As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at leisure products stocks, starting with Harley-Davidson (NYSE: HOG).

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

The 12 leisure products stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 3.5% while next quarter’s revenue guidance was 0.7% below.

In light of this news, share prices of the companies have held steady as they are up 4.8% on average since the latest earnings results.

Harley-Davidson (NYSE: HOG)

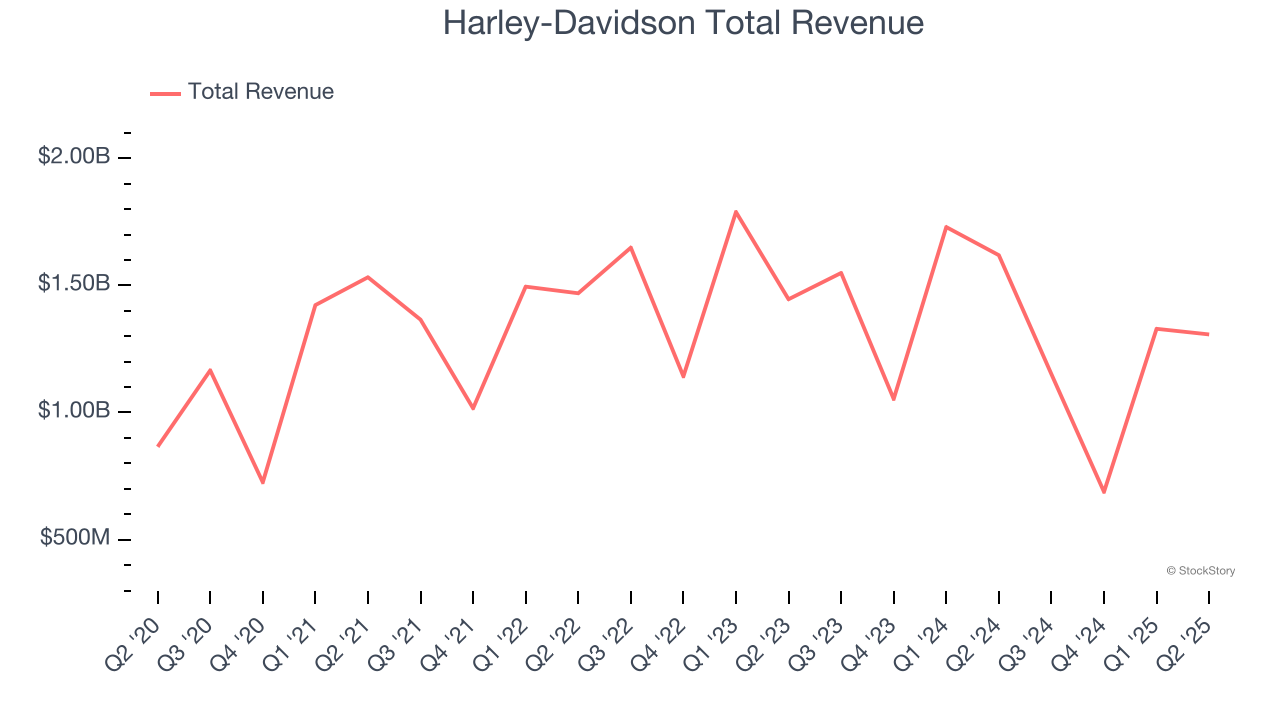

Founded in 1903, Harley-Davidson (NYSE: HOG) is an American motorcycle manufacturer known for its heavyweight motorcycles designed for cruising on highways.

Harley-Davidson reported revenues of $1.31 billion, down 19.3% year on year. This print fell short of analysts’ expectations by 4.6%. Overall, it was a disappointing quarter for the company with a miss of analysts’ EBITDA estimates.

"While our second quarter results continue to be impacted by a challenging commercial environment for discretionary products and an uncertain tariff situation, we are extremely pleased to announce a strategic partnership for HDFS with KKR and PIMCO that generates significant value for Harley-Davidson on all levels," said Jochen Zeitz, Chairman, President and CEO, Harley-Davidson.

Interestingly, the stock is up 31.7% since reporting and currently trades at $30.23.

Read our full report on Harley-Davidson here, it’s free.

Best Q2: Smith & Wesson (NASDAQ: SWBI)

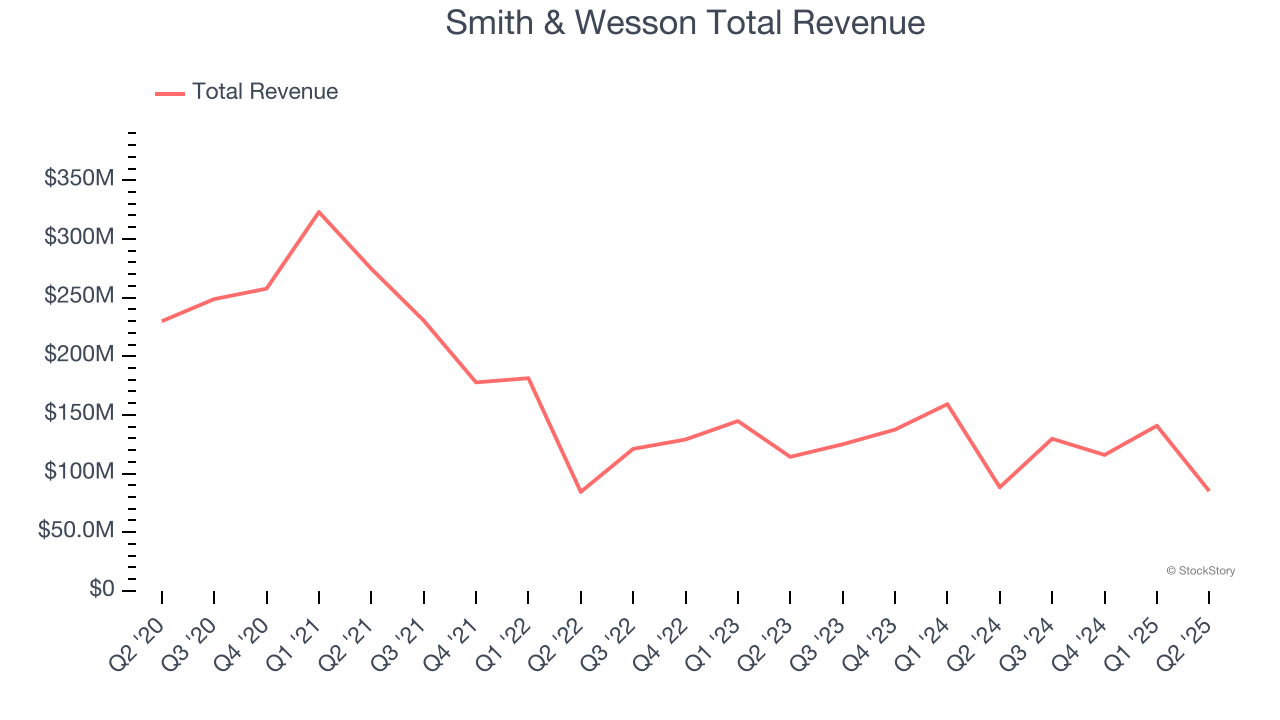

With a history dating back to 1852, Smith & Wesson (NASDAQ: SWBI) is a firearms manufacturer known for its handguns and rifles.

Smith & Wesson reported revenues of $85.08 million, down 3.7% year on year, outperforming analysts’ expectations by 7.4%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

The market seems happy with the results as the stock is up 14.2% since reporting. It currently trades at $9.38.

Is now the time to buy Smith & Wesson? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: American Outdoor Brands (NASDAQ: AOUT)

Spun off from Smith and Wesson in 2020, American Outdoor Brands (NASDAQ: AOUT) is an outdoor and recreational products company that offers outdoor and shooting sports products but does not sell firearms themselves.

American Outdoor Brands reported revenues of $29.7 million, down 28.7% year on year, falling short of analysts’ expectations by 17%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

American Outdoor Brands delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 17.9% since the results and currently trades at $8.53.

Read our full analysis of American Outdoor Brands’s results here.

MasterCraft (NASDAQ: MCFT)

Started by a waterskiing instructor, MasterCraft (NASDAQ: MCFT) specializes in designing, manufacturing, and selling sport boats.

MasterCraft reported revenues of $79.52 million, up 46.4% year on year. This result topped analysts’ expectations by 13.5%. More broadly, it was a mixed quarter as it also recorded a beat of analysts’ EPS estimates but EBITDA guidance for next quarter missing analysts’ expectations.

MasterCraft delivered the fastest revenue growth but had the weakest full-year guidance update among its peers. The stock is up 6.7% since reporting and currently trades at $22.31.

Read our full, actionable report on MasterCraft here, it’s free.

Latham (NASDAQ: SWIM)

Started as a family business, Latham (NASDAQ: SWIM) is a global designer and manufacturer of in-ground residential swimming pools and related products.

Latham reported revenues of $172.6 million, up 7.8% year on year. This print lagged analysts' expectations by 1.4%. Aside from that, it was a mixed quarter as it also logged an impressive beat of analysts’ adjusted operating income estimates but EPS in line with analysts’ estimates.

The stock is up 13.3% since reporting and currently trades at $7.75.

Read our full, actionable report on Latham here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.