Inflation is everywhere . As you can see from the B of A chart on the right, 13% of the conference calls have mentioned inflation as a key factor going forward and that's up 300% from last year. Inflation has many problems for the market and one of them is uncertainty – markets don't like that. As long as we have the certainty of the Fed backing us up, we can ignore inflation but, of course, inflation is the one key factor that is most likely to force the Fed to stop printing money – as it can quickly get out of hand. Home prices are up over 10% since last year, despite the Recession and materials like lumber are through the roof – so don't expect that to ease up any time soon. Core Inflation would have to persist above 2%, perhaps for several quarters, to spur policymakers to move. With its policy shift, the Fed now also promises to aim for 2% inflation on average over a period of time, rather than using 2% as a hard annual target, as it had since 2012. Still, as we know, the CPI is just so much BS and you can see how our CEOs see inflation as a real problem that's impacting their industries already from these earnings report comments: IN PROGRESS

Inflation is everywhere.

Inflation is everywhere.

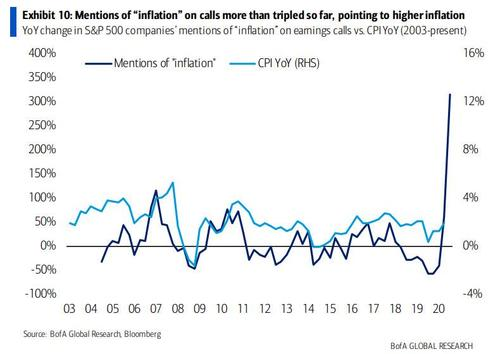

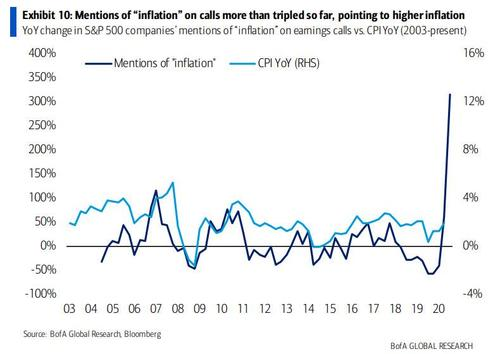

As you can see from the B of A chart on the right, 13% of the conference calls have mentioned inflation as a key factor going forward and that's up 300% from last year. Inflation has many problems for the market and one of them is uncertainty – markets don't like that. As long as we have the certainty of the Fed backing us up, we can ignore inflation but, of course, inflation is the one key factor that is most likely to force the Fed to stop printing money – as it can quickly get out of hand.

Home prices are up over 10% since last year, despite the Recession and materials like lumber are through the roof – so don't expect that to ease up any time soon. Core Inflation would have to persist above 2%, perhaps for several quarters, to spur policymakers to move. With its policy shift, the Fed now also promises to aim for 2% inflation on average over a period of time, rather than using 2% as a hard annual target, as it had since 2012.

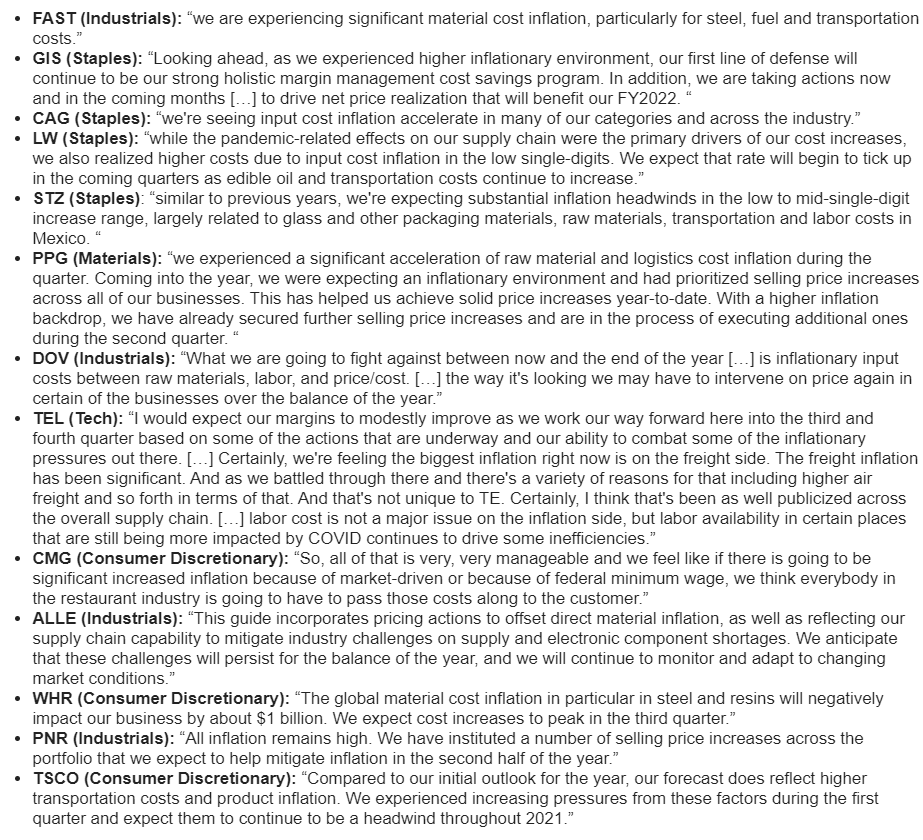

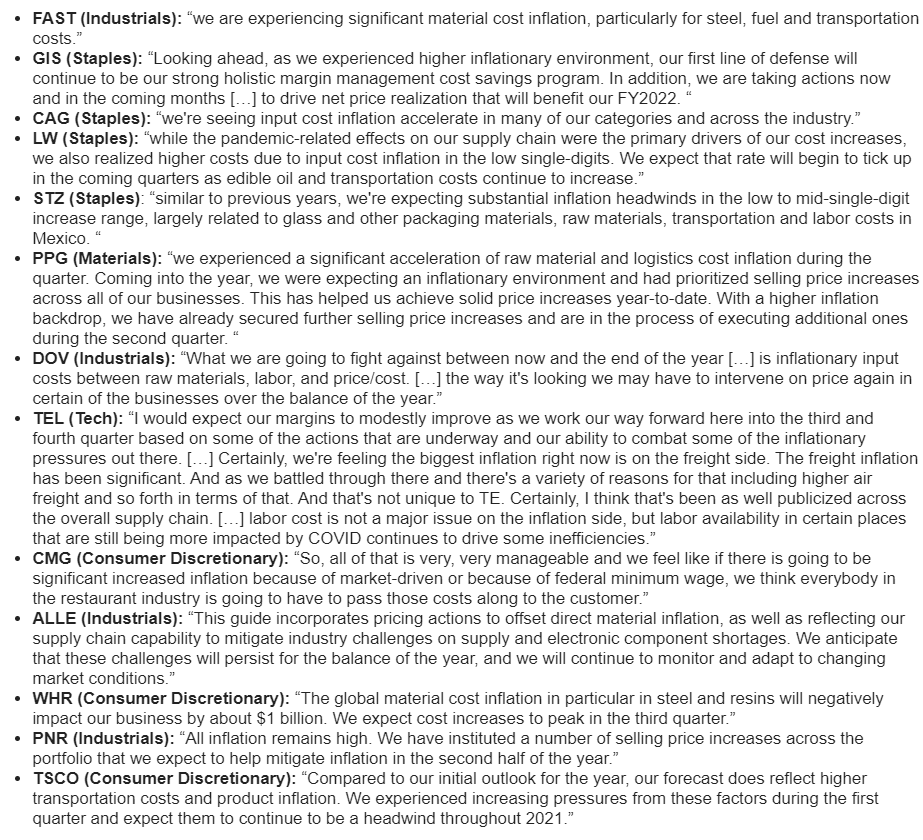

Still, as we know, the CPI is just so much BS and you can see how our CEOs see inflation as a real problem that's impacting their industries already from these earnings report comments:

IN PROGRESS