-

Initial Mineral Resource Estimate defined for the Valley Gold Deposit, located on Snowline's 100% owned Rogue Project in the Yukon Territory, Canada:

- Indicated Mineral Resource: 76 Mt at 1.66 g/t Au for 4.05 million ounces

- Inferred Mineral Resource: 81 Mt at 1.25 g/t Au for an additional 3.26 million ounces

- Resource is constrained within a revenue factor 0.72 pit shell and reported above a 0.40 g/t Au cut-off grade

- Quality of discovery highlighted by continuous, non-refractory gold mineralization, with a significant component of higher-grade mineralization starting from bedrock surface (see Table 3) providing strength and optionality for potential future development scenarios

- Initial resource has clear potential for expansion, with open zones of 1-2 g/t Au mineralization across multiple broad edges of the deposit and with abundant mineralization encountered beyond the limits of the current pit shell

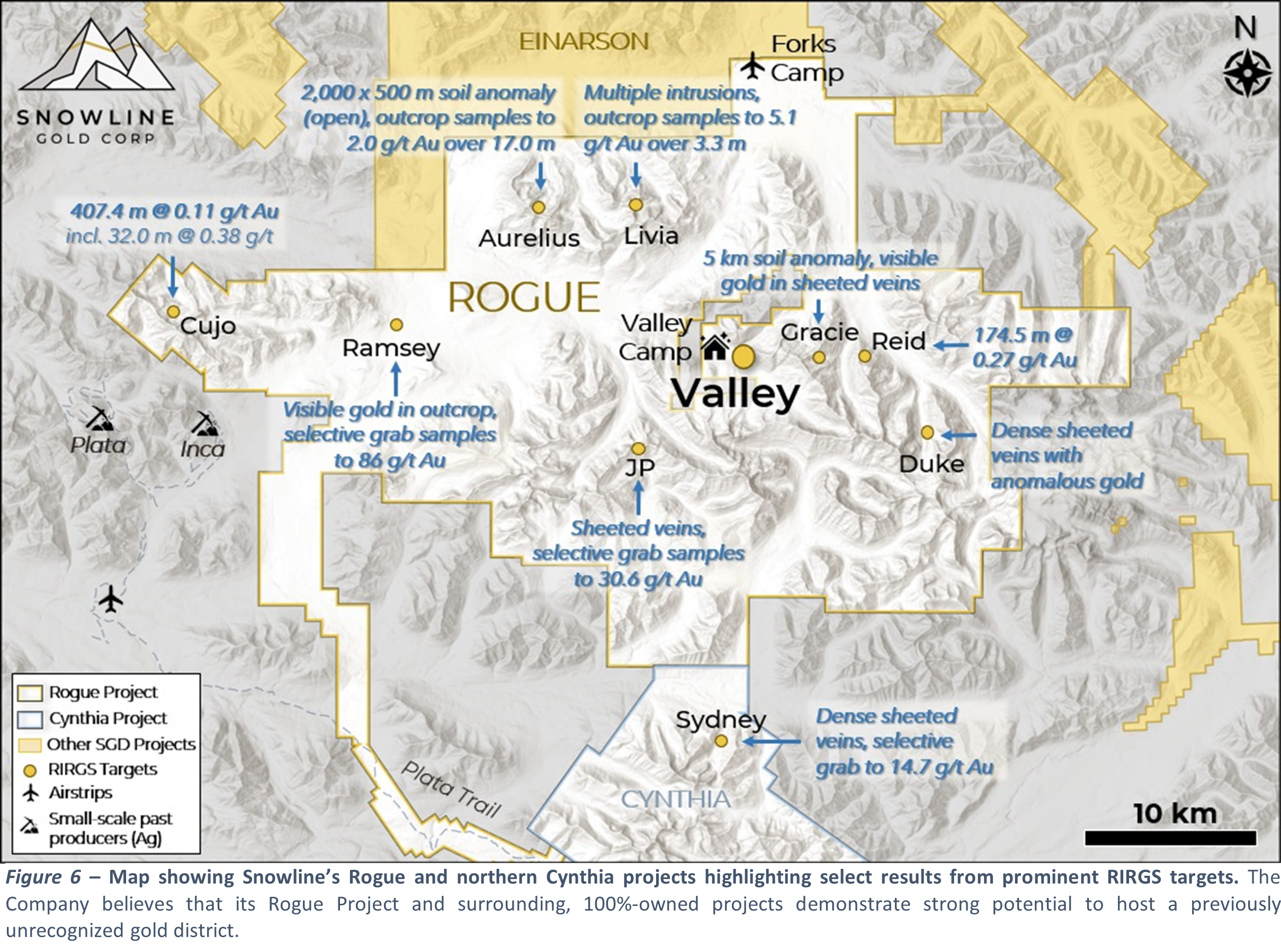

- The Valley Deposit sits on <0.01% of the Company's land holdings, within a cluster of high priority targets sharing key geological characteristics with Valley highlighting district level potential

- 2024 drill program at Valley ongoing, with three drills active on the Valley Deposit and roughly 4,000 m drilled to date (assays pending).

VANCOUVER, BC / ACCESSWIRE / June 17, 2024 / SNOWLINE GOLD CORP. (TSX-V:SGD)(US OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to report an initial Mineral Resource Estimate (MRE) prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (NI 43-101) standards for the Valley Deposit, the first discovery on its 100% owned, 1,110 km2 Rogue Project in Canada's Yukon Territory.

"In just two full exploration seasons, Snowline has advanced its Valley target from greenfield discovery holes to a robust multi-million-ounce gold deposit with continued exploration upside," said Scott Berdahl, CEO & Director of Snowline. "The rapid advancement is a testament both to the quality of the discovery-with exceptional continuity of strong, non-refractory gold mineralization beginning at surface-and to the quality of the ongoing work by our talented and hard-working field team. We believe that Valley has excellent potential for continued growth, as evidenced by broad intervals of 1-2 g/t gold mineralization returned in drilling on multiple edges of the system. We are actively building on this milestone for Valley with our largest drill campaign to date, currently underway, while testing multiple prospective greenfield targets in a region we believe has the potential to become a prolific minerals district."

INITIAL MINERAL RESOURCE ESTIMATE OVERVIEW

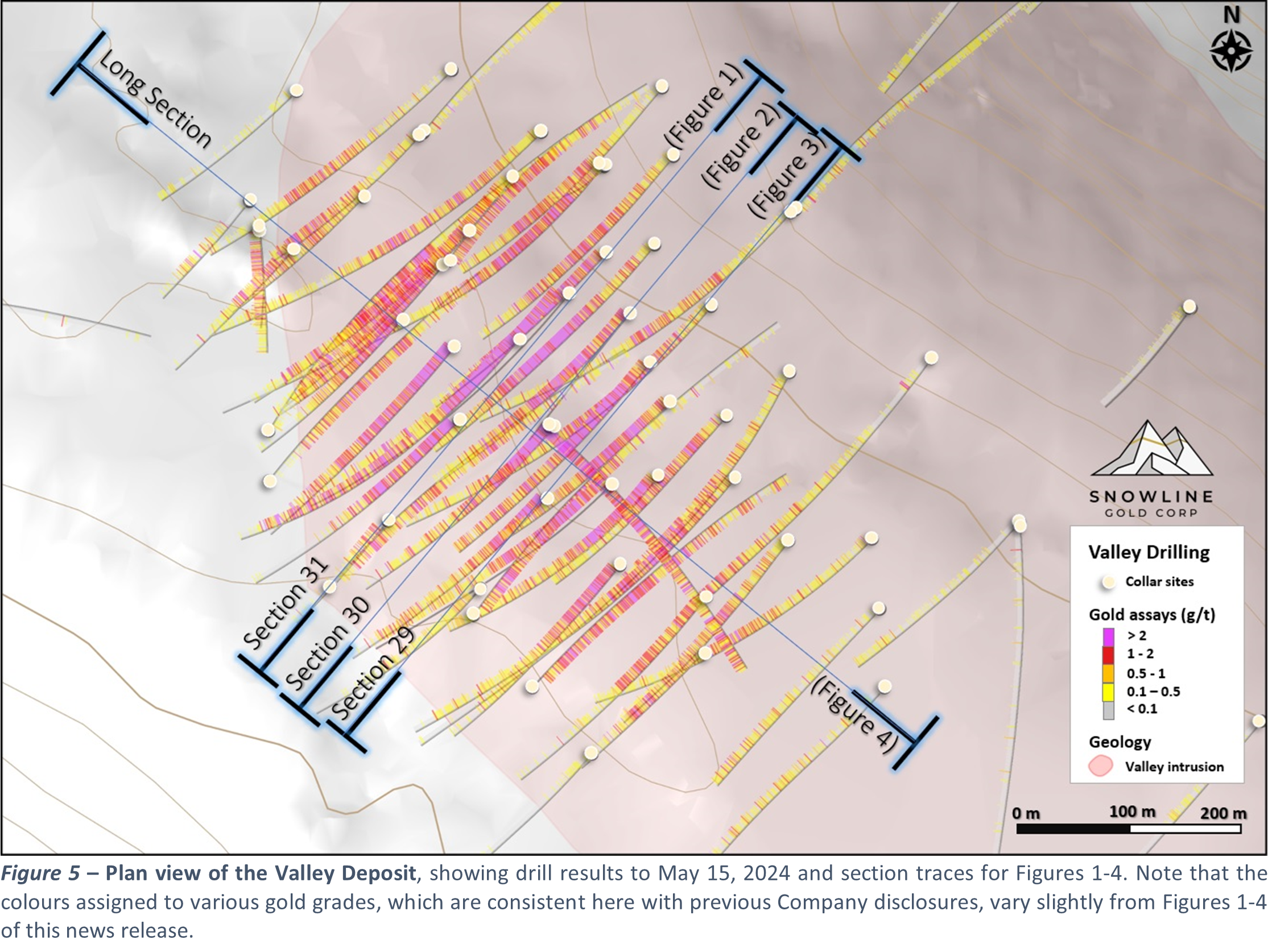

The initial MRE for the Valley Deposit is prepared in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards incorporated by reference in NI 43-101. The initial, revenue factor 0.72 pit shell-constrained MRE contains Indicated Mineral Resources of 76 million tonnes (Mt) at 1.66 grams per tonne gold (g/t Au) for 4.05 million ounces (Moz) gold in addition to Inferred Mineral Resources of 81 Mt at 1.25 g/t Au for 3.26 million ounces gold (Table 1) using a 0.4 g/t Au cut-off grade. The estimate is based on 27,911 metres (m) drill data from all 68 holes at Valley available as of May 15, 2024, prior to the commencement of Snowline's ongoing 2024 drill campaign. Work is underway to expand on the initial MRE, which supports Snowline's view that Valley has encouraging potential to host a long-life, high-quality gold mine.

Snowline Gold Rogue Project, Yukon, Canada

Table 1: Valley Deposit Gold Mineral Resource Estimate

Mineral Resources (Above 0.40 g/t gold cut-off within 297 Mt total Material Shell)

Mineral Resource Category |

Tonnage (t x 1000) |

Gold Grade (Au g/t) |

Contained Gold (ounces x 1000) |

| Indicated Resources | 75,836 |

1.66 |

4,052 |

| Inferred Resources | 81,039 |

1.25 |

3,260 |

Notes:

- The effective date of the Mineral Resource Estimate is May 15, 2024, and the Mineral Resource Estimate is based upon all available exploration data available to the end of January 2024.

- Values for tonnage and contained gold are rounded to the nearest thousand

- Estimated Mineral Resources were classified following CIM Definition Standards. The quantity and grade of the Inferred Mineral resources listed here are uncertain in nature and have insufficient exploration data to classify them as Indicated Mineral Resources, and it is not certain that additional exploration will result in the upgrading of the Inferred Mineral Resources to a higher category.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by Metal Prices, Economic Factors, Environmental, Permitting, Legal, Title, or other relevant issues.

- All stated Mineral Resources are contained with a pit shell of approximately 297 Mt of material. All blocks located below or outside of this pit shell have been excluded from the Mineral Resource Estimate regardless of gold grade or Mineral Resource category.

- The Mineral Resource cut-off grade of 0.40 g/t gold and the Lerchs-Grossman limiting pit shell have been defined with the following assumptions:

- An assumed conventional gold mill processing operation with a nominal process rate in the range of 25,000 t/day milled.

- A gold price of US$ 1,800/ounce and CAN$/US$ exchange rate of 1.30.

- Average mining costs of CAN$ 3.50 per tonne of material mined.

- Average processing costs of CAN$ 22.00 per tonne processed.

- A process recovery of 93% for gold.

- Average administrative costs of CAN$ 80 million per annum or CAN$ 8.77 per tonne processed.

- A 1% royalty on recovered gold.

- Refining and selling costs of CAN$ 9.10 per recovered ounce of gold.

- Overall pit slopes of 45 degrees.

- The pit shell selected as the Mineral Resources limit has a revenue factor of 0.72.

Snowline Gold Rogue Project, Yukon, Canada

Table 2: Valley Deposit Gold Mineral Resource Estimate

Sensitivity to Gold Cut-Off Grade

|

Gold Cut-off (Au g/t) |

Mineral Resource Category |

Tonnage (t x 1000) |

Gold Grade (Au g/t) |

Contained Gold (ounces x 1000) |

0.6 g/t |

Indicated Resources |

67,914 |

1.80 |

3,925 |

Inferred Resources |

65,793 |

1.43 |

3,016 |

|

0.5 g/t |

Indicated Resources |

72,009 |

1.73 |

3,997 |

Inferred Resources |

72,871 |

1.34 |

3,141 |

|

0.4 g/t |

Indicated Resources |

75,836 |

1.66 |

4,052 |

Inferred Resources |

81,039 |

1.25 |

3,260 |

|

0.3 g/t |

Indicated Resources |

79,474 |

1.60 |

4,093 |

Inferred Resources |

90,152 |

1.16 |

3,361 |

|

0.2 g/t |

Indicated Resources |

82,682 |

1.55 |

4,119 |

Inferred Resources |

101,909 |

1.05 |

3,455 |

Notes:

- Bolded row represents the base case for the MRE.

- Cut-off grades as low as 0.2 g/t Au are still considered to meet NI 43-101 guidelines for Reasonable Prospects for Eventual Economic Extraction.

Snowline Gold Rogue Project, Yukon, Canada

Table 3: Valley Deposit Gold Mineral Resource Estimate

Incremental Breakdown of Mineral Resources (>0.40 g/t Gold) Within Internal Shells

Incremental Pit Shells |

Mineral Resources and Waste |

Tonnage (t x 1000) |

Gold Grade (Au g/t) |

Contained Gold (ounces x 1000) |

|

Between Surface & Shell-1 |

Indicated Resources |

25,463 |

2.45 |

2,006 |

Inferred Resources |

13,533 |

2.16 |

939 |

|

Waste Material |

3,304 |

|||

|

Between Shell-1 & Shell-2 |

Indicated Resources |

22,129 |

1.46 |

1,041 |

Inferred Resources |

22,250 |

1.22 |

870 |

|

Waste Material |

19,274 |

|||

|

Between Shell-2 & Shell-3 |

Indicated Resources |

13,916 |

1.25 |

559 |

Inferred Resources |

25,291 |

1.03 |

837 |

|

Waste Material |

48,450 |

|||

|

Between Shell-3 & Shell-4 |

Indicated Resources |

14,328 |

0.97 |

446 |

Inferred Resources |

19,965 |

0.96 |

614 |

|

Waste Material |

69,096 |

|||

Mineral Resource Total |

Indicated Resources |

75,836 |

1.66 |

4,052 |

Inferred Resources |

81,039 |

1.25 |

3,260 |

|

Waste Material |

140,124 |

Table 2 highlights the low sensitivity to cut-off grades in Valley's initial MRE, demonstrating a resilience to increases in cost assumptions and to decreases in the price of gold. Using the current cost assumptions, for example, the break-even price of gold for the 0.6 g/t Au cut-off would be US$1,350 per ounce.

Table 3 provides an incremental breakdown of this initial MRE as contained within sequentially expanding shells. It should be read with reference to Figure 4, which illustrates these sequential shells on a long section of the Valley Deposit. This table provides a quantitative basis for the description of relatively high-grade, continuous, near-surface mineralization at Valley. The Company believes that the front-heavy distribution of mineralization between these iterative pit shells materially enhances the potential of the project, providing strength and optionality in potential future development scenarios.

Further details regarding the initial MRE including the estimation methods and procedures will be detailed in a pending NI 43-101 Technical Report, prepared with oversight from Ausenco Engineering Canada ULC, which will be filed on SEDAR+ (www.sedarplus.ca) under the Company's profile within 45 days from the date of this news release.

VALLEY DEPOSIT GEOLOGY

The Valley gold deposit belongs to a class of gold systems known as reduced intrusion-related gold systems (RIRGS). RIRGS are characterized by sheeted, gold-bearing quartz vein arrays within and near felsic, ilmenite series intrusions. The quartz veins are generally thin (<2 cm in width), but their grade, abundance, and continuity across large spatial volumes can make RIRGS occurrences attractive bulk tonnage targets for mining.

Mineralization at Valley is hosted primarily within the western half of a 1-km-scale, polyphase granodiorite stock and to a lesser extent in surrounding hornfels sedimentary rock. Multiple overprinting gold-bearing quartz vein arrays are present, resulting in an unusually high density of veins for a RIRGS and thus unusually high bulk tonnage grades. Gold primarily occurs in its native form within the quartz veins, associated with minor to trace amounts of bismuth and tellurium minerals. Overall sulphur content is low (<0.5%), and carbonate minerals present in the quartz veins produce a strong natural buffering effect.

Metallurgical testing of Valley demonstrates the non-refractory nature of mineralization and its amenability to multiple conventional processing techniques. Average gold recoveries across 10 large contiguous core samples taken from different parts of the deposit were 94.1% using bottle roll cyanidation, 95.4% using flotation, and 95.7% using carbon-in-leach, each with a 75-micron grind size (see Snowline press release dated June 14, 2023).

ABOUT ROGUE

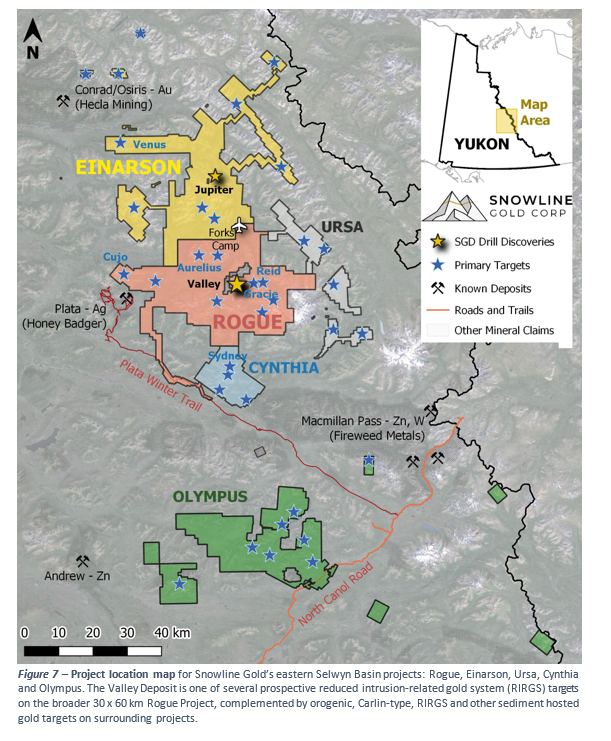

Snowline Gold's 100%-owned Rogue Project, in Canada's Yukon Territory, covers a 60 x 30 km cluster of intrusions in the eastern Tombstone Gold Belt known as the Rogue Plutonic Complex.

Since its launch in 2021, Snowline has progressed the Rogue Project's Valley target from a greenfield prospecting discovery to a significant bulk tonnage gold resource, with 4.05 Moz gold indicated mineral resource at 1.66 g/t Au and an additional 3.26 Moz inferred mineral resource at 1.25 g/t Au within a pit-shell constraint. Exploration of the open Valley system is ongoing. Valley is a reduced intrusion-related gold system (RIRGS), geologically similar to multi-million-ounce RIRGS deposits currently in production, like Kinross's Fort Knox Mine in Alaska, but with substantially higher gold grades. Gold is associated with bismuthinite and telluride minerals hosted in sheeted quartz vein arrays within and along the margins of a one-kilometer-scale, mid-Cretaceous aged Mayo-series intrusion.

The Rogue Project area hosts multiple intrusions similar to Valley (Figure 6) along with widespread gold anomalism in stream sediment, soil and rock samples. Elsewhere, RIRGS deposits are known to occur in clusters. For these reasons, Snowline considers the Rogue Project to have district-scale potential to host additional reduced intrusion-related gold systems.

ABOUT SNOWLINE GOLD CORP.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with an eight-project portfolio covering roughly 360,000 ha (3,600 km2). The Company is exploring its flagship 111,000 ha (1,110 km2) Rogue gold project in the highly prospective yet underexplored Selwyn Basin. Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits. The Company's first-mover position and extensive exploration database provide a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

QUALIFIED PERSON

The technical work of the initial MRE was completed by Dan Redmond, P.Geo., an independent qualified person as defined by NI 43-101. He has reviewed, verified and approved the technical information related to the MRE in this news release.

All other information in this news release has been prepared under the supervision of, verified and approved by Thomas K. Branson, M.Sc., P. Geo., VP Exploration of Snowline, as a qualified person for the purposes of NI 43-101.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements about the Company's belief that Valley has excellent potential for continued growth, the Company's belief that the region around Valley has the potential to become a prolific minerals district, the Company's view that Valley has encouraging potential to host a long-life, high-quality gold mine and the Company considering the Rogue Project to have district-scale potential to host additional reduced intrusion-related gold systems. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View the original press release on accesswire.com