Over the past six months, First Financial Bankshares’s shares (currently trading at $30.65) have posted a disappointing 11% loss, well below the S&P 500’s 19.8% gain. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Following the pullback, is now a good time to buy FFIN? Find out in our full research report, it’s free for active Edge members.

Why Is FFIN a Good Business?

With roots dating back to 1890 and a network spanning over 70 locations across the Lone Star State, First Financial Bankshares (NASDAQ: FFIN) is a Texas-focused regional bank providing commercial banking, trust services, and wealth management across numerous communities throughout the state.

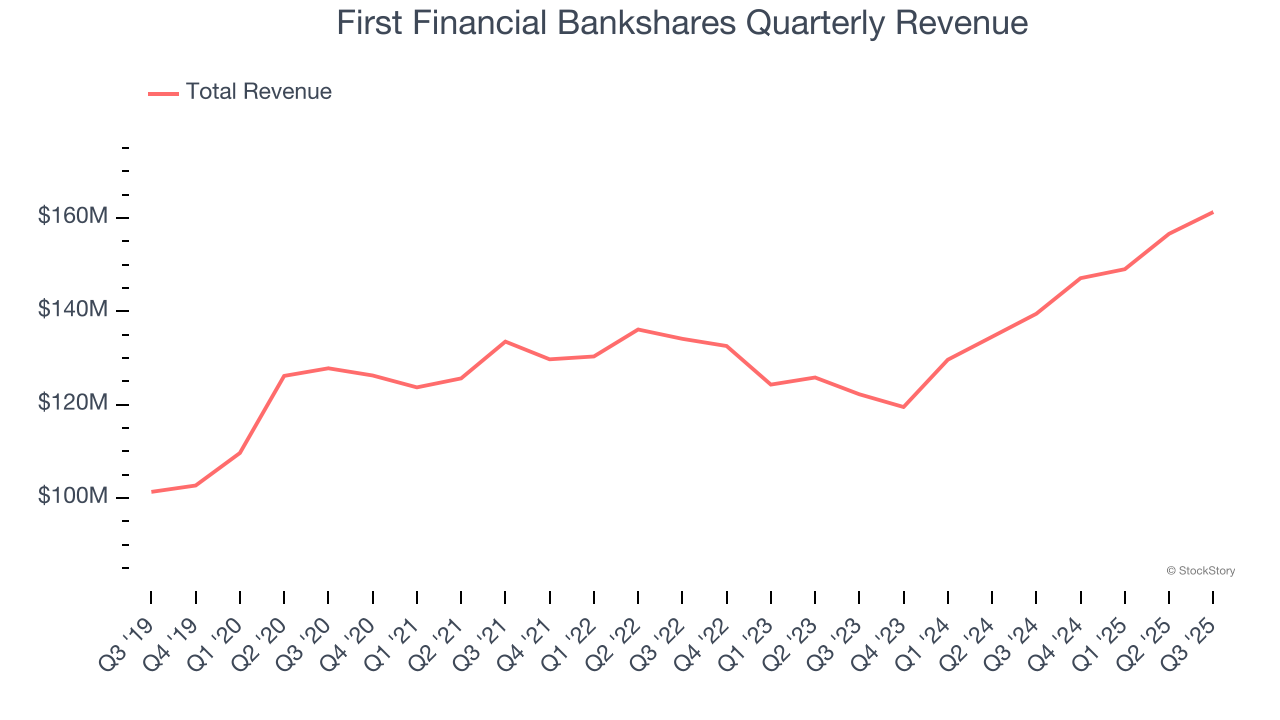

1. Long-Term Revenue Growth Shows Momentum

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities.

Luckily, First Financial Bankshares’s revenue grew at a decent 5.7% compounded annual growth rate over the last five years. Its growth was slightly above the average banking company and shows its offerings resonate with customers.

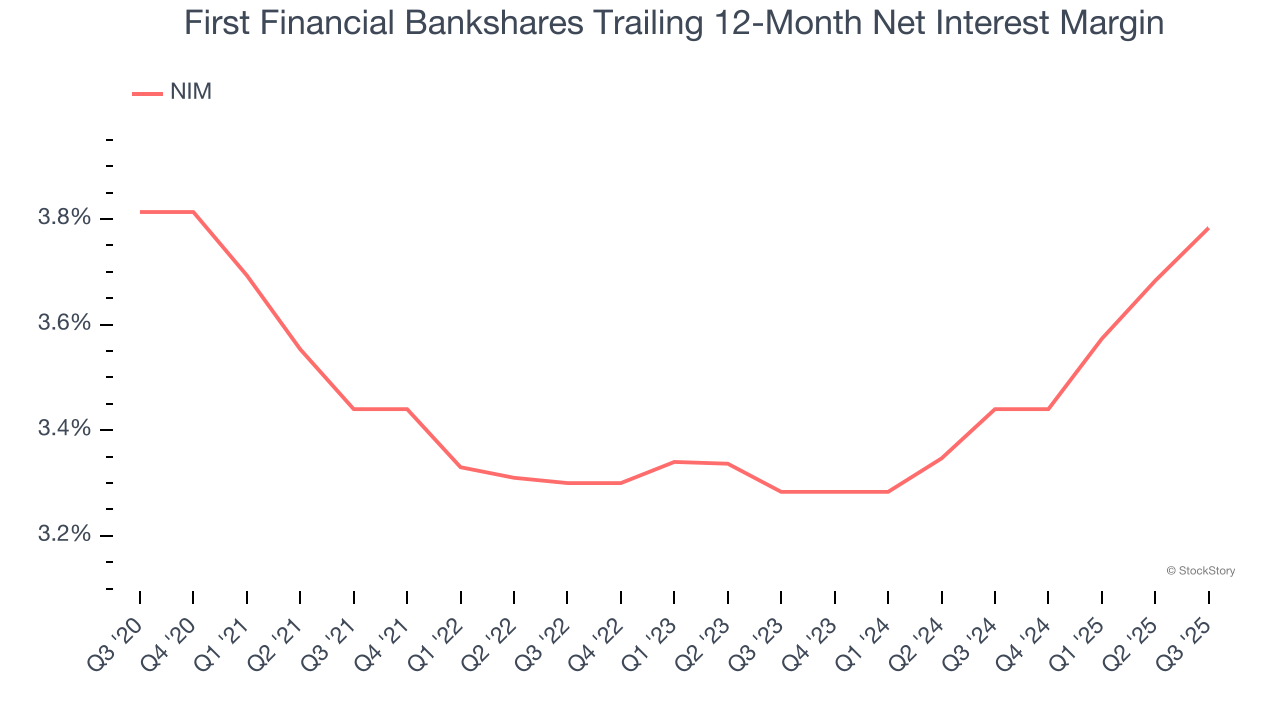

2. Increasing Net Interest Margin Juices Financials

Net interest margin (NIM) serves as a critical gauge of a bank's fundamental profitability by showing the spread between interest income and interest expenses. It's essential for understanding whether a firm can sustainably generate returns from its lending operations.

Over the past two years, First Financial Bankshares’s net interest margin averaged 3.6%, climbing by 50 basis points (100 basis points = 1 percentage point) over that period.

This expansion was a tailwind for its net interest income, and while prevailing interest rates matter the most for industry net interest margins, banks that consistently increase this figure generally boast higher-earning loan books (all else equal such as the risk of those loans) or provide differentiated services that give them the ability to charge higher rates (pricing power).

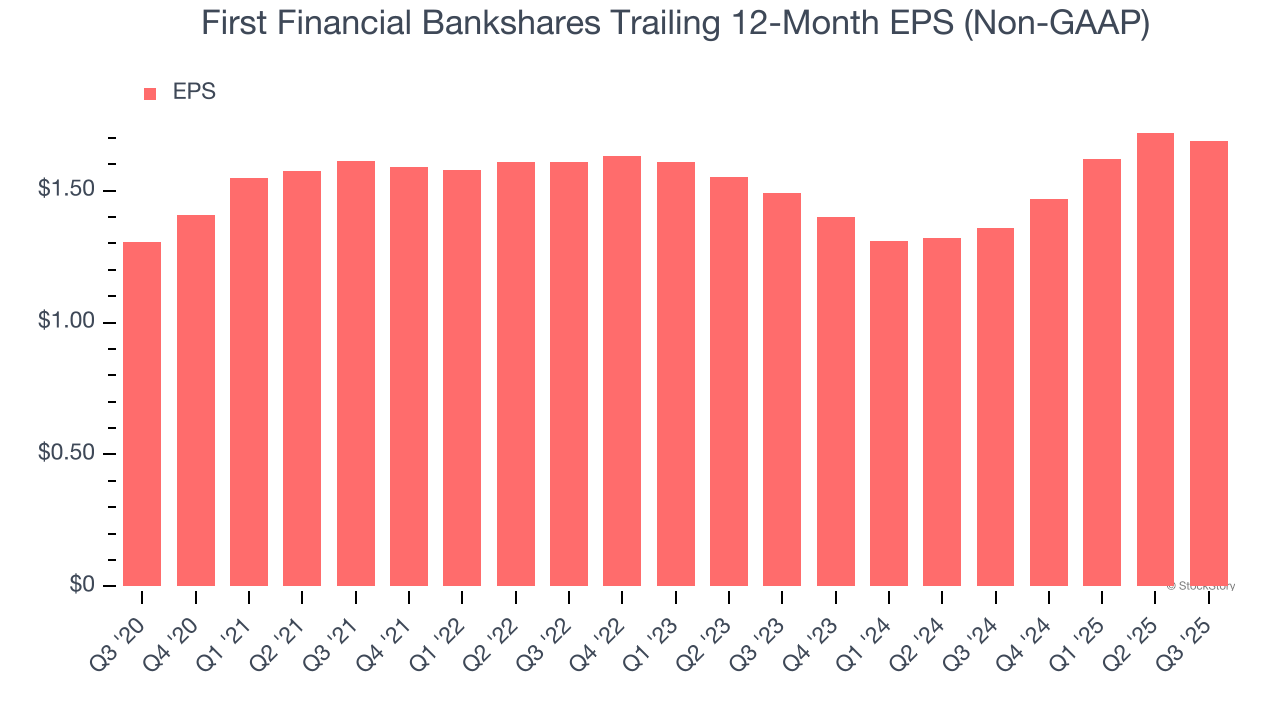

3. EPS Moving Up Steadily

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

First Financial Bankshares’s decent 5.3% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Final Judgment

These are just a few reasons why First Financial Bankshares ranks highly on our list. After the recent drawdown, the stock trades at 2.3× forward P/B (or $30.65 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than First Financial Bankshares

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.