Rumble has gotten torched over the last six months - since May 2025, its stock price has dropped 21.9% to $6.08 per share. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Following the drawdown, is now a good time to buy RUM? Find out in our full research report, it’s free for active Edge members.

Why Does RUM Stock Spark Debate?

Founded in 2013 as a champion for content creator rights and free expression, Rumble (NASDAQ: RUM) is a video sharing platform that positions itself as a free speech alternative to mainstream platforms, offering creators more favorable revenue-sharing opportunities.

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

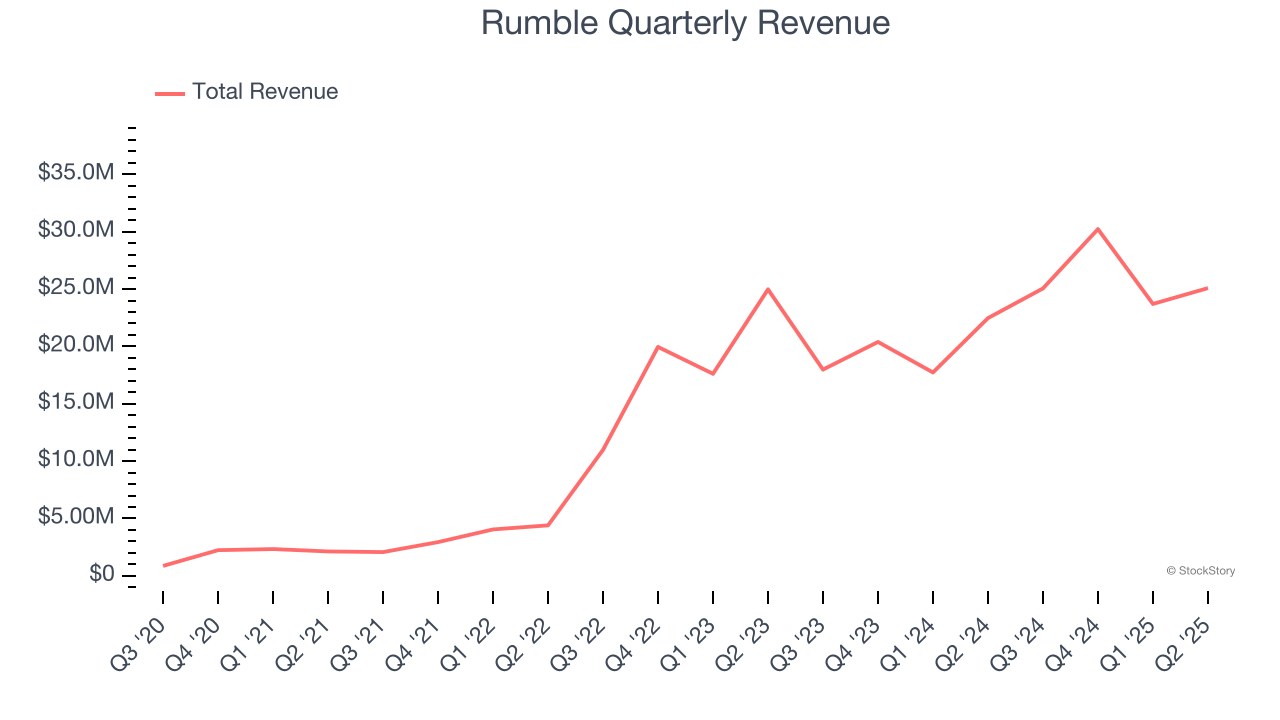

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last four years, Rumble grew its sales at an incredible 92.6% compounded annual growth rate. Its growth beat the average business services company and shows its offerings resonate with customers.

2. Wall Street Expects Impressive Revenue Gains

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Rumble’s revenue to rise by 7.8%. While this projection is below its 19% annualized growth rate for the past two years, it is noteworthy and implies the market is baking in success for its products and services.

One Reason to be Careful:

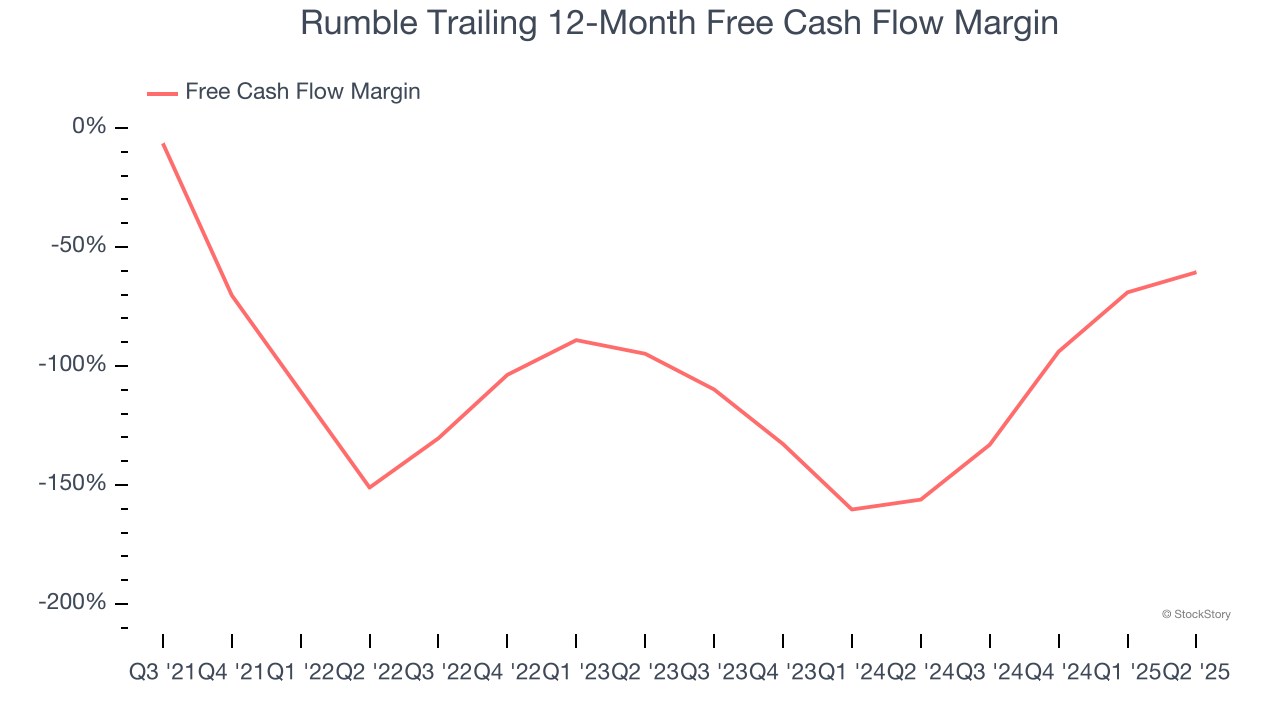

Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Rumble’s margin dropped by 62.4 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal it’s in the middle of a big investment cycle. Rumble’s free cash flow margin for the trailing 12 months was negative 60.6%.

Final Judgment

Rumble has huge potential even though it has some open questions. With the recent decline, the stock trades at $6.08 per share (or a trailing 12-month price-to-sales ratio of 15.2×). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free for active Edge members.

Stocks We Like Even More Than Rumble

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.