Socially responsible bank Amalgamated Financial (NASDAQ: AMAL) missed Wall Street’s revenue expectations in Q4 CY2025 as sales rose 3.2% year on year to $85.2 million. Its non-GAAP profit of $0.99 per share was 9.4% above analysts’ consensus estimates.

Is now the time to buy Amalgamated Financial? Find out by accessing our full research report, it’s free.

Amalgamated Financial (AMAL) Q4 CY2025 Highlights:

- Net Interest Income: $77.85 million vs analyst estimates of $76.32 million (6.5% year-on-year growth, 2% beat)

- Net Interest Margin: 3.7% vs analyst estimates of 3.6% (7 basis point beat)

- Revenue: $85.2 million vs analyst estimates of $85.98 million (3.2% year-on-year growth, 0.9% miss)

- Efficiency Ratio: 54.5% vs analyst estimates of 51.4% (311 basis point miss)

- Adjusted EPS: $0.99 vs analyst estimates of $0.91 (9.4% beat)

- Tangible Book Value per Share: $26.18 vs analyst estimates of $26.16 (15.8% year-on-year growth, in line)

- Market Capitalization: $1.08 billion

Priscilla Sims Brown, President and Chief Executive Officer, commented, “We had a record breaking quarter for deposit gathering, generating nearly $1 billion of new deposits across all of our customer segments. This demonstrates the mission-aligned, differentiated competitive advantage that only Amalgamated possesses. We now look forward to driving the next phase of Amalgamated’s growth, and building on this solid foundation.”

Company Overview

Founded in 1923 by labor unions seeking a financial institution aligned with worker values, Amalgamated Financial (NASDAQGM:AMAL) operates a values-oriented bank that provides commercial banking, trust services, and investment management to socially responsible organizations and individuals.

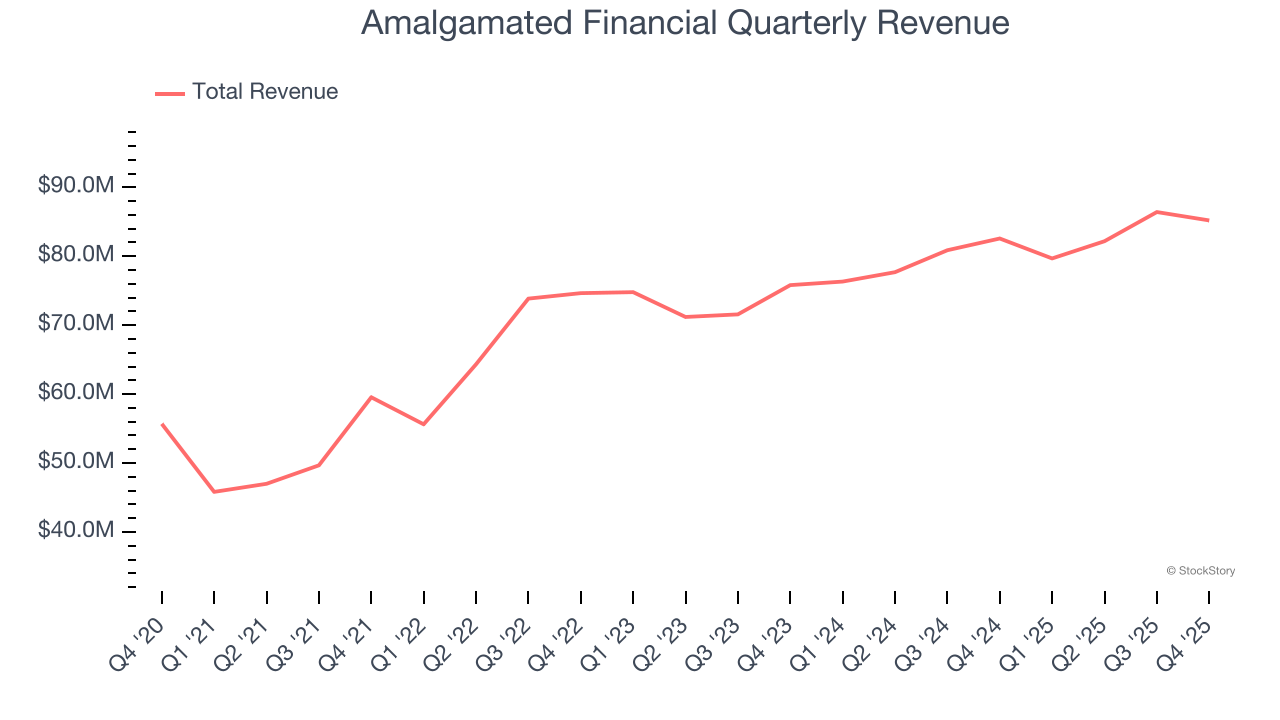

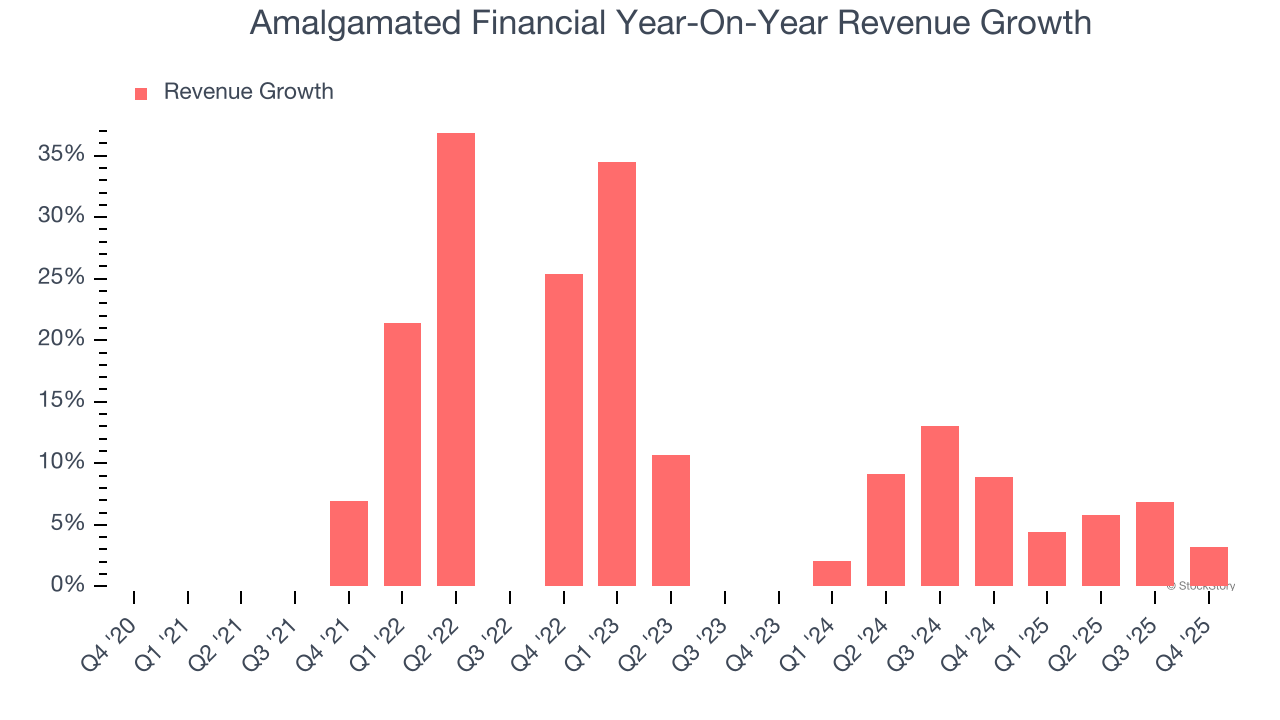

Sales Growth

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees. Regrettably, Amalgamated Financial’s revenue grew at a mediocre 10% compounded annual growth rate over the last five years. This wasn’t a great result compared to the rest of the banking sector, but there are still things to like about Amalgamated Financial.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Amalgamated Financial’s recent performance shows its demand has slowed as its annualized revenue growth of 6.6% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Amalgamated Financial’s revenue grew by 3.2% year on year to $85.2 million, falling short of Wall Street’s estimates.

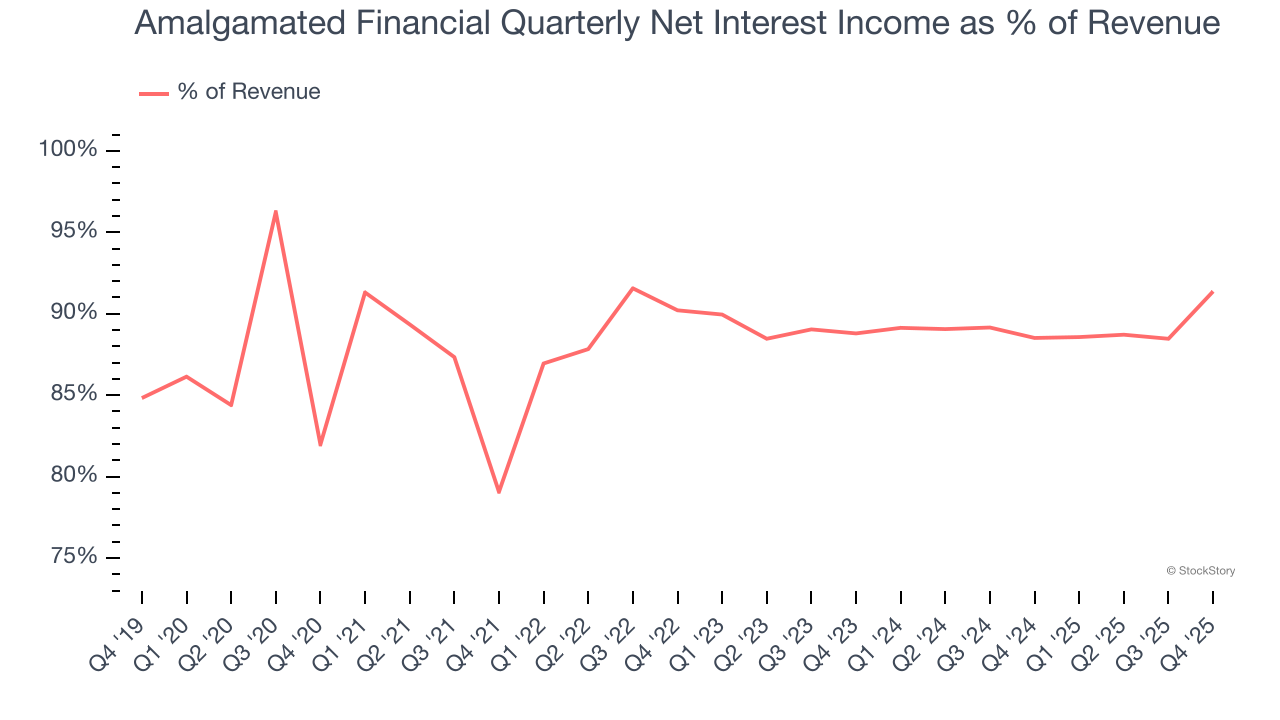

Net interest income made up 88.6% of the company’s total revenue during the last five years, meaning Amalgamated Financial barely relies on non-interest income to drive its overall growth.

Our experience and research show the market cares primarily about a bank’s net interest income growth as non-interest income is considered a lower-quality and non-recurring revenue source.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

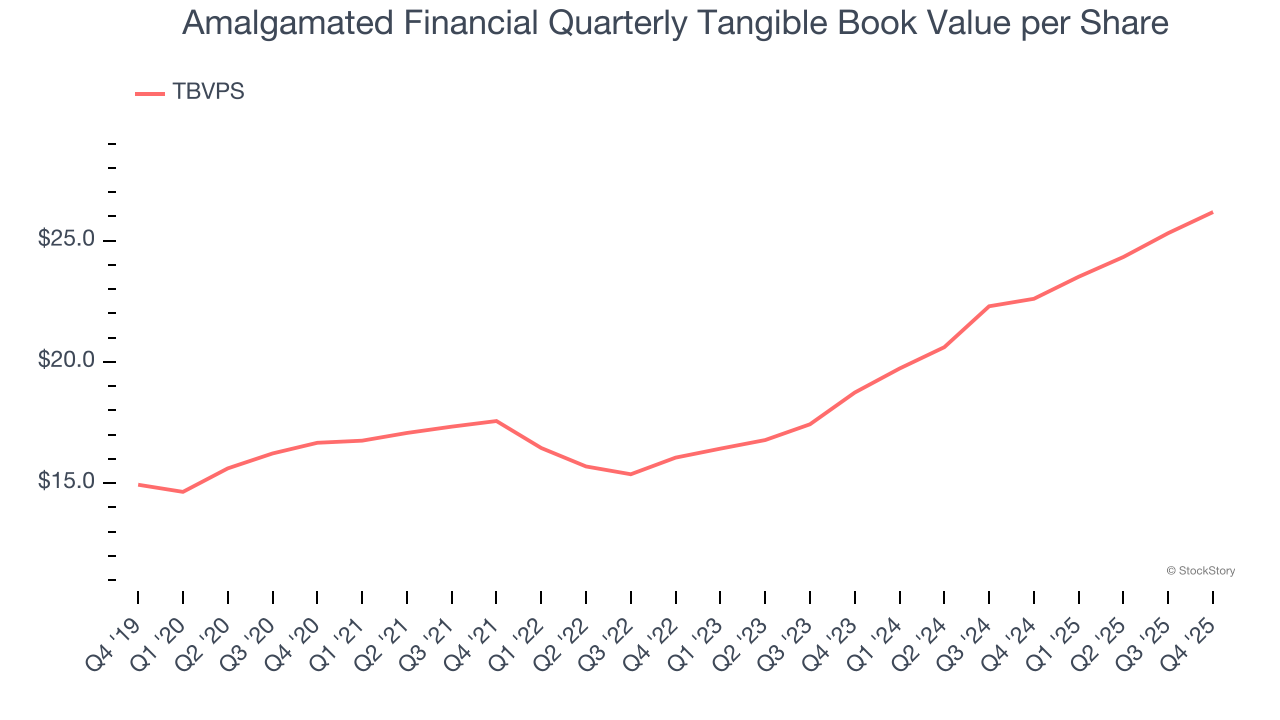

Tangible Book Value Per Share (TBVPS)

The balance sheet drives banking profitability since earnings flow from the spread between borrowing and lending rates. As such, valuations for these companies concentrate on capital strength and sustainable equity accumulation potential.

This is why we consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation. Traditional metrics like EPS are helpful but face distortion from M&A activity and loan loss accounting rules.

Amalgamated Financial’s TBVPS grew at an exceptional 9.5% annual clip over the last five years. TBVPS growth has also accelerated recently, growing by 18.2% annually over the last two years from $18.74 to $26.18 per share.

Over the next 12 months, Consensus estimates call for Amalgamated Financial’s TBVPS to grow by 14.3% to $29.92, decent growth rate.

Key Takeaways from Amalgamated Financial’s Q4 Results

It was encouraging to see Amalgamated Financial beat analysts’ net interest income expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue slightly missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $36.03 immediately after reporting.

Big picture, is Amalgamated Financial a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).