Beyond Meat (BYND) stock has declined sharply by 63% for the year. The deep correction has been on the back of worsening fundamentals, with revenue decline being the catalyst.

The company was expected to report Q3 2025 results on Nov. 4. However, results have been delayed by a week to Nov. 11 as the company seeks time to assess material impairment charges.

While a sharp correction in the recent past might look like a good entry opportunity, further weakening of fundamentals is likely when Q3 is reported. Being on the sidelines, therefore, seems to be a prudent decision.

About Beyond Meat Stock

Beyond Meat was founded in 2009 and is a plant-based meat company. The company differentiates itself by offering plant-based meat from ingredients that are free from GMOs, hormones, or antibiotics.

For the first half of 2025, the company reported revenue of $143.7 million, with 59% of revenue coming from the U.S. markets. For the same period, Beyond Meat reported an adjusted EBITDA loss of $64.5 million, with weak demand impacting growth and key margins.

With revenue decline, cash burn, and higher credit stress, BYND stock has declined by almost 50% in the last six months. Further, sentiments are likely to remain negative as Beyond Meat continues to face growth headwinds.

Results Continue to Disappoint

For Q2 2025, Beyond Meat reported a revenue decline of 19.6% on a year-on-year (YoY) basis to $75 million. Further, preliminary Q3 2025 results indicate a revenue decline of 14% on a YoY basis to $70 million.

This is indicative of continued weakness in demand for the plant-based meat category. An important point to note is that the weakness in sales is not limited to the United States. Even for international markets, the company’s revenue has declined.

Another key factor contributing to the weakness in BYND stock is the company’s EBITDA-level losses. For Q2 2025, the adjusted EBITDA loss was $22.1 million. With losses likely to be sustained in Q3, the business is burning cash coupled with revenue decline. The credit stress is therefore significant.

Last month, Beyond Meat announced that its convertible noteholders have agreed to a debt swap. With 326,190,370 shares being offered in the swap deal coupled with $202.5 million in new notes, the balance sheet debt declined. However, massive dilution of equity translated into BYND stock trending lower.

As cash burn sustains, Beyond Meat will continue to require external financing for maintaining operations. Therefore, credit metrics are likely to remain stressed. While Beyond Meat has initiated cost-cutting measures, it’s unlikely to impress the markets as revenues remain subdued and the flexibility for capital investments diminishes.

What Analysts Say About BYND Stock

Last month, J.P. Morgan included BYND stock in its list of top short ideas in the consumer sector going into Q4. J.P. Morgan is “Underweight” on the stock, with key factors being an eroding market share and the worsening of the balance sheet.

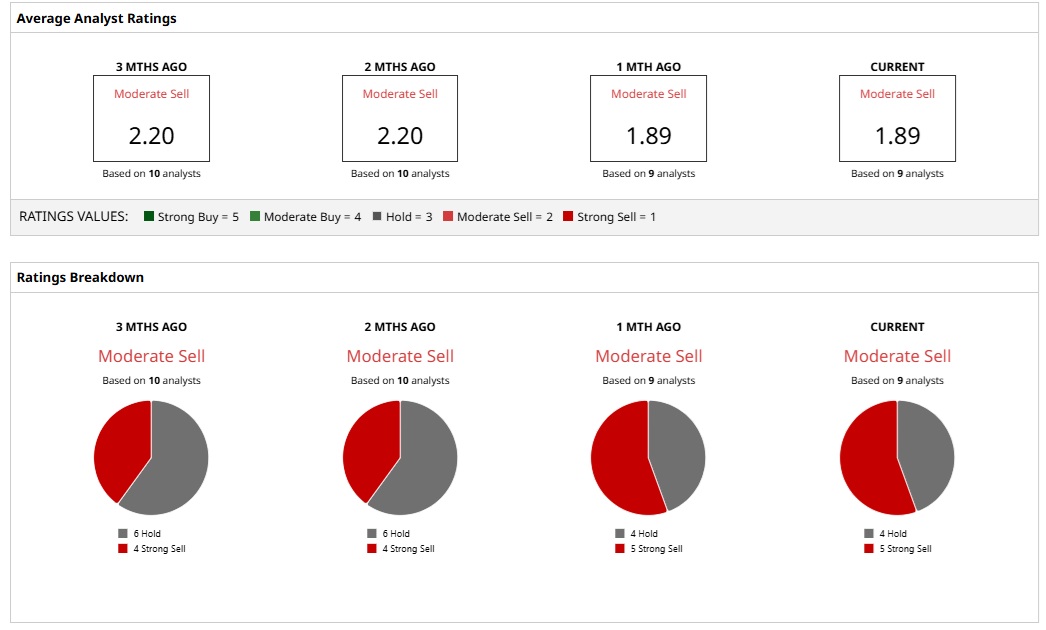

With Beyond Meat struggling, the broader analyst view is also pessimistic. Based on the rating of nine analysts, BYND stock is a “Moderate Sell.” Currently, four analysts have assigned a “Hold” rating, while five analysts opine that BYND stock is a “Strong Sell.” This view is underscored by the point that earnings growth is likely to remain muted even for FY 2026.

Further, analysts have a mean price target of $2.23. With the recent sell-off, BYND stock trades at $1.41, and this implies an upside potential of about 60% from current levels.

Having said that, the most bearish price target is 80 cents, and it implies a downside potential of 43%. With preliminary Q3 results indicating sales decline and margin compression, the weakness in BYND stock is likely to persist.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart