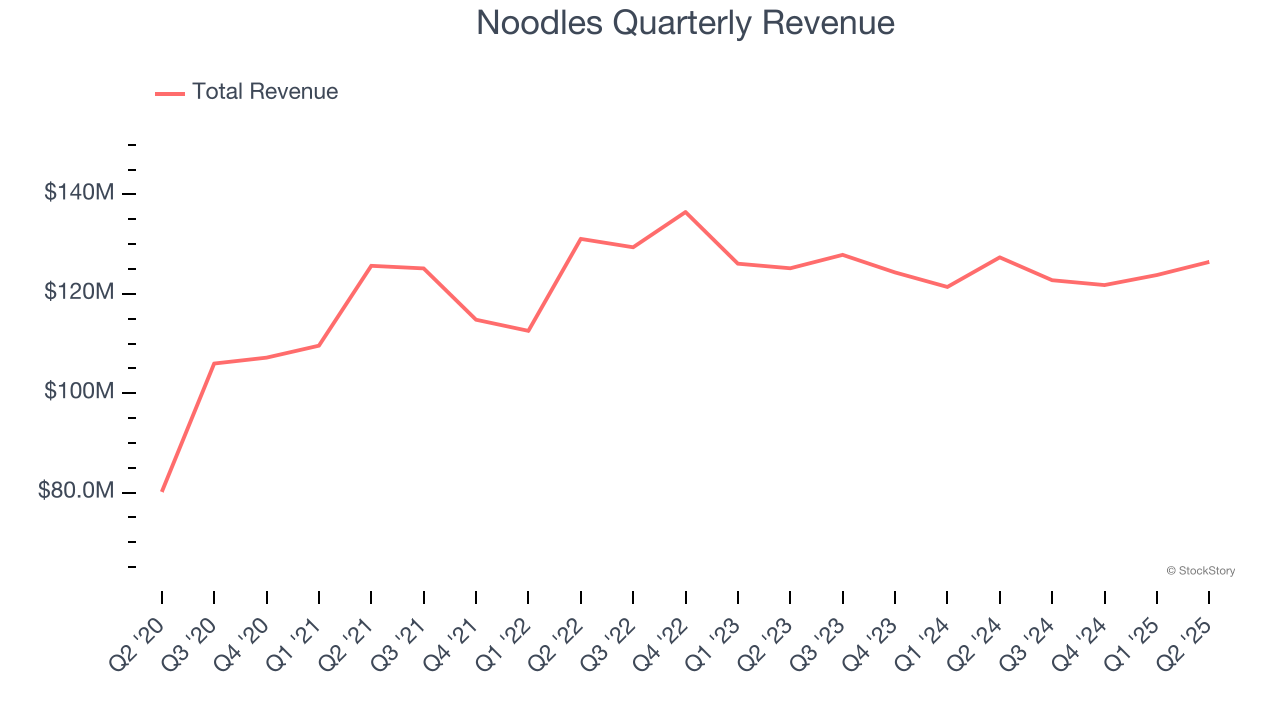

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $494.8 million in revenue over the past 12 months, Noodles is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

As you can see below, Noodles grew its sales at a weak 1.2% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts).

This quarter, Noodles missed Wall Street’s estimates and reported a rather uninspiring 0.7% year-on-year revenue decline, generating $126.4 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months. Although this projection suggests its newer menu offerings will catalyze better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Restaurant Performance

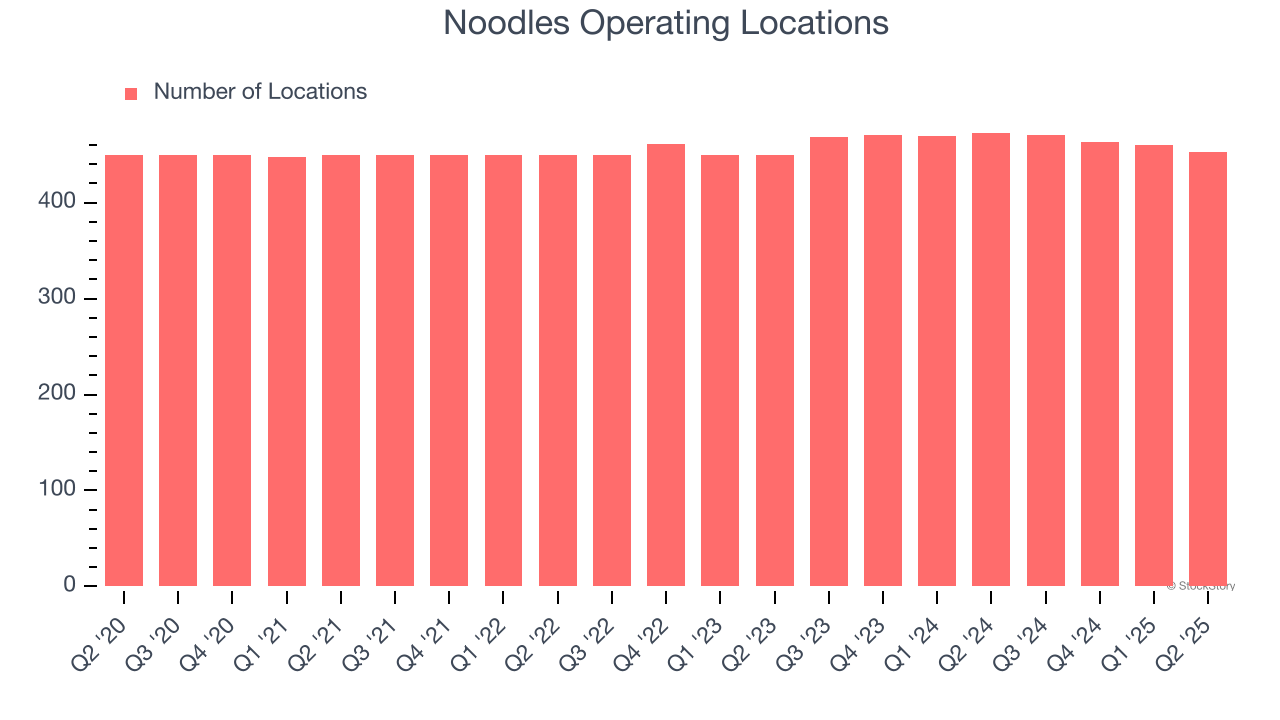

Number of Restaurants

Noodles sported 453 locations in the latest quarter. Over the last two years, it has generally opened new restaurants, averaging 1% annual growth. This was faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

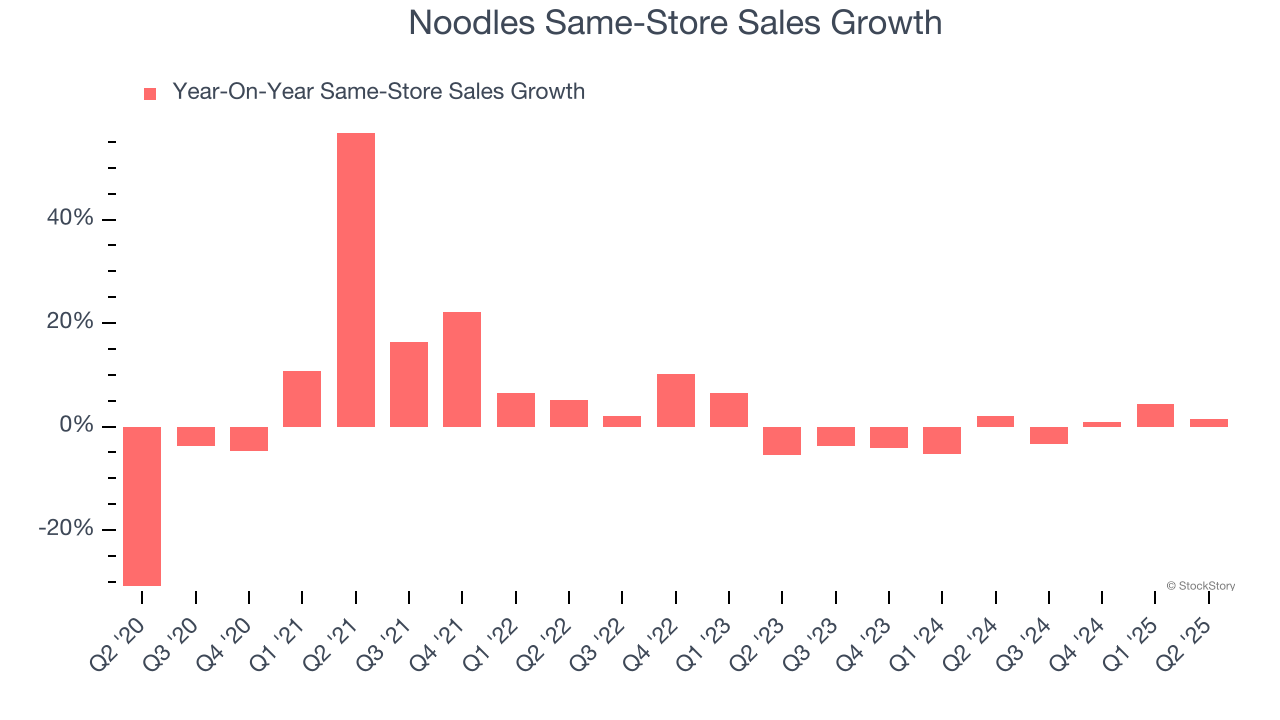

Same-Store Sales

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

Noodles’s demand within its existing dining locations has barely increased over the last two years as its same-store sales were flat. Noodles should consider improving its foot traffic and efficiency before expanding its restaurant base.

In the latest quarter, Noodles’s same-store sales rose 1.5% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Noodles’s Q2 Results

We struggled to find many positives in these results. Its full-year revenue guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 12.9% to $0.88 immediately following the results.

The latest quarter from Noodles’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.