Coming off the 2025 rally in which the PHLX Semiconductor Index ($SOX) jumped more than 40%, expectations for the semiconductor industry in 2026 are adjusting. In its new 2026 outlook report titled "Semiconductors & Automotive Technologies," Mizuho declared that while the easy money in the industry has been made, investment opportunities remain for those looking past the commonly recognized industry leaders.

The rationale for such positioning has Mizuho sticking with the likes of Nvidia (NVDA) and Broadcom (AVGO), but it also points to a relatively less crowded name that benefits from the same trend, Lumentum (LITE). With hyperscalers' capex expected to increase 32% year-over-year (YOY) to $540 billion in 2026, the money has begun to trickle down to areas like optical interconnects, photonics, and high-speed data transfer — exactly where Lumentum plays.

About Lumentum Stock

Lumentum is an optical and photonics specialist headquartered in San Jose, California. The company provides key elements within data center interconnects, the long-haul network, and cloud connectivity, domains that are rapidly becoming ever more crucial due to the expansion of AI processing. Lumentum has a market capitalization of around $24 billion, placing it in a middle position that is noteworthy yet largely overlooked in comparison to the semiconductor firms that make headlines.

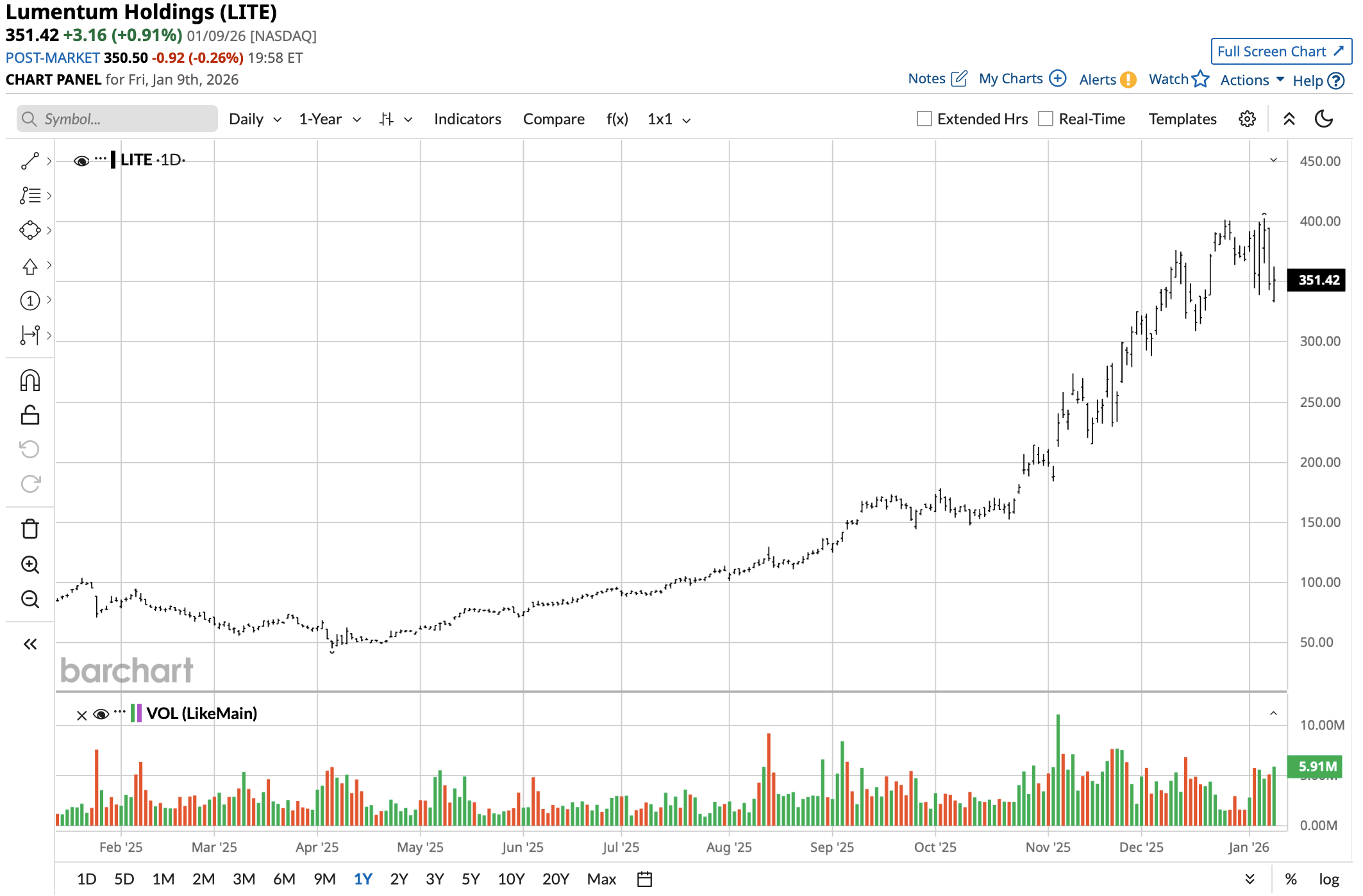

In terms of market-driven pricing, LITE stock has certainly been very dynamic and strong. The stock is recently hovering around the $350 level, which is significantly bounded between $46 and $400, a pattern that can be attributed to the cyclic nature of the optical market as well as the changing views on the cost structure of AI infrastructure. Notwithstanding the limited upside of the S&P 500 ($SPX), it is clear that market sentiment can shift dramatically once network capacity tightens.

Valuations are high based on conventional measures, with a forward price-to-earnings ratio of 89 times and a price-to-sales ratio of 15 times. At face, this would seem richly valued. However, what matters most to market participants is whether a growth story based on optics now enabled by AI architecture might support a revaluation in optics, and not simply a multiple contraction in response to AI adoption and its associated growth drivers being now widely visible.

Lumentum Beats Earnings as Demand for AI Quickens

The fiscal first-quarter results for 2026 offered new reason to believe in the bull thesis for LITE stock. Lumentum showed revenue of $533.8 million, a sharp 58% increase from the same period last year, along with non-GAAP earnings of $1.10 for the period, which was soundingly in excess of forecasts. Operating margins under non-GAAP measures also showed an impressive increase to 18.7% from 3% in Q1 2025.

Management's commentary emphasized the point that this isn't a one-quarter pop. The company has witnessed robust momentum in data center, data center interconnect, and long-haul markets and is guiding for a 20% sequential boost in the next quarter. Enablers of growth, such as optical circuit switches and co-packaged optics, are also in their infancy stages but have already started influencing customer roadmaps.

Looking forward, Lumentum sees Q2 fiscal 2026 revenue in the range of $630 million to $670 million, and non-GAAP EPS in the range of $1.30 to $1.50. Such guidance reflects not only confidence in market demand, but also confidence in market execution. The next earnings release will be carefully watched, as investors try to determine the sustainability of this AI-led inflection point.

Analyst Projections for LITE Stock

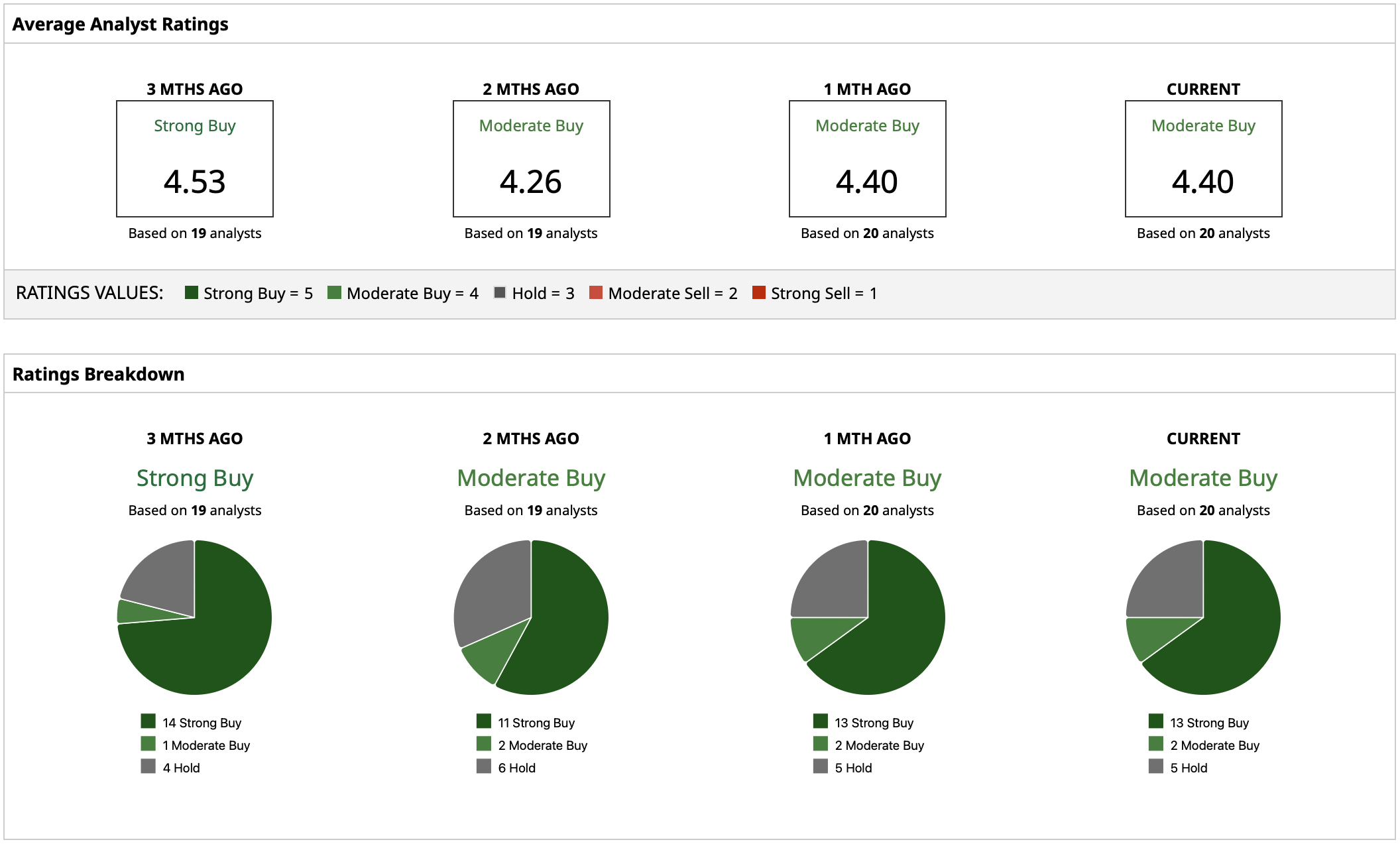

There is a strongly positive consensus on Lumentum, as well as an emerging view of the company as less a cyclical optical component player and more a key player in the infrastructure of AI hardware. This is important, as it represents a change in how risk is assessed based on valuation.

LITE has a consensus “Moderate Buy” rating. The average target price for Lumentum stands at $281.28, with the Street-high target at $470 and the low at $140. At $281.28, the average target price offers about 21% potential downside. Still, bullish analysts point out that if the adoption of AI-driven optics accelerates, LITE stock has bright mornings ahead.

To sum up, Mizuho’s recommendation is only a hint at an underlying fact: 2026’s future of AI investment may see the less conspicuous facilitators benefit. For the risk-tolerant investor, Lumentum’s role in AI networking means that LITE is certainly a stock worth keeping a close eye on.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- If You Missed the Boat, Nvidia (NVDA) Stock Options Are Giving You Another Ticket

- Mizuho Says This 1 Lesser-Known Chip Stock Is a Top Buy for 2026

- Citi Is Betting on Another ‘Supercycle’ in Palantir Stock. Should You Buy PLTR Here?

- Palmer Luckey Warns China’s ‘Most Powerful Weapon’ Isn’t a ‘Missile or Drone, It’s Their Ability to Control People’s Minds Through the Media’