Over the last six months, Guardant Health’s shares have sunk to $46.13, producing a disappointing 5.1% loss - a stark contrast to the S&P 500’s 3.1% gain. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Guardant Health, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Guardant Health Not Exciting?

Despite the more favorable entry price, we're swiping left on Guardant Health for now. Here are three reasons why you should be careful with GH and a stock we'd rather own.

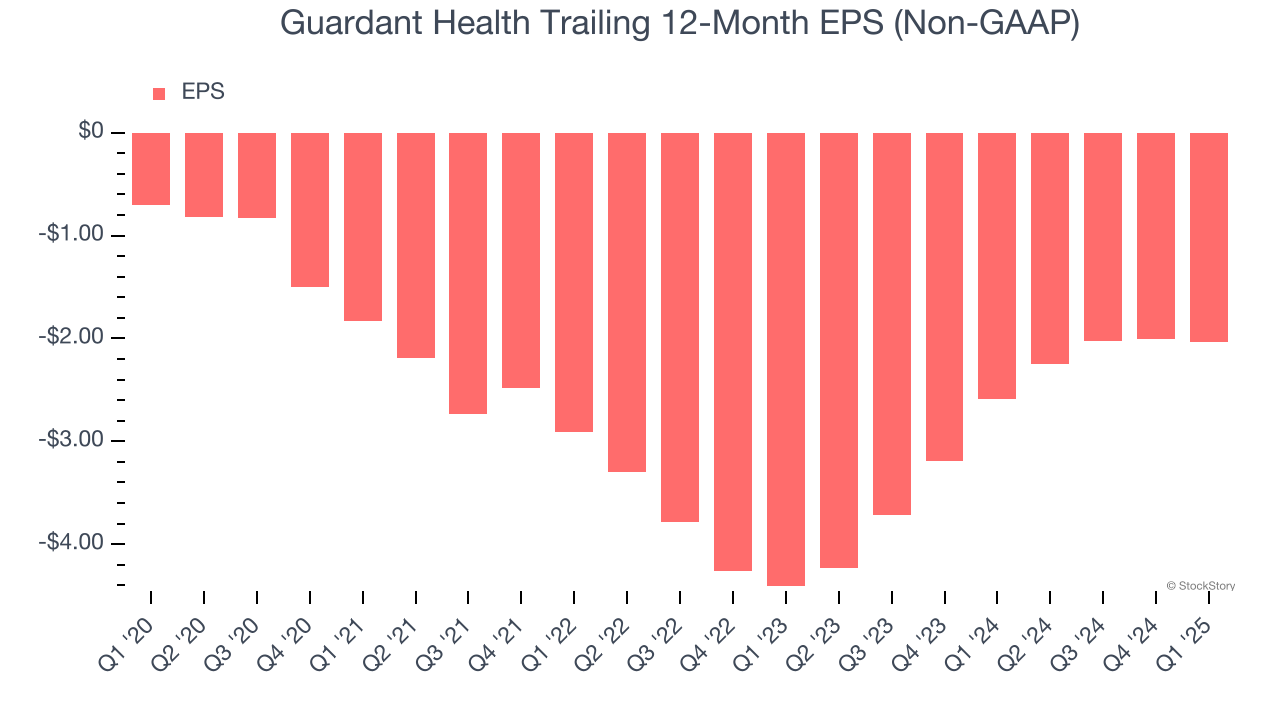

1. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Guardant Health’s earnings losses deepened over the last five years as its EPS dropped 23.7% annually. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

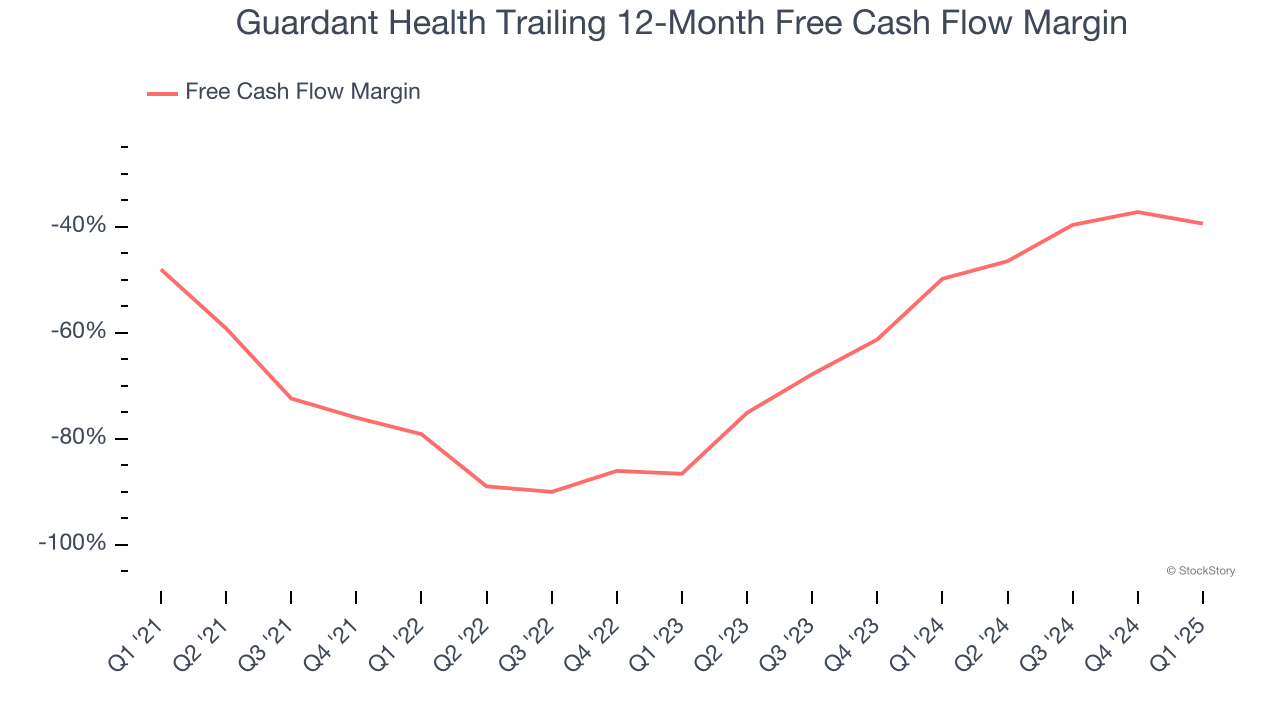

2. Cash Burn Ignites Concerns

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Guardant Health’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 57.9%, meaning it lit $57.90 of cash on fire for every $100 in revenue.

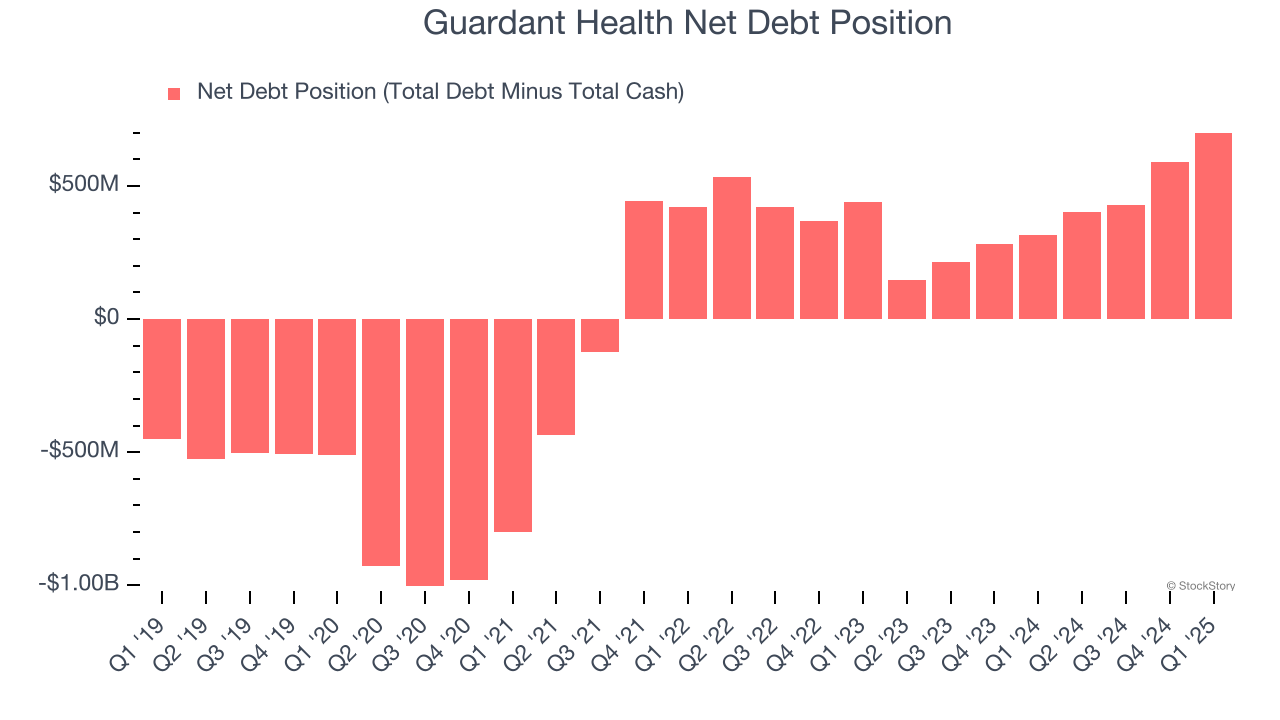

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Guardant Health burned through $304.9 million of cash over the last year, and its $1.40 billion of debt exceeds the $698.6 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Guardant Health’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Guardant Health until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

Guardant Health isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at $46.13 per share (or a forward price-to-sales ratio of 6.2×). The market typically values companies like Guardant Health based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy. Let us point you toward the most entrenched endpoint security platform on the market.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2024, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.