Denny’s (DENN) shares soared over 50% on Tuesday morning after the diner chain said it’s set to go private in a $620 million all-cash transaction led by TriArtisan Capital Advisors.

The private equity firm has valued DENN shares at $6.25 apiece and the deal is expected to close in the first quarter of 2026, pending shareholder and regulatory approvals.

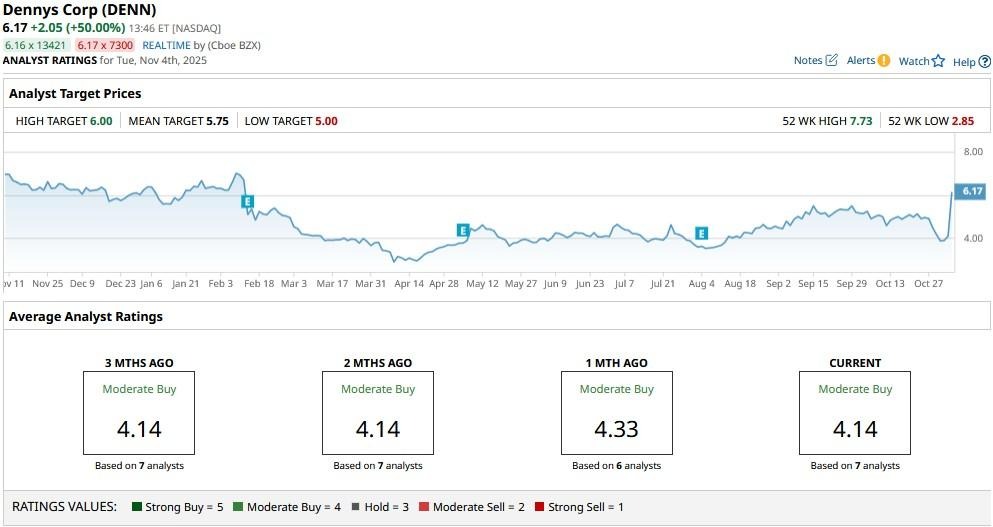

Despite today’s meteoric rally, Denny’s stock remains down over 15% versus its year-to-date high.

Is There Any Further Upside Left in DENN Stock?

With DENN stock already hovering near the $6.25 buyout price, the market has largely priced in the acquisition.

That leaves minimal upside for new investors unless a competing bidder emerges, which isn’t very likely given the board already reached out to more than 40 potential suitors.

The premium offered reflects a thorough strategic review and is considered fair by the company’s advisors.

Unless this deal falls through or a higher offer materializes, Denny’s shares are unlikely to run any higher from here – which makes them a risky bet for those hoping to capitalize post-announcement.

Why Is Denny’s Going Private Then?

While DENN shares no longer offer upside to investors, the company itself stands to benefit from the transition.

Going private positions Denny’s to focus on its long-term strategy without the pressure of quarterly earnings or public market scrutiny. Plus, its new owners bring operational expertise and capital to support growth initiatives as well.

Freed from the constraints of public reporting, the Spartanburg-headquartered firm will streamline operations, invest in modernization, and reposition itself amid shifting consumer habits.

For the brand, going private could effectively prove a fresh chapter of revitalization and strategic flexibility.

Wall Street Is No Longer in Favor of Owning Denny’s Shares

Investors should also note that Wall Street firms no longer see potential for any further upside in Denny’s stock either.

While consensus rating on DENN shares sits at “Moderate Buy,” even the highest price target of $6 is about 3% below their current price.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart