The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how ingredients, flavors & fragrances stocks fared in Q3, starting with Ingredion (NYSE: INGR).

Ingredients, flavors, and fragrances companies supply essential components to food, beverage, personal care, and household product manufacturers. These firms develop proprietary formulations that enhance taste, scent, and texture, creating customer stickiness through specialized expertise and regulatory-approved ingredient portfolios. Tailwinds include growing consumer demand for natural and clean-label products, expansion in emerging markets, and innovation in plant-based and functional ingredients. However, headwinds persist from volatile raw material costs, particularly for agricultural and petrochemical inputs. Regulatory scrutiny over synthetic additives and fragrance allergens poses compliance challenges, while consolidation among major customers increases pricing pressure and negotiating leverage against suppliers.

The 5 ingredients, flavors & fragrances stocks we track reported a mixed Q3. As a group, revenues missed analysts’ consensus estimates by 2.5%.

Thankfully, share prices of the companies have been resilient as they are up 5.5% on average since the latest earnings results.

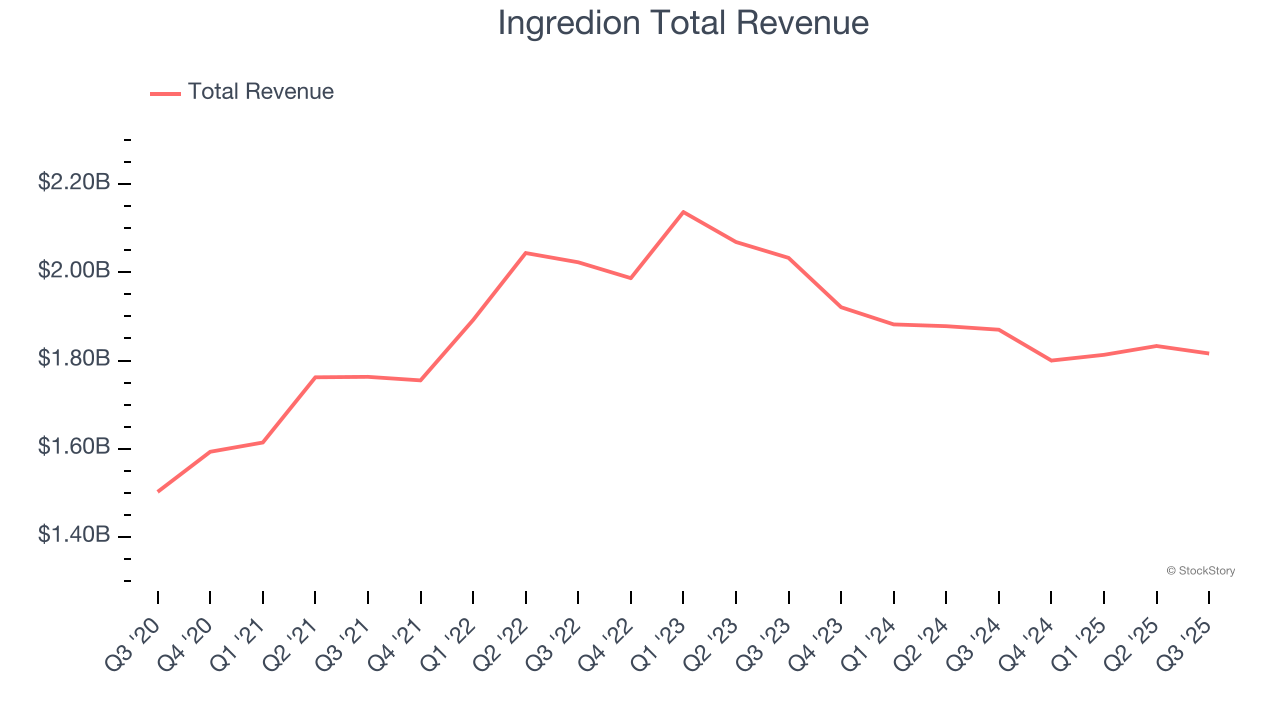

Weakest Q3: Ingredion (NYSE: INGR)

Known for its ability to turn ordinary corn into thousands of different food ingredients, Ingredion (NYSE: INGR) transforms grains, fruits, vegetables and other plant-based materials into specialty starches, sweeteners and other ingredients for food, beverage and industrial markets.

Ingredion reported revenues of $1.82 billion, down 2.9% year on year. This print fell short of analysts’ expectations by 4%. Overall, it was a softer quarter for the company with a significant miss of analysts’ EBITDA and revenue estimates.

Unsurprisingly, the stock is down 3.2% since reporting and currently trades at $110.43.

Read our full report on Ingredion here, it’s free for active Edge members.

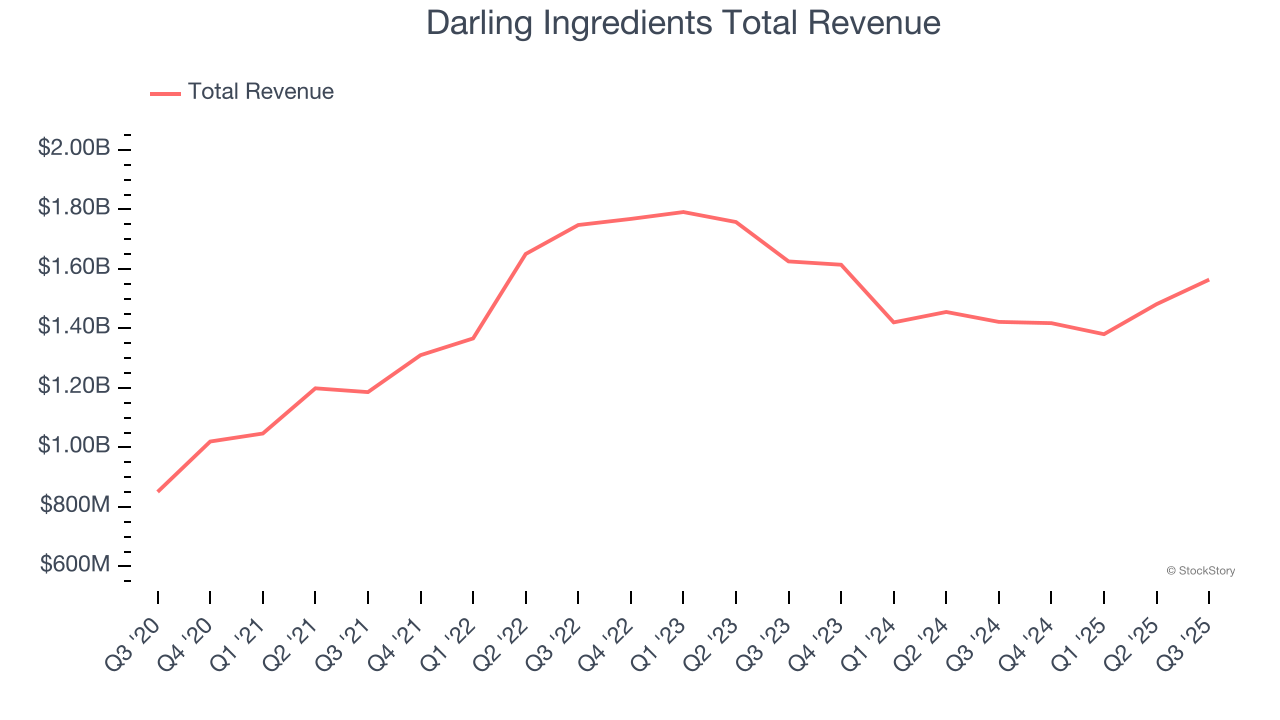

Best Q3: Darling Ingredients (NYSE: DAR)

Turning what others consider waste into valuable resources, Darling Ingredients (NYSE: DAR) collects and transforms animal by-products, used cooking oil, and other bio-nutrients into valuable ingredients for food, feed, fuel, and industrial applications.

Darling Ingredients reported revenues of $1.56 billion, up 10% year on year, outperforming analysts’ expectations by 4.5%. The business had a strong quarter with an impressive beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ revenue estimates.

Darling Ingredients scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 22.2% since reporting. It currently trades at $38.03.

Is now the time to buy Darling Ingredients? Access our full analysis of the earnings results here, it’s free for active Edge members.

Bunge Global (NYSE: BG)

With origins dating back to 1818 and operations spanning both hemispheres to balance seasonal harvests, Bunge Global (NYSE: BG) is an agribusiness and food company that processes oilseeds, grains, and other agricultural commodities into vegetable oils, protein meals, flours, and specialty ingredients.

Bunge Global reported revenues of $22.16 billion, up 71.6% year on year, falling short of analysts’ expectations by 13.3%. Still, it was a satisfactory quarter as it posted a solid beat of analysts’ EBITDA estimates.

Bunge Global delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. The stock is flat since the results and currently trades at $93.38.

Read our full analysis of Bunge Global’s results here.

Archer-Daniels-Midland (NYSE: ADM)

Transforming crops from the world's most productive agricultural regions into everyday essentials, Archer-Daniels-Midland (NYSE: ADM) processes and transports agricultural commodities like grains and oilseeds while manufacturing ingredients for food, beverages, feed, and industrial applications.

Archer-Daniels-Midland reported revenues of $20.37 billion, up 2.2% year on year. This number missed analysts’ expectations by 2%. More broadly, it was a satisfactory quarter as it also logged an impressive beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ gross margin estimates.

The stock is flat since reporting and currently trades at $59.01.

Read our full, actionable report on Archer-Daniels-Midland here, it’s free for active Edge members.

International Flavors & Fragrances (NYSE: IFF)

Responsible for the scents in your favorite perfumes and the flavors in your daily snacks, International Flavors & Fragrances (NYSE: IFF) creates and manufactures ingredients for food, beverages, personal care products, and pharmaceuticals used in countless consumer goods.

International Flavors & Fragrances reported revenues of $2.69 billion, down 7.9% year on year. This print surpassed analysts’ expectations by 2.1%. It was a strong quarter as it also recorded an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ EBITDA estimates.

International Flavors & Fragrances had the slowest revenue growth among its peers. The stock is up 9.3% since reporting and currently trades at $67.18.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.