With a market cap of $36.5 billion, Garmin Ltd. (GRMN) is a leading global provider of navigation, communication, and wearable technology. The company designs, manufactures, and markets a wide range of GPS-enabled devices and wireless solutions across fitness, outdoor, marine, automotive, and aviation segments.

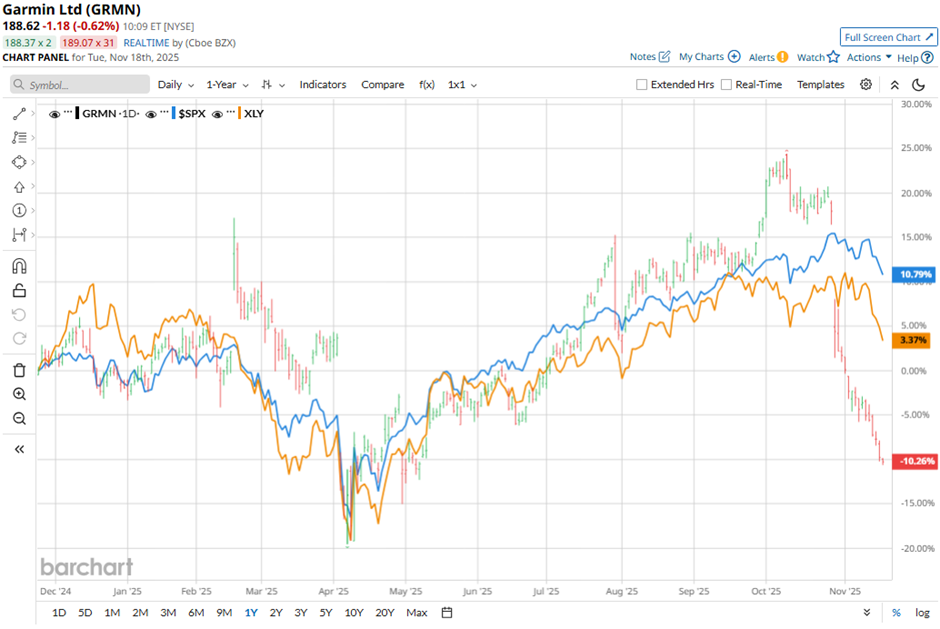

Shares of the Schaffhausen, Switzerland-based company have underperformed the broader market over the past 52 weeks. GRMN stock has decreased 9.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 12.4%. In addition, shares of the company have declined 8.5% on a YTD basis, compared to SPX’s 12.6% rise.

Moreover, shares of the GPS device maker have lagged behind the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 4.3% return over the past 52 weeks.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $1.99, GRMN shares tumbled 11.5% on Oct. 29 as the company missed revenue expectations with $1.77 billion, as both the outdoor segment fell 5% and auto OEM revenue fell 2%. Garmin also reported a sharp 15% jump in operating expenses to $590 million, driven by higher personnel and R&D/SG&A costs.

For the fiscal year ending in December 2025, analysts expect GRMN’s adjusted EPS to grow nearly 11% year-over-year to $8.20. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

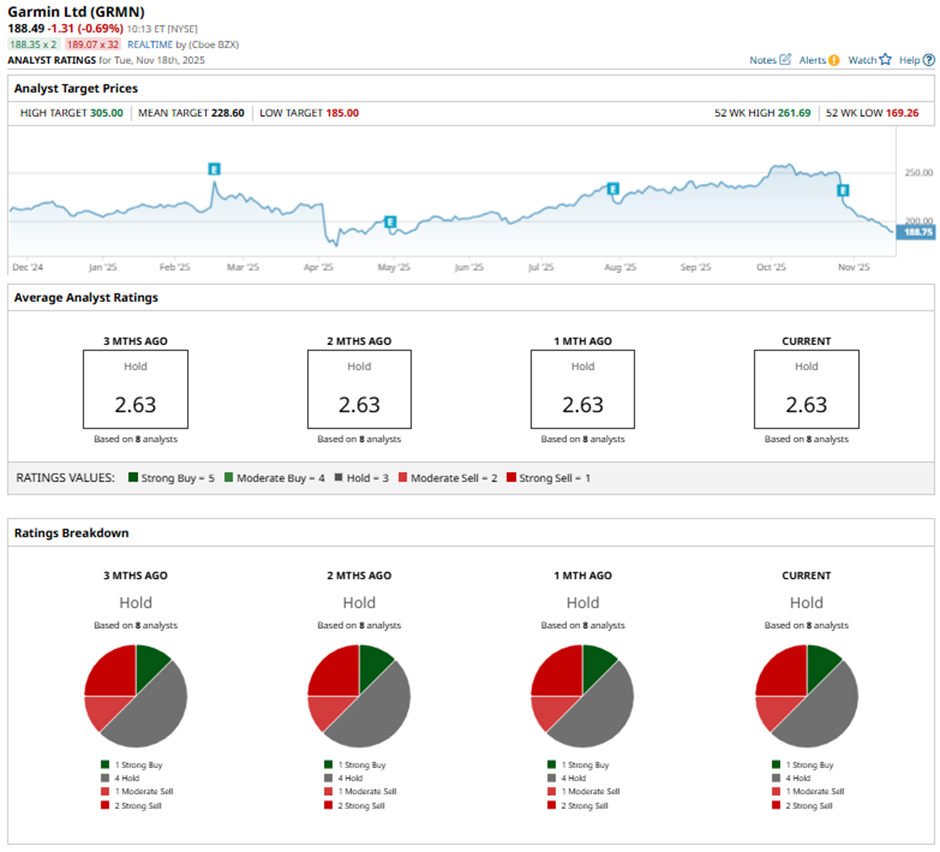

Among the eight analysts covering the stock, the consensus rating is a “Hold.” That’s based on one “Strong Buy” rating, four “Holds,” one “Moderate Sell,” and two “Strong Sells.”

On Oct. 30, Barclays raised its price target on Garmin to $208 from $167 but kept an “Underweight” rating.

The mean price target of $228.60 represents a 21.3% premium to GRMN’s current price levels. The Street-high price target of $305 suggests a 61.8% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart