Beverage industry powerhouse The Coca-Cola Company (KO) recently launched a limited-edition beverage, Coca-Cola Y3000, which was created using the help of Artificial Intelligence (AI). KO’s consistent efforts to retain health-conscious young consumers could benefit the company in the long run.

The company also announced its decision to stop raising drink prices this year in U.S. and European markets. KO had been raising prices to combat higher costs, which has led customers to switch to private-labeled bottled water and juices.

On top of it, the company raised its full-year forecast after a robust second-quarter performance. KO expects organic revenue growth of 8% to 9% for the full year, compared with a prior forecast of an increase of 7% to 8%. The company expects to generate free cash flow of approximately $9.5 billion through cash flow from operations of approximately $11.4 billion.

Given this backdrop, let’s look at the trends of KO’s key financial metrics to understand why it could be wise to invest in the stock now.

Analyzing Coca-Cola's Financial Performance: Key Metrics from 2020 to 2023

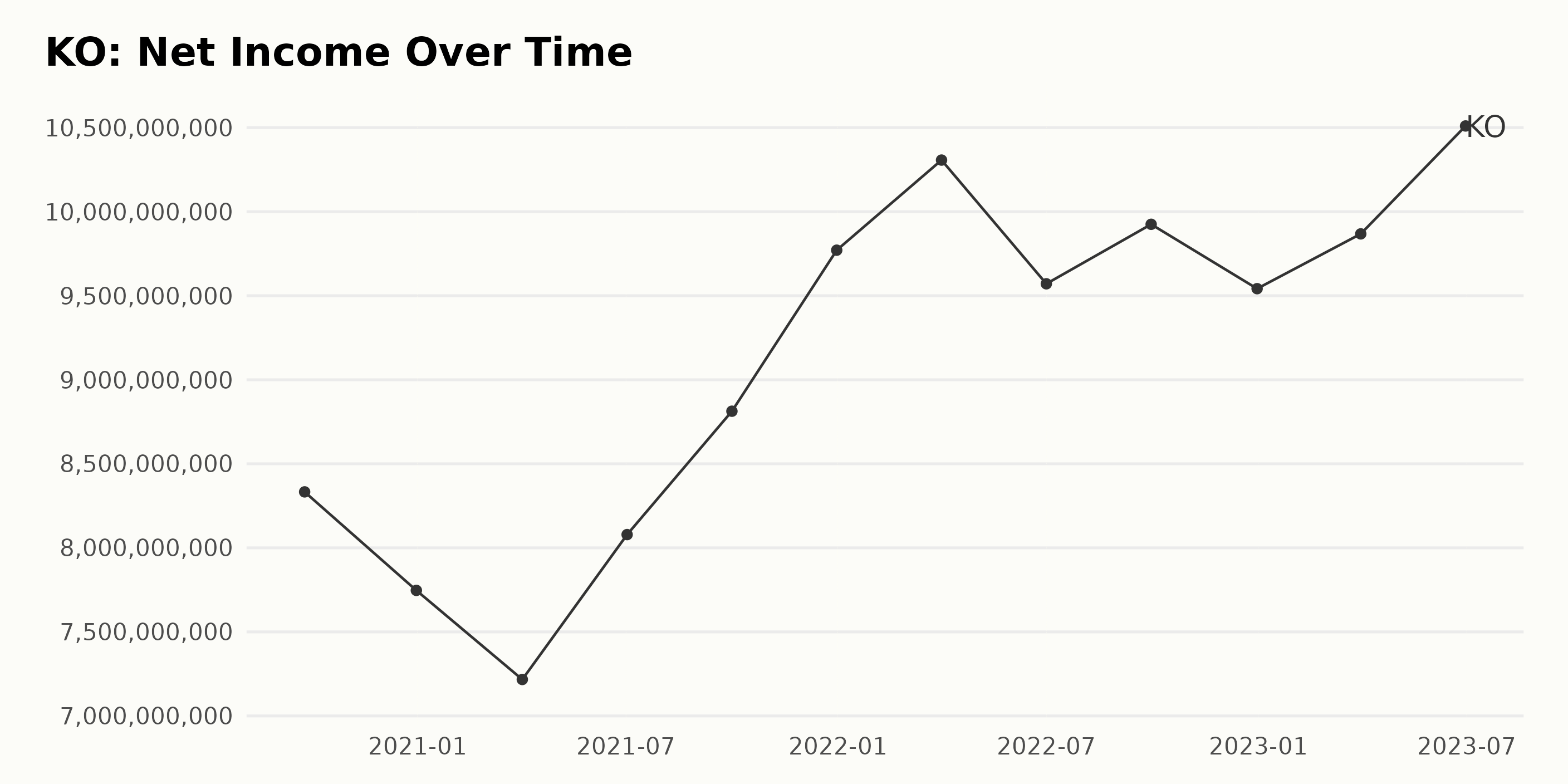

The data provided shows the trailing-12-month net income of KO from September 25, 2020, through June 30, 2023.

- On September 25, 2020, KO's net income was $8.33 billion.

- By December 31, 2020, the net income decreased to $7.75 billion.

- Over the course of 2021, KO's net income showed fluctuations. It started at $7.22 billion in April, increased to $8.07 billion in July, and further rose to $8.81 billion in October. By the end of 2021, it stood at $9.77 billion.

- In 2022, KO's net income increased to $10.31 billion in April, decreased a bit to $9.57 billion in July, but picked up to reach $9.92 billion in September. However, by the end of the year, it declined slightly to $9.54 billion.

- In 2023, there was an apparent increase in the year's first half. The net income was recorded as $9.87 billion at the end of March and quickly jumped to $10.51 billion by the end of June.

Upon calculation, the growth rate of KO's net income from September 2020 to June 2023 comes out to be approximately 26.23%, bearing witness to the company's impressive performance over this period despite the observed fluctuations.

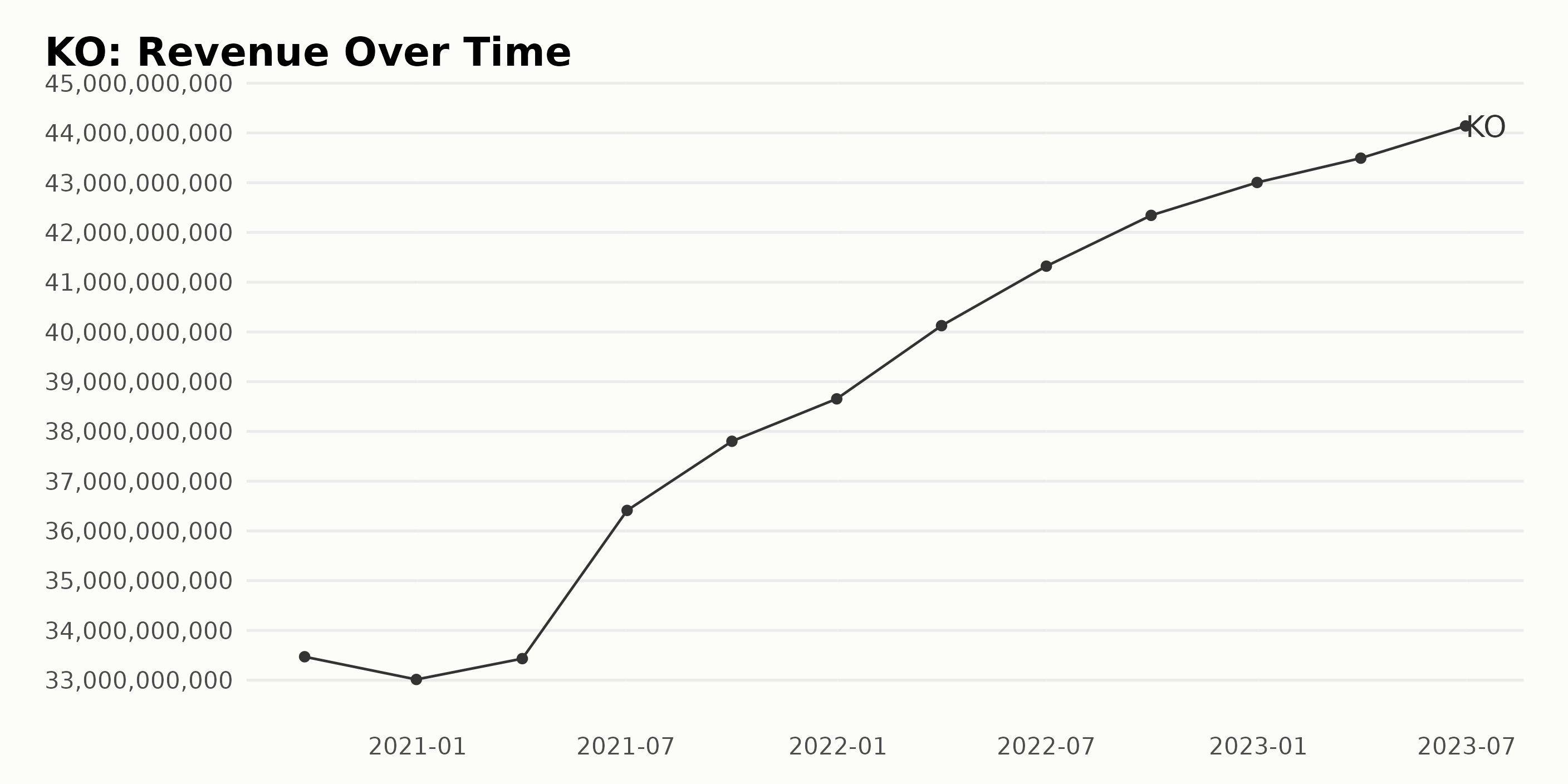

The trailing-12-month revenue trends of KO reveal a general upward trajectory from September 2020 to June 2023:

- In September 2020, the revenue was at $33.47 billion.

- By the end of 2020 (December 31, 2020), a slight drop to $33.01 billion was recorded.

- An increase trend resumed in the first quarter of 2021(April 2, 2021), reaching $33.43 billion, which further escalated to $38.65 billion by the end of the year (December 31, 2021).

- The year 2022 began on a strong note with $40.13 billion in the first quarter (April 1, 2022) and showed continued growth, reaching $43 billion at the end of the third quarter (September 30, 2022) and closing the year with a slightly higher figure of $43.004 billion (December 31, 2022).

- The first half of 2023 displayed an ongoing upward trend, tallying $43.49 billion in the first quarter(March 31, 2023) and culminating in $44.14 billion at mid-year (June 30, 2023).

Measuring from the beginning of the series to the last reported value indicates a significant growth in the revenue of the company. Between September 2020 and June 2023, there has been an approximately 31.90% growth rate in revenue.

Given an analysis of more recent figures, it's clear that KO has maintained a steady growth in revenue, with notable fluctuations relative to each quarter. Despite occasional dips, the overarching trend is a positive and promising growth trajectory.

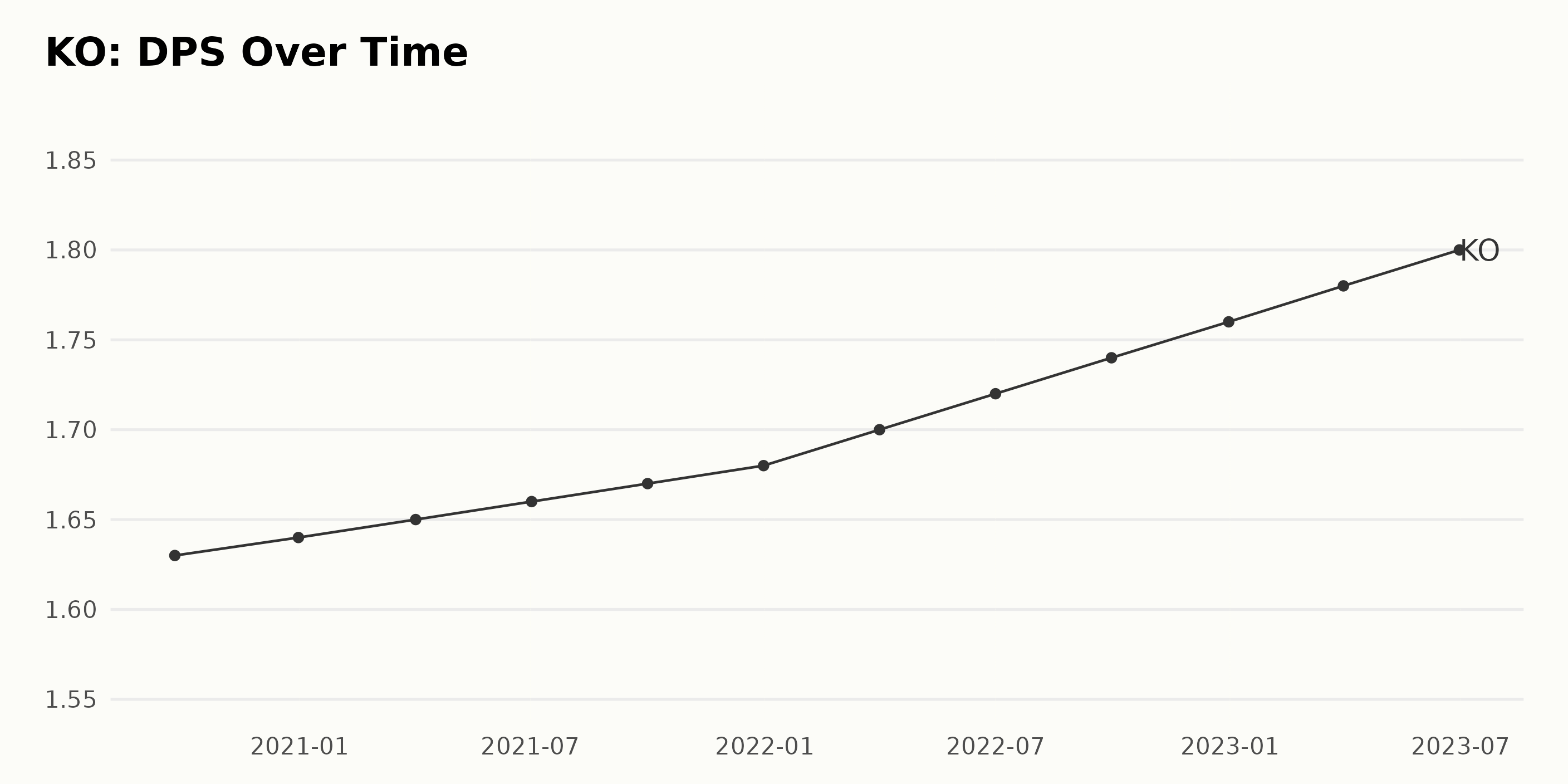

KO's DPS (Dividend Per Share) showed a steadily increasing trend from September 25, 2020, to June 30, 2023, based on the provided data series. Here are the key statistics:

- On September 25, 2020, KO's DPS was $1.63.

- The value steadily rose to $1.76 by December 31, 2022, and further increased to $1.80 by June 30, 2023.

The last recorded value in this series is $1.80 as of June 30, 2023. Between September 2020 and June 2023, the DPS of KO steadily grew with minimal fluctuations. The rate of growth during this period, taking into account the range from the first value ($1.63) to the last value ($1.8), was approximately 10.42%.

In recent years, the highest increase in value was observed between December 31, 2022, and June 30, 2023, with DPS rising from $1.76 to $1.8. In summary, over the period from September 2020 to June 2023, KO demonstrated a stable and progressive increase in DPS, reflecting positive dividend payment trends.

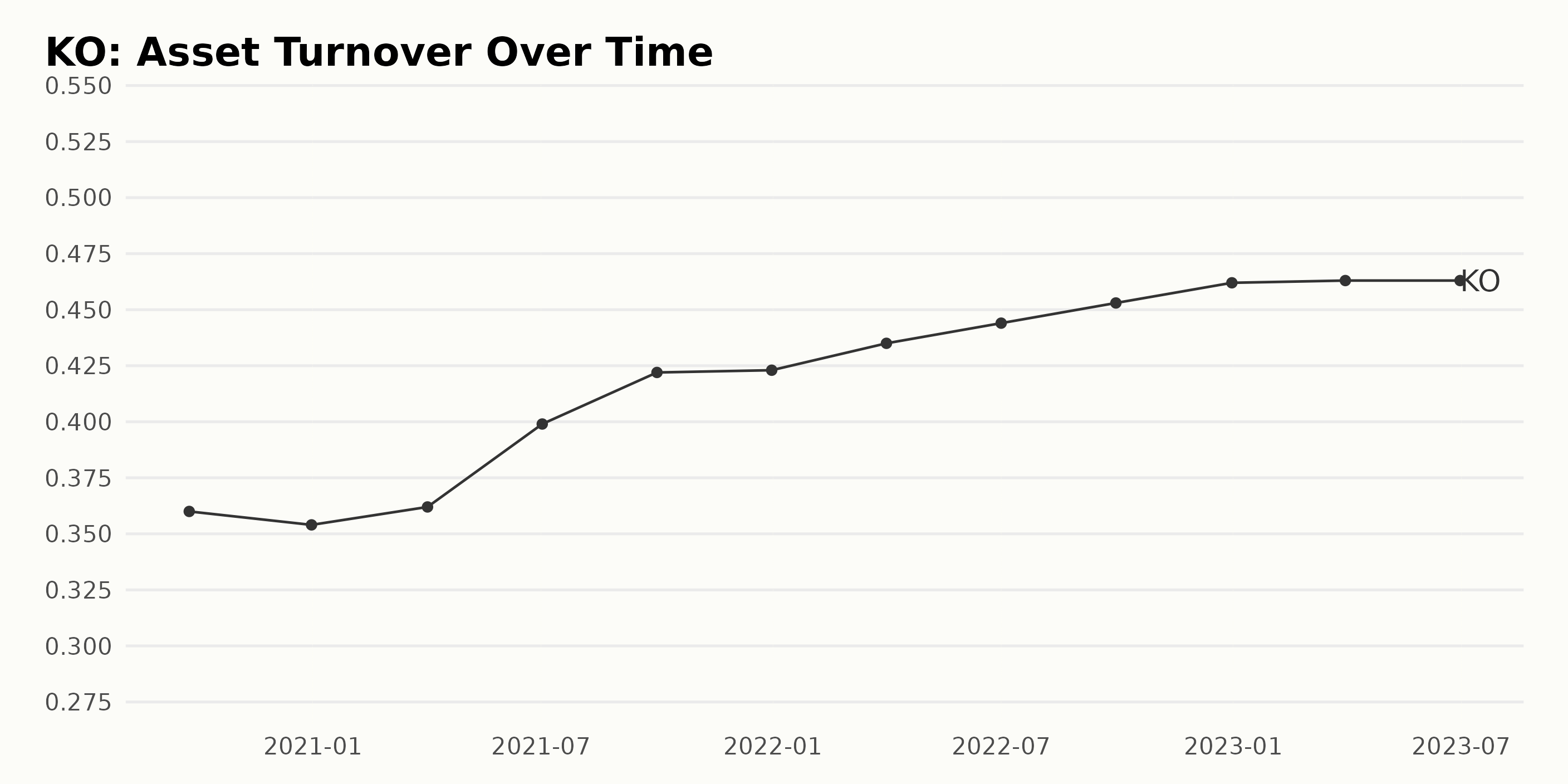

The trend in KO's asset turnover shows an overall positive growth with several fluctuations. Here is a summary of the changes:

- From September 25, 2020, when the asset turnover was recorded as 0.36, there has been a steady increase, with occasional minor declines.

- At the end of 2020 (December 31), the value slightly decreased to 0.354.

- However, starting from 2021, the value has generally been on an upward trend, increasing to 0.362 by April 2, 2021.

- A significant boost occurred between April and July of 2021, where the asset turnover increased from 0.362 to 0.399. This upward trend continued even further and reached 0.422 by October 1, 2021.

- As we approach the more current data, we observe that the asset turnover has continued to rise, reaching 0.462 by the end of 2022.

- The most recent data points, March 31, 2023, and June 30, 2023, show a slight stabilization, with the asset turnover consistently at 0.463.

In terms of growth rate calculated from the first value (0.36 in September 2020) to the last value (0.463 in June 2023), KO's asset turnover has grown approximately 29% over this period. These figures suggest a general improvement in KO's efficiency in using its assets to generate sales or revenue during the referenced period.

Analyzing Coca-Cola's Share Price Volatility and Trends in 2023

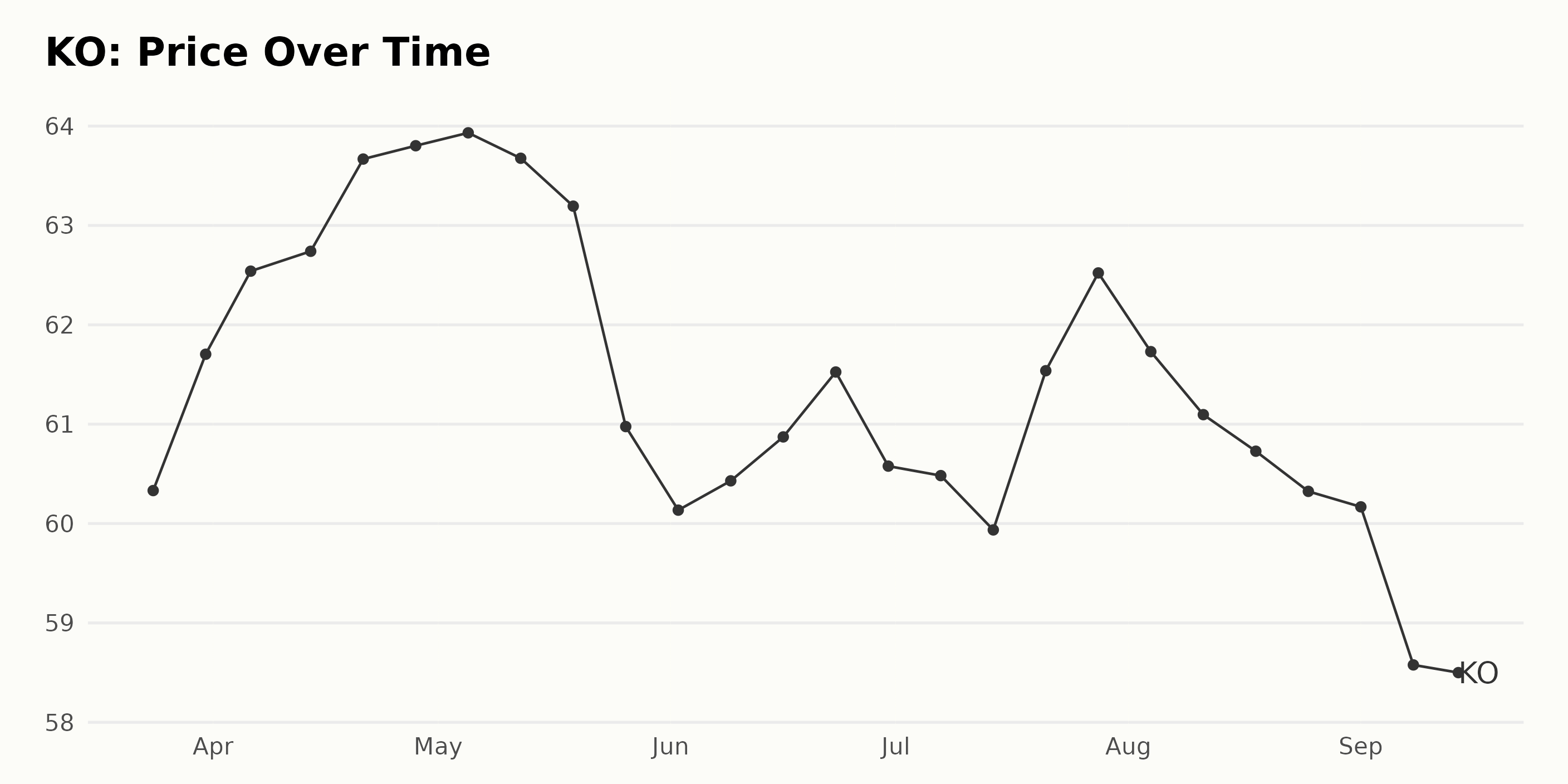

Based on the provided data, we observe the following trends for KO’s share price:

- The share price increased from $60.33 on March 24, 2023, to a peak of $63.93 on May 5, 2023. During this period, the company experienced consistent growth over six weeks.

- However, there was a decline in share prices starting from May 12, 2023 ($63.68), gradually falling to $60.14 on June 2, 2023.

- This decline was reversed briefly from the week of June 9, 2023, where the share price was $60.43, increasing slightly over the weeks to reach $61.53 on June 23, 2023.

- There was a slight downward swing again from June 30, 2023 ($60.58) to July 21, 2023 ($61.54), with a small dip to $59.94 on July 14, 2023.

- Dates between July 28, 2023, and August 4, 2023, show a rise from $62.52 to $61.73, respectively, followed by a steady decline from $61.10 on August 11, 2023, to $58.46 on September 14, 2023.

Summarizing the above, the share price of KO appeared to have an initial growth trend that peaked in early May 2023, only to be followed by a period of irregular fluctuations and a general decrease in value towards the latter end of the data set.

The pace of these changes, both increases and decreases in share price, doesn't follow a speedily accelerating or decelerating trend - the movements are relatively mild. These trends suggest a somewhat volatile period for the share price of KO in this time frame. Here is a chart of KO's price over the past 180 days.

Analyzing Coca-Cola's Market Strengths: Quality, Stability, and Rising Sentiment

KO, a stock in the Beverages category, currently holds a POWR Ratings grade of B (Buy) as of its most recent data from September 14, 2023. This is an improvement from an earlier C (Neutral) rating noted on April 1, 2023. Here are some key points outlining KO's POWR grade journey:

- On March 25, 2023, KO had a B (Buy) grade with a rank of #20 out of 35 stocks in the category.

- The grade dipped to a C (Neutral) for the week of April 1, 2023. However, its category rank slightly improved to #19.

- KO regained its B (Buy) grade on April 8, 2023, maintaining its category rank at #19.

- Over the next few weeks and months, KO remained consistent with a B (Buy) grade while its rank improved gradually, reaching rank #13 by the week of July 29, 2023.

- KO continued to hold a B (Buy) grade through August 2023, maintaining its improved category rank of #13 through most of August.

- As of the latest data point on September 15, 2023, KO still commands a B (Buy) POWR grade, and its rank in the Beverages category is recorded at #13.

In this category comprising 35 stocks, the lower the rank-in-category value, the better the position of the stock. Thus, KO's gradual move from rank #20 to #13 demonstrates an overall climb in its category standing over this period.

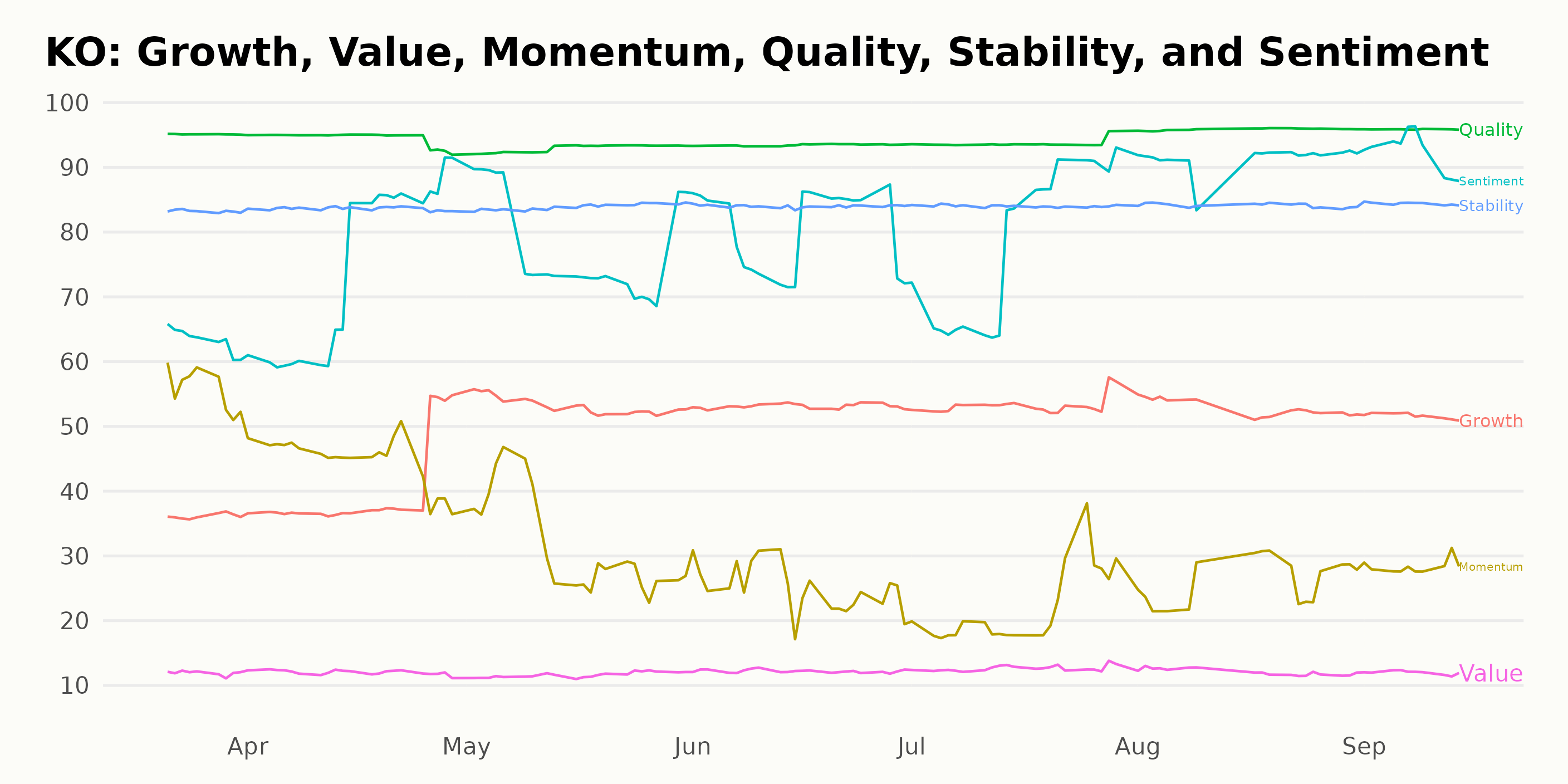

From the POWR Ratings for KO, it appears that the three most noteworthy dimensions are Quality, Stability, and Sentiment. Based on available data from March 2023 to September 2023, below are some key observations:

Quality

- The Quality dimension consistently performed exceptionally well over the course of these months, hitting a high rating of 96 in August and September 2023.

Stability

- Stability is another strong dimension for KO, maintaining a steady rating of 84 from April 2023 to September 2023.

Sentiment

- The Sentiment rating displayed a clear trend of growth over this period. While starting with a score of 63 in March 2023, it gradually increased to achieve a high of 92 by September 2023, showing improving market sentiment towards the company.

From the above analysis, it's clear that Quality, Stability, and Sentiment are the strengths of KO, which positions the brand well in the market. However, companies should keep monitoring these ratings over time as they may fluctuate according to market variations and internal changes.

How does The Coca-Cola Company (KO) Stack Up Against its Peers?

Other stocks in the Beverages sector that may be worth considering are Coca-Cola Consolidated, Inc. (COKE), Coca-Cola HBC AG (CCHGY), and Coca-Cola FEMSA, S.A.B. de C.V. (KOF) - they have better POWR Ratings. Click here to explore more stocks in the Beverages sector.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

KO shares were trading at $58.13 per share on Friday afternoon, down $0.33 (-0.56%). Year-to-date, KO has declined -6.48%, versus a 16.79% rise in the benchmark S&P 500 index during the same period.

About the Author: Anushka Dutta

Anushka is an analyst whose interest in understanding the impact of broader economic changes on financial markets motivated her to pursue a career in investment research.

The post Evaluating Coca-Cola's (KO) Investment Prospects for September appeared first on StockNews.com