Investment banking firm Jefferies Financial Group (NYSE: JEF) reported revenue ahead of Wall Street’s expectations in Q3 CY2025, with sales up 21.6% year on year to $2.05 billion. Its GAAP profit of $1.01 per share was 26.2% above analysts’ consensus estimates.

Is now the time to buy Jefferies? Find out by accessing our full research report, it’s free.

Jefferies (JEF) Q3 CY2025 Highlights:

- Revenue: $2.05 billion vs analyst estimates of $1.89 billion (21.6% year-on-year growth, 8.4% beat)

- Pre-tax Profit: $331.8 million (16.2% margin, 31.3% year-on-year growth)

- EPS (GAAP): $1.01 vs analyst estimates of $0.80 (26.2% beat)

- Tangible Book Value per Share: $33.38 vs analyst estimates of $33.33 (14% year-on-year decline, in line)

- Market Capitalization: $13.76 billion

Company Overview

Tracing its roots back to 1962 and rebranded from Leucadia National Corporation in 2018, Jefferies Financial Group (NYSE: JEF) is a global investment banking and capital markets firm that provides advisory services, securities trading, and asset management to corporations, institutions, and wealthy individuals.

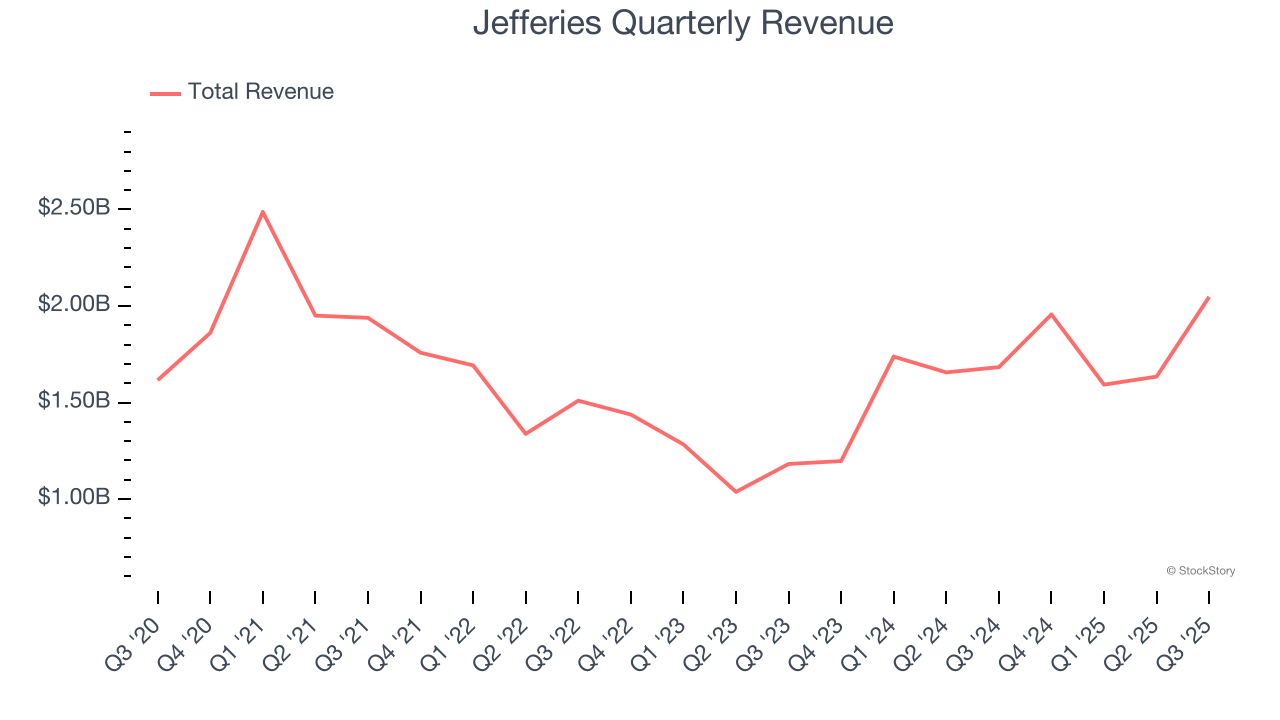

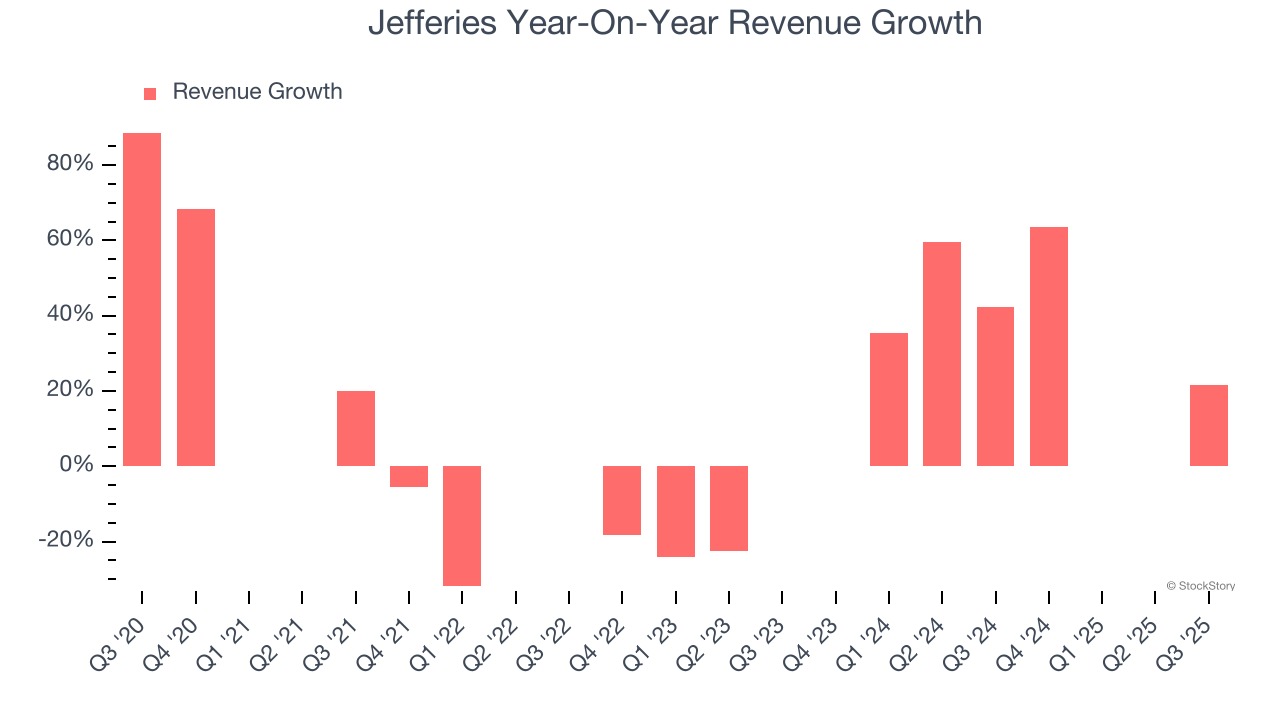

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Jefferies’s 6.6% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the financials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Jefferies’s annualized revenue growth of 21% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Jefferies reported robust year-on-year revenue growth of 21.6%, and its $2.05 billion of revenue topped Wall Street estimates by 8.4%.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

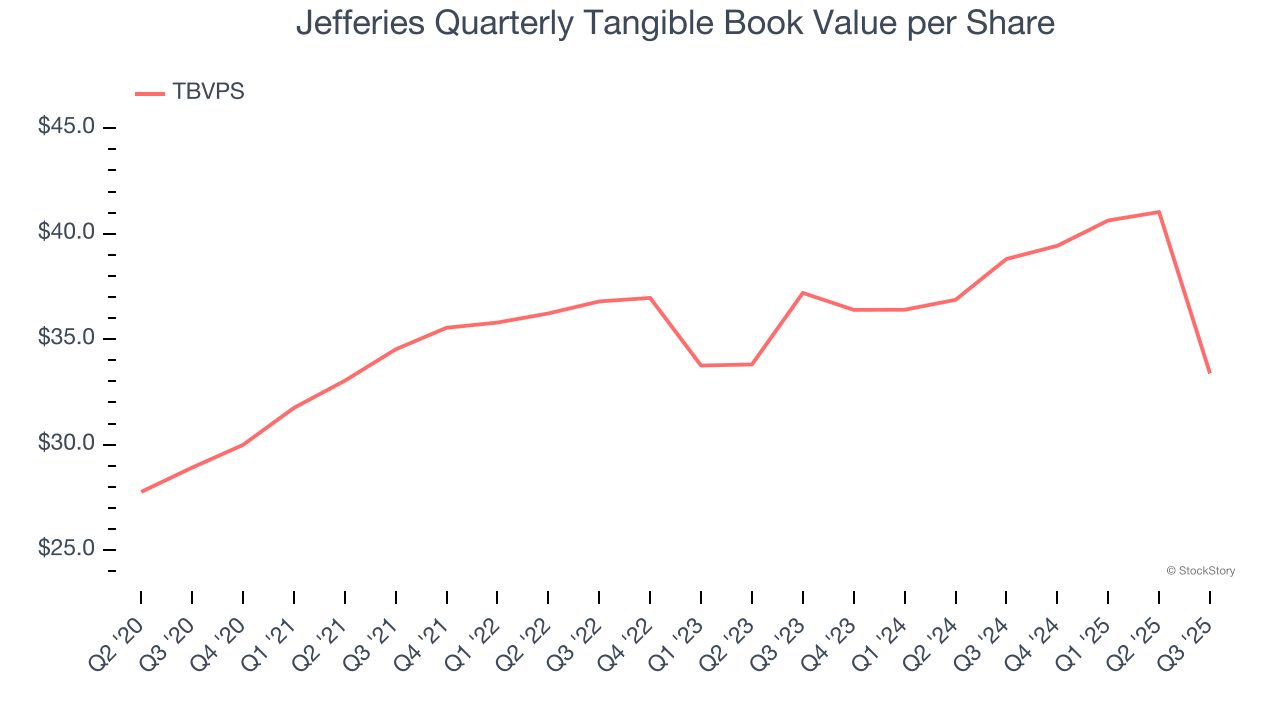

Tangible Book Value Per Share (TBVPS)

Financial firms generate earnings through diverse intermediation activities, making them fundamentally balance sheet-driven enterprises. Investors focus on balance sheet quality and consistent book value compounding when evaluating these multifaceted financial institutions.

When analyzing this sector, tangible book value per share (TBVPS) takes precedence over many other metrics. This measure isolates genuine per-share value and provides insight into the institution’s capital position across diverse operations. On the other hand, EPS is often distorted by the diverse nature of operations, mergers, and various accounting treatments across different business units. Book value provides clearer performance insights.

Jefferies’s TBVPS grew at a sluggish 2.9% annual clip over the last five years. On a two-year basis, however, dynamics have changed as TBVPS dropped by 5.3% annually ($37.19 to $33.38 per share).

Tangible Book Value Per Share (TBVPS)

Financial institutions with multiple business lines manage complex balance sheets that span various financial activities. Market valuations reflect this operational complexity, prioritizing balance sheet strength and sustainable book value growth across all business segments.

Because of this, tangible book value per share (TBVPS) emerges as the critical performance benchmark for the sector. This metric captures real, liquid net worth per share that reflects the institution’s overall financial health across all business lines. Traditional metrics like EPS are helpful but face distortion from the complexity of diversified operations, M&A activity, and various accounting rules that can obscure true performance across multiple business lines.

Jefferies’s TBVPS grew at a sluggish 2.9% annual clip over the last five years. On a two-year basis, however, dynamics have changed as TBVPS dropped by 5.3% annually ($37.19 to $33.38 per share).

Key Takeaways from Jefferies’s Q3 Results

It was good to see Jefferies beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The market seemed to be hoping for more, and the stock traded down 1.8% to just over $65 immediately after reporting.

Is Jefferies an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.