Quantum computing is no longer just a distant scientific concept—it’s steadily evolving into a transformative technology with real commercial implications. As advances in hardware, error correction, and hybrid classical-quantum systems accelerate, the conversation is shifting from if quantum computing will matter to who will benefit most as commercialization gains momentum. For long-term investors, this emerging field represents one of the most compelling, but complex, frontiers in technology.

Investing in quantum computing requires a careful balance between vision and execution. Commercial adoption remains in its early stages, timelines are uncertain, and volatility is inevitable. That makes company selection critical. Analyst sentiment, in particular, can offer useful insight into which companies are best positioned to translate quantum innovation into long-term shareholder value.

With that, let's dig into three quantum computing stocks—Nvidia (NVDA), Amazon (AMZN), and D-Wave Quantum (QBTS)—which were selected based on analyst ratings data from Barchart, highlighting companies that analysts view as best positioned to capitalize on the next phase of quantum computing’s evolution.

Quantum Computing Stock #1: Nvidia (NVDA)

Nvidia is a premier technology firm known for its expertise in graphics processing units and artificial intelligence solutions. The company is renowned for its pioneering contributions to gaming, data centers, and AI-driven applications. NVDA’s technological solutions are developed around a platform strategy that combines hardware, systems, software, algorithms, and services to provide distinctive value. The chipmaker’s market cap stands at $4.49 trillion, ranking it as the most valuable company in the world.

Shares of the AI darling have started the new year on a muted note, up only about 0.3% year-to-date (YTD). Investors seem to be awaiting clarity on what soaring memory-product prices mean for the company while also digesting mixed signals about how close it is to restarting exports of its AI chips to China.

You might not consider Nvidia to be a quantum computing company, but they actually do a lot in that area. The company provides critical classical infrastructure, along with software such as CUDA-Q and hardware like NVQLink, to support hybrid quantum systems, allowing AI to control and accelerate quantum processors for complex applications, including drug discovery and materials science.

More precisely, Nvidia recently launched NVQLink, an open platform architecture that connects today’s GPU superchips directly to Quantum Processing Units (QPUs). This enables classical GPUs to handle real-time tasks such as quantum error correction and calibration, which are crucial to making early-stage quantum machines practical. Nvidia CEO Jensen Huang has called NVQLink “the Rosetta Stone connecting quantum and classical supercomputers.” Huang also said, “In the near future, every Nvidia GPU scientific supercomputer will be hybrid, tightly coupled with quantum processors to expand what is possible with computing.”

Meanwhile, much like CUDA cemented Nvidia’s dominance in AI, the CUDA-Q platform is becoming the industry standard for hybrid programming. It allows developers to write code that runs simultaneously across CPUs, GPUs, and QPUs. The company went a step further by offering Nvidia Quantum Cloud, which enables quantum simulation using its GPUs and the CUDA-Q platform. Notably, three of the four largest cloud service providers, Microsoft Azure, Google Cloud, and Oracle Cloud Infrastructure, have integrated Nvidia Quantum Cloud into their platforms.

Nvidia is essentially building the “operating system” and “superhighway” for quantum computing, positioning itself as the central hub for this emerging field rather than building quantum computers directly. This path ensures its GPUs remain at the core of scientific and industrial breakthroughs for decades to come.

While quantum computing presents promising opportunities, Nvidia’s leadership in AI remains central to its growth story. In the third quarter, Nvidia posted record revenue of $57 billion, up 22% from the previous quarter and 62.5% year-over-year (YoY). Earnings came in at $1.30 per share. Both top and bottom lines exceeded analysts’ estimates. “Blackwell sales are off the charts, and cloud GPUs are sold out,” said Huang. Nvidia’s main data center segment generated $51.2 billion in quarterly revenue, up 25% sequentially and 66% YoY, driven by three major platform shifts: accelerated computing, powerful AI models, and agentic applications. Looking ahead, management guided for revenue of around $65 billion in Q4, well above analysts’ expectations. And the company said last week its revenue forecast has only gotten brighter due to strong demand and large customer deals.

Analysts tracking the company project a 61.68% YoY increase in its profit to $7.59 per share for fiscal 2027, with revenue expected to grow 50.30% from the prior year to $320.5 billion.

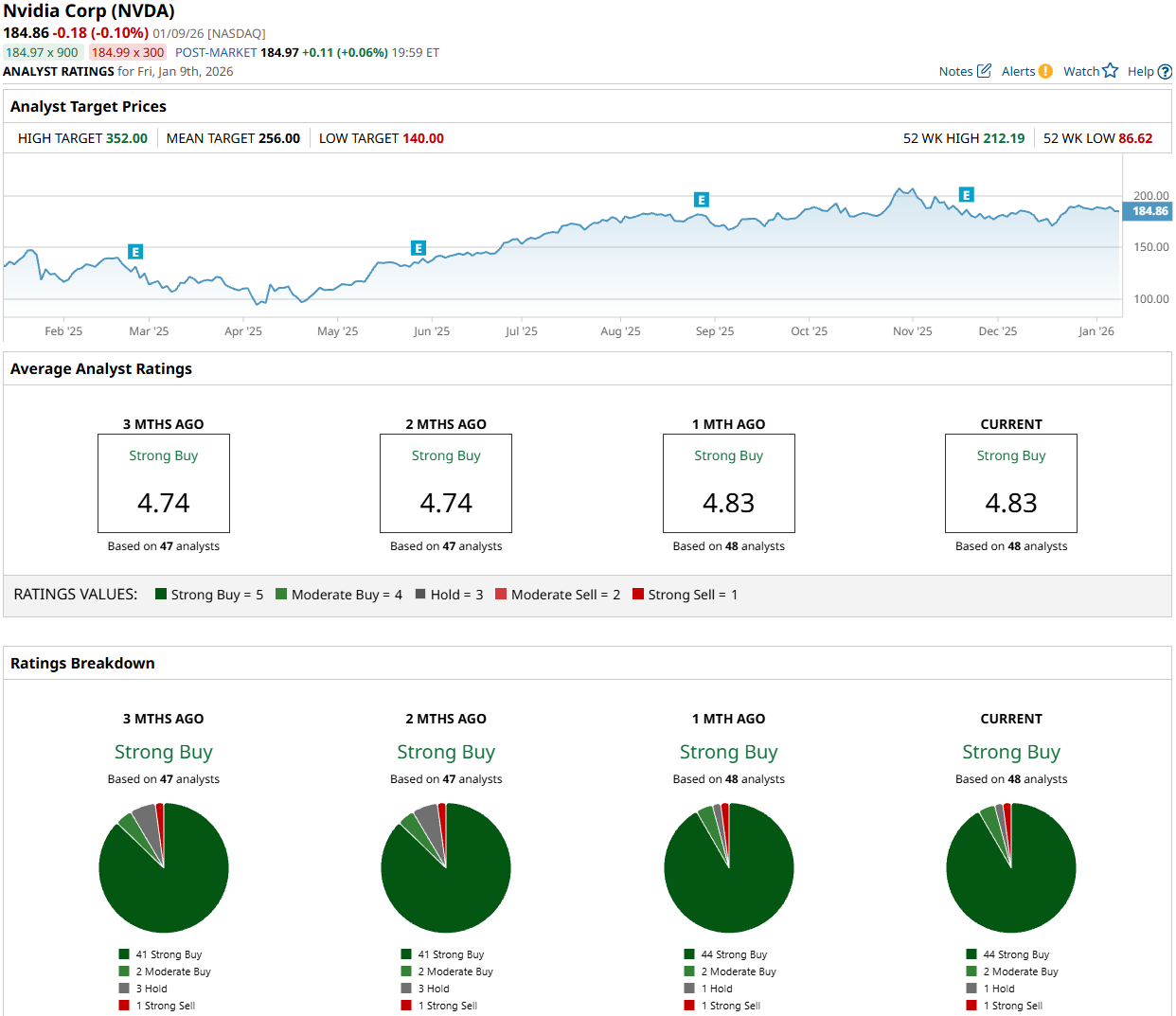

Wall Street analysts are highly bullish on Nvidia’s outlook, as reflected in a consensus rating of “Strong Buy.” Among the 48 analysts covering the stock, 44 rate it a “Strong Buy,” two assign a “Moderate Buy” rating, one recommends holding, and one has a “Strong Sell” rating. The mean price target for NVDA stands at $256, implying a 38.5% upside potential from Friday’s closing price.

Quantum Computing Stock #2: Amazon (AMZN)

Amazon stands as a global leader in e-commerce and cloud computing. The company operates a diverse business model, encompassing retail sales of consumer products through its online and physical stores, cloud services through AWS, and advertising and subscription offerings. AMZN has a market cap of $2.64 trillion.

Shares of the e-commerce and cloud services giant have had a strong start to the year, up 7.2% YTD, making it the best-performing stock among the Magnificent Seven peers. Investors appear to have rotated into the stock after last year’s underperformance, betting that strong growth in Amazon Web Services (AWS) and emerging tech initiatives will eventually propel shares higher.

Amazon stands to benefit from quantum computing primarily by integrating quantum solutions into its dominant AWS cloud platform, developing its own hardware to reduce error correction overhead, and leveraging the technology across its e-commerce and AI operations. As the leading public cloud provider, AWS offers Amazon Braket, a cloud-based quantum research and development platform that gives customers unified access to quantum hardware from partners such as IonQ and Rigetti. This “quantum-computing-as-a-service” model allows Amazon to lead the commercialization of this nascent technology as it matures.

Meanwhile, Amazon has moved beyond being just a service provider and has made its own quantum chip. In February 2025, AWS unveiled Ocelot, its first proprietary quantum computing chip, which uses “cat qubits” to make error correction up to 90% more resource-efficient than traditional methods. In addition, the company established the AWS Center for Quantum Computing near the Caltech campus to speed development and research into applications best suited for quantum computing. This also includes the Amazon Quantum Solutions Lab, a collaborative program where AWS experts work directly with enterprise customers to identify and develop real-world quantum use cases.

In late 2025, Amazon changed things up and put its Quantum Computing, AI, and Silicon development teams together into a single unit. While widespread commercial adoption is still likely years away, quantum computing could significantly improve areas such as drug discovery, materials science, logistics, and supply chain management—each highly relevant to Amazon’s diverse business operations.

In late October, Amazon beat Q3 estimates across the board, with stronger-than-expected net sales, profits, and subscription revenue, highlighted by a beat on the company’s AWS, which sent the stock soaring over 9%. The company’s total net sales rose 13.4% YoY to $180.2 billion, beating Wall Street’s consensus by $2.44 billion. All three segments—North America, International, and AWS—delivered solid growth, with AWS once again leading the way. More precisely, the AWS segment generated $33 billion in revenue during the quarter, up 20% YoY. The growth topped analysts’ expectations and represented the largest YoY increase since the debut of OpenAI’s ChatGPT in late 2022. Amazon’s GAAP earnings per share (EPS) came in at $1.95 in Q3, beating estimates by $0.39. Looking ahead, the company guided holiday-quarter net sales to a range of $206 billion to $213 billion and operating income to between $21 billion and $26 billion.

For 2026, analysts tracking the company foresee an 11.19% YoY increase in its GAAP EPS to $7.86, while revenue is expected to increase 11.13% YoY to $794.35 billion.

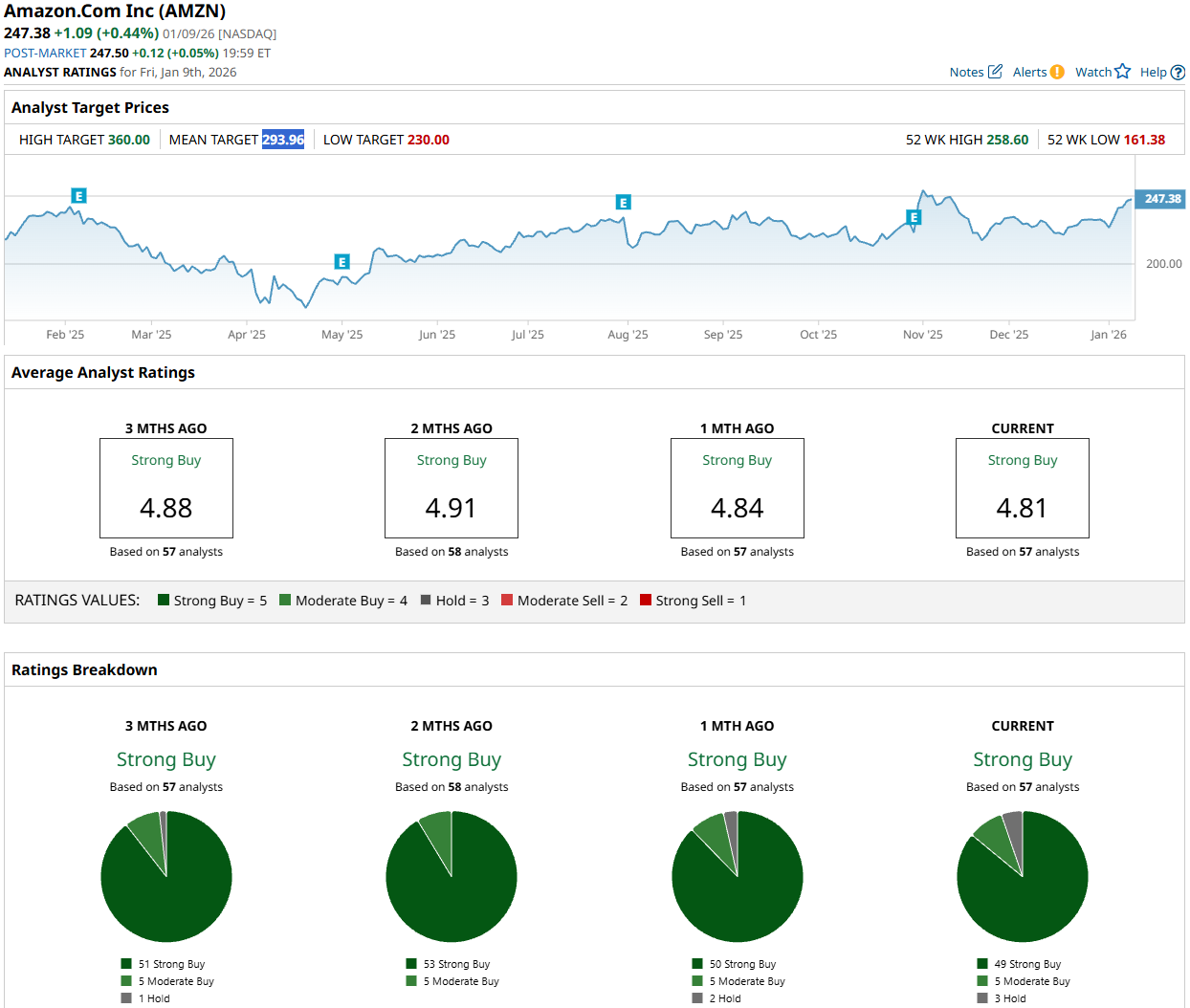

Wall Street analysts are bullish on Amazon’s outlook for 2026 and beyond. Of the 57 analysts offering recommendations for the stock, 49 call it a “Strong Buy,” five label it a “Moderate Buy,” and the remaining three recommend holding. This translates to a top-tier “Strong Buy” consensus rating. The average price target for AMZN stock is $293.96, representing an 18.8% upside from Friday’s closing price.

Quantum Computing Stock #3: D-Wave Quantum (QBITS)

D-Wave Quantum stands out as a premier provider of quantum computing systems, software, and services and holds the distinction of being the first commercial supplier of quantum computers. QBTS’s technology is versatile, serving a broad spectrum of fields such as logistics, artificial intelligence, material sciences, drug discovery, and financial modeling. It caters to numerous blue-chip clients, such as Mastercard (MA), Deloitte, Siemens (SIEGY), and Lockheed Martin (LMT), among others. It has a market cap of $9.84 billion.

Shares of the quantum computing company are up 7.6% YTD, building on the strong momentum from 2025, when they staged a massive rally as investors chased early-stage breakthroughs and the industry’s long-term potential.

Unlike Nvidia and Amazon, whose core businesses extend beyond quantum computing, D-Wave Quantum is one of the few pure-play publicly traded companies in the field. D-Wave is the world’s first commercial quantum computing provider and the only company developing both annealing and gate-model quantum computers. Its current sixth-generation annealing quantum computing system is called Advantage2. The system features a QPU with over 4,400 qubits and is designed to solve complex 3D lattice and combinatorial optimization problems. With that, the company generates revenue by selling its quantum computing systems directly to customers or by providing access to them through its Leap quantum cloud service as part of its quantum-computing-as-a-service (QCaaS) offerings. In addition, the company provides professional services that help customers identify and implement quantum computing applications.

In early November, the company posted its third-quarter financial results. Revenue rose to $3.7 million from $1.8 million a year earlier, representing a 100% increase. The number came in slightly above analysts’ expectations. Top-line growth was largely driven by $1.8 million in revenue from a system upgrade project, along with higher professional services revenue. Meanwhile, CEO Alan Baratz highlighted D-Wave’s bookings, which reflect customer orders expected to translate into future revenue. The company’s bookings grew 80% quarter-over-quarter to $2.4 million in Q3. However, the report had one glaring flaw that disappointed investors. And that’s D-Wave’s net loss. The company’s net loss widened to $140 million in Q3, compared to a $22.7 million loss a year earlier. D-Wave said the larger net loss was driven by more than $120 million in non-cash, non-operating charges related to its warrants and realized losses from warrant exercises. In terms of liquidity, the company held $836.2 million in cash and equivalents as of Sept. 30, 2025, so despite ongoing losses, the risk of running out of money appears minimal for now.

Analysts tracking D-Wave expect its GAAP net loss to narrow by 5% YoY to $0.19 per share in FY26, while revenue is forecast to jump 55.46% YoY to $39.82 million.

Meanwhile, D-Wave Quantum announced last week a $550 million agreement to acquire Quantum Circuits, a software and hardware developer. The deal includes $300 million in D-Wave common stock and $250 million in cash. The acquisition combines D-Wave’s expertise in scalable control of superconducting processors and its production-grade, high-availability quantum cloud platform with Quantum Circuits’ leading approach to error-corrected superconducting gate-model technology. As a result, the company plans to introduce superconducting gate-model quantum systems later this year.

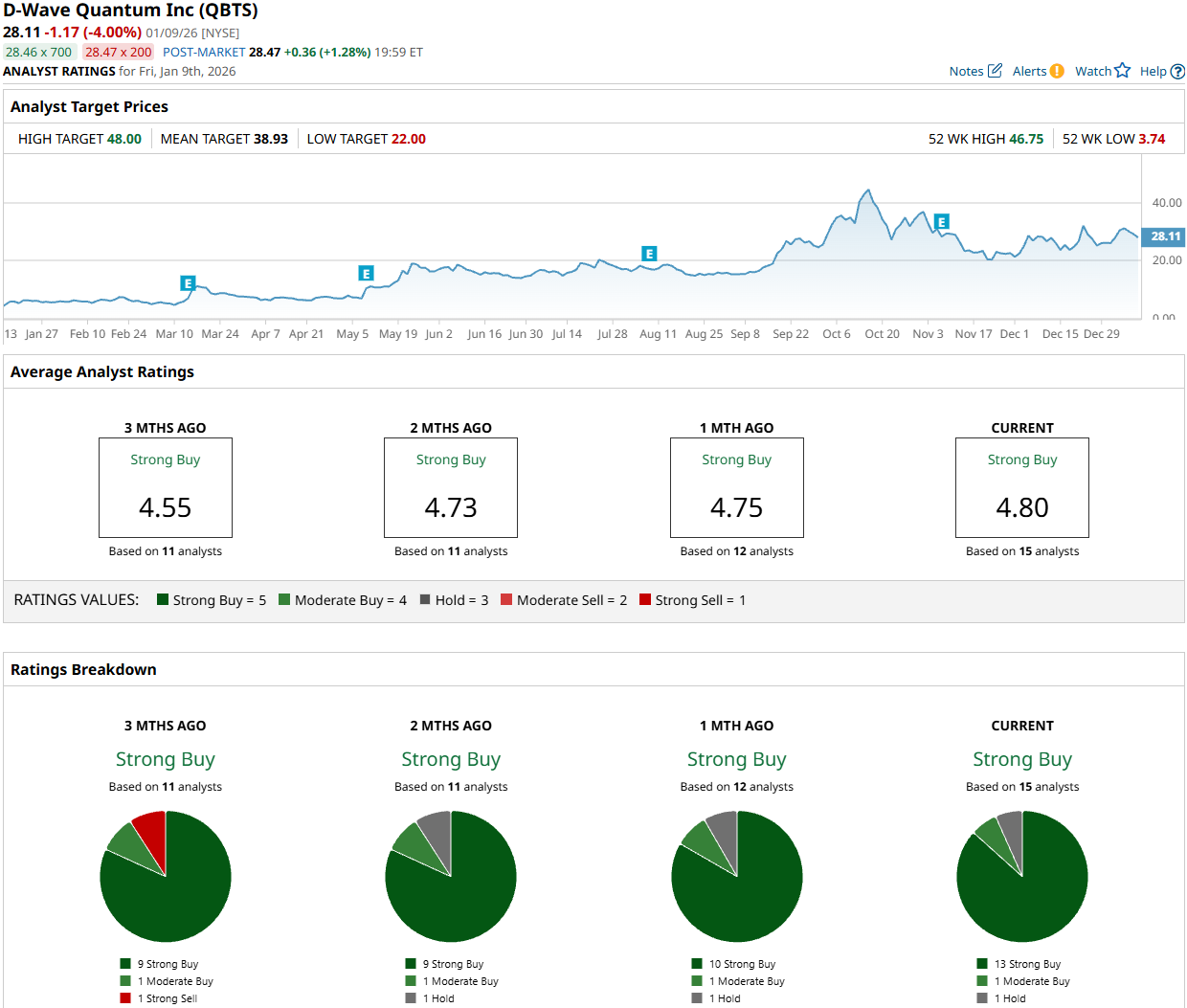

Wall Street analysts have a consensus rating of “Strong Buy” on QBTS stock. Among the 15 analysts covering the stock, 13 recommend a “Strong Buy,” one suggests a “Moderate Buy,” and one advises holding. The mean price target for QBTS stock is $38.93, which is 38.5% above Friday’s closing price.

On the date of publication, Oleksandr Pylypenko had a position in: NVDA , AMZN . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- A $107 Million Reason to Buy This Red-Hot Penny Stock Now

- China Is Stepping in to Help Alibaba Amid a Major Price War. Does That Make BABA Stock a Buy Here?

- As SanDisk Eyes Doubling Memory Prices, Should You Buy Red-Hot SNDK Stock?

- This Gold Stock Is Winning on the Back of a So-Called ‘Sell America’ Trade