Over the last six months, SouthState’s shares have sunk to $92.76, producing a disappointing 11.7% loss - a stark contrast to the S&P 500’s 3.3% gain. This may have investors wondering how to approach the situation.

Following the pullback, is now the time to buy SSB? Find out in our full research report, it’s free.

Why Are We Positive On SSB?

With roots dating back to the Great Depression era of 1933, SouthState (NYSE: SSB) is a financial holding company that provides banking services, wealth management, and correspondent banking services across six southeastern states.

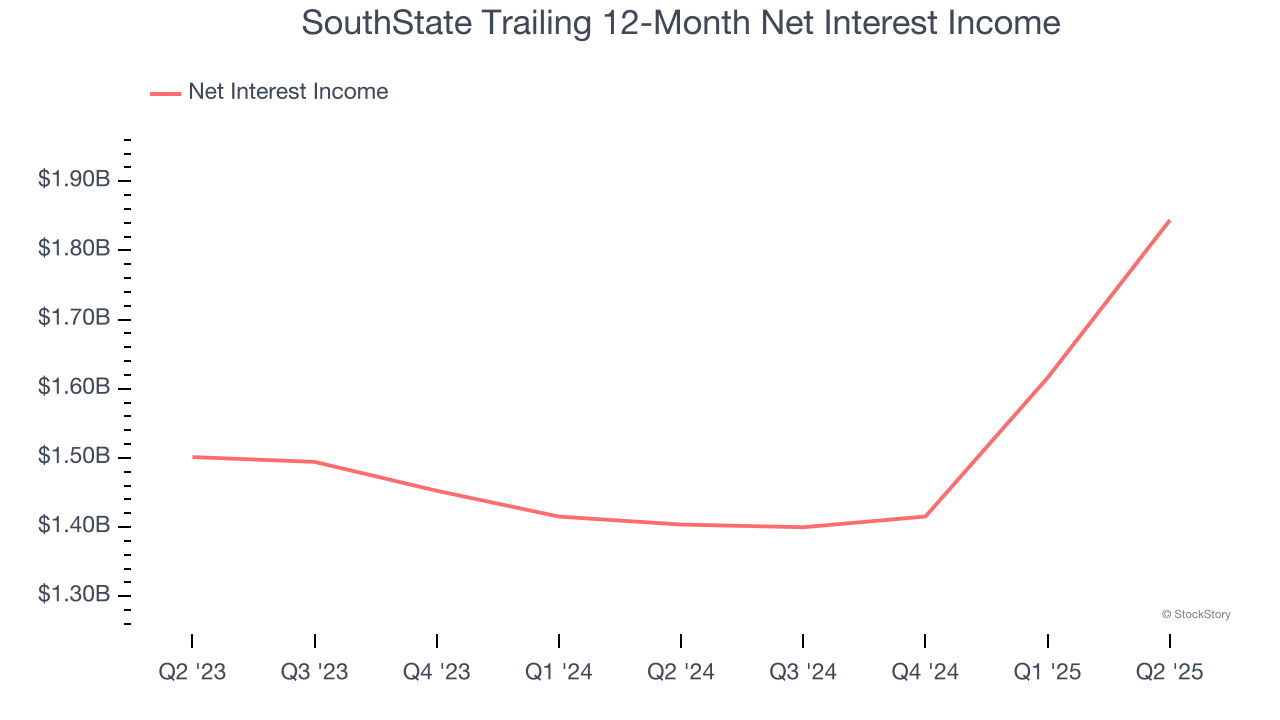

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

Net interest income commands greater market attention due to its reliability and consistency, whereas one-time fees are often seen as lower-quality revenue that lacks the same dependable characteristics.

SouthState’s net interest income has grown at a 31% annualized rate over the last five years, much better than the broader bank industry and faster than its total revenue. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

2. Projected Net Interest Income Growth Is Remarkable

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect SouthState’s net interest income to rise by 24.5%, an improvement versus its 10.8% annualized growth for the past two years.

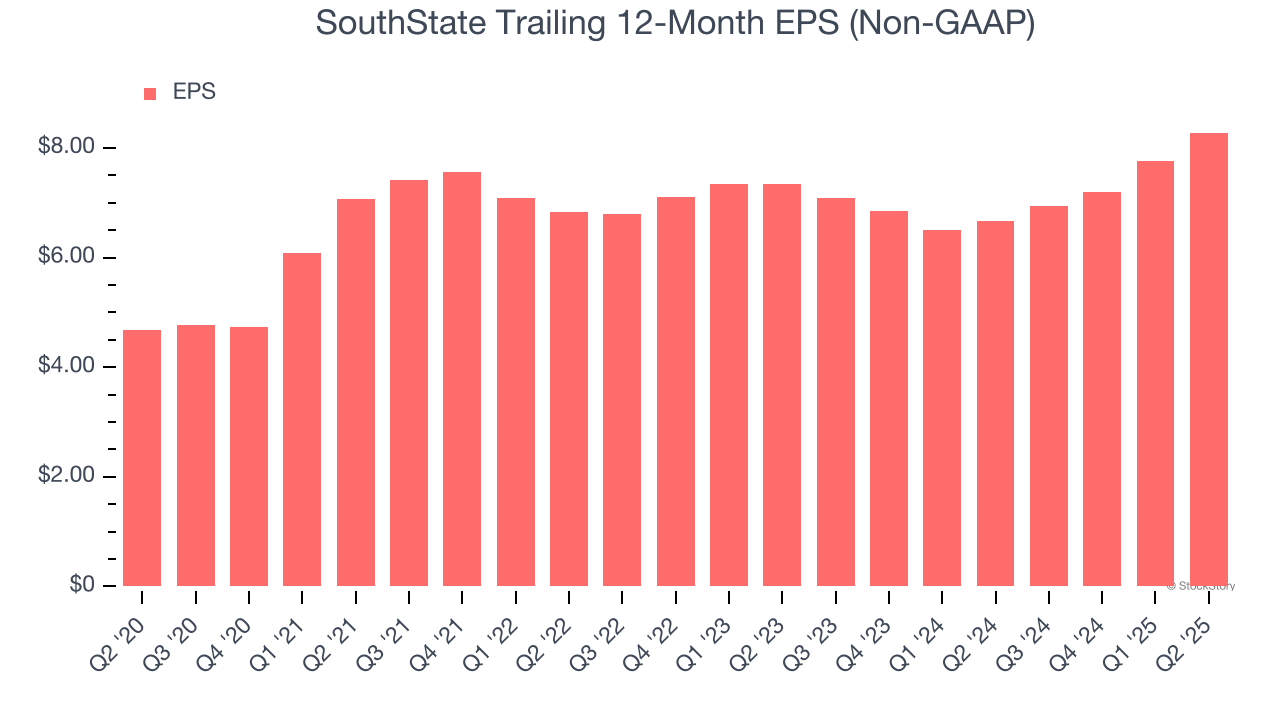

3. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

SouthState’s EPS grew at an astounding 12.1% compounded annual growth rate over the last five years. This performance was better than most bank businesses.

Final Judgment

These are just a few reasons why we're bullish on SouthState. With the recent decline, the stock trades at 1× forward P/B (or $92.76 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than SouthState

Donald Trump’s April 2024 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.