Furniture company La-Z-Boy (NYSE: LZB) met Wall Street’s revenue expectations in Q2 CY2025, but sales were flat year on year at $492.2 million. On the other hand, next quarter’s revenue guidance of $520 million was less impressive, coming in 1.6% below analysts’ estimates. Its non-GAAP profit of $0.47 per share was 10.8% below analysts’ consensus estimates.

Is now the time to buy La-Z-Boy? Find out by accessing our full research report, it’s free.

La-Z-Boy (LZB) Q2 CY2025 Highlights:

- Revenue: $492.2 million vs analyst estimates of $490.4 million (flat year on year, in line)

- Adjusted EPS: $0.47 vs analyst expectations of $0.53 (10.8% miss)

- Adjusted EBITDA: $36.74 million vs analyst estimates of $39.25 million (7.5% margin, 6.4% miss)

- Revenue Guidance for Q3 CY2025 is $520 million at the midpoint, below analyst estimates of $528.4 million

- Operating Margin: 4.5%, down from 6.5% in the same quarter last year

- Free Cash Flow Margin: 3.6%, down from 7.4% in the same quarter last year

- Market Capitalization: $1.58 billion

Melinda D. Whittington, Board Chair, President and Chief Executive Officer of La-Z-Boy Incorporated, said, “We were pleased to deliver sales and margin growth in our Wholesale segment for the quarter, primarily driven by our core North America La-Z-Boy wholesale business. In addition, our Retail segment grew delivered sales and written sales for the quarter. On top of this, during the quarter we announced the acquisition of a 15-store network in the Southeast region, further highlighting the multiple levers we have to grow our business. Investments in our Century Vision strategy to grow our Retail store footprint and expand brand reach, combined with soft industry demand, had a downward impact on our margin performance this quarter, and we are actively taking steps to adjust our near-term operations and prudently navigate the current environment. Our iconic brand, vertically integrated business model, and robust balance sheet are foundational to our continued strategic growth and position us to disproportionately benefit when industry tailwinds reemerge.

Company Overview

The prized possession of every mancave, La-Z-Boy (NYSE: LZB) is a furniture company specializing in recliners, sofas, and seats.

Revenue Growth

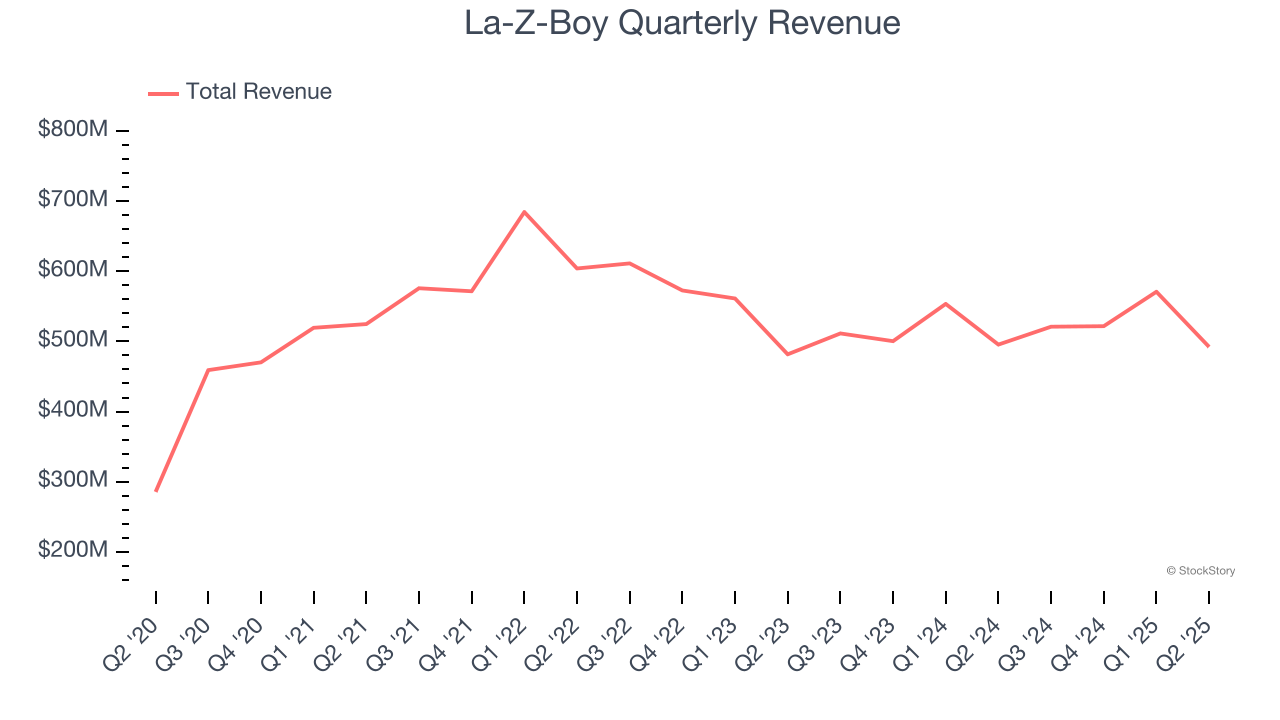

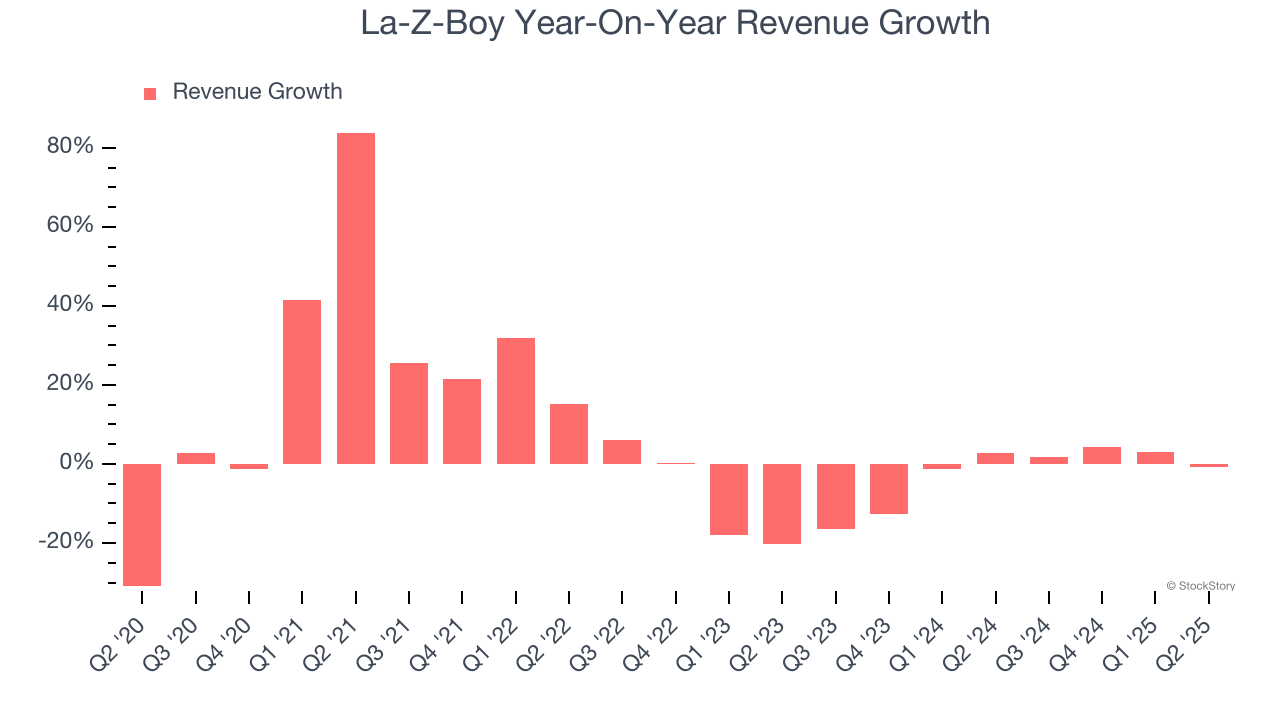

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, La-Z-Boy’s 6% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the consumer discretionary sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. La-Z-Boy’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.8% annually.

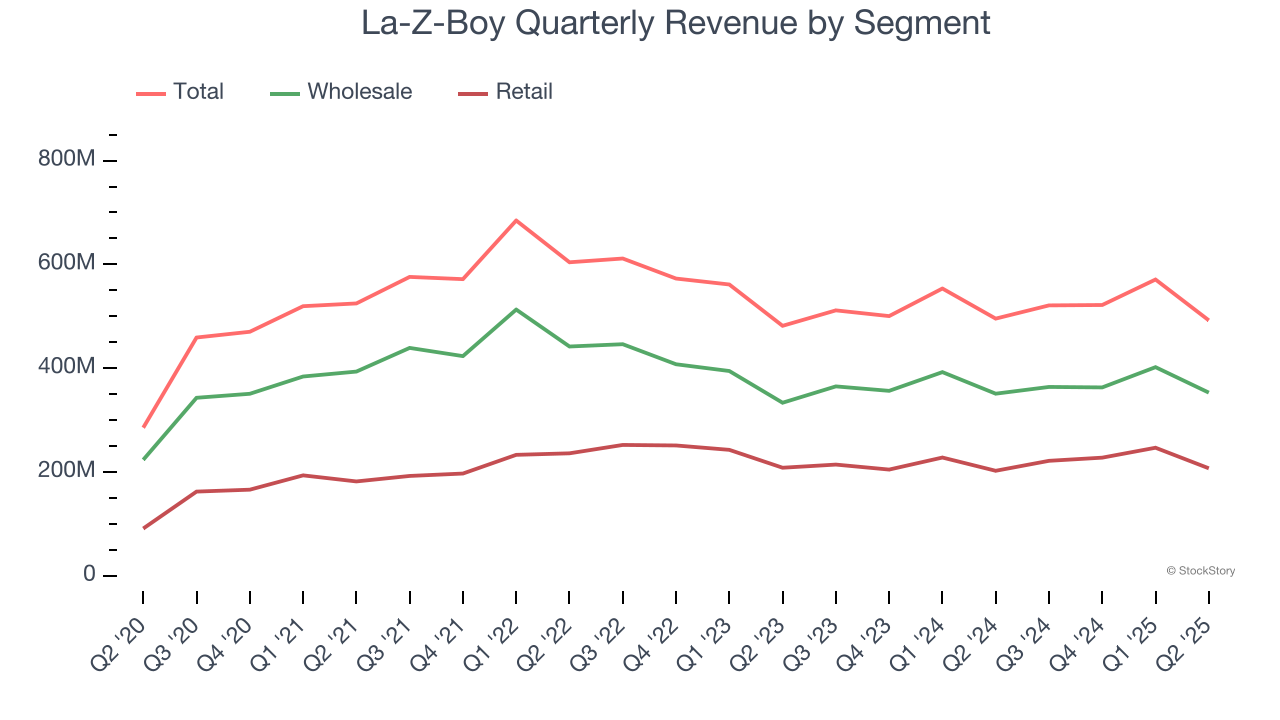

We can better understand the company’s revenue dynamics by analyzing its most important segments, Wholesale and Retail, which are 63% and 37% of core revenues. Over the last two years, La-Z-Boy’s Wholesale revenue (sales to retailers) averaged 2.7% year-on-year declines while its Retail revenue (direct sales to consumers) averaged 2.1% declines.

This quarter, La-Z-Boy’s $492.2 million of revenue was flat year on year and in line with Wall Street’s estimates. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

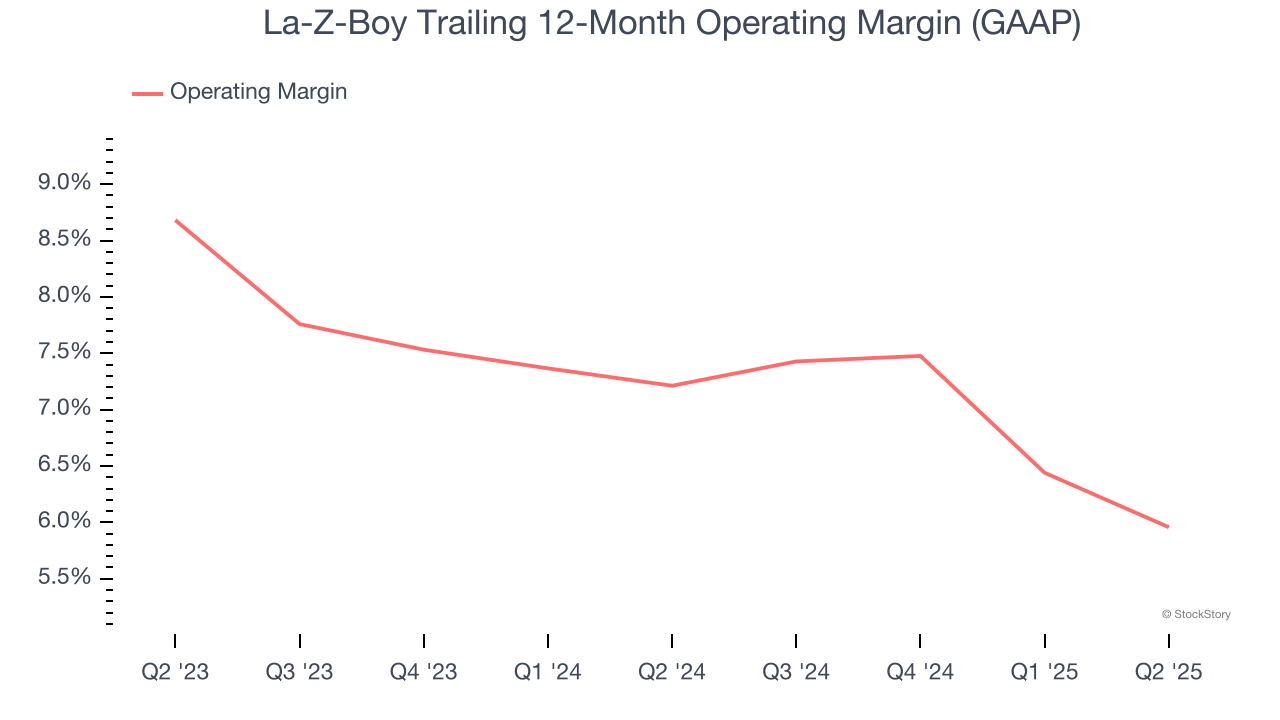

La-Z-Boy’s operating margin has been trending down over the last 12 months and averaged 6.6% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, La-Z-Boy generated an operating margin profit margin of 4.5%, down 2.1 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

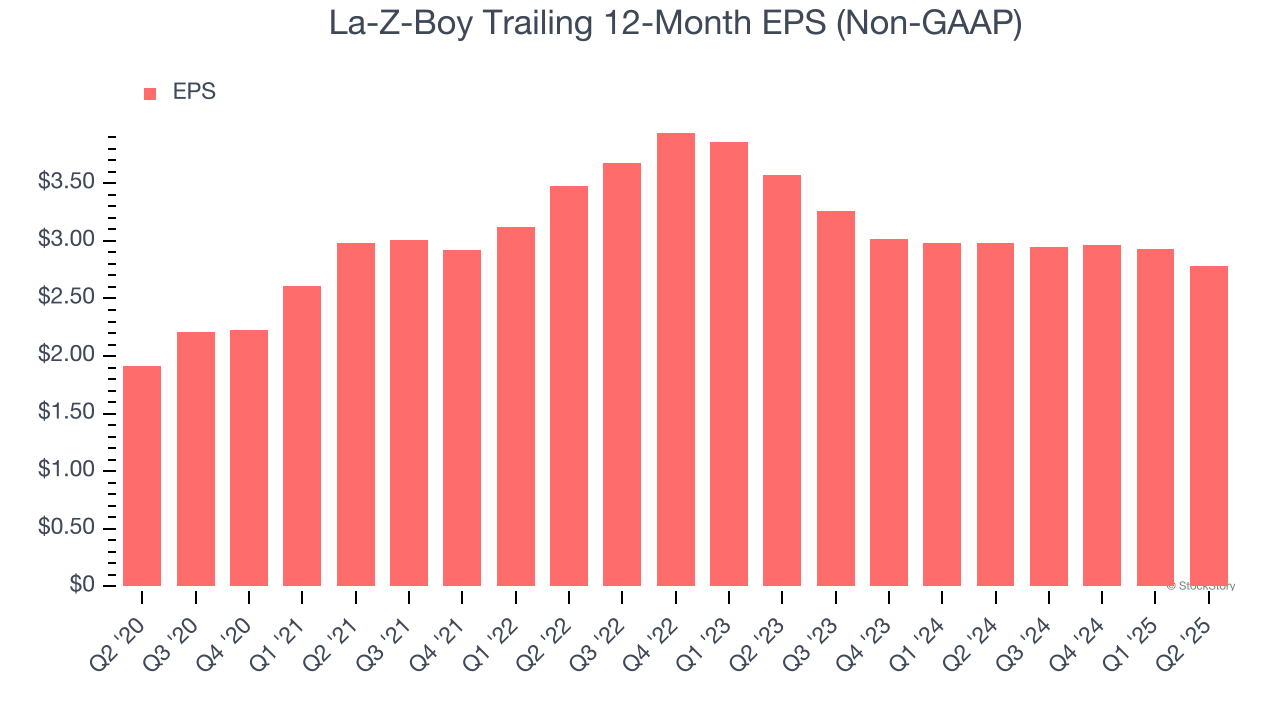

La-Z-Boy’s unimpressive 7.8% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

In Q2, La-Z-Boy reported adjusted EPS of $0.47, down from $0.62 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects La-Z-Boy’s full-year EPS of $2.78 to grow 15.8%.

Key Takeaways from La-Z-Boy’s Q2 Results

We struggled to find many positives in these results. Its EPS missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 20% to $31.30 immediately following the results.

La-Z-Boy didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.