Based in Seoul, South Korea, POSCO Holdings Inc. (PKX) and its subsidiaries primarily manufacture and sell steel-related products and plates globally. The company operates through four segments: Steel; Construction; Trading; and Others.

On March 23, 2022, PKX became the first to initiate the commercialization of brine lithium in Argentina. A pioneer across several fields, PKX expects global growth of 2% in steel supply and demand in 2022. Its revenue is estimated to grow 13% year-over-year to $37.99 billion for its fiscal year ending Dec. 31, 2022.

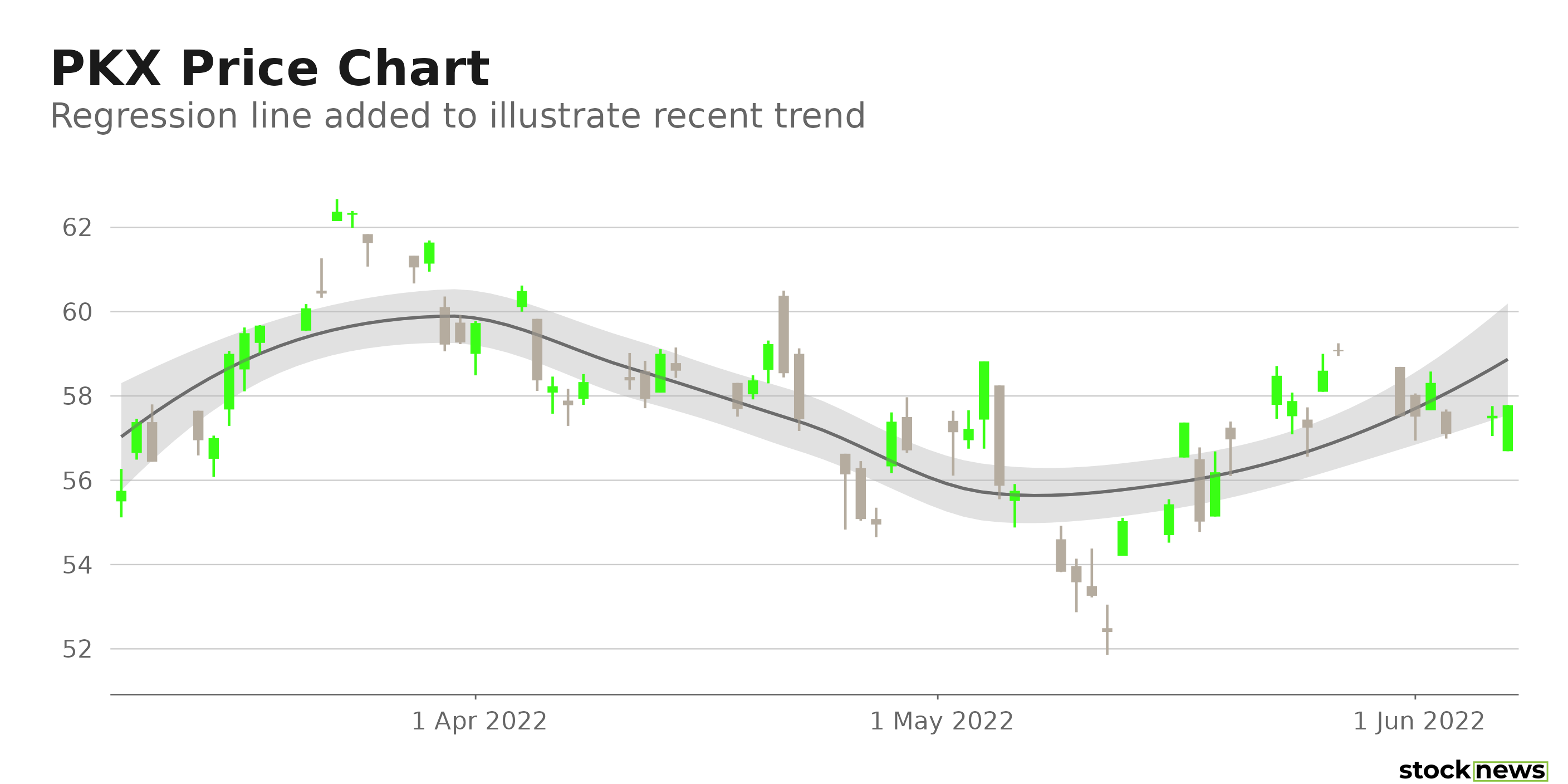

Its $3.72 annual dividend yields 5.12% on its prevailing share price. The company’s dividend payouts have increased at a 17.5% CAGR over the past three years and a 12.3% CAGR over the past five years. Its four-year average yield is 4.15%. Over the past year, PKX stock has declined 26.7% in price and marginally year-to-date to close yesterday’s trading session at $57.53. However, the stock has gained 3.2% over the past month.

Strong Financials

PKX reported impressive growth last year and registered record profits from all its sectors in fiscal 2021.

For the year ended Dec. 31, 2021, PKX’s revenue has risen 32.1% year-over-year to KRW76.33 trillion ($60.73 billion). The company’s gross profit came in at KRW11.88 trillion ($9.45 billion), up 151.7% year-over-year. Its net profit rose 302.5% from its year-ago value to KRW7.20 trillion ($5.73 billion).

Business Expansion

On April 27, 2022, PKX announced its entry into the gas market by expanding its oxygen and nitrogen tanks. Duk-il Yoon, Head of the Corporate Planning & Finance Division, said, “We expect to not only improve the stabilization of industrial gas supplies of front industries, such as domestic semiconductors and shipbuilding, but also to contribute to revitalizing the local economy with Korea’s largest oxygen and nitrogen facility base that POSCO has.”

This investment could help the company increase its profit margin by multiplying its production and revenue generation.

Favorable Valuations

In terms of its forward EV/S, PKX is currently trading at 0.68x, which is 55.6% lower than the 1.53x industry average. The stock’s 0.46x forward P/S is 64% lower than the 1.28x industry average, while its 2.84x forward EV/EBITDA is 57.8% lower than the 6.73x industry average.

POWR Ratings

PKX has an overall B rating, which equates to Buy in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

It has a B grade for Value, which is consistent with its favorable valuation ratios.

The stock also has a B grade for Stability, in sync with its 24-month beta of 0.63.

In the 33-stock Steel industry, PKX is ranked #15. The industry is rated A.

Click here to see the additional POWR Ratings for PKX (Growth, Momentum, Sentiment, and Quality).

View all the top stocks in the Steel industry here.

Bottom Line

PKX’s dividend payouts have grown significantly over the years and are expected to remain consistent in the near term, thanks to its robust financials and steady profit margins. Moreover, the stock looks undervalued at its current price. Hence, I think PKX could be a wise investment to ensure a stable income amid wide market fluctuations.

How Does POSCO Holdings Inc. (PKX) Stack Up Against its Peers?

While PKX has an overall POWR B Rating, one might consider looking at its industry peers, Acerinox, S.A. (ANIOY), ArcelorMittal S.A. (MT), and Insteel Industries, Inc. (IIIN), which have an overall A (Strong Buy) rating.

Note that MT is one of the few stocks handpicked by our Chief Value Strategist, Steve Reitmeister, currently in the POWR Value portfolio.

Want More Great Investing Ideas?

PKX shares were trading at $57.79 per share on Tuesday afternoon, up $0.26 (+0.45%). Year-to-date, PKX has declined -0.86%, versus a -12.44% rise in the benchmark S&P 500 index during the same period.

About the Author: Riddhima Chakraborty

Riddhima is a financial journalist with a passion for analyzing financial instruments. With a master's degree in economics, she helps investors make informed investment decisions through her insightful commentaries.

The post POSCO Holdings: A Stable Dividend Stock to Invest In appeared first on StockNews.com