With a market cap of $86.2 billion, 3M Company (MMM) is a diversified global technology firm operating across the Americas, Asia Pacific, Europe, the Middle East, and Africa. It serves a wide range of customers through three core business segments - Safety and Industrial, Transportation and Electronics, and Consumer.

Shares of the Saint Paul, Minnesota-based company have surpassed the broader market over the past 52 weeks. MMM stock has returned over 28% over this time frame, while the broader S&P 500 Index ($SPX) has increased 18.9%. In addition, shares of the company are up 24.8% on a YTD basis, compared to SPX’s 15.5% gain.

Moreover, shares of 3M have outpaced the Industrial Select Sector SPDR Fund’s (XLI) 13.9% rise over the past 52 weeks.

Shares of 3M surged 7.7% on Oct. 21 after the company raised its 2025 adjusted EPS forecast to $7.95 - $8.05, driven by a shift toward higher-margin products and tighter cost controls. The company reported Q3 2025 adjusted EPS of $2.19 and revenue of $6.32 billion, surpassing expectations. Investors were also encouraged by product innovation under the management, including 70 new product launches in Q3 and expectations to reach 250 by year-end, alongside a 22.8% drop in selling, general, and administrative expenses.

For the fiscal year ending in December 2025, analysts expect 3M’s adjusted EPS to rise 10.1% year-over-year to $8.04. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

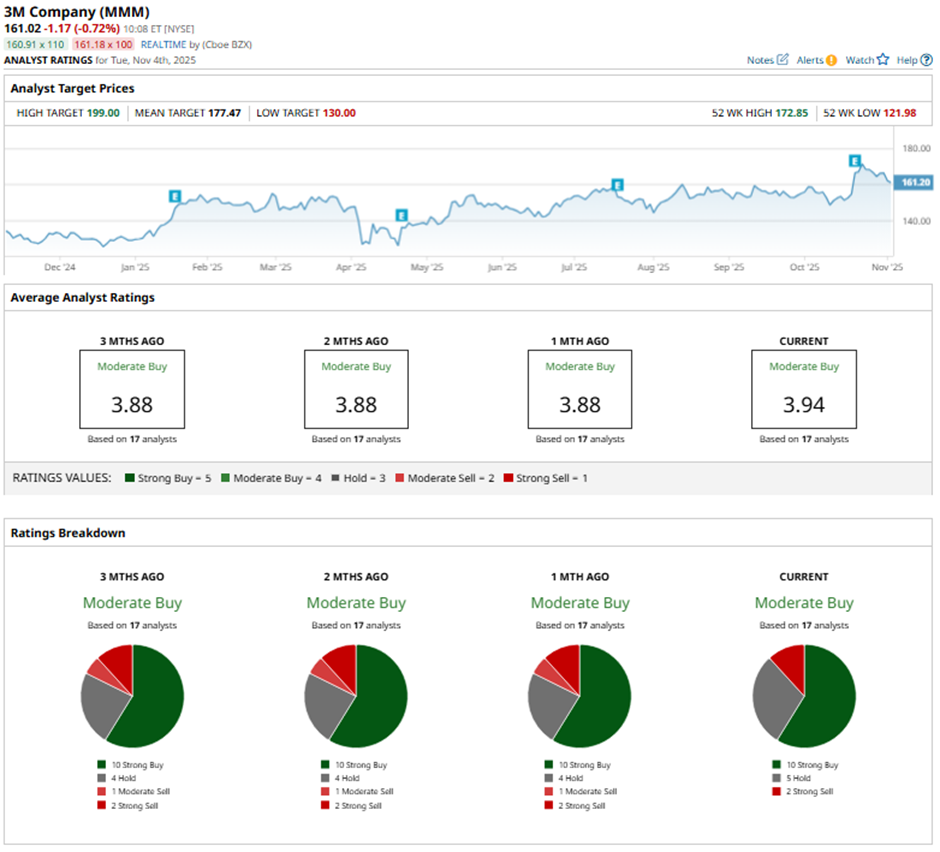

Among the 17 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, five “Holds,” and two “Strong Sells.”

On Oct. 22, UBS maintained a “Buy” rating on 3M and raised its price target to $190.

The mean price target of $177.47 represents a 10.2% premium to MMM’s current price levels. The Street-high price target of $199 suggests a 23.6% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Top 100 Stocks to Buy: Two Penny Stocks Moved Up 51 Spots. Should You Buy Either?

- Apple Stock Is Still ‘Expensive’ But This 1 Catalyst Could Change the Game, According to Analysts

- Microsoft Produces Strong FCF As Expected - Shorting OTM Puts is an Attractive Play

- This Influencer-Friendly Stock Has Doubled in a Year and Keeps Hitting New Highs