While the S&P 500 is up 16.5% since March 2025, S&P Global (currently trading at $544.40 per share) has lagged behind, posting a return of 10.1%. This may have investors wondering how to approach the situation.

Taking into account the weaker price action, is now a good time to buy SPGI? Find out in our full research report, it’s free.

Why Is S&P Global a Good Business?

Tracing its roots back to 1860 when it published the first railroad industry manual, S&P Global (NYSE: SPGI) provides credit ratings, market intelligence, commodity data, automotive analytics, and financial indices that help investors and businesses make decisions.

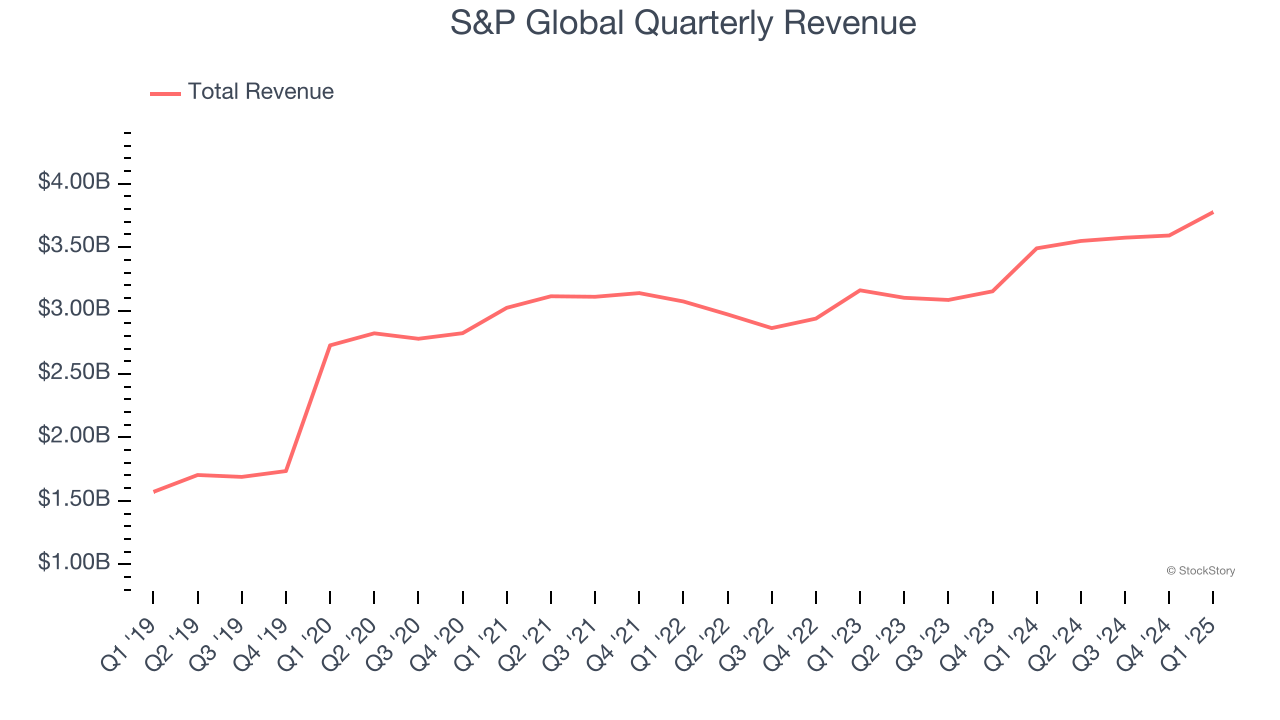

1. Long-Term Revenue Growth Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

Thankfully, S&P Global’s 13% annualized revenue growth over the last five years was solid. Its growth beat the average financials company and shows its offerings resonate with customers.

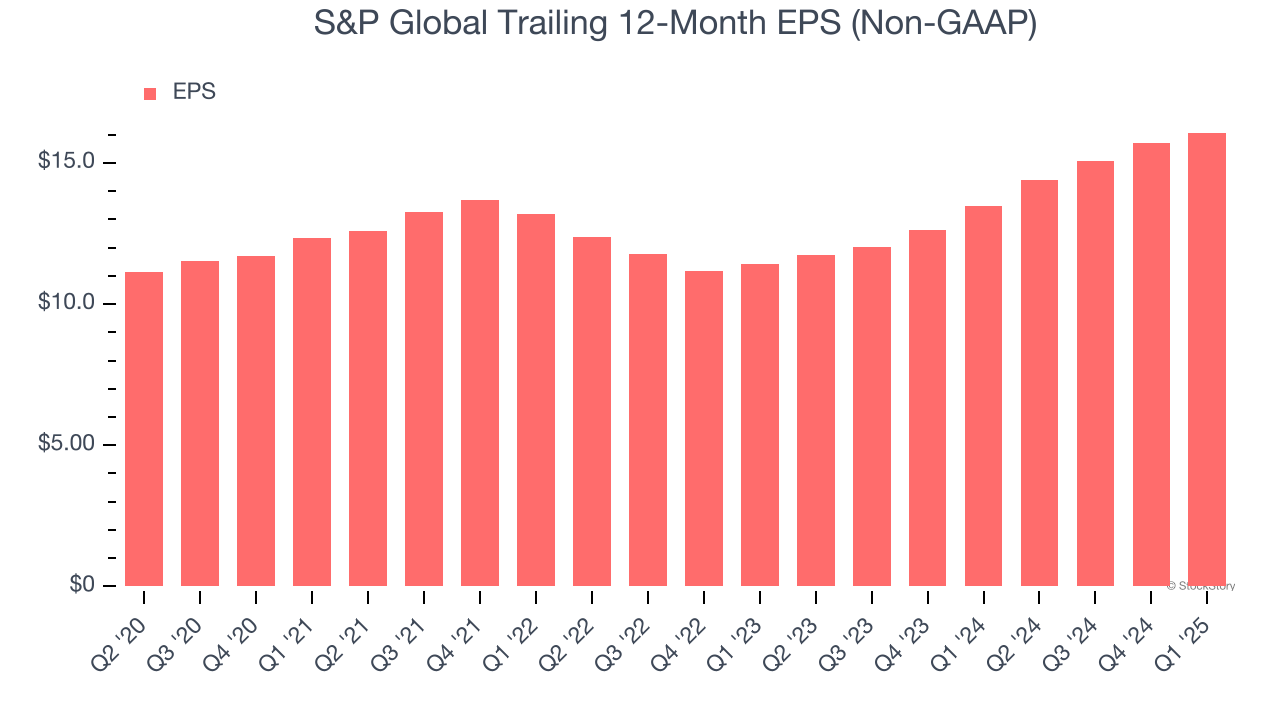

2. EPS Surges Higher Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

S&P Global’s EPS grew at a remarkable 18.6% compounded annual growth rate over the last two years, higher than its 10.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

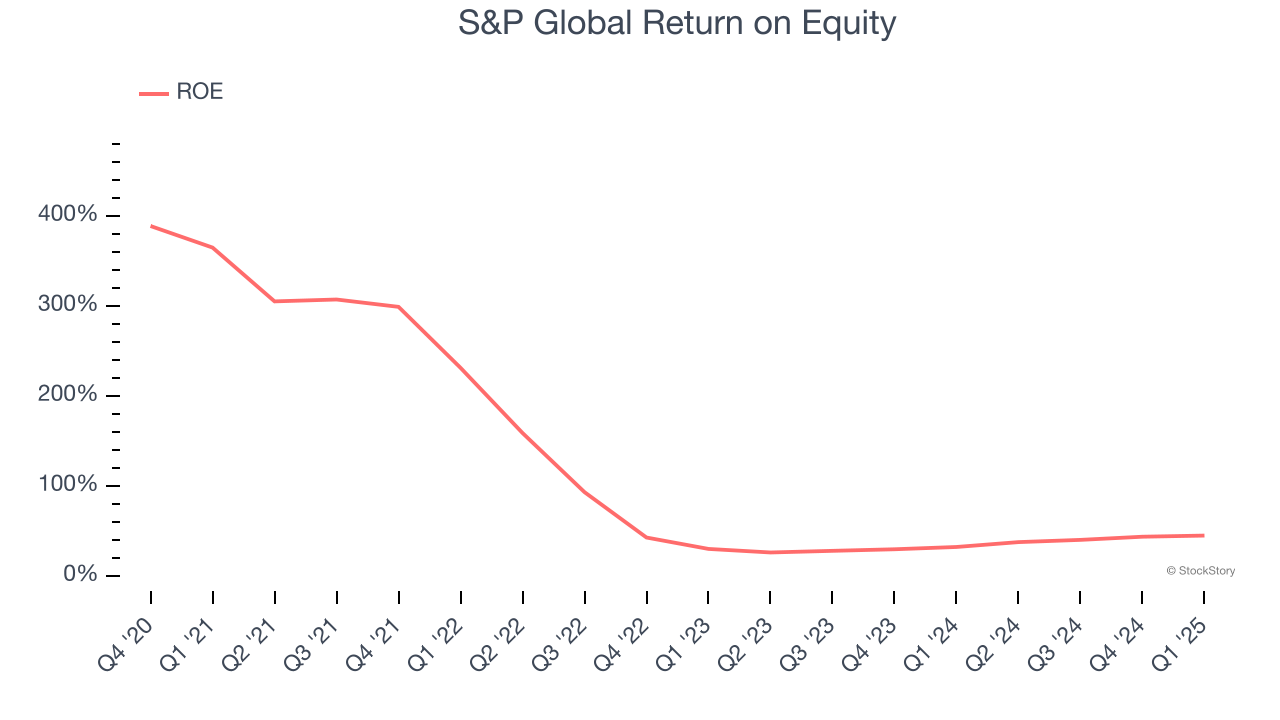

3. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, S&P Global has averaged an ROE of 35.1%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows S&P Global has a strong competitive moat.

Final Judgment

These are just a few reasons S&P Global is a rock-solid business worth owning. With its shares underperforming the market lately, the stock trades at 31.2× forward P/E (or $544.40 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than S&P Global

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.