Visual discovery engine company Pinterest, Inc. (PINS) in San Francisco, allows people to discover and personalize visual content–called Pins–which are created when Pinners, creators, and businesses create new content for or save existing Web content, including recipes, style, and home inspiration, do it yourself (DIY), and others to its platform. Earlier this month, the company announced its intention to combat climate misinformation and claimed to be the only major digital platform to have clearly defined guidelines against false or misleading climate change information, including conspiracy theories, across content and ads.

The stock hit an $81.77 high in 2021 amid the COVID-19 pandemic and stay-at-home restrictions. However, the content platform’s popularity has begun to wane in the post-pandemic period, with the company reporting decreasing monthly active users for the past few quarters as people have reengaged with outdoor activities. PINS’ global monthly active users (MAUs) decreased 6% year-over-year to 431 million in its fiscal fourth quarter, ended Dec. 31, 2021, while its MAUs declined 12% in the United States.

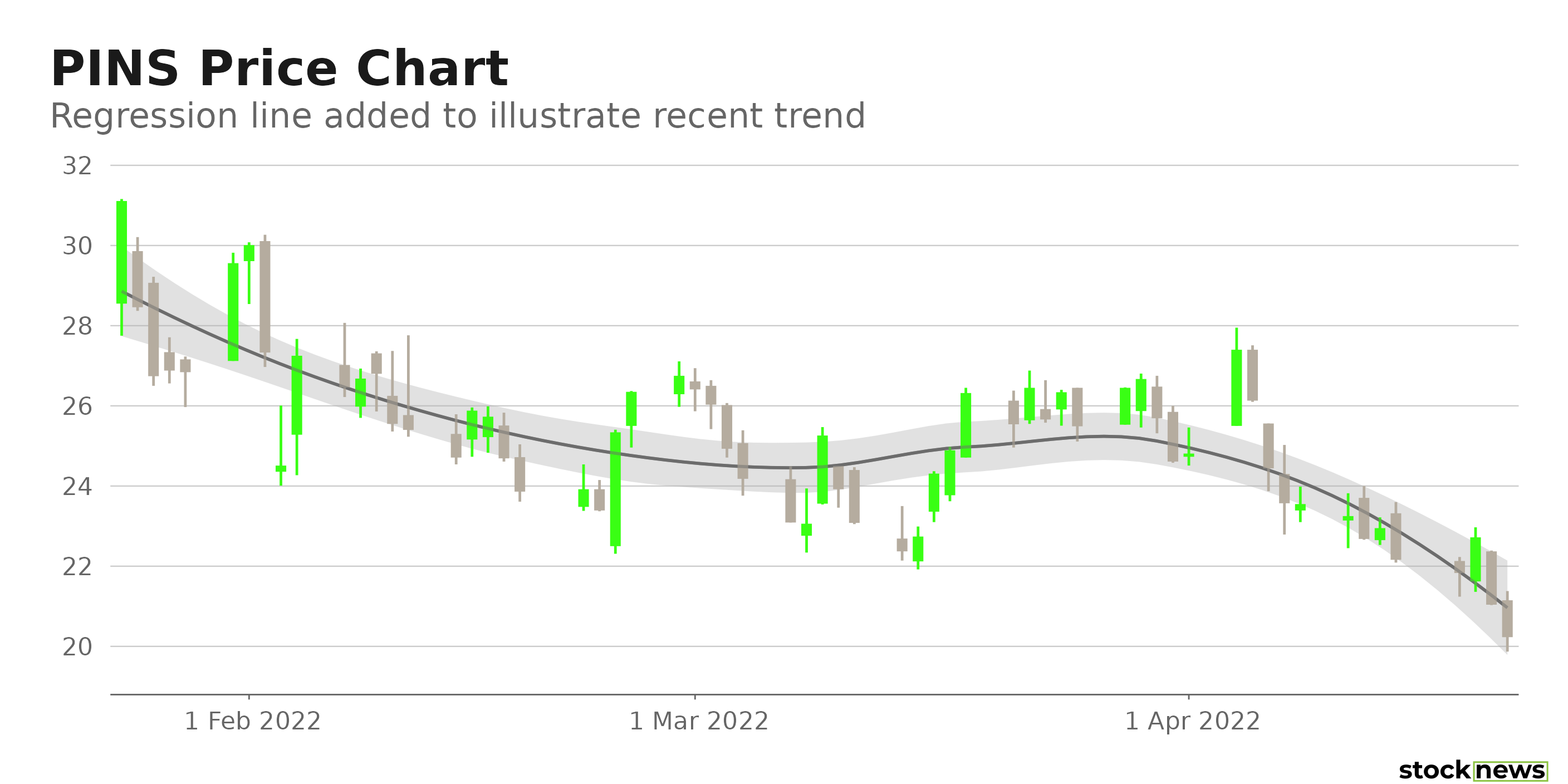

PINS cited lower search traffic driven by Google’s algorithm change in November and increasing competition for time spent online from video-centric consumer apps as having negatively impacted its MAUs on a year-over-year and sequential basis. The declining user engagement has led the stock of the pandemic darling to decline 67% in price over the past six months and 44.4% year-to-date to close the last trading session at $20.23.

Here is what could shape PINS’ performance in the near term:

Downgraded by Morgan Stanley

Morgan Stanley analyst Brian Nowak downgraded PINS to Equal Weight from Overweight with a$30 price, down from $53. He noted that there was “too much uncertainty” for the company. PINS has been trying to expand its content offerings while focusing on short-form video, but Nowak worries about PINS’ ability to keep users engaged. Furthermore, new short-form video content monetizes at a lower rate. He added that larger companies, such as Meta Platforms Inc. (FB), and Alphabet Inc. (GOOGL), will have an advantage over PINS when it comes to monetizing this new format, making the transition adds “even more uncertainty to revenue and profitability.” Nowak lowered his ad-revenue estimate by 9% for 2022 and 8% for 2023 and cut his adjusted EBITDA estimates by 48% for 2022 and 42% for 2023.

Stable Financials

For its fiscal fourth quarter, ended Dec. 31, 2021, PINS’ revenues increased 20% year-over-year to $846.66 million. Its adjusted net income increased 15.3% from its year-ago value to $339.45 million, while its adjusted EPS rose 14% year-over-year to $0.49. The company’s adjusted EBITDA came in at $350.86 million, up 17.3% from the prior-year quarter.

Bottom Line Expected to Decline

Analysts expect PINS’ revenues to increase 18.1% year-over-year in the quarter ended March 31, 2022, to $573.17 million. Also, its revenues are expected to grow 13.1% in the current quarter, ending June 30, 2022, and 20.6% in the current year. However, the company’s EPS is expected to be $0.03 in the about to be reported quarter, ended March 31, 2022, indicating a 72.7% decline year-over-year. Also, the Street expects PINS’ EPS to decrease 36% in the current quarter and 9.7% in the current year.

Impressive Profit Margins

PINS’ 79.47% gross profit margin is 56.4% higher than the 50.83% industry average. Also, its 12.27% net income margin is 146.4% higher than the 4.98% industry average.

PINS’ 11.98%, 8.95%, and 8.20% respective ROE, ROA, and ROTC compare with the 6.20%, 2.92%, and 3.77% industry averages.

POWR Ratings Reflect Uncertainty

PINS has an overall C rating, which translates to Neutral in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

The stock has a grade of C for Growth. The stock’s mixed growth prospects justify this grade.

PINS has a D grade for Stability, which is consistent with its beta of 1.19.

Among the 71 stocks in the Internet industry, PINS is ranked #16.

Beyond what I have stated above, one can also view PINS’ grades for Value, Sentiment, Momentum, and Quality here.

View the top-rated stocks in the Internet industry here.

Bottom Line

The social-media company's shares seem to be on a downtrend due to its declining user engagement despite its stable revenue growth. Although the company is trying to expand its offerings and attract users, the growing competition in the fast-growing content market could be a significant headwind. Also, considering the bearish sentiments, I think it could be wise to wait for a better entry point in the stock.

How Pinterest, Inc. (PINS) Does Stack Up Against its Peers?

While PINS has an overall POWR Rating of C, one might want to consider looking at its industry peers, trivago N.V. (TRVG), which has an A (Strong Buy) rating, and Yelp Inc. (YELP) and Travelzoo (TZOO), which have a B (Buy) rating.

Note that TRVG is one of the few stocks handpicked by our Chief Growth Strategist, Jaimini Desai, currently in the POWR Stocks Under $10 portfolio. Learn more here.

PINS shares fell $0.05 (-0.25%) in premarket trading Friday. Year-to-date, PINS has declined -44.35%, versus a -7.48% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Is Pinterest a Buy Under $25? appeared first on StockNews.com