Jobs report today.

Jobs report today.

In September we added an anemic 194,000 jobs and October is projected to rebound to 450,000 but does it matter? The S&P 500 is up 100 points (2%) this week and up almost 10% since we got that crappy payroll report last month. The economic numbers haven't been good and earnings have not been great but, in 19 out of 23 market days since the last NFP Report, the market has gone up and up and up and up.

We're investors, we should be happy. Our Long-Term Portfolio, which we last reviewed on October 15th, is up $50,000 (10%) for the month – and we only made 3 changes in the last review. Just sit back and make money is what the market is teaching us but, do you know what that's called? Complacency! And complacency is a very dangerous disease for a trade to catch. The SPY ETF hasn't cracked 100M in volume since October 6th and it's been closer to 50M most days – 50M is the kind of volume we used to see on half day holidays.

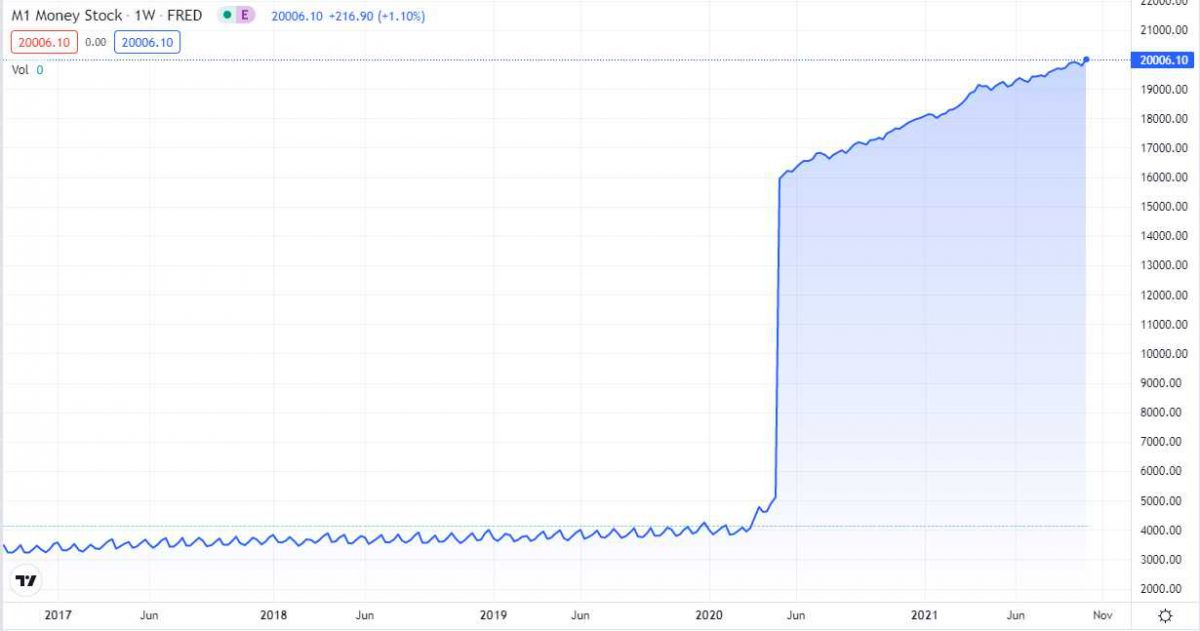

When there's very little trading, there is a larger percentage of computer trading as a certain amount of money flows into ETFs every day from payrolls and retirement accounts, which all run on algorithms. And, of course, if money is coming in and people aren't selling, the algos that run other trading platforms interpret that as a strong market and maintain their own positive bias and, more importantly, they never see a sell signal. The Fed has pumped another 10% into the money supply this year, pushing us up $2Tn – $2Tn was HALF of the total money supply in 2019 – that's what they added this year – and they wonder where the inflation is coming from:

Where does this money go? Well mostly to the Banksters but then they get to multiply that money by 10 and play with it as they see fit. Some of those Banksters are JPM and GS and they buy a lot of stock with it and they lend money (margin, etc) to their clients, who also buy a lot of stocks – and every other asset on the planet that isn't…