With a market cap of $72.2 billion, The PNC Financial Services Group, Inc. (PNC) is a diversified U.S. financial services company operating through Retail Banking, Corporate & Institutional Banking, and Asset Management Group segments. It serves consumers, businesses, and institutional clients with a broad range of banking, lending, investment, and wealth management services.

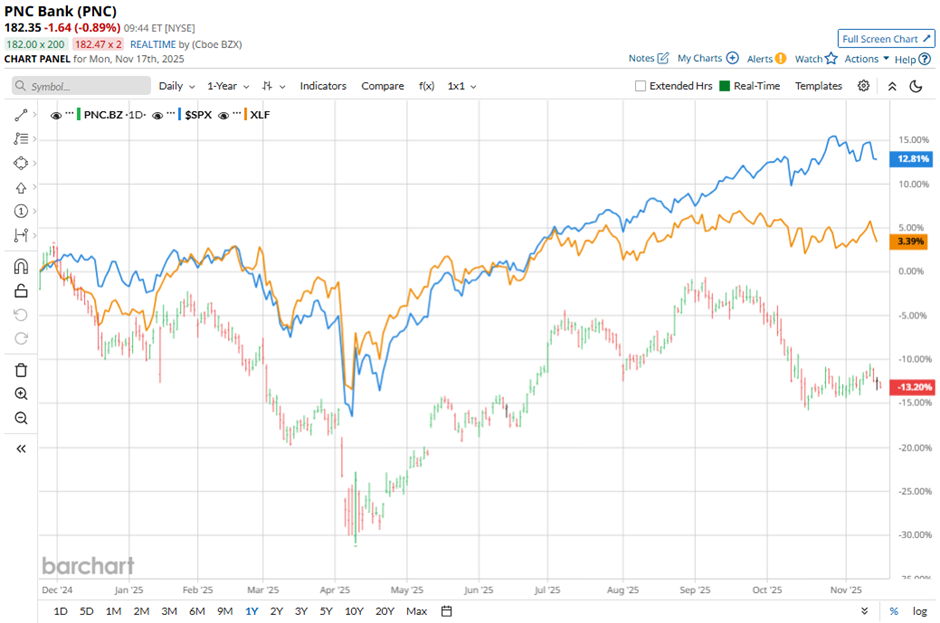

The Pittsburgh, Pennsylvania-based company's shares have lagged behind the broader market over the past 52 weeks. PNC stock has dropped 11.6% over this time frame, while the broader S&P 500 Index ($SPX) has increased 13.2%. Moreover, shares of the company are down 4.8% on a YTD basis, compared to SPX’s 14.5% gain.

In addition, shares of PNC have also underperformed the Financial Select Sector SPDR Fund’s (XLF) 5.1% return over the past 52 weeks.

Despite reporting better-than-expected Q3 2025 EPS of $4.35 and revenues of $5.91 billion, shares of PNC fell 3.9% on Oct. 15 as investors focused on weakness in the bank’s core lending operations. Net interest income and net interest margin both missed consensus forecasts, signaling potential pressure on PNC’s primary profit engine.

For the fiscal year ending in December 2025, analysts expect PNC’s EPS to grow 14.2% year-over-year to $15.88. The company’s earnings surprise history is strong. It beat the consensus estimates in the last four quarters.

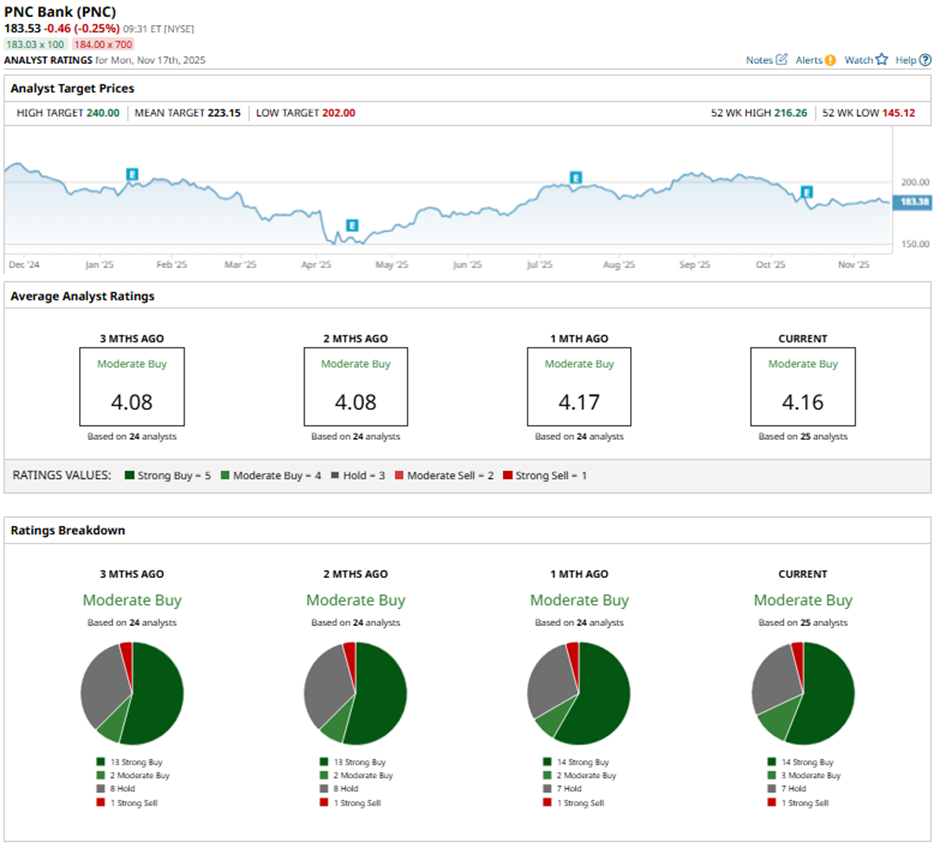

Among the 25 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 14 “Strong Buy” ratings, three “Moderate Buys,” seven “Holds,” and one “Strong Sell.”

This configuration is slightly more bullish than three months ago, with 13 “Strong Buy” ratings on the stock.

On Oct. 15, RBC Capital analyst Gerard Cassidy maintained a “Buy” rating on PNC Financial and set a $219 price target.

The mean price target of $223.15 represents a premium of 21.6% to PNC's current price. The Street-high price target of $240 suggests a 30.8% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This ‘DINO’ Dividend Stock Is Definitely Not a Dinosaur

- Legendary Investor David Tepper Just Ditched Intel Stock. Should You?

- Should You Buy Nvidia Stock Before November 19 or Wait for a Post-Earnings Dip?

- Warren Buffett Says Investors Should Measure Their Investing Success On ‘Slugging Percentage, Not Batting Average’