The past six months have been a windfall for Ross Stores’s shareholders. The company’s stock price has jumped 41.7%, hitting $189.86 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Following the strength, is ROST a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does ROST Stock Spark Debate?

Selling excess inventory or overstocked items from other retailers, Ross Stores (NASDAQ: ROST) is an off-price concept that sells apparel and other goods at prices much lower than department stores.

Two Things to Like:

1. Store Growth Signals an Offensive Strategy

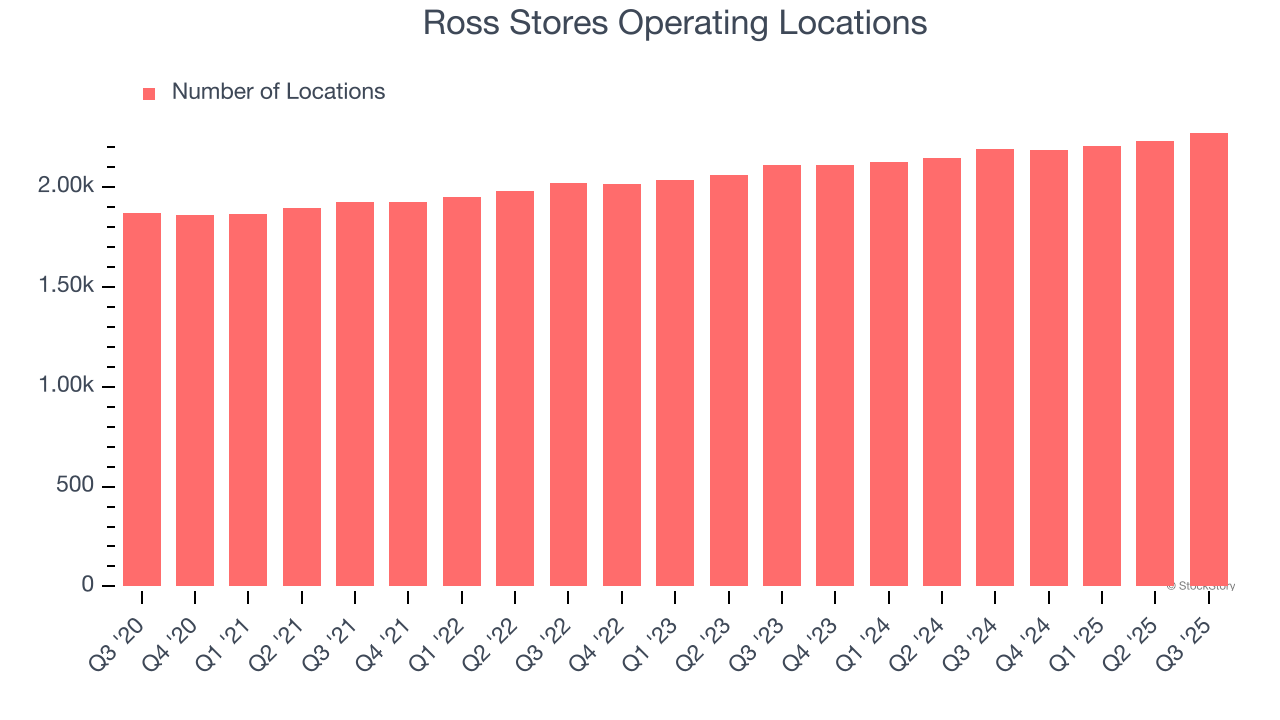

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

Ross Stores operated 2,273 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years, averaging 4% annual growth, much faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

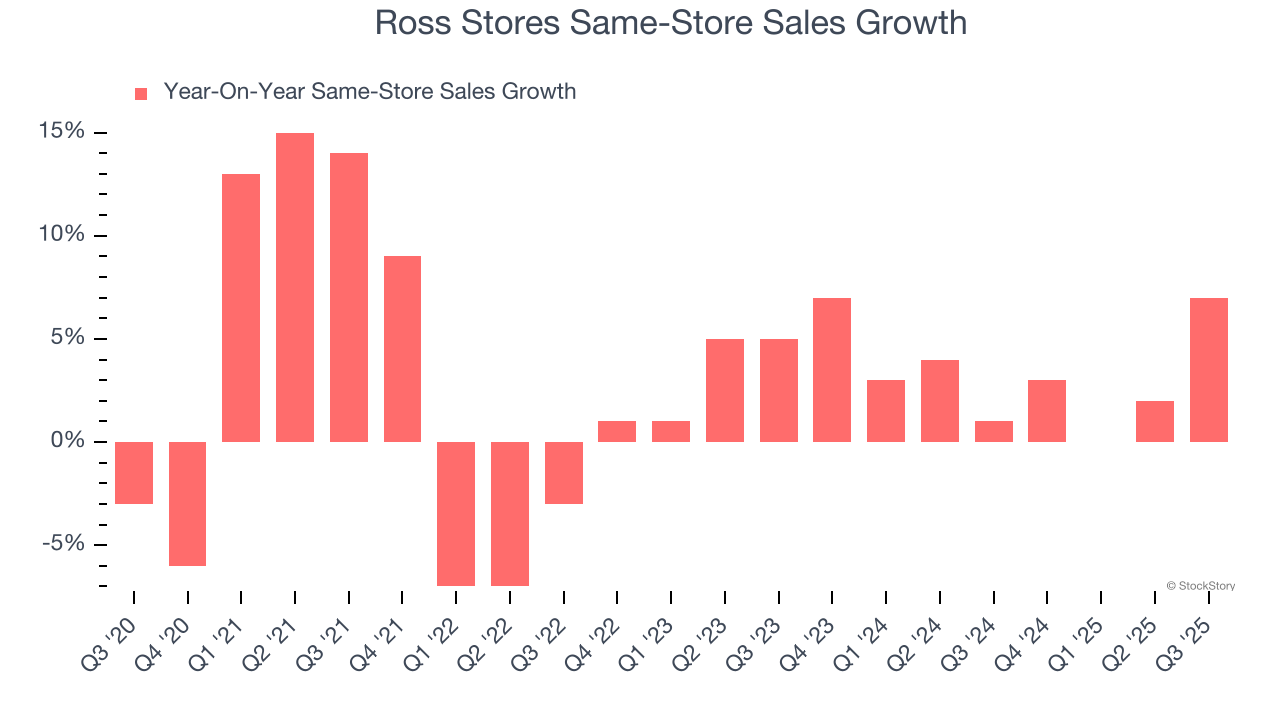

2. Surging Same-Store Sales Show Increasing Demand

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Ross Stores’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 3.4% per year.

One Reason to be Careful:

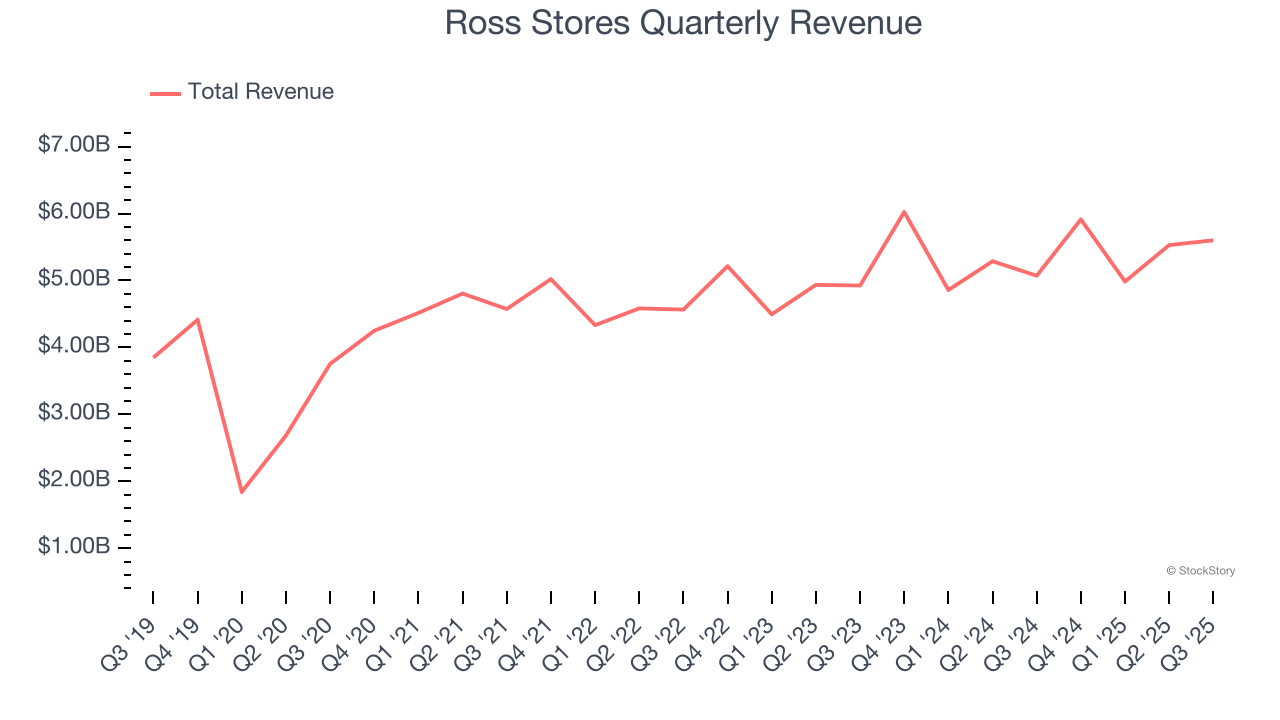

Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Ross Stores’s sales grew at a tepid 6% compounded annual growth rate over the last three years. This wasn’t a great result compared to the rest of the consumer retail sector, but there are still things to like about Ross Stores.

Final Judgment

Ross Stores’s merits more than compensate for its flaws, and with the recent surge, the stock trades at 27.5× forward P/E (or $189.86 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.