Charter Communications, Inc. (CHTR) operates as a broadband connectivity and cable operator company serving residential and commercial customers. Valued at $26.1 billion by market cap, the company offers cable broadcasting, internet, voice, and mass media services.

Shares of this broadband giant have considerably underperformed the broader market over the past year. CHTR has declined 47.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 12.3%. In 2025, CHTR’s stock fell 41.5%, compared to the SPX’s 12.5% rise on a YTD basis.

Narrowing the focus, CHTR’s underperformance looks more pronounced compared to the iShares U.S. Telecommunications ETF (IYZ). The exchange-traded fund has gained about 19.3% over the past year. Moreover, the ETF’s 19.6% returns on a YTD basis outshine the stock’s losses over the same time frame.

CHTR's underperformance was driven by a larger-than-expected loss of 109,000 internet customers, attributed to intense competition from fixed wireless and fiber providers. Despite adding 500,000 mobile lines and improving video customer retention, the company faced challenges in new customer acquisitions and a demanding advertising environment.

On Oct. 31, CHTR reported its Q3 results, and its shares closed down by 5% in the following trading session. Its EPS of $8.34 fell short of Wall Street expectations of $9.32. The company’s revenue was $13.67 billion, missing Wall Street forecasts of $13.74 billion.

For the current fiscal year, ending in December, analysts expect CHTR’s EPS to grow 5% to $36.73 on a diluted basis. The company’s earnings surprise history is disappointing. It missed the consensus estimates in three of the last three quarters while beating the forecast on another occasion.

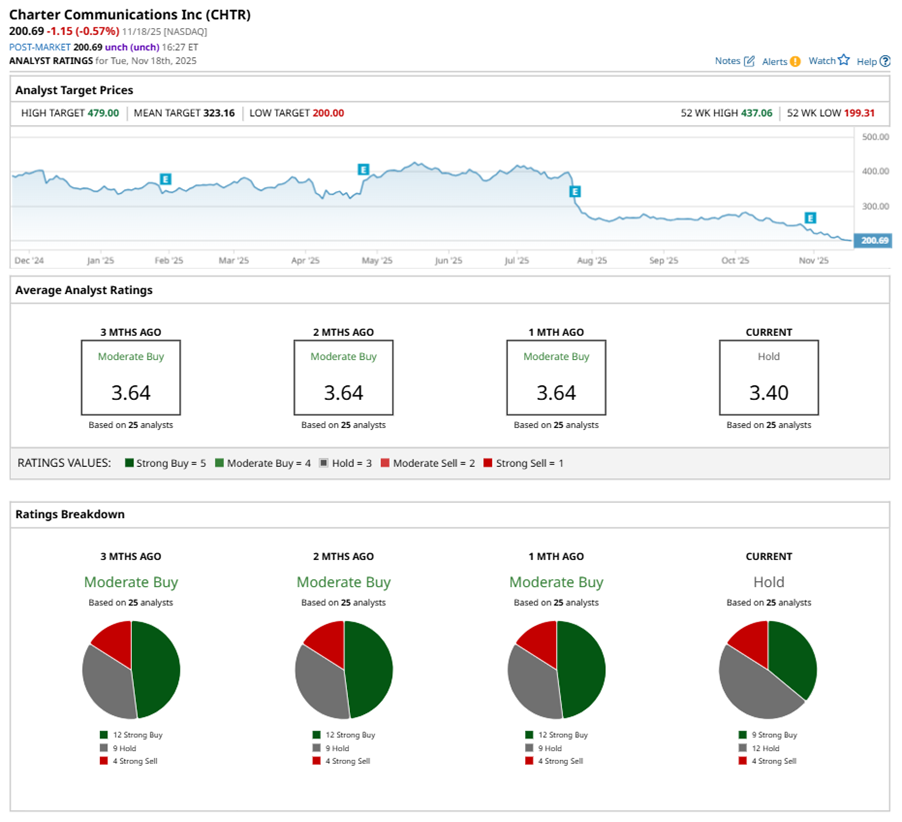

Among the 25 analysts covering CHTR stock, the consensus is a “Hold.” That’s based on nine “Strong Buy” ratings, 12 “Holds,” and four “Strong Sells.”

This configuration is less bullish than a month ago, with an overall rating of “Moderate Buy,” consisting of 12 analysts suggesting a “Strong Buy.”

On Nov. 3, RBC Capital analyst Jonathan Atkin maintained a “Sector Perform” rating on CHTR and lowered the price target to $265, implying a potential upside of 32% from current levels.

The mean price target of $323.16 represents a 61% premium to CHTR’s current price levels. The Street-high price target of $479 suggests an ambitious upside potential of 138.7%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart