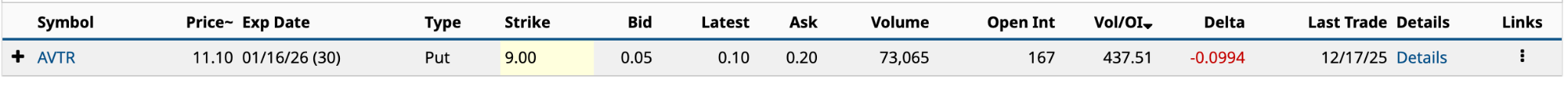

In what has to be one of the highest Vol/OI (volume-to-open-interest) ratios I’ve seen in a very long time, Avantor (AVTR) had a put option yesterday that was nearly double the next highest, a C3.ai call.

Even though I’m not a big follower of health-sector stocks, I just had to write about the lab-supplies provider’s Jan. 16/2026 $9 put. It’s not often you see a 437.51 Vol/OI ratio.

Of course, when I reviewed the latest news stories about Avantor, I immediately understood why—the calls to join a class action lawsuit against the company have increased dramatically. Yesterday’s volume of 73,647 was more than 11 times the 30-day average, with the $9 put accounting for all but 1% of this volume.

As investors know, there are two sides to every trade. Yesterday’s unusual options activity on the $9 put expiring in 30 days suggests one side believes the stock won’t fall below $9 by expiration, while the other is looking for downside protection should the stock continue to move lower, perhaps into the single digits.

There’s a patsy here. The question is who it is. I’ll try to answer that.

The Put Option in Question

As I said in the introduction, the put option in question is the Jan. 16/2026 $9 put.

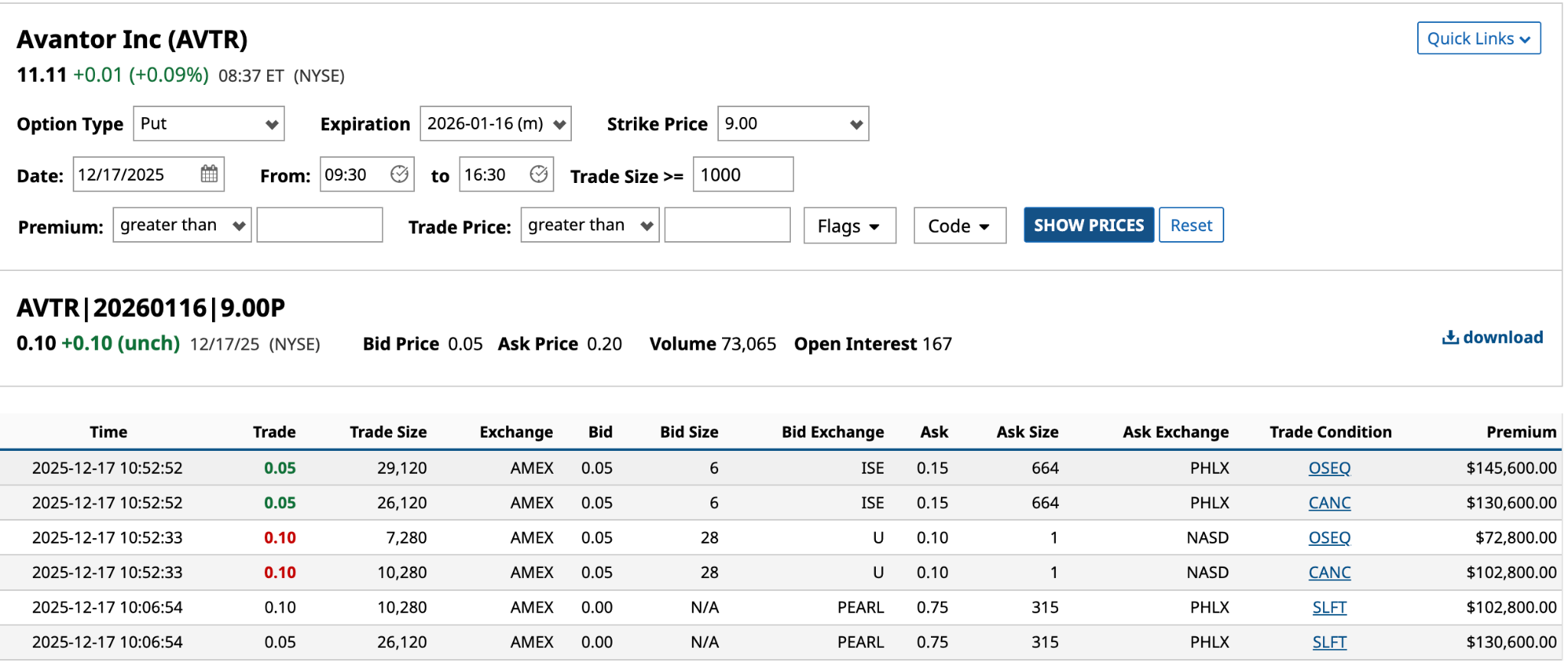

Breaking down the put trades, you had four (29,120, 26,120, 7,280, and 10,280), accounting for 99.6% of yesterday's volume. These weren’t punters. The trade prices ranged from $0.05 to $0.10 per contract. But for this article, I’ll use the bid and ask prices at the close.

Let’s consider both sides of the trade: a long put and a short put.

Is the Short Put’s Return Worth It?

In the case of the short put, the investor sells $9 put contracts for $0.05 in premium income. That’s an annualized return of 6.8% [$0.05 bid price / $9 strike price - $0.05 bid price * 365 / 30].

I’m usually quite keen on investors selling Cash-Secured Puts to generate income while they wait for a better entry point to go long on a particular stock. In this case, should the stock fall by 19.4% to the $8.95 breakeven [$9 strike price - $0,05 bid price] by the Jan. 16, you may face assignment, forced to buy 100 shares at $9.

The risk of this plan is that the stock continues to fall, perhaps into penny-stock territory below $5. The last time AVTR traded below $5? Never! It went public in May 2019 at $14 a share. On March 18, 2020, its low that day was $6.66. By the end of that March, it was back above $11, about where it is today.

But let’s assume, for a second, that all the doubting Thomases contemplating suing the company for compensation are wrong and that the business is ready to rebound. This short put could turn out to be hugely successful. After all, it traded above $44 as recently as September 2021. If AVTR were to return there over the next four years, that would be a CAGR (compound annual growth rate) of 42.9%.

But will it?

Here’s what the class action complaint has to say about the alleged securities fraud:

“The filed complaint alleges that defendants made false statements and/or concealed that: (1) Avantor's competitive positioning was weaker than defendants had publicly represented; (2) Avantor was experiencing negative effects from increased competition; and (3) as a result, defendants' representations about the Company's business, operations, and prospects were materially false and misleading and/or lacked a reasonable basis.”

Essentially, the argument against Avantor management is that they kept investors in the dark about the company's struggles while growing sales in a highly competitive market.

Looking at its five-year annuals, there is no question that the business is deteriorating. For example, its return on assets peaked at 5.7% in 2021. Since then, they’ve declined for three consecutive years; a fifth appears likely, at 3.4% as of Sept. 30, according to S&P Global Market Intelligence.

In 2021, its five-year revenue CAGR was 60.6%. As of Sept. 30, it was 1.4% and falling. This number alone should be enough for class-action lawyers to know the writing is on the wall. Caveat emptor goes the saying.

Is There Any Downside Left to Protect?

The long $9 put’s ask price of $0.20 was only 1.8% of Avantor’s $11.10 closing price from yesterday. That’s peanuts for someone spending over $100,000 in put contracts. Initially, my focus on the long put was on downside protection.

However, the $8.80 breakeven is nearly 21% lower than yesterday’s close. For 35 cents more per contract, you get a breakeven of $10.45, $1.65 higher, just 6.9% below the $11.23 share price as I write this early Wednesday afternoon. That’s considerably better.

And then it dawned on me.

The big buyers of long $9 puts believe the stock is about to crater. The Barchart Technical Opinion for AVTR stock is a Strong Sell with 100% confidence that its downward momentum will continue. That said, the expected move over the next month is $1.15 or 10.21%. At an $11.23 share price, a $1.15 drop would result in a $10.08 share price at expiration on Jan. 16, well above the $8.80 breakeven.

Avantor reports Q4 2025 results on Feb. 6, about 35 business days from now, and 20 business days from expiration. If the volume takes off between now and Jan. 16, there’s no telling how far AVTR stock could drop.

Barchart’s analyst data show that only 4 of 18 analysts rate AVTR a Buy. More alarming is that the average analyst rating has fallen from 3.72 out of 5 two months ago to 3.28 today. On a positive note, the 12-month target price is $13.50, 20% above its current price.

The Bottom Line on Avantor’s Unusually Active Put

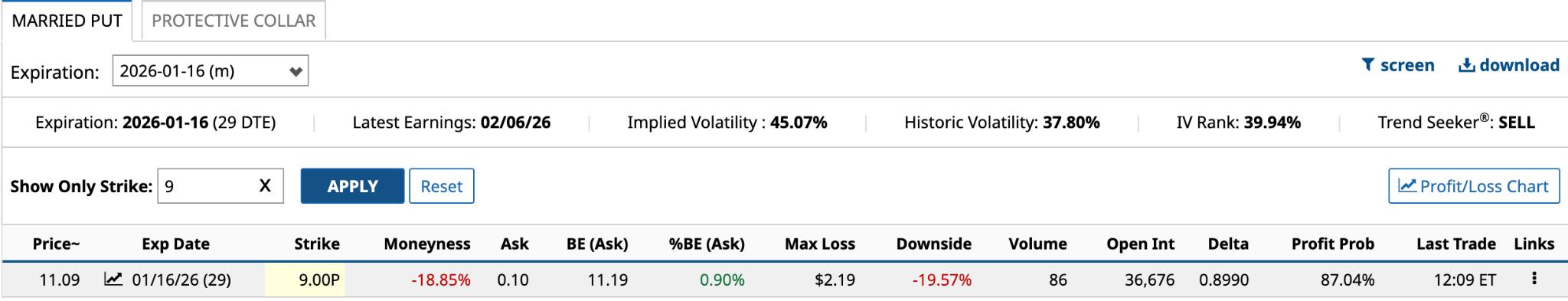

If you don’t own Avantor stock, here’s what a $9 protective put looks like in today’s trading.

In this example, the share price is one cent below yesterday’s price, while the ask price is 10 cents lower. Your maximum loss is $2.19 [$11.09 share price + $0.10 ask price - $9 strike price].

Let’s consider two possibilities: 1) the share price is $14.09 at expiration, and 2) the share price is $8.09 at expiration.

In the former, your profit is $2.90 [$14.09 share price at expiration - $11.09 purchase price - $0.10 ask price]. In the latter, your loss is $1.99 [$11.09 purchase price - $9 strike price - $0.10 ask price].

My guess is that the big hitters from yesterday’s unusually active Avantor $9 put option were using a married puts strategy to limit losses while profiting from any potential upside.

I wouldn’t own AVTR stock, but that doesn’t mean you shouldn’t.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart