Affirm Holdings, Inc. (AFRM) in San Francisco is a digital and mobile-first commerce platform in the United States and Canada. Its platform includes a POS payment solution for customers, merchant commerce solutions, and a consumer-focused app. The company recently announced a multi-year renewal of its partnership with Shopify (SHOP), a provider of key internet infrastructure for commerce in the United States. The arrangement establishes AFRM as the exclusive pay-over-time supplier for Shop Pay Installments in the United States.

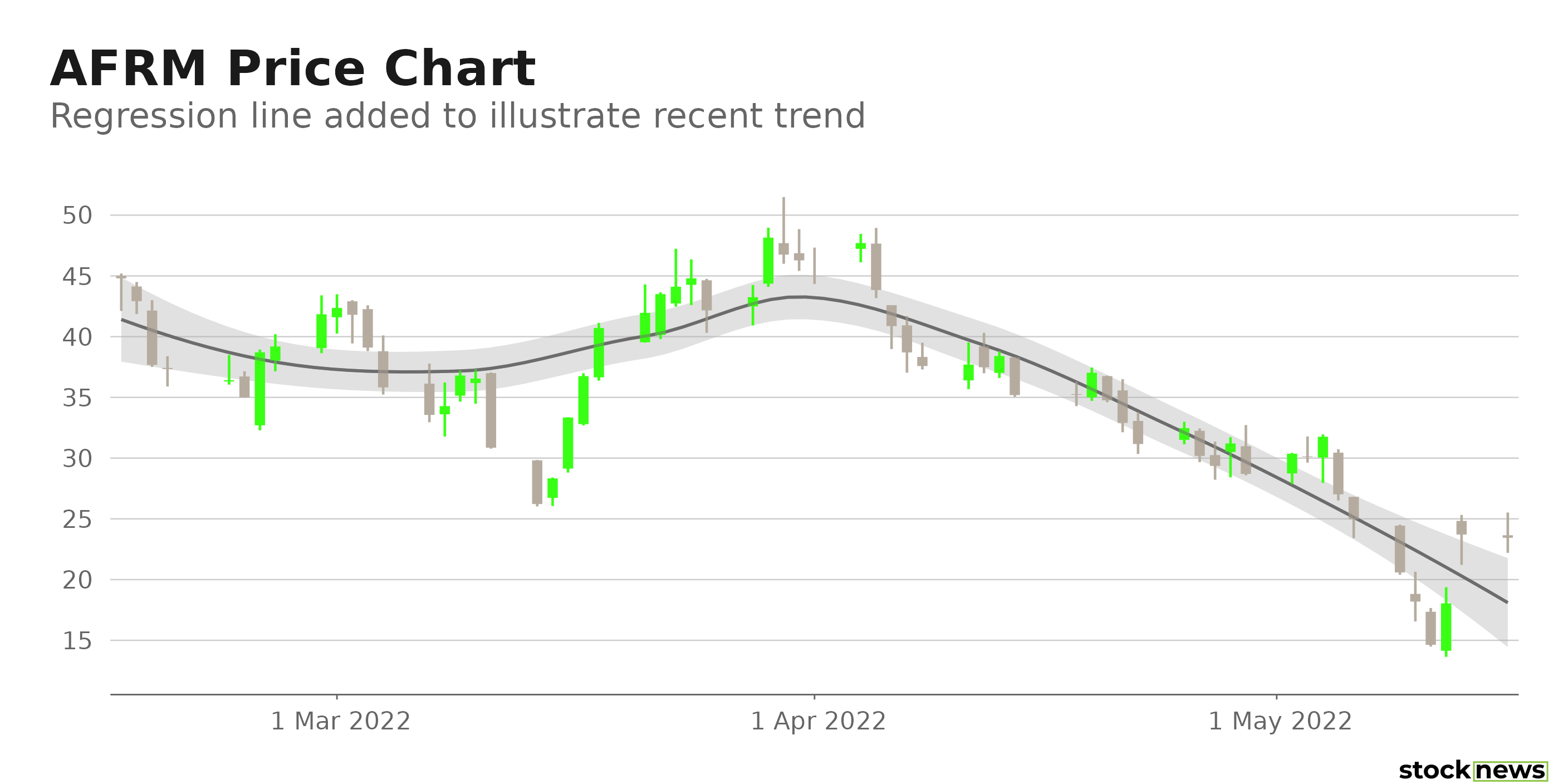

However, the stock is down 50.9% in price over the past year and 38.3% over the past month to close its last trading session at $23.71. In addition, the stock is currently trading 86.6% below its 52-week high of $176.65.

Also, AFRM was downgraded by equities research analysts at Stephens to an "underweight" rating from an "equal weight" rating in a research note issued last week

Here is what could shape AFRM's performance in the near term:

Poor Bottom-line Performance

AFRM's total revenue increased 53.8% year-over-year to $354.76 million for the three months ended March 31, 2022. Its active consumers grew 137% from its year-ago value to $12.7 million sequentially from Dec. 31, 2021.

However, its costs and expenses increased 32.1% from its year-ago value to $581.31 million. Its operating loss rose 8.2% from the prior-year quarter to $226.51 million. And the company's net loss was $54.67 million. Its loss per share amounted to $0.19 over this period.

Poor Profitability

AFRM's 0.21% trailing-12-months asset turnover ratio is 66.7% lower than the 0.63% industry average. Its trailing-12-months cash from operations stood at negative $123 million versus the $85.32 million industry average. Also, its trailing-12-months ROA, net income margin, and ROC are negative 9.02%, 50.9%, and 9.1%, respectively.

Unfavorable Earnings Estimates

Analysts expect AFRM's EPS to remain negative in the current quarter and next quarter. In addition, its EPS is expected to decline at a 35.1% rate per annum over the next five years.

POWR Ratings Reflect Bleak Outlook

AFRM has an overall F rating, which equates to a Strong Sell in our proprietary POWR Ratings system. The POWR ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. AFRM has an F grade for Quality, which is justified given the company's poor profitability.

Among the 79 stocks in the C-rated Technology – Services industry, AFRM is ranked #77.

Beyond what I have stated above, one can view AFRM ratings for Growth, Value, Stability, Momentum, and Sentiment here.

Bottom Line

While AFRM reported stable top-line growth in its last reported quarter, its near-term bleak growth prospects are concerning. In addition, the stock is currently trading below its 50-day and 200-day moving average of $34.81 and $82.77, respectively, indicating a downtrend. Furthermore, considering its poor profitability and recent analysts’ rating downgrade, we think the stock is best avoided now.

How Does Affirm Holdings Inc. (AFRM) Stack Up Against its Peers?

While AFRM has an overall D rating, one might want to consider its industry peers, Fujitsu Limited (FJTSY), Celestica Inc. (CLS), and Information Services Group Inc. (III), which have an overall A (Strong Buy) rating.

Note that III is one of the few stocks handpicked by our Chief Growth Strategist, Jaimini Desai, currently in the POWR Stocks Under $10 portfolio. Learn more here.

AFRM shares were trading at $23.62 per share on Monday morning, down $0.09 (-0.38%). Year-to-date, AFRM has declined -76.51%, versus a -15.79% rise in the benchmark S&P 500 index during the same period.

About the Author: Pragya Pandey

Pragya is an equity research analyst and financial journalist with a passion for investing. In college she majored in finance and is currently pursuing the CFA program and is a Level II candidate.

The post Affirm Holdings: Buy, Sell, or Hold? appeared first on StockNews.com