The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how insurance brokers stocks fared in Q3, starting with Arthur J. Gallagher (NYSE: AJG).

The insurance brokerage industry, while influenced by insurance pricing cycles, benefits from durable secular tailwinds as rising risk complexity (climate, data privacy), regulatory scrutiny, and insurance pricing inflation. These increase demand for professional risk-management advice. Brokers operate models that rely on commissions and fees tied to premium volumes and growing contributions from recurring advisory, benefits, and compliance services. Scale is a key advantage, enabling better carrier access, stronger data and benchmarking, and efficient deployment of technology and compliance investments, which in turn supports ongoing industry consolidation. The headwinds are labor intensity and wage inflation for producers, regulatory complexity (this cuts both ways, as you can see), and execution risk when integrating new digital tools into legacy workflows.

The 5 insurance brokers stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.1%.

While some insurance brokers stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.6% since the latest earnings results.

Weakest Q3: Arthur J. Gallagher (NYSE: AJG)

Founded in 1927 and operating in approximately 130 countries through direct operations and correspondent networks, Arthur J. Gallagher (NYSE: AJG) provides insurance brokerage, reinsurance, consulting, and third-party claims settlement services to businesses and individuals worldwide.

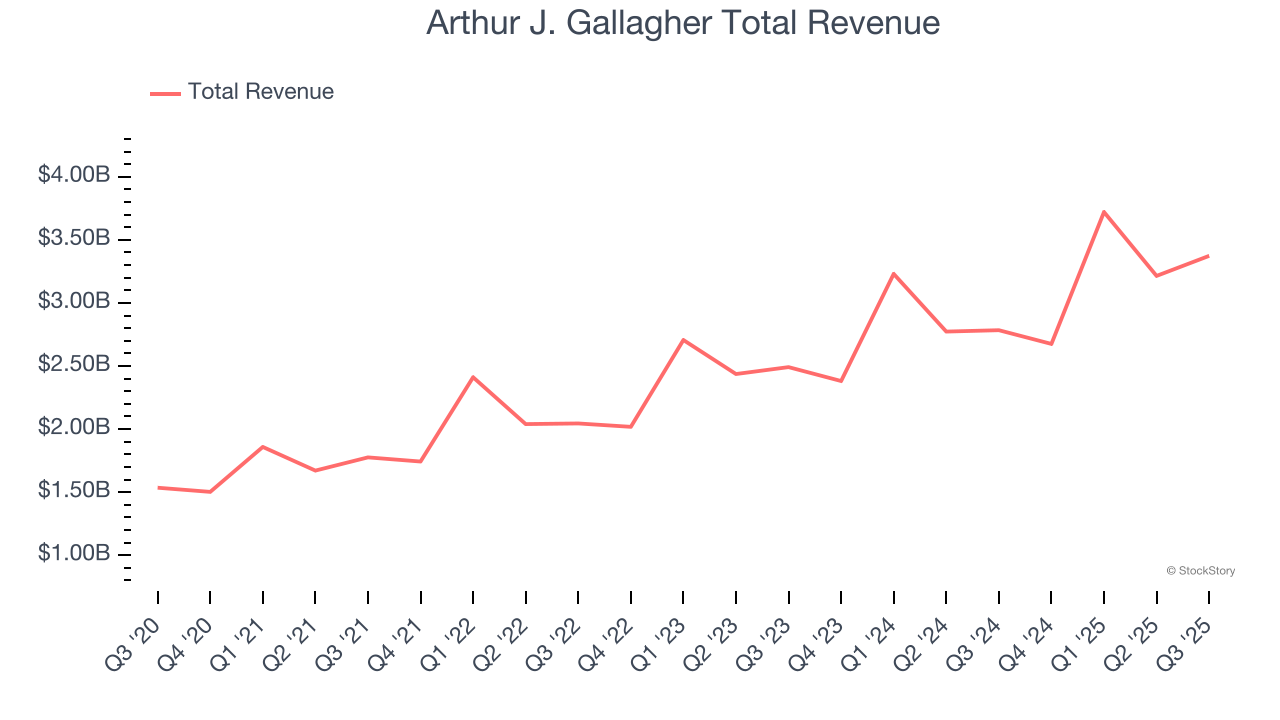

Arthur J. Gallagher reported revenues of $3.37 billion, up 21.2% year on year. This print fell short of analysts’ expectations by 2.6%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ revenue and EPS estimates.

Arthur J. Gallagher delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 1.5% since reporting and currently trades at $258.01.

Is now the time to buy Arthur J. Gallagher? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Brown & Brown (NYSE: BRO)

With roots dating back to 1939 and operations spanning 44 U.S. states and 14 countries, Brown & Brown (NYSE: BRO) is an insurance brokerage and risk management firm that markets and sells insurance products across property, casualty, and employee benefits sectors.

Brown & Brown reported revenues of $1.61 billion, up 35.4% year on year, outperforming analysts’ expectations by 3.9%. The business had a very strong quarter with a beat of analysts’ EPS and revenue estimates.

Brown & Brown pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 10.4% since reporting. It currently trades at $78.60.

Is now the time to buy Brown & Brown? Access our full analysis of the earnings results here, it’s free for active Edge members.

Baldwin Insurance Group (NASDAQ: BWIN)

Rebranded from BRP Group in May 2024, Baldwin Insurance Group (NASDAQ: BWIN) is an independent insurance distribution company that provides tailored insurance, risk management, and employee benefits solutions to businesses and individuals.

Baldwin Insurance Group reported revenues of $365.4 million, up 7.8% year on year, exceeding analysts’ expectations by 0.9%. Still, it was a mixed quarter as it posted a slight miss of analysts’ organic revenue estimates.

Baldwin Insurance Group delivered the slowest revenue growth in the group. The stock is flat since the results and currently trades at $23.78.

Read our full analysis of Baldwin Insurance Group’s results here.

Ryan Specialty (NYSE: RYAN)

Founded in 2010 by insurance industry veteran Patrick Ryan, Ryan Specialty (NYSE: RYAN) is a wholesale insurance broker and underwriting manager that helps retail brokers place complex or hard-to-place risks with insurance carriers.

Ryan Specialty reported revenues of $754.6 million, up 24.8% year on year. This number topped analysts’ expectations by 2.9%. It was a very strong quarter as it also produced a solid beat of analysts’ organic revenue estimates and an impressive beat of analysts’ revenue estimates.

The stock is flat since reporting and currently trades at $51.01.

Read our full, actionable report on Ryan Specialty here, it’s free for active Edge members.

Marsh & McLennan (NYSE: MMC)

With roots dating back to 1871 and a presence in over 130 countries, Marsh & McLennan (NYSE: MMC) is a global professional services firm that helps organizations manage risk, strategy, and workforce challenges through its four specialized businesses.

Marsh & McLennan reported revenues of $6.35 billion, up 11.5% year on year. This print was in line with analysts’ expectations. Overall, it was a satisfactory quarter as it also recorded a beat of analysts’ EPS estimates.

The stock is down 2.2% since reporting and currently trades at $182.50.

Read our full, actionable report on Marsh & McLennan here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.