(Please enjoy this updated version of my weekly commentary published March 17th, 2022 from the POWR Stocks Under $10 newsletter).

First, let’s review the past week…

Over this past week, the S&P 500 is up by 3.6%. More impressive, we are up nearly 6% from Monday’s close.

There are 2 major factors behind this turnaround: One is that there is some positive chatter about the prospects of a ceasefire or even a peace deal between Russia and Ukraine despite the ongoing war.

It’s also kind of gotten to a stalemate in terms of Russia unable to advance but continuing to bombard cities and towns.

The second factor is that the Fed finally hiked rates for the first time since 2018. In my opinion, the Fed was pretty hawkish in terms of lowering its growth outlook, while raising its inflation and rate hike outlook. Still, the market had a furious rally following an initial 2% drop.

Why?

Well, the market has been selling off in anticipation of the rate hike and tighter monetary policy since early January. So, this was simply a “sell the rumor, buy the news” type of rally.

Similar to what happened on February 24 as the market sold off on fears of Russia invading Ukraine and then ripped 5% higher in a couple of days as soon as the invasion commenced.

Navigating the Range

For a couple of weeks now, we’ve determined that the stock market was range-bound, so it makes sense that we have rallied off the bottom-end of the range.

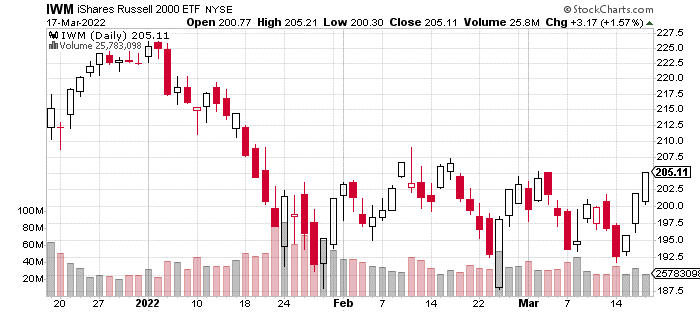

It’s actually not as clear with the S&P 500 but quite obvious if we look at the Russell 2000:

As discussed last week, the market had its initial tumble in January. Since then, it’s absorbed a lot of bad news and managed to trade sideways.

The range is pretty clear for the IWM (R2K ETF): 187.5 to 210. For the S&P 500, it’s more like 4,100 to 4,600. My hunch is that we are going to test the upper end of this range a couple of times just as we’ve tested the bottom-end.

And, yes, I would look to take some profits on these tests of the upper-end. Although, we have had some marginally positive news about Ukraine-Russia, I don’t think such a complicated issue with roots going back centuries will be so easily resolved.

Many of the leaks and market-moving news items are more about creating leverage and shaping narratives rather than reflecting reality.

Thus, I still don’t think this is an appropriate time to take big swings or risks. Rather, it’s a market for singles and doubles.

This is primarily because, I believe these choppy conditions are going to last for at least a few more weeks and possibly for a few more months.

Finally, even if this is resolved, we still have the Fed and inflation as potent headwinds which was the impulse for this correction in the first place.

2 More Trends to Watch

Corrections are not as fun as bull markets for obvious reasons, but the one upside is that they give us opportunities to scoop up high-quality stocks at favorable valuations.

Think of all the bargains that were available in March 2020. The same type of opportunities will present themselves when this correction is finally over.

Therefore, I continue to pay attention to economic data and earnings reports to find the stocks and sectors that are seeing continued momentum and improving fundamentals.

We’ve talked often about travel stocks and energy and have taken decent positions in both. Today, I want to talk about 2 more – housing and gold.

Housing stocks have sold off as many believe the increase in mortgage rates could cool the market. Yes, some slowing is possible, but I believe the underlying supply/demand dynamics are strong enough to overcome this headwind.

Earnings reports from homebuilders have been very strong in terms of margins and demand. Even more, P/E multiples are in the single-digits implying that these stocks are pricing in a slowdown.

Well, I don’t see any slowdown which means that these will be fantastic buying opportunities.

The next area of interest is precious metals. Now, I’m normally not a fan and rather invest in productive assets rather than gold and silver. Further, as long as I can remember, I’ve heard from gold and silver bulls about hyperinflation, government default, the dollar dying, etc.

What bothers me isn’t gold and silver but simply that this group refuses to adjust their thinking based on the evidence that emerges. For example, many warned that QE in 2009 would lead to hyperinflation. It didn’t. And, gold fell nearly 50% between 2012 and 2015.

At the same time… I shouldn’t make the same mistake by not having an open mind and dismissing gold and silver without considering the evidence.

My antenna ears always perk up when something happens… that shouldn’t happen. This often is a precursor to a major trend. For example, gold topped in August 2020 despite so many bullish catalysts like the Fed’s easy money policy and the federal government running trillion dollar deficits.

Basically, gold was range-bound between August 2020 and February 2021, while nearly every other asset was soaring higher.

But, now gold is finding a bid even with the Fed embarking on its first rate hike since 2018. Yes, this is in part, due to the elevated geopolitical risk with Russia’s invasion of Ukraine.

Still, there are some real similarities between the bull market in gold from 2002 to 2007 when prices nearly quadrupled and today. Then, we had 9/11 which had numerous ripple effects that were difficult to predict at that time, and the Fed was raising rates. Today is eerily similar.

Therefore, we have 1 gold position – BTG – but I’m increasingly seeing this as an asset class to watch especially as it tends to do well in choppy or downtrending markets when opportunities for outperformance in most parts of the market may be limited.

What To Do Next?

If you’d like to see more top stocks under $10, then you should check out our free special report:

What gives these stocks the right stuff to become big winners?

First, because they are all low priced companies with explosive growth potential.

But even more important, is that they are all top Buy rated stocks according to our coveted POWR Ratings system and they excel in key areas of growth, sentiment and momentum.

Click below now to see these 3 exciting stocks which could double (or more!) in the year ahead.

All the Best!

Jaimini Desai

Chief Growth Strategist, StockNews

Editor, POWR Stocks Under $10 Newsletter

SPY shares rose $0.76 (+0.17%) in after-hours trading Friday. Year-to-date, SPY has declined -6.41%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Jaimini Desai

Jaimini Desai has been a financial writer and reporter for nearly a decade. His goal is to help readers identify risks and opportunities in the markets. He is the Chief Growth Strategist for StockNews.com and the editor of the POWR Growth and POWR Stocks Under $10 newsletters. Learn more about Jaimini’s background, along with links to his most recent articles.

The post 2 Investing Trends to Watch and What They Mean for the Broader Market appeared first on StockNews.com