Optix is well-positioned to be a key protocol in the DeFi 2.0 megatrend by unlocking this next wave of sustainable growth across the ecosystem.

Optix is an on-chain option protocol where liquidity providers earn a high yield on their crypto assets. This can be done through its option vaults and a simple user experience (UX) for traders who want to grow their money passively.

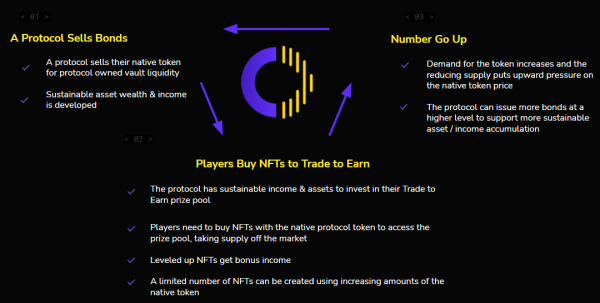

Optix also provides the ability for other protocols to sell bonds for protocol owned vault liquidity positions and “trade to earn” gamefi to drive viral token growth.

Explore More: Providing liquidity with Optix

Optix Vaults, Bonds, and Trade to Earn

Optix Vaults

Structured products such as covered calls have proven that they can sustainably provide a significantly higher yield than what currently is available in DeFi.

Optix Vaults are structured products such as covered calls or puts that provide a passive way for liquidity providers to earn compounding yields. With this, APYs can sustainably be around 10-20%.

Optix Bonds

To diversify their treasuries and establish other income streams, any protocol can use Optix to sell bonds in their native token for any option vault liquidity pool. Vault liquidity purchased is then owned by the protocol earning yield on trading swap fees & option yield.

Optix Trade to Earn

Optix Trade to Earn allows other protocols to leverage NGU technology (Number Go Up) with free-to-play play-to-earn dynamics, providing both native token demand and virality.

Also Read: Learn how to buy bonds with Optix

Option sellers can earn compounding yield by using Optix’s simple trading interface to buy options and passive structured products. Other protocols can also use Optix to issue bonds in their native token for any vault’s liquidity pool which the protocol then owns the liquidity it has purchased. Thus, earning yield on swap fees & option premiums.

Learn more about Optix through its official website and get to know more about what more it can offer, its future, and its plans going forward.

Twitter: https://twitter.com/OptixProtocol

Discord: https://discord.gg/8ycMuYt7PS

Telegram: https://t.me/OptixCommunity

GitHub: https://github.com/OptixProtocol

Media Contact

Company Name: Micky Pty Ltd

Contact Person: Michael Manlapig

Email: Send Email

Country: Australia

Website: https://micky.com.au/optix-better-user-experience-for-passive-income-traders/