With a market cap of $103.4 billion, DoorDash, Inc. (DASH) operates a global commerce platform connecting merchants, consumers, and independent contractors. Through its DoorDash and Wolt marketplaces, the company provides delivery, logistics, and merchant services, along with membership programs and white-label fulfillment solutions.

Shares of the San Francisco, California-based company have outperformed the broader market over the past 52 weeks. DASH stock has surged 50.8% over this time frame, while the broader S&P 500 Index ($SPX) has increased 19.6%. Moreover, shares of the company are up 41.3% on a YTD basis, compared to SPX’s 16.5% rise.

Focusing more closely, shares of DoorDash have outpaced the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 19.7% return over the past 52 weeks.

Shares of DoorDash soared 5% following its Q2 2025 results on Aug. 6 as the company delivered EPS of $0.65, beating estimates. Revenue rose 24.9% year-over-year to $3.3 billion, ahead of the consensus, while Marketplace GOV surged 23% to $24.2 billion with total orders up 20% to 761 million. Investor optimism was further fueled by guidance for Q3 GMV of $24.2 billion - $24.7 billion, above estimates, signaling continued strong demand in food, grocery, and non-food delivery.

For the fiscal year ending in December 2025, analysts expect DASH’s EPS to climb significantly 755.2% year-over-year to $2.48. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

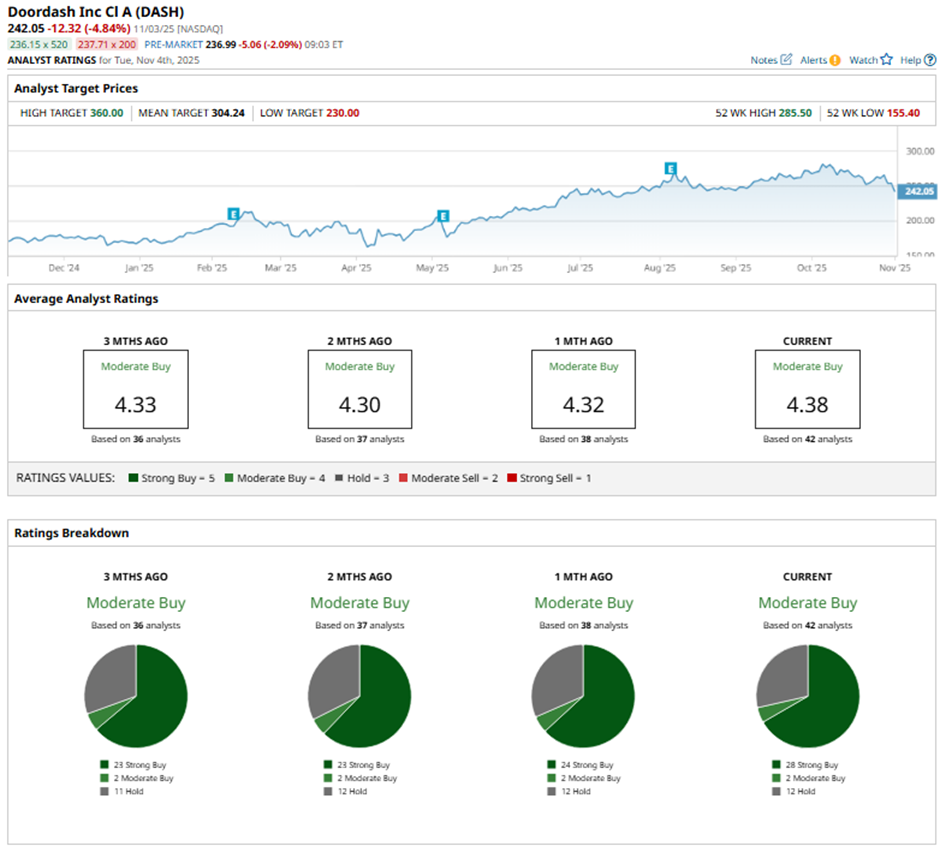

Among the 42 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 28 “Strong Buy” ratings, two “Moderate Buys,” and 12 “Holds.”

This configuration is more bullish than three months ago, with 23 “Strong Buy” ratings on the stock.

On Oct. 30, Wedbush analyst Scott Devitt reaffirmed a “Hold” rating on DoorDash and maintained a $280 price target.

The mean price target of $304.24 represents a premium of 25.7% to DASH's current price. The Street-high price target of $360 suggests a 48.7% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Will SoFi Stock Keep Climbing or Is It Due for a Pullback After a 181% Gain?

- 35% of the Top 100 U.S. Stocks Are Down This Year. These 3 Stocks in Particular Will Tell Us When It’s Time to Run.

- 2 Stocks to Buy Now to Profit from the Rise of Robotics

- Bull Put Spread Provides Opportunities for Long-Term Microsoft Bulls