As part of its annual reconstitution, the Nasdaq 100 Index ($IUXX) will add data storage product maker Western Digital Corporation (WDC) before the market opens on Dec. 22. Addition to an index is seen as a positive development for any stock because it results in the stock being added to the funds tracking the index. In this case, Western Digital’s stock is set to be added to more than 200 index-tracking products that the Nasdaq 100 underpins, including the Invesco QQQ Trust (QQQ).

In light of this, we take a deeper look at Western Digital.

About Western Digital Stock

Based in San Jose, California, Western Digital is a leading maker of data storage products, building hard disk drives (HDDs), solid-state drives (SSDs), and flash memory devices for home users, companies, and large data centers. The company handles research and manufacturing in locations such as Shanghai and Malaysia and sells worldwide.

Founded in 1970, the company continues to develop new ways to reliably meet large-scale data needs. It boasts a market cap of $59.8 billion.

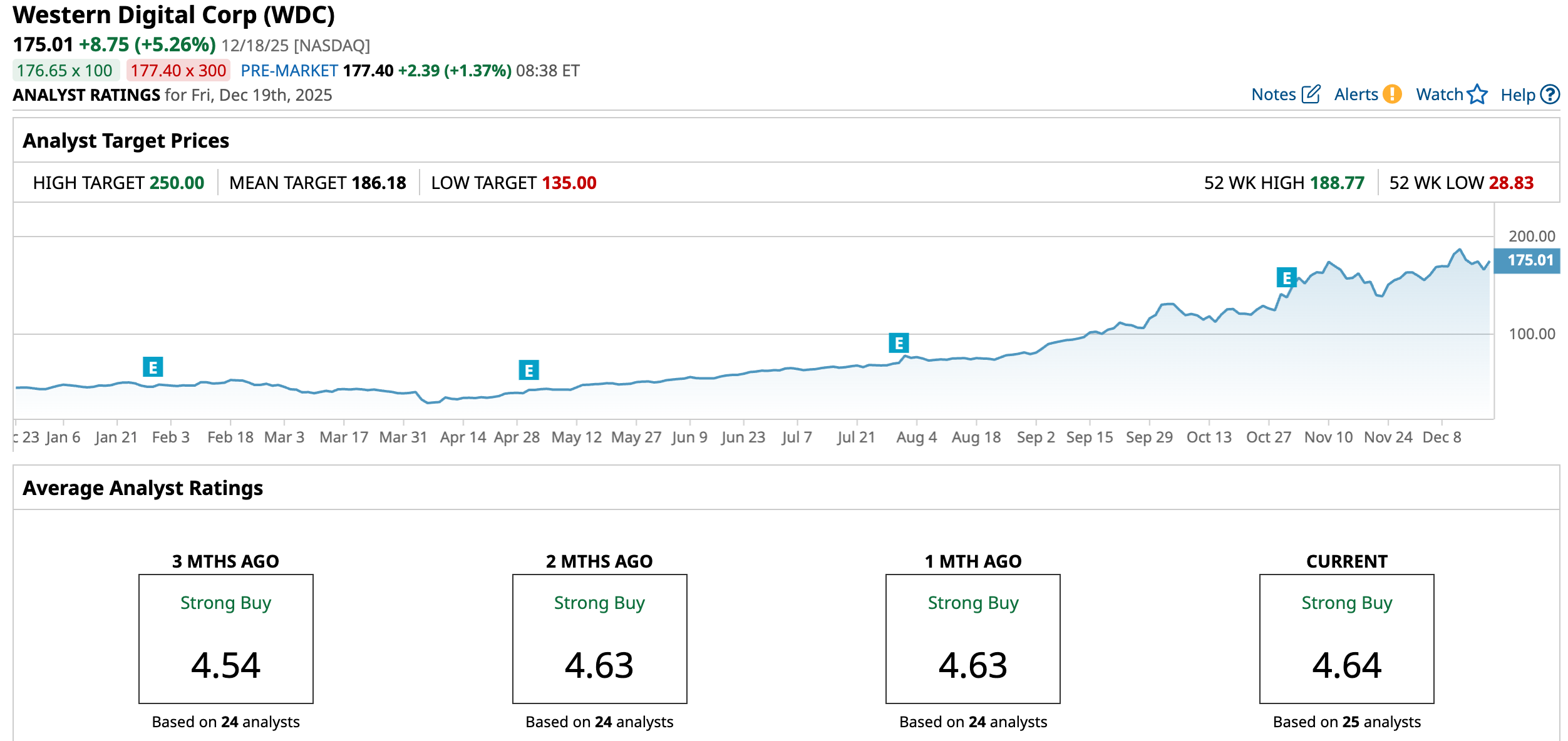

The surging demand for SSDs and HDDs in data centers and hyperscale artificial intelligence (AI) workloads has driven robust stock gains in the past year. Over the past 52 weeks, Western Digital’s shares have gained 267.24%, while they have been up 195.67% over the past six months. Just for comparison, the broader Technology Select Sector SPDR Fund (XLK) has gained 21.89% and 17.16% over the same periods, respectively.

Western Digital’s stock had reached a 52-week high of $188.77 on Dec. 11, possibly due to broader market optimism, but it is down 7.86% from that level.

The stock is trading at a relatively cheaper valuation. Its price-to-earnings ratio is 24.49x, which is below the industry average of 31.07x.

What Are Western Digital’s Financials Telling Us?

On Oct. 30, Western Digital reported its first-quarter financial results for fiscal 2026 (the quarter ended Oct. 3). The company reported strong demand driven by growth in cloud data storage. Its revenue increased 27% year-over-year (YOY) to $2.82 billion, exceeding the $2.72 billion Wall Street analysts expected.

It is also evident that the company is becoming increasingly cloud-infrastructure oriented, since it earned 89% of its top line from the Cloud in Q1. In the prior year’s period, Western Digital had generated about 86% of its revenue from the Cloud.

Top line expansion and lower expenses drove robust bottom-line gains. The company’s non-GAAP operating margin expanded by 1,200 basis points to 30.4%, while adjusted EPS increased 137% YOY to $1.78, surpassing the analyst-estimated $1.59 figure.

Looking ahead, Western Digital expects revenue growth to be driven by data center demand and profitability from high-capacity drives. Its Q2 FY2026 revenue is projected at $2.90 billion, +/- $100 million, and EPS is expected at $1.88, +/- $0.15.

Wall Street analysts are considerably optimistic about Western Digital’s future earnings. They expect the company’s EPS to increase by 16.1% YOY to $1.80 for the fiscal second quarter. For fiscal 2026, EPS is projected to surge 57.4% annually to $7.13, followed by a 41.7% growth to $10.10 in the next fiscal year.

What Do Analysts Think About Western Digital’s Stock?

Wall Street analysts remain exceptionally bullish on this data storage product manufacturer. This month, Citi analyst Asiya Merchant raised the stock’s price target from $180 to $200, while maintaining a “Buy” rating, citing a solid supply/demand backdrop and limited production, which should contribute to sustained pricing momentum. Citi analysts also highlighted that AI-driven unstructured data generation is driving greater demand visibility through 2027.

Last month, analysts at BofA Securities raised the price target on Western Digital’s stock from $170 to $197, while keeping their “Buy” rating. BofA analysts cited several factors as reasons for this optimistic outlook, including HDD demand expected to exceed supply for the foreseeable future. And, they highlighted the company’s technology roadmap and noted that, while dollar-per-terabyte remains flat or increases, strong execution is driving costs lower.

In the same month, Loop Capital analyst Ananda Baruah raised the price target on Western Digital’s shares from $190 to $250, while maintaining a “Buy” rating. Baruah expects HDD capacity demand to rise next year and selling prices to increase for higher capacity drives. This “materially accretive” tailwind could be durable and in the early stages.

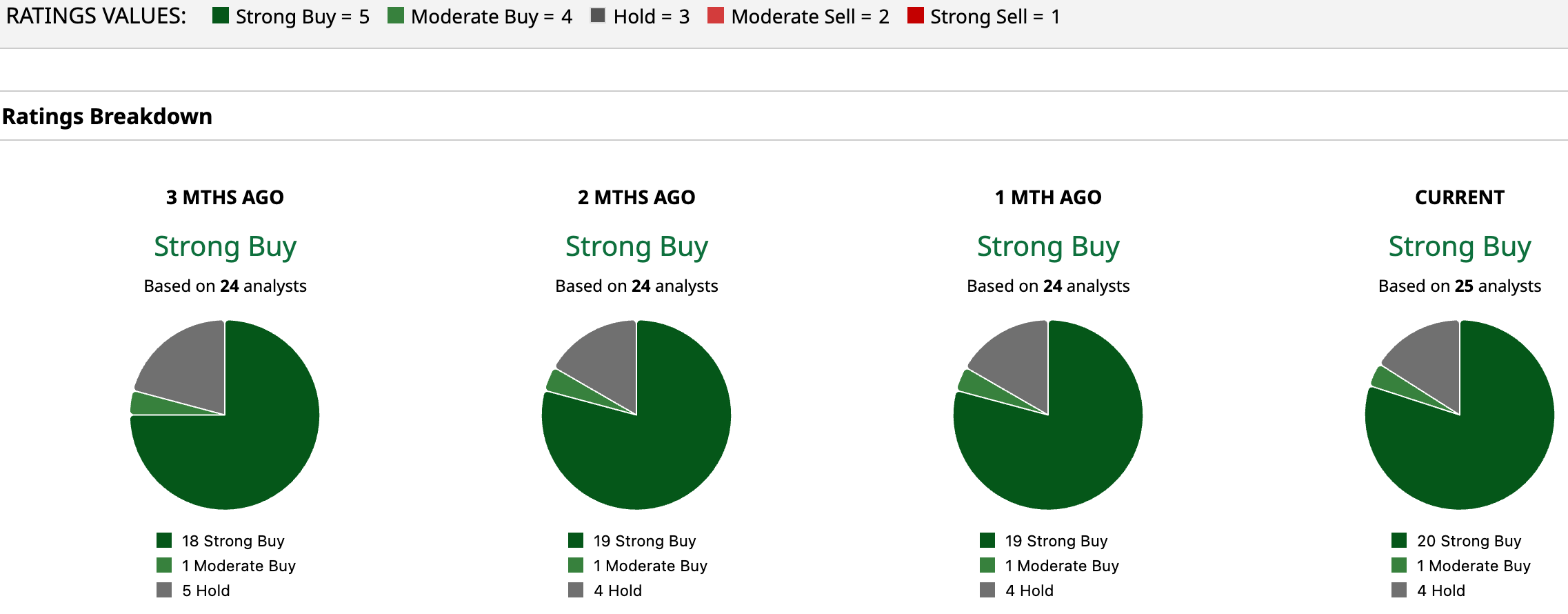

Western Digital has become a popular name on Wall Street, with analysts awarding it a consensus “Strong Buy” rating overall. Of the 25 analysts rating the stock, a majority of 20 analysts have rated it a “Strong Buy,” one analyst suggests a “Moderate Buy,” while four analysts are playing it safe with a “Hold” rating. The consensus price target of $186.18 represents 6.38% upside from current levels. However, the Street-high Loop Capital-given price target of $250 indicates a 42.85% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy Medline Stock After the MDLN IPO?

- This Biotech Stock Has More Than Tripled in 2025, but Red Flags Are Waving

- No ‘Intelligence or Emotional Stability’ Required: Warren Buffett Warns Short-Term Markets Are a ‘Voting Machine,’ But Eventually Reflect Reality

- UnitedHealth Is Expanding OptumRX. What Does That Mean for UNH Stock?