Nextech AR Solutions Corp. (“Nextech”or the “Company”) (OTCQB: NEXCF) (NEO: NTAR) (CSE: NTAR) (FSE: N29) reports its financial and operating results for the third quarter 2021 ending September 30th, 2021. Subsequently, Nextech will host a conference call to discuss the third quarter results on November 11th, 2021 at 9:00 A.M. Eastern Time. Please join Evan Gappelberg, Chief Executive Officer, and Andrew Chan, Chief Financial Officer, to discuss these financial and operating results followed by a question-and-answer period.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211111005375/en/

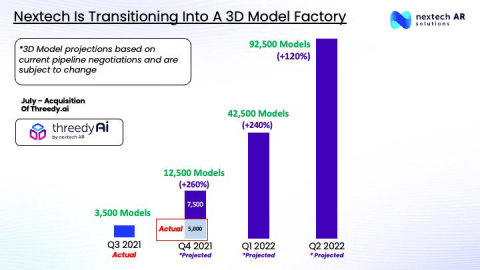

With it’s augmented reality and Metaverse suite of products, Nextech is focused on transitioning to a business of mass 3D Model creation. This chart highlights the Company’s projection through the second quarter of 2022 for 3D model creation at scale, with its’ 3D model factory. (Graphic: Business Wire)

Three Month Q3 Financial Highlights:

- Revenue for the three months ended September 30th, 2021 was $5.7 million an increase of 23% compared to the three months ended September 30th, 2020 of $4.7 million. Product sales increased 20% to $4.6 million, technology services increased 22% to $0.8 million and renewable software licenses increased 153% to $0.2 million.

- Gross profit for the three months ended September 30th, 2021 was $1.8 million a decrease of 39% compared to the three months ended September 30th, 2020 of $3.0 million. Profitability from product sales declined 6% as global supply chain issues increased our cost of acquiring inventory, and we incurred a gross loss from technology services as we continued to incur direct fixed delivery costs in the slower summer months.

Nine Month Q3 Financial Highlights:

- Revenue for the nine months ended September 30th, 2021, was $19.6 million an increase of 83% compared to the nine months ended September 30th, 2021 of $10.7 million. Product sales increased 61% to $15.0 million, technology services increased 207% to $3.7 million and renewable software licenses increased 497% to $0.9 million.

- Gross profit for the nine months ended September 30th, 2021, was $7.4 million, an increase of 14% compared to the nine months ended September 30th, 2020 of $6.5 million. Profitability from product sales increased 26%, while technology services contributed $1.0 million in gross profits over the nine month period.

Nextech AR Solutions Corp. |

|||||||||

Condensed Consolidated Interim Statements of Financial Position |

|||||||||

(Expressed in Canadian dollars) |

|||||||||

(Unaudited) |

|||||||||

| As at | |||||||||

| September 30, 2021 | December 31, 2020 | ||||||||

| Assets | |||||||||

| Current assets | |||||||||

| Cash | $ |

8,258,563 |

|

$ |

10,684,952 |

|

|||

| Digital Assets (Note 4) |

|

- |

|

|

2,546,035 |

|

|||

| Receivables (Note 5) |

|

1,895,277 |

|

|

1,312,548 |

|

|||

| Contract Asset (Note 14) |

|

267,865 |

|

|

244,478 |

|

|||

| Prepaid expenses (Note 6) |

|

895,117 |

|

|

1,354,369 |

|

|||

| Inventory (Note 7) |

|

4,581,632 |

|

|

3,211,675 |

|

|||

|

15,898,454 |

|

|

19,354,057 |

|

||||

| Non-current assets | |||||||||

| Equipment (Note 8) |

|

367,784 |

|

|

300,558 |

|

|||

| Right-of-use asset (Note 9) |

|

1,147,661 |

|

|

1,034,724 |

|

|||

| Intangible assets (Note 10) |

|

7,239,443 |

|

|

3,500,041 |

|

|||

| Goodwill (Note 10) |

|

7,832,208 |

|

|

4,886,513 |

|

|||

| Total assets | $ |

32,485,550 |

|

$ |

29,075,893 |

|

|||

| Liabilities and Shareholders' Equity | |||||||||

| Current liabilities | |||||||||

| Accounts payable and accrued liabilities (Note 11) | $ |

3,832,913 |

|

$ |

2,527,437 |

|

|||

| Deferred revenue (Note 14) |

|

1,573,270 |

|

|

383,022 |

|

|||

| Lease liability (Note 9) |

|

288,966 |

|

|

150,662 |

|

|||

| Contingent consideration (Note 3) |

|

463,030 |

|

|

2,717,859 |

|

|||

|

6,158,179 |

|

|

5,778,980 |

|

||||

| Non-current liabilities | |||||||||

| Lease liability (Note 9) |

|

860,152 |

|

|

877,978 |

|

|||

| Total liabilities |

|

7,018,331 |

|

|

6,656,958 |

|

|||

| Shareholders' Equity | |||||||||

| Share capital (Note 12) |

|

65,020,985 |

|

|

41,968,520 |

|

|||

| Reserves |

|

10,041,357 |

|

|

6,757,098 |

|

|||

| Deficit |

|

(49,595,123 |

) |

|

(26,306,683 |

) |

|||

|

25,467,219 |

|

|

22,418,935 |

|

||||

| Total liabilities and shareholders' equity | $ |

32,485,550 |

|

$ |

29,075,893 |

|

|||

Nextech AR Solutions Corp. |

||||||||||||||||

Condensed Consolidated Interim Statements of Comprehensive Loss |

||||||||||||||||

(Expressed in Canadian dollars) |

||||||||||||||||

(Unaudited) |

||||||||||||||||

| Three months ended | Three months ended | Nine months ended | Nine months ended | |||||||||||||

| September 30, 2021 | September 30, 2020 | September 30, 2021 | September 30, 2020 | |||||||||||||

| Revenue (Note 14) | $ |

5,737,585 |

|

$ |

4,662,928 |

|

$ |

19,555,840 |

|

$ |

10,683,942 |

|

||||

| Cost of sales (Note 15) |

|

(3,936,309 |

) |

|

(1,705,571 |

) |

|

(12,147,574 |

) |

|

(4,209,001 |

) |

||||

| Gross profit |

|

1,801,276 |

|

|

2,957,357 |

|

|

7,408,266 |

|

|

6,474,941 |

|

||||

| Operating expenses: | ||||||||||||||||

| Sales and marketing (Note 15) |

|

4,358,738 |

|

|

3,145,881 |

|

|

13,494,067 |

|

|

5,933,721 |

|

||||

| General and administrative (Note 15) |

|

3,735,240 |

|

|

639,773 |

|

|

9,914,613 |

|

|

3,156,980 |

|

||||

| Research and development (Note 15) |

|

1,863,785 |

|

|

1,048,161 |

|

|

5,389,276 |

|

|

1,552,714 |

|

||||

|

9,957,763 |

|

|

4,833,815 |

|

|

28,797,956 |

|

|

10,643,415 |

|

|||||

| Other expense (income) | ||||||||||||||||

| Stock-based compensation (Note 12) |

|

(574,131 |

) |

|

2,124,158 |

|

|

2,384,912 |

|

|

2,989,057 |

|

||||

| Amortization (Note 10) |

|

682,889 |

|

|

189,236 |

|

|

1,276,798 |

|

|

409,947 |

|

||||

| Right of Use Amortization (Note 9) |

|

64,735 |

|

|

- |

|

|

144,057 |

|

|

- |

|

||||

| Gain on digital assets (Note 4) |

|

- |

|

|

- |

|

|

(219,321 |

) |

|

- |

|

||||

| (Gain) loss on contingent consideration (Note 3) |

|

102,400 |

|

|

- |

|

|

(1,413,648 |

) |

|

- |

|

||||

| Depreciation (Note 8) |

|

37,286 |

|

|

25,440 |

|

|

97,321 |

|

|

52,723 |

|

||||

| Foreign exchange gain |

|

(252,992 |

) |

|

(15,284 |

) |

|

(371,369 |

) |

|

(7,307 |

) |

||||

|

60,187 |

|

|

2,323,550 |

|

|

1,898,750 |

|

|

3,444,420 |

|

|||||

| Loss before income taxes |

|

(8,216,674 |

) |

|

(4,200,008 |

) |

|

(23,288,440 |

) |

|

(7,612,894 |

) |

||||

| Deferred income tax recovery |

|

- |

|

|

24,139 |

|

|

- |

|

|

72,617 |

|

||||

| Net loss | $ |

(8,216,674 |

) |

$ |

(4,175,869 |

) |

$ |

(23,288,440 |

) |

$ |

(7,540,277 |

) |

||||

| Other comprehensive income (loss) | ||||||||||||||||

| Exchange differences on translating foreign operations |

|

413,553 |

|

|

(195,249 |

) |

|

296,096 |

|

|

(15,485 |

) |

||||

| Total comprehensive loss | $ |

(7,803,121 |

) |

$ |

(4,371,118 |

) |

$ |

(22,992,344 |

) |

$ |

(7,555,762 |

) |

||||

| Loss per common share | ||||||||||||||||

| Basic and diluted loss per common share |

|

(0.09 |

) |

|

(0.06 |

) |

|

(0.28 |

) |

|

(0.11 |

) |

||||

Weighted average number of common shares outstanding |

||||||||||||||||

Basic and diluted |

|

86,125,077 |

|

|

71,979,018 |

|

|

82,002,671 |

|

|

66,112,703 |

|

||||

Nextech AR Solutions Corp. |

||||||||||||||||

Condensed Consolidated Interim Statements of Cash Flows |

||||||||||||||||

(Expressed in Canadian dollars) |

||||||||||||||||

(Unaudited) |

||||||||||||||||

| Three months ended | Three months ended | Nine months ended | Nine months ended | |||||||||||||

| September 30, 2021 | September 30, 2020 | September 30, 2021 | September 30, 2020 | |||||||||||||

| Cashflows from operating activities | ||||||||||||||||

| Net loss | $ |

(8,216,674 |

) |

$ |

(4,175,869 |

) |

$ |

(23,288,440 |

) |

$ |

(7,540,277 |

) |

||||

| Items not affecting cash | ||||||||||||||||

| Amortization of intangible assets |

|

682,889 |

|

|

189,236 |

|

|

1,276,798 |

|

|

409,947 |

|

||||

| Deferred income tax recovery |

|

- |

|

|

(24,139 |

) |

|

- |

|

|

(72,617 |

) |

||||

| Amortization of right to use asset |

|

13,466 |

|

|

36,007 |

|

|

92,788 |

|

|

36,007 |

|

||||

| Depreciation of property and equipment |

|

37,286 |

|

|

25,440 |

|

|

97,321 |

|

|

52,723 |

|

||||

| Gain on digital assets |

|

- |

|

|

- |

|

|

(219,321 |

) |

|

- |

|

||||

| (Gain) loss on contingent consideration |

|

102,400 |

|

|

- |

|

|

(1,413,648 |

) |

|

- |

|

||||

| Shares issued for services |

|

78,535 |

|

|

- |

|

|

1,378,382 |

|

|

- |

|

||||

| Stock-based compensation |

|

(574,131 |

) |

|

- |

|

|

2,384,912 |

|

|

- |

|

||||

| Share-based payments |

|

- |

|

|

2,332,046 |

|

|

- |

|

|

3,844,950 |

|

||||

| Shares issued to settle related party liability |

|

- |

|

|

- |

|

|

- |

|

|

38,239 |

|

||||

| Changes in non-cash working capital balances | ||||||||||||||||

| Receivables |

|

(797,207 |

) |

|

(867,929 |

) |

|

(582,729 |

) |

|

(728,382 |

) |

||||

| Contract Asset |

|

69,342 |

|

|

- |

|

|

(23,387 |

) |

|

- |

|

||||

| Prepaid expenses |

|

411,727 |

|

|

(124,032 |

) |

|

459,252 |

|

|

(119,374 |

) |

||||

| Inventory |

|

(514,123 |

) |

|

(1,160,476 |

) |

|

(1,369,957 |

) |

|

(1,488,357 |

) |

||||

| Accounts payable and accrued liabilities |

|

1,399,775 |

|

|

119,806 |

|

|

1,305,476 |

|

|

600,593 |

|

||||

| Deferred revenue |

|

133,360 |

|

|

526,005 |

|

|

1,190,248 |

|

|

526,005 |

|

||||

| Other payables |

|

- |

|

|

- |

|

|

- |

|

|

(230,174 |

) |

||||

| Net cash used in operating activities | $ |

(7,173,355 |

) |

$ |

(3,123,905 |

) |

$ |

(18,712,305 |

) |

$ |

(4,670,717 |

) |

||||

| Cashflows from investing activities | ||||||||||||||||

| Purchase of equipment |

|

(27,653 |

) |

|

(68,022 |

) |

|

(138,572 |

) |

|

(68,022 |

) |

||||

| Proceeds from sale of digital assets |

|

- |

|

|

- |

|

|

2,765,356 |

|

|

- |

|

||||

| Purchase of Next Level Ninjas |

|

- |

|

|

(719,895 |

) |

|

- |

|

|

(719,895 |

) |

||||

| Cash acquired during acquisition |

|

- |

|

|

(45,715 |

) |

|

- |

|

|

(45,715 |

) |

||||

| Net cash used in investing activities | $ |

(27,653 |

) |

$ |

(833,632 |

) |

$ |

2,626,784 |

|

$ |

(833,632 |

) |

||||

| Cashflows from financing activities | ||||||||||||||||

| Proceeds from exercise of options and warrants |

|

123,986 |

|

|

1,949,438 |

|

|

1,416,934 |

|

|

3,882,162 |

|

||||

| Proceeds from private placement |

|

- |

|

|

- |

|

|

- |

|

|

3,009,047 |

|

||||

| Proceeds from public offering, net of issuance costs |

|

- |

|

|

12,118,689 |

|

|

12,632,937 |

|

|

12,118,689 |

|

||||

| Payment of lease obligations |

|

(13,145 |

) |

|

(39,475 |

) |

|

(148,923 |

) |

|

(39,475 |

) |

||||

| Payment of contingent consideration |

|

(18,902 |

) |

|

- |

|

|

(18,902 |

) |

|

- |

|

||||

| Net cash provided by financing activities | $ |

91,939 |

|

$ |

14,028,652 |

|

$ |

13,882,046 |

|

$ |

18,970,423 |

|

||||

| Change in cash during the period |

|

(7,109,069 |

) |

|

10,071,115 |

|

|

(2,203,475 |

) |

|

13,466,074 |

|

||||

| Cash, beginning of period |

|

15,395,005 |

|

|

6,282,197 |

|

|

10,684,952 |

|

|

2,849,344 |

|

||||

| Effects of foreign exchange on cash |

|

(27,373 |

) |

|

34,700 |

|

|

(222,914 |

) |

|

72,594 |

|

||||

| Cash, end of period | $ |

8,258,563 |

|

$ |

16,388,012 |

|

$ |

8,258,563 |

|

$ |

16,388,012 |

|

||||

| Supplemental cash flow information | ||||||||||||||||

| Taxes paid |

|

(224 |

) |

|

- |

|

|

8,743 |

|

|

- |

|

||||

| Interest Paid |

|

9,022 |

|

|

- |

|

|

16,298 |

|

|

- |

|

||||

| Interest received |

|

(54,895 |

) |

|

- |

|

|

(33,426 |

) |

|

- |

|

||||

Conference Call Details:

Date: Thursday, November 11, 2021

Time: 9:00 a.m. Eastern Standard Time

Toll Free Dial-In Number: (877) 201-0168

International Dial-In Number: (647) 788-4901

Conference ID: 5039337

Webcast Link: Nextech AR Q3, 2021 Earnings Call

For those unable to join the live event, a recording of the presentation will be posted on the company's website.

Nextech is also pleased to reveal that an updated Corporate Presentation is now available on the Company’s website - https://www.nextechar.com/investor-relations-overview

To learn more, please follow us on Twitter, YouTube, Instagram, LinkedIn, and Facebook, or visit our website: https://www.Nextechar.com.

On behalf of the Board of Nextech AR Solutions Corp.

Evan Gappelberg

CEO and Director

info@nextechar.com

866-274-8493

About Nextech AR

Nextech develops and operates augmented reality (“AR”) platforms that transports three-dimensional (“3D”) product visualizations, human holograms and 360° portals to its audiences altering e-commerce, digital advertising, hybrid virtual events (events held in a digital format blended with in-person attendance) and learning and training experiences.

Nextech focuses on developing AR solutions however most of the Company’s revenues are derived from three e-Commerce platforms: vacuumcleanermarket.com (“VCM”), infinitepetlife.com (“IPL”) and Trulyfesupplements.com (“TruLyfe”). VCM and product sales of residential vacuums, supplies and parts, and small home appliances sold on Amazon.

Non-IFRS Financial Measures

Total Bookings is not defined by and does not have a standardized meaning under International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board. This non-IFRS financial performance measure is defined below. Non-IFRS financial measures are used by management to assess the financial and operational performance of the Company. The Company believes that this non-IFRS financial measure, in addition to conventional measures prepared in accordance with IFRS, enables investors to evaluate the Company's operating results, underlying performance and prospects in a similar manner to the Company's management. As there are no standardized methods of calculating these non-IFRS measures, the Company's approaches may differ from those used by others, and accordingly, the use of these measures may not be directly comparable. Accordingly, this non-IFRS measure is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

"Total Bookings" is the total dollar value of all services/goods included in contracts with our customers. ‘Value’ is the total revenue (recognizable or not) associated with each transaction, as opposed to the amount invoiced in the period.

Please refer to the Company's most recent management discussion and analysis for further information on non-IFRS measures.

Forward-looking Statements

This press release may contain forward-looking information within the meaning of applicable securities laws, which reflects the Company's current expectations regarding future events, including with respect to the Company's financial outlook. In some cases, but not necessarily in all cases, forward-looking statements can be identified by the use of forward looking terminology such as "plans", "targets", "expects" or "does not expect", "is expected", "an opportunity exists", "is positioned", "estimates", "intends", "assumes", "anticipates" or "does not anticipate" or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", "will" or "will be taken", "occur" or "be achieved". In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances contain forward-looking statements. Forward-looking statements are not historical facts, nor guarantees or assurances of future performance but instead represent management's current beliefs, expectations, estimates and projections regarding future events and operating performance.

Specifically, NexTech's forecast on Total Bookings is considered forward-looking information. The foregoing demonstrates NexTech's objectives, which are not forecasts or estimates of its financial position but are based on the implementation of its strategic goals, growth prospects and growth initiatives. Management's assessments of, and outlook for, Total Bookings set out herein are generally based on the following assumptions: (a) NexTech's results of operations will continue as expected, (b) the Company will continue effectively execute against its key strategic growth priorities, (c) the Company will continue to retain and grow its existing customer base and market share, (d) the Company will be able to take advantage of future prospects and opportunities, and continue to realize on synergies, (e) there will be no changes in legislative or regulatory matters that negatively impact NexTech's business, (f) current tax laws will remain in effect and will not be materially changed, (g) economic conditions will remain relatively stable throughout the period, and (h) the industries NexTech operates in will continue to grow consistent with past experience. The Company considers these assumptions to be reasonable in the circumstances, given the time period for such projections and targets. The achievement of target revenue set out above is subject to significant risks including: (a) that the Company will be unable to effectively execute against its key strategic growth priorities and (b) the Company will be unable to continue to retain and grow its existing customer base and market share. These estimates have been prepared by and are the responsibility of management.

Forward-looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond the Company's control, which could cause actual results and events to differ materially from those that are disclosed in or implied by such forward-looking information. Such risks and uncertainties include, but are not limited to, the factors discussed under "Risk Factors" in the final short form prospectus of the Company dated August 12, 2020. NexTech does not undertake any obligation to update such forward-looking information, whether as a result of new information, future events or otherwise, except as expressly required by applicable law.

The NEO has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Certain information contained herein may constitute “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified using forward-looking terminology such as, “will be”, “looking forward” or variations of such words and phrases or statements that certain actions, events, or results “will” occur. Forward-looking statements regarding the Company increasing investors awareness are based on the Company’s estimates and are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, levels of activity, performance, or achievements of NexTech to be materially different from those expressed or implied by such forward-looking statements or forward-looking information, including capital expenditures and other costs. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. NexTech will not update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211111005375/en/

Contacts

Investor Relations

Bradley Gittings

Vice President, Investor Relations

bradley.gittings@Nextechar.com

(905) 823-1419 Ext 7068