Healthcare provider stocks are falling out of favor as higher operating expenses and renewed debate over patient subsidies pressure earnings across the sector. Hedge funds have responded by turning aggressive sellers, building short positions in U.S. healthcare providers, especially dialysis and hospital operators, where shorts now outnumber long positions by roughly eight to one.

DaVita (DVA) sits at the center of that bearish trade. Short interest in the dialysis operator climbed to about 11.6% of its float by year-end, up roughly 12% in just one month, putting it among the most shorted names in the S&P 500 ($SPX).

The shift marks a sharp turn for a stock long viewed as a Warren Buffett favorite. Berkshire Hathaway (BRK.A) (BRK.B) has already trimmed its stake, and DaVita shares now trade near one-year lows. Investors are arguing whether it is the right time to sell its stock now. Let's find out.

About DVA Stock

DaVita is a leading kidney care services provider specializing in dialysis. It operates thousands of outpatient dialysis centers worldwide and offers a full suite of renal care, from in-center hemodialysis and at-home peritoneal dialysis to home therapies and lab and nutrition support.

DaVita has emphasized innovation and leadership lately. In November, it celebrated 25 years by unveiling new clinical research on advanced kidney treatments such as GLP-1 drugs and middle-molecule clearance at ASN Kidney Week. In December, DaVita appointed two longtime executives to new roles, such as Stephanie Hendrickson as Chief People Officer and Steve Phillips as Chief Strategy Officer, to drive its next growth phase.

However, the shares did not see any major gain following these moves and slid sharply over the past year. After hitting a record high near $177 in early February 2025, DVA is now around $105, making it down about 36% over the past 52 weeks. Investors point to softer treatment volumes and mounting profit pressure as key concerns.

Following the underperformance, DVA now trades at attractive valuations. For instance, its price-to-sales (P/S) of 0.69 is significantly lower than the sector median of 4.01, indicating the stock is undervalued relative to its peers. Similarly, its price-to-earnings (P/E) of 12 is a 54% discount compared to the sector median of 26.

Hedge Funds Ramp Up Short Bets on DaVita

Recent data show hedge funds doubling down on bearish bets in DaVita. Short interest hit 11.64% of float as of Dec. 31, 2025, up nearly 12% from mid-November. This surge follows a trend of funds net-selling healthcare stocks and signals skepticism. Part of the concern stems from DaVita’s third-quarter results, which showed adjusted EPS of $2.51, badly missing estimates of $3.23, and were down 3% from a year ago, even as revenue grew just 4.8% to $3.42 billion. U.S. dialysis volumes were soft, and a recent cyberattack incurred charges of $11.7 million.

However, management noted these results were in line with internal expectations: “Our third quarter performance was in line with our expectations and keeps us on track to achieve our full-year guidance,” CEO Javier Rodriguez said. DaVita still targets $10.35 to $11.15 adjusted EPS for 2025.

Its balance sheet remains strong, with cash flow staying healthy. Operating cash flow was $842 million, and free cash flow was $604 million, both up year-over-year (YoY). The company repurchased 3.3 million shares for about $465 million, authorizing another $2 billion for buybacks.

At the same time, Warren Buffett’s firm quietly sold more DaVita shares, 401,514 shares at about $135 in late October, which may have added to the downbeat sentiment. The short-selling pressure could weigh on the stock in the near term. But if DaVita hits its guidance, contrarian investors might view the high short interest as a buying opportunity.

Analysts Views and Final Words

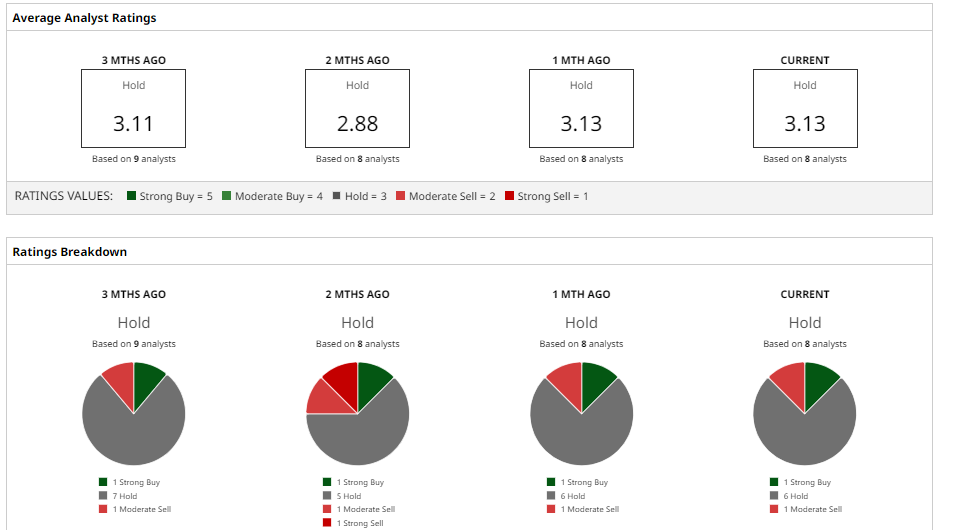

Wall Street is cautious on DVA. By consensus, analysts rate it a “Hold.” Truist recently cut its 12-month target from $140 to $128 with an “Hold” rating, and Barclays lowered its target from $149 to $143. UBS, by contrast, remains the outlier “Buy” with a $186 target.

In aggregate, five of eight analysts at Barchart’s tracking sites rate DVA a hold, with one “Strong Buy” and one “Moderate Sell,” for an average target of $141. These forecasts imply roughly 34% upside from current levels.

Taking all into consideration, DaVita faces pressure from rising costs, weak volumes, and heavy short selling, so caution makes sense. Selling part of a position could limit risk. A rebound could happen if volumes improve or policy worries ease, but signs are not clear yet. Investors should wait for better earnings and stronger trends before buying more shares.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Mark Cuban Warns Healthcare Giants Are ‘Too Big to Care’: Is Divestiture the Only Cure for the 3,200% Admin Bubble?

- Morningstar’s New Generative AI Index Could Unlock Opportunities in OpenAI and Anthropic for Everyday ETF Investors

- SoFi CEO Anthony Noto Says His Company Is Poised to Win if Trump Caps Credit Card Rates: Why Personal Loans Could Come Out on Top

- Hedge Funds Are Shorting This Classic Warren Buffett Stock. Should You Sell Shares Now?