Boca Raton, Florida-based SBA Communications Corporation (SBAC) is a real estate investment trust (REIT) that owns and operates wireless communications infrastructure, including towers, rooftops, distributed antenna systems and small-cell networks. Valued at a market cap of $21 billion, the company serves major wireless carriers and broadband providers.

This specialty REIT has considerably underperformed the broader market over the past 52 weeks. Shares of SBAC have declined 9.7% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.2%. Moreover, on a YTD basis, the stock is down 3.2%, compared to SPX’s 14.5% uptick.

Narrowing the focus, SBAC has also underperformed the Pacer Benchmark Data & Infrastructure Real Estate ETF’s (SRVR) 4.3% drop over the past 52 weeks and 2.4% YTD loss.

On Nov. 3, SBAC delivered better-than-expected Q3 results, sending its shares up 1.4% in the following trading session. Due to higher site leasing and site development revenues, the company’s total revenue improved 9.7% year-over-year to $732.3 million, surpassing consensus estimates by 3.9%. Additionally, while its AFFO declined marginally from the year-ago quarter to $3.30, it handily topped analyst expectations of $3.19.

For the current fiscal year, ending in December, analysts expect SBAC’s FFO to decline 8.8% year over year to $12.19. The company’s FFO surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

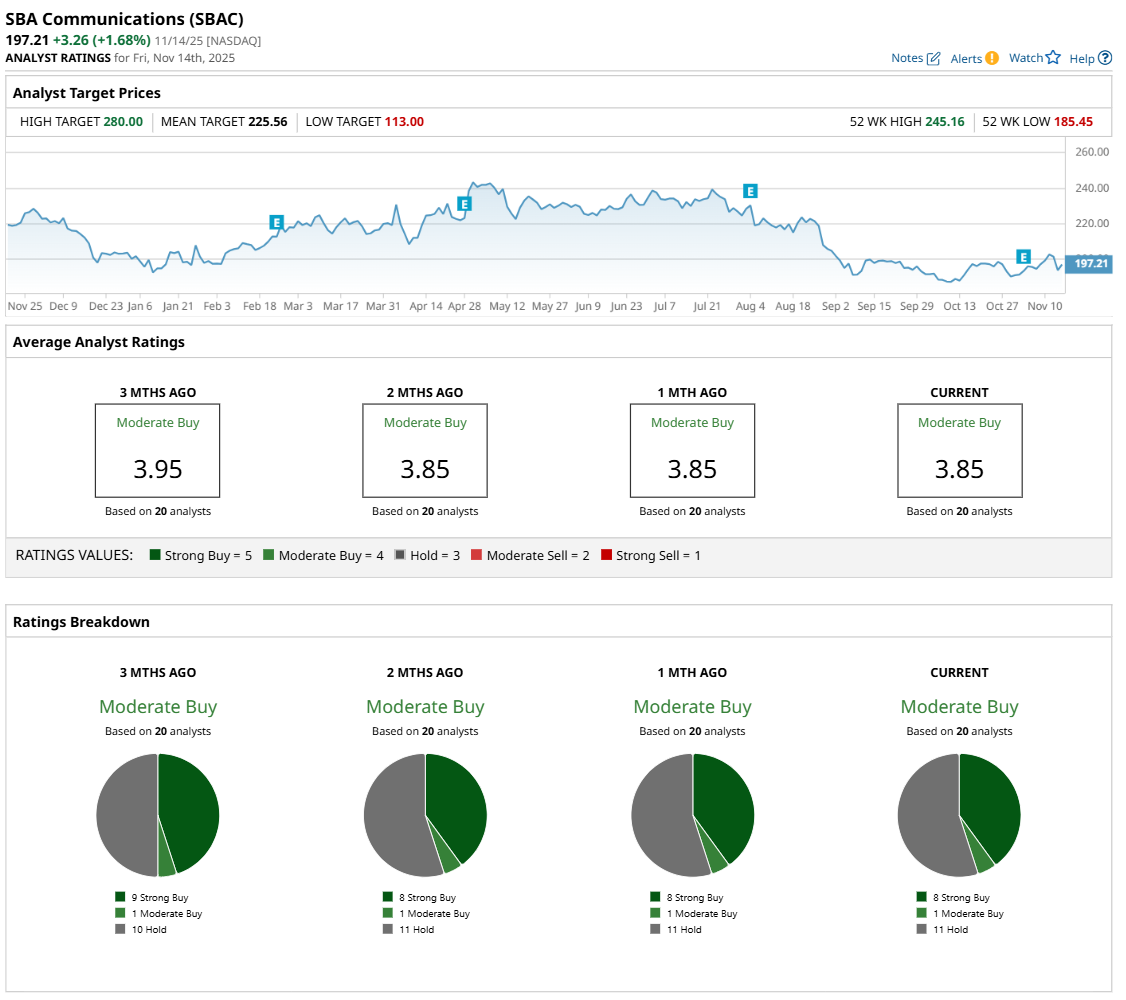

Among the 20 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on eight “Strong Buy,” one "Moderate Buy,” and 11 "Hold” ratings.

This configuration is slightly less bullish than three months ago, with nine analysts suggesting a “Strong Buy” rating.

On Nov. 10, RBC Capital maintained an "Outperform" rating on SBAC but lowered its price target to $232, indicating a 17.6% potential upside from the current levels.

The mean price target of $225.56 represents a 14.4% premium from SBAC’s current price levels, while the Street-high price target of $280 suggests an ambitious 42% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Warren Buffett Says Investors Should Measure Their Investing Success On ‘Slugging Percentage, Not Batting Average’

- Oklo Is ‘Setting the Stage’ for a Revolution in Nuclear Energy. Should You Buy OKLO Stock Here?

- This Semiconductor Stock Just Got a New Street-High Price Target. Should You Buy It Now?

- Nasdaq Year-End Playbook Decode 5-Year Correlations and Seasonal Q4