With a market cap of $29.3 billion, Tractor Supply Company (TSCO) is a U.S.-based rural lifestyle retailer offering a wide range of products for livestock, pets, land maintenance, and home and outdoor living. It serves recreational farmers, ranchers, and rural enthusiasts through its retail stores and online platforms.

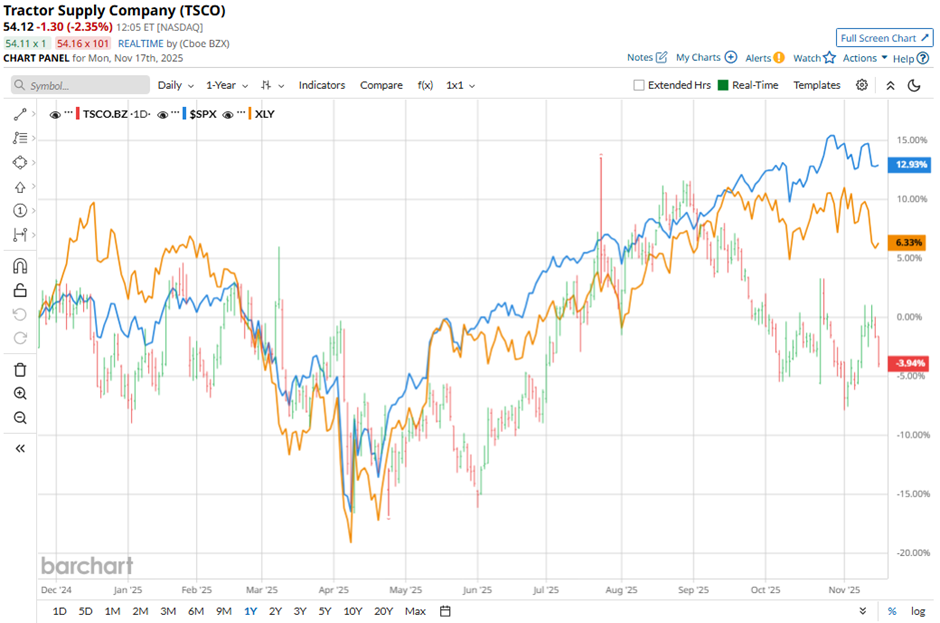

Shares of the Brentwood, Tennessee-based company have underperformed the broader market over the past 52 weeks. TSCO stock has fallen nearly 2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.2%. Moreover, shares of the company have risen 1.9% on a YTD basis, compared to SPX’s nearly 14% gain.

Focusing more closely, shares of Tractor Supply have lagged behind the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 7.9% return over the past 52 weeks.

TSCO shares rose 2.8% on Oct. 23 because the company posted stronger-than-expected Q3 2025 results, including net sales up 7.2% to a record $3.72 billion and comparable store sales up 3.9% driven by 2.7% transaction growth and 1.2% ticket growth. Investors reacted positively to margin resilience, with gross profit up 7.7% to $1.39 billion and EPS rising 8.6% to $0.49, despite higher SG&A and transportation costs.

For the fiscal year ending in December 2025, analysts expect TSCO’s EPS to rise 3.4% year-over-year to $2.11. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

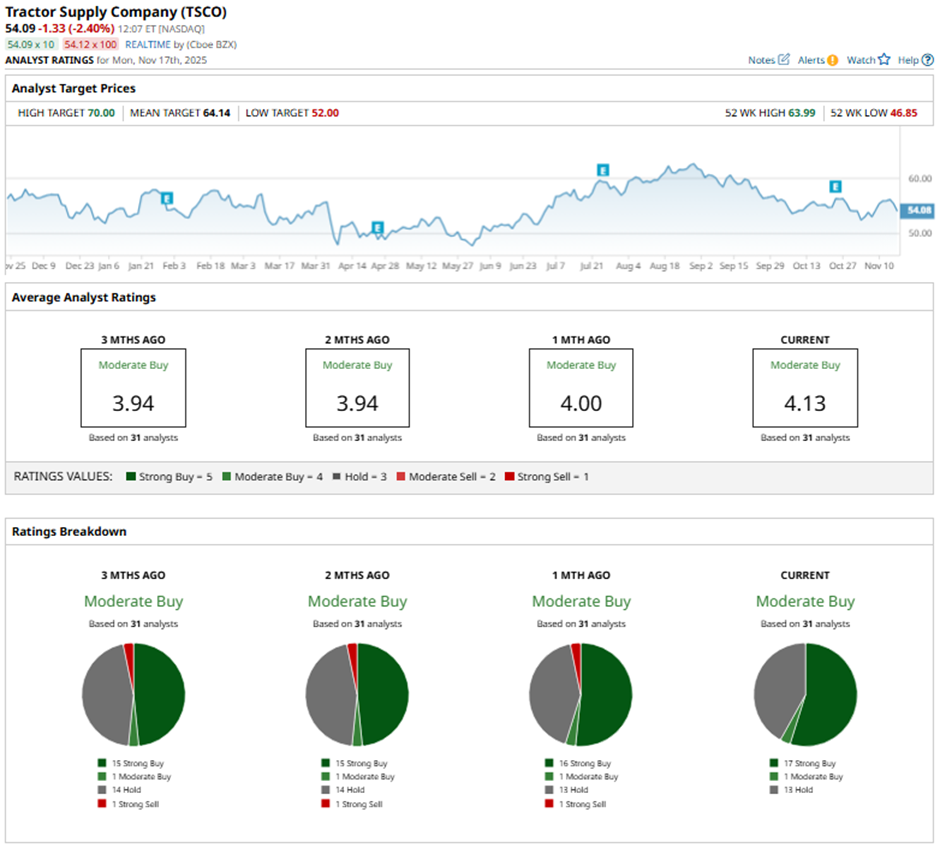

Among the 31 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 17 “Strong Buy” ratings, one “Moderate Buy,” and 13 “Holds.”

This configuration is more bullish than three months ago, with 15 “Strong Buy” ratings on the stock.

On Oct. 24, Mizuho raised its price target on TSCO to $65 and reiterated an “Outperform” rating.

The mean price target of $64.14 represents a premium of 18.6% to TSCO's current price. The Street-high price target of $70 suggests a 29.4% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- American Airlines Stock Is Down 28% in 2025 But Billionaire David Tepper Is Betting on a Turnaround

- Dear Fannie Mae Stock Fans, Mark Your Calendars for November 18

- Why MP Materials’ (MP) Implosion Presents a Rare Upside Opportunity for Quants

- Wedbush Says to Push Through the ‘Whiteknuckle Moment’ and Keep Buying Palantir Stock